Mozambi Claims Largest JORC Resource in Tanzania

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

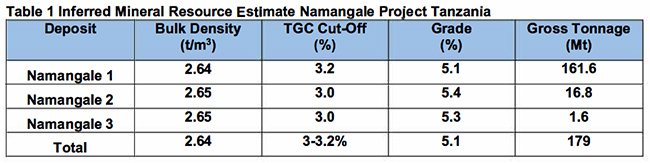

Mozambi Resources (ASX:MOZ), a junior graphite explorer operating in East Africa, has announced its maiden JORC Resource totalling 179 million tonnes at 5.1% Total Graphitic Content (TGC). Announced pre-market open, the news helped MOZ shares to gain 22% at the time of writing.

The Inferred JORC estimate was carried out by ‘ROM Resources’ and compiled by Mark Biggs, a Competent Person and Member of the Australasian Institute of Mining and Metallurgy.

The estimate was calculated using 82 RC holes and 9 Diamond holes with a maximum depth of 100m with mineralisation starting at or near surface. MOZ’s Namangale prospect is now the largest reported JORC graphite project in Tanzania and one of the largest coarse flake projects in the world.

The Resource classification criteria is based on drill spacing, geological mapping, trenches and pitting results, which together used to confirm the grade and geological continuity of the graphite schist mineralisation.

Mozambi in Tanzania

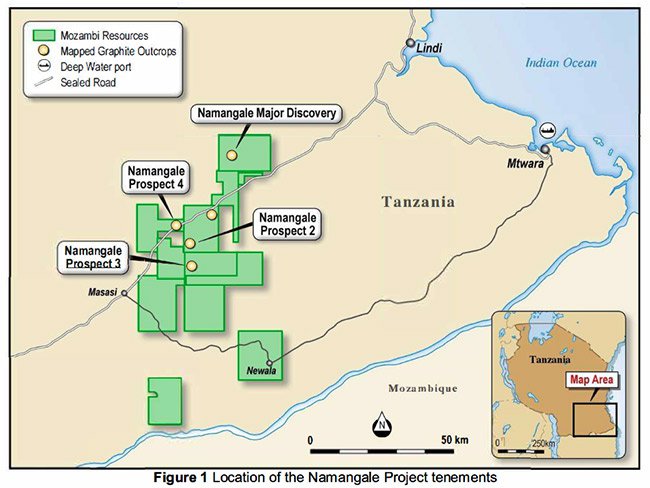

MOZ’s Tanzania operations are located close to the deep-water port of Mtwara, 140km from the Namangale Prospect.

Sealed roads and high-voltage are available across its prospects, connecting MOZ to export routes internationally. Mtwara Port has a capacity of 400,000 metric tonnes per annum and could handle up to 750,000 metric tonnes per annum with the same number of berths if additional equipment is put in place for handling containerised traffic. The port is currently heavily underutilised, with approximately 34% of its total capacity currently in use.

The official JORC certification means MOZ has pipped Magnis Resources (ASX:MNS) to having the largest graphite resource in Tanzania, albeit at a much earlier stage of development.

MNS currently has a JORC Resource of 156Mt at 5.2% TGC with a current market valuation of A$134 million. MOZ on the other hand, now as an Inferred JORC Resource of 179Mt, currently capped at $26.3 million.

Announcing the news to the market earlier today, MOZ reports that its Namangale Project has now become its prime focus for future exploration activity.

The Namangale Prospect is a shallow deposit with all drilling limited to 100m maximum depth. MOZ also reports that all Deposits remain open along strike and at depth and the project hosts multiple untested targets identified but not yet drill tested.

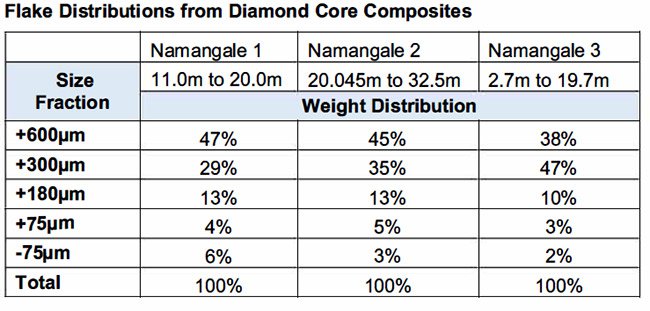

Furthermore, “exceptional metallurgical results show very high proportion of Super Jumbo 500+ Microns and Jumbo 300+ Microns flake sizes”. Metallurgical tests conducted as part of exploration activity have confirmed that Namangale’s “graphite is easily liberated from the host rock”.

Having obtained a JORC compliant resource, MOZ says the company “is now reviewing requests from potential off-take partners and end-users” with product samples being sent out. Hinting at potential future off-take deals, MOZ says that “a number of these requests have now been received and will be carefully reviewed by the Board”.

Mozambi Resources Chairman Stephen Hunt says, “The results have been outstanding in every respect. We now have a very significant maiden JORC resource, coupled with excellent coarse flake size graphite, which has been drilled from a very shallow depth. This, together with the fantastic infrastructure goes a long way to ensuring the success of Namangale as a genuine graphite project. We are all very excited by these results and it bodes extremely well for the future development of the Company [MOZ].”

Assay Results

Assay results for the first thee diamond core composites samples have been returned confirming excellent proportions of +300μm and + 600μm size fractions. For the three composites between 76% and 85% of the graphite was in the +300μm size fractions.

Mozambi is now focused on proving up the potential of the project to produce high quality Jumbo and Super Jumbo flake graphite, which continues to attract premium pricing and very strong customer demand.

Mozambi Future

MOZ’s maiden JORC resource is currently in the Inferred Category but MOZ plans to upgrade the deposit to the Indicated and Measured categories later this year. MOZ is now focused on progressing Namangale and says it’s in discussions with a number of specialist companies with regards to initiating a Prefeasibility study (PFS) on the Namangale Prospect “in the first quarter of 2016”.

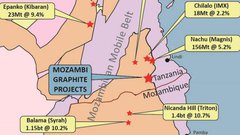

Namangale is rapidly emerging as a potential world class graphite deposit, rivalling larger explorers such as Magnis, Kibaran and IMX Resources who are also ASX-listed and operating in Tanzania.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.