VRC Set for Further Upside? Graphite Resource Bigger than $337M Magnis

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

The players are starting to arrange themselves on the great graphite chessboard.

The company we’re featuring today is emerging as one of the more important players in the game.

$70M capped Volt Resources (ASX:VRC), previously known as Mozambi Resources, has the largest graphite resource in Tanzania by weight, bigger than the lauded $337M capped (fully diluted) Magnis Resources (ASX:MNS), and has started to put all the pieces onto the board as it continues its Pre-Feasibility Study at its flagship Namangale project.

Before we go too far, it should be noted that for political and social reasons, this is a very high-risk stock. Getting mining projects up and running in countries such as Tanzania is no simple feat, and there may be challenges ahead.

We first wrote about VRC back in February 2015 , when the share price was 1.2 cents and it was trading under the ticker code MOZ. Now, VRC is trading as high as 8.8 cents – that’s a 630% gain...

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We hope you have been paying attention. VRC is by no means finished yet though – there is potential for further gains still, when you consider:

Magnis is still worth almost five times more than its up and coming neighbour VRC

Blue Ocean Equities recently released a research report on Magnis with a price target of $1.40 / share (Magnis is currently trading around 79 cents a share):

Source: Blue Ocean Equities

Now, analysts don’t have crystal balls, so this price target is no guarantee of being realised – don’t invest simply on analyst price targets alone.

Whilst Blue Ocean demonstrate the upside potential in Magnis, our lesser known, ‘younger’ stock, VRC is following exactly the same path as Magnis, and has a resource down the road that is bigger than its older brother.

Another encouraging sign for VRC shareholders is that Magnis’ project has an NPV of over a billion dollars, based on current economics.

So in VRC it appears there is more upside in this emerging story.

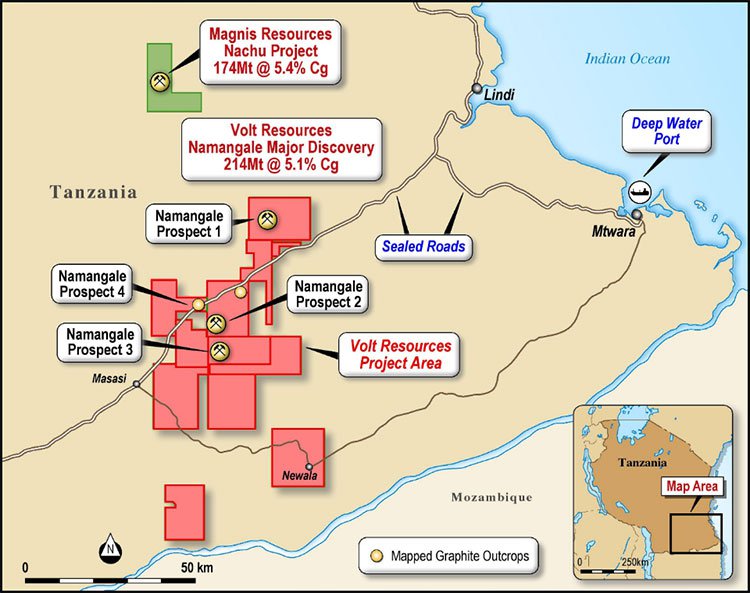

The following map shows where Magnis and VRC sit, and you can also directly compare their resources:

VRC’s major graphite discovery is close to vital infrastructure in English speaking Tanzania, and the surrounding infrastructure includes access to the deep water Mtwara Port.

Hot off the press is VRC’s excellent metallurgical flotation results with concentrates up to 98.3% Total Graphitic carbon (TGC) in the +300 and +500 micron flake categories.

Just to recap, VRC is down the road from the much higher valued Magnis, with a bigger graphite resource, and a much bigger land holding to potentially expand that resource – yes, this could get bigger...

It’s probably why one “Sugar Man” has decided to get involved...

VRC recently appointed EAS Advisors , a boutique global advisory firm established in 2008 led by Mr Edward Sugar, as its North American Corporate Advisor.

Mr Sugar has a significant background in working with ASX listed companies and facilitating their growth, and is somewhat of a legend for getting ASX companies in front of deep pocketed investors in the US.

EAS has a reputation for picking early stage mining and industrial groups, providing US-based introductions to financial markets and access to capital.

Mr Sugar was instrumental in bankrolling Fortescue Metal Group’s start up stage and in doing so made hundreds of millions for Jefferies Bank where he was MD at the time.

He then set his sights on LNG.

One only has to look at his recent form to understand that there may still be potential for further gains in VRC over the short and long term.

Here is a list of ASX stocks that Sugar has had a big part in transforming:

- LNG – was up as high as 1900% since Sugar’s appointment;

- EMC – up 400% since Sugar’s appointment;

- YOW – as high as 125% since Sugar’s appointment, and helped them raise $32M at a price of 90% above his appointment price;

- AJX – up as high as 400% since Sugar’s appointment, and helped that company raise $6m at a price of 263% above his appointment price;

- And now, VRC is up over 90% since Sugar’s appointment ....

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Mr Sugar’s EAS Advisors will be working with VRC to promote them in the US and help finance the company to production.

EAS has overseen US$3.5 billion ($A4.8 billion) in transactions and has an excellent track record in providing financial support to companies at key stages of their lifecycle.

It’s no wonder then that VRC sought him out and they are hoping for similar results – which could well be achievable with VRC’s new star players also on board.

Building the talent roster

Stephen Hunt

The last time we covered off on VRC, it had a new man as the chairman of the board, in the form of Stephen Hunt.

Hunt made waves when he decided to leave a more established regional graphite player – yes, that’s right, Mr Hunt departed Magnis Resources (ASX:MNS).

Mr Hunt was a central player in Magnis being able to bag MoUs for offtake deals which could be worth as much as $800 million with key buyers – and now he has jumped over to VRC, to do it all over again in an earlier stage growth story.

Hunt spent 15 years with BHP Billiton, including five years in London with a focus on marketing minerals to European and Middle Eastern customers. He has also started up his own minerals trading company with a focus on Chinese customers.

The key message here is that this is a guy who knows the market inside out and backward – he knows what the customers want and he’s there to make sure VRC delivers on that.

It’s probably why he ended up at VRC in the first place, namely, he sees an early-stage company with the potential to deliver exactly what the customers want.

But, Hunt isn’t the only big name jumping on the VRC bandwagon...

Alwyn Vorster

Alwyn Vorster is known as a wheeler and dealer in WA mining circles, and in fact, is an award-winning wheeler and dealer.

Literally.

Back in 2013 he was named ‘dealer of the year’ at the prestigious Diggers and Dealers mining conference.

Nothing says you can swing a deal like winning an award for it.

Vorster joins VRC as a non-executive director on the board, and has been drafted in as a steadying hand as VRC goes through the PFS and eventually the definitive or bankable feasibility study.

Suffice to say, he comes with a pretty impressive CV.

More recently, he was Kerry Stokes’ right-hand man at Iron Ore Holdings, taking the company from just another mining company through to an off-market merger with junior miner BC Iron.

He was also the general manager of Aquila Resources as it developed the West Pilbara iron ore project.

This appointment is important for a couple of reasons.

Vorster obviously knows how to do a deal, but also knows how to take big, unwieldy things like mining projects and get them over the line. That’s no mean feat in itself, but it’s perhaps a cultural shift in mining circles which is the more important part of the appointment.

Vorster is an iron ore man through and through. Although he does have some experience in southern Africa which will be invaluable for VRC, he’s been read as the quintessential Perth-based iron ore executive.

With the price of iron ore currently riding low, Vorster’s appointment signals that the iron ore set are looking around for the next big opportunity.

Although this is a non-executive role and could be read as dipping a toe in graphite water – it demonstrates that the same minds who played a role in getting the Pilbara region to where it is today are looking at graphite as the next major macro mining play.

For a long time graphite has had a bit of a buzz around it, but the appearance of more and more iron ore players on the scene reinforces the legitimacy of the mineral.

Here are people who have played a leading role in making iron ore a bulk commodity play, now moving to the graphite scene.

I don’t think we need to draw you a picture on this one...

Recently buoyed by a $4.5M capital raising, VRC’s PFS is fully funded toward completion.

VRC has the ground, the resource, the backing and is angling to become a preferred supplier of high quality large flake graphite to the emerging high technology industry.

That includes companies like Tesla.

Much has been written about graphite and lithium, with those minerals key ingredients in lithium-ion batteries.

These are the kind of batteries which are powering electric cars and storing energy from solar panels. To give you an idea of the weight of this emerged industry, Tesla, the car/battery/energy giant pre-sold 300,000 Model 3 cars worth more than US$12 billion in less than 72 hours.

Tesla is a company itching for graphite to fuel its operation.

Could VRC be one of the companies to supply the mega-demand for resources being fuelled by Tesla?

We’ve been keeping our eye on VRC for quite a while now, and we’ve seen it grow from a junior with a couple of drillholes and a crazy dream to the company it is today.

Now, VRC stands on the threshold of potentially being one of the junior breakout stars on the ASX... bigger than Magnis.

Remember however, that this is still an early stage play and caution is advised if considering this stock for your portfolio.

One of VRC’s current objectives is to increase and optimise its current 214mt @ 5.1% TGC JORC Resource, which is a resource that contains high quality Jumbo and Super Jumbo graphite, just the type of graphite that offtake customers want to get their hands on.

To do all of this, VRC will draw on its highly skilled and experienced board members, stakeholders and partners to ensure that it develops innovative and competitive project development solutions.

In doing so, VRC will aim to bring in the best revenue to cost ratios in the industry.

Looking at Namangale

VRC’s Namangale project is roughly 140km inland from the Tanzanian coast, and therefore about 140km from the deep water port of Mtwara – and ultimately the route to export and commercialisation.

On first glance, 140km may seem like a pretty long distance to market – but in terms of mining it’s actually a pretty short distance.

Take Gina Rinehart’s Roy Hill project in the Pilbara for instance. That particular project is roughly 277km south of Port Hedland – the main port for the Pilbara’s iron ore exporters.

So in mining terms, Namangale is actually close to market.

Luckily for VRC, sealed roads and high voltage power is available throughout the project region, meaning it’s easier for large mining equipment to get around and it will ultimately be easier for the company to power the machines and processing equipment needed to turn VRC into a money-spinner.

We here at The Next Small Cap and sister site The Next Mining Boom have had plenty of companies cross our desk which have all the promising geological charts for their projects in the world – and it’s all rather impressive.

We’re not just about rocks though, we’re about money ultimately.

These same companies, when it comes to answering questions about how they hope to make a return for investors find that geological charts aren’t enough – because they’re in the middle of nowhere.

If you have geology in the middle of nowhere, you just have a pile of rocks.

VRC has the rocks and the access to market which is needed

The Mtwara Port has capacity of 400,000 tonnes export – but this can be upgraded to 750,000 metric tonnes if infrastructure for handling containerised traffic is put in place.

At the moment, however, the port only has a utilisation rate of 34% – meaning there’s plenty of space and upside for graphite players in the region to play with.

VRC is just one of the companies looking for graphite in the region – but the commentary suggests that there’ll be a lot of export room in the region to play with.

We’d even suggest that if producers in the region band together they could present a pretty compelling case to the Tanzanian government for even more expansion.

It has the location, and it’s shaping up as having the resource too.

The largest graphite resource in Tanzania

Back in January, VRC made waves by announcing that it had the largest graphite resource in Tanzania by size.

Not contained graphite, but the largest quantity of graphite ore in the country.

For a company capped at just a hair under $70 million (at the time of writing), that’s a pretty good achievement in itself.

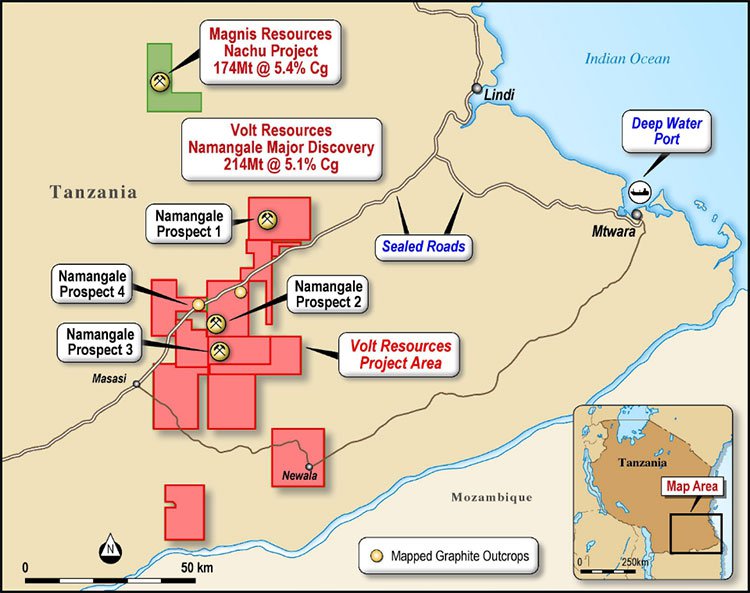

It unveiled a maiden JORC-compliant resource of 179 million tonnes of graphite at an average grade of 5.1% total graphitic content.

VRC’s resource now stands at 214 Mt at 5.1% contained graphite.

As we’ll go into later, VRC is also looking for a premium product to bring to market – meaning it’s looking for both scale and quality.

The JORC resource was compiled by a third party, based off the information gleamed from 82 reverse circulation holes and nine diamond holes.

You can take a look at some of the grade information from the holes here:

The thing is that if you go back and take a look at the holes drilled at Namangale 1, 2, and 3 you’ll notice something about their depth – mainly that they have a maximum depth of 100m.

While VRC is yet to compile a Pre-Feasibility Study, having ore available at shallow depth is a positive.

Generally the rule in mining is that the deeper it is, the harder and therefore more expensive it will be to get at it.

For a small company (at this stage) such as VRC, that’s somewhat of a god-send.

In any case, what VRC now has on its hands is one of the largest coarse graphite projects in the world, at shallow depth, and close to infrastructure.

All the pieces are falling into place nicely for VRC.

The thing that really sets VRC apart from the crowd, however, isn’t resource size or depth, but rather flake.

Flake size is key for VRC

The flakes at the Namangale prospect keep on getting bigger – luckily that’s just what the market wants.

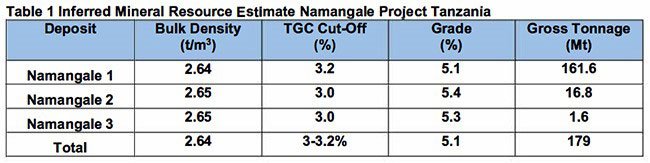

Analysts are predicting a shortage in quality coarse flake and therefore a possible price increase for larger size fractions.

End users have consistently asked for extra-large, jumbo, or super jumbo flakes as the bigger the flakes are, the easier they are to liberate from a concentrate.

It basically means less time and energy is spent by end users liberating the graphite from the concentrate – meaning more time and money for the end user.

Luckily, as time goes on VRC keeps on proving it has the good stuff.

Last month it sent samples from nine diamond core composites from six holes drilled at the Namangale prospect to the lab, and 94.5% of the flakes within the composites were found to be large, jumbo, or super-jumbo.

But don’t take our word for it: here’s the lab sheet.

The tests, conducted at SGS Laboratories in South Africa also found that the flakes from the core could be liberated using a simple crushing and process – without the need for more chemical liberation.

Again, that’s a boon on the cost front.

Meanwhile, floatation work on the core is has now come back, which tested both fresh and oxidised mineralisation.

Results found that the graphite concentrate produced from Namangale 2 returned concentrate grade of up to 98.3% TGC with +300 and +500 micron flake and the graphite concentrate from Namangale 1 returned concentrate grades of up to 97.7% with +300 micron flake.

Numerous samples returned have now demonstrated that the Namangale deposit can consistently provide clean, high-grade TGC graphite suitable for commercial applications specifically within the lithium-ion battery market.

VRC now has more information on concentrate grade, yield, and flake distribution post-floatation – another vital step in the process.

VRC chairman Stephen Hunt says the flake result was especially good, given what he was seeing in the market.

All the talk in the market is about what kind of premium larger flakes are getting at the moment – and consultancy CSA Global put together this handy guide in an edition of Paydirt last year .

As you can see, as long as the purity of the flakes is on-point, then you’re looking for flake which is at least ‘medium’. That’s not to say you can’t make money mining finer flake, but you need a hell of a lot of it to turn a buck – as there’s an abundance of it in the marketplace.

We should caution at this point that projecting future outcomes based on the current state of the market can be...problematic, so best not to use this to totally inform an investment decision.

So, if you’re a smaller player like VRC and you want to make money as quickly as possible, you go after the big Kahuna flakes.

All the evidence to date suggests VRC is doing just that.

No wonder the investors are starting to get on board the VRC train...

Fast-tracking a DFS on investor crush

Last month it unveiled a capital raising to sophisticated and institutional investors which finished heavily oversubscribed and intentions to place 135 million new shares at 3.3c to raise $4.5 million before costs .

VRC was only intending to raise $2.6 million originally, but as it turns out lead arranger Taylor Collison’s phone was running rather hot.

We imagine the crush of institutional investors seeking to get on looked a little something like this*:

*Conceptual image only

At the time, VRC Chairman Hunt said it wasn’t only the chance to turn a buck which had investors piling in, but a chance to participate in disrupting energy markets.

“Not only have the participants believed in the Company’s strategy, but also are very supportive of the need to contribute to the evolution of the energy generation sector and the removal of old world energy sources, as the world embraces cleaner, greener technologies,” Hunt said.

Hunt said the company was well on its way to providing key ingredients of clean battery cell technology going forward.

The capital raise was more about fast-tracking the Pre-Feasibility Study on the project rather than any ‘high falutin’’ ideals.

A PFS is one of the early-stage things a company such as VRC needs to do in order to convince key backers that a project can fly.

It’s basically an early roadmap on how a project may look, what sort of money will be needed, and how VRC hopes to process its graphite.

The money went towards fast-tracking this process, giving potential investors a look at the numbers at an earlier stage than hoped.

We should note that the PFS is just one step in the ultimate prediction of a project’s economics, but it will lay down an early marker for the company.

VRC brought in Perth-based consultancy Battery Limits to help with the process, a company with some impressive names on the client sheet.

It has done work for the likes of BHP Billiton, Barrick Gold, and Hancock Exploration on their projects.

It has, however, also become somewhat of a Tanzanian graphite expert by doing work for companies such as Magnis Resources and IMX Resources.

Tanzania can be a difficult place to do business, as we’ve already told you, so knowing the intricacies of the market can be an advantage.

Bankers and investors rely on the PFS and subsequent documents to make investment decisions, so having insight into the true cost of graphite projects in that country is invaluable.

A less experienced consultancy may severely underestimate the difficulties of doing business in Tanzania, thereby misleading potential investors and punters on the cost of the project.

On the flip-side, they may severely overestimate the difficulty of doing business, thereby inflating the numbers – leading to a lesser investor confidence in the project.

By tapping Battery Limits, however, VRC has a sure as bet as you can get at this stage that the numbers will reflect the reality on the ground.

Battery Limits has already started work on stage one of the Namangale PFS, with metallurgical work also under way.

The key target for the testing will be the production of flake graphite concentrate suitable for the lithium-ion battery market – using existing diamond core samples.

The final word

Most junior resources companies aren’t getting a lot of love lately, but graphite is being looked at as a space where companies are doing some great work for investors back pockets, including VRC.

VRC is moving through the phases nicely, having completed a fair chunk of drilling (with more to come, we’re sure).

It has attracted some top talent to the board and in an advisory capacity, and sophisticated investors are starting to see what’s on the table here:

A big resource, big flakes, big names, and big ambitions.

We’ll keep on keeping on with VRC, or at the very least keep our eye on it to see how this emerging graphite story plays out.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.