NML Drills Deeper into the “Australian Andes”

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

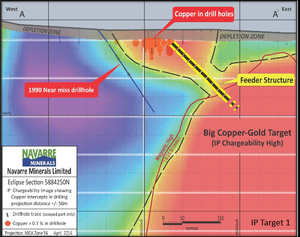

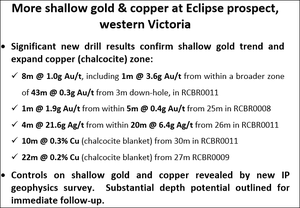

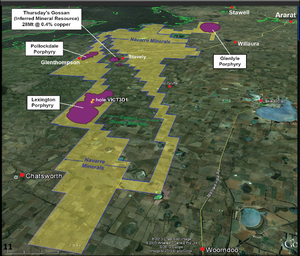

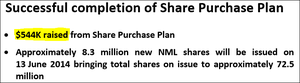

It’s official. NML has now kicked off its ‘deeper’ drilling campaign, with results due in just weeks... Right now it is hunting a giant porphyry-copper deposit on its flagship ‘Eclipse’ prospect, one of its 4 porphyry targets identified in the newly uncovered Miga Arc copper belt in western Victoria. Eclipse contains a bulging red IP copper and gold target that has been staring NML in the face for some months now – it is located directly under a shallow secondary (chalcocite) blanket of enriched copper and gold. The target is one of three identified by a geophysics survey at Eclipse, and it may well be a giant Aussie porphyry, just like the beasts you find in Peru. NML is starting to unlock the secrets of what is down there – a total of 3,000m will be drilled this time, with holes ranging between 60 and 200m deep. In order to fund this campaign, NML recently raised $544k from a Share Purchase Plan (SPP), and a further $300k from Crocodile Gold, its largest shareholder and owner of Victoria’s two largest operating gold mines. Now NML is well funded to tackle porphyry discoveries not only at Eclipse but also within their broader Western Victoria Copper properties. If NML uncovers something big in the current drill campaign, then we will be hoping for a re-rate...

It’s been about a month since The Next Small Cap last bough you news on NML’s progress in the Miga Arc. Since we first covered NML back in late March, it’s had a fairly decent run:

Chart Source: Etrade.com.au

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. In early May, friendly rival Victorian porphyry hunter Stavely Minerals launched their IPO. Stavely listed at a market cap of $16 million, and is now worth about $23 million:

Chart Source: Etrade.com.au

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. Stavely’s big debut together with a State and Federal government funded deep drilling program on the Miga Arc has swung the spotlight firmly on this emerging copper belt in western Victoria and NML is using all of that publicity to its fullest advantage. As well as all the action in regional Victoria, the politicians have started to come to the party for Aussie investors. You may have thought the Federal budget was a tough one, but for NML investors, it hasn’t been so bad.

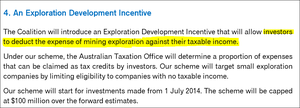

Investing in small exploration companies who are exploring in Australia and have no income will soon be tax deductible.

Yes, that’s right – Aussie investors get a tax break for supporting little exploration companies like NML. Australia’s Industry Minister, the Honourable Ian Macfarlane recently outlined the government’s new resources policy which is called the Exploration Development Incentive which is designed to encourage investment in junior minerals explorers.

![]()

This AUS$100M program is set to be launched on July 1 st 2014 and allows investors to deduct mining exploration expenses incurred by juniors against their taxable income in Australia. It is almost like the tax credit you get from a franked dividend. So just as NML announces a major step towards discovering a huge copper deposit in a red hot mining zone the government gets set to launch a scheme that will reward investors who support it. Meanwhile back down to regional Victoria, the current $23M market cap commanded by Stavely includes one modest inferred shallow copper resource in the Miga Arc but it is yet to discover a deeper porphyry source to this mineralisation. Like Stavely, NML has discovered similar shallow copper blankets at Eclipse and also at its Lexington porphyry prospect just down the road from Stavely. Very soon NML should know more about the deeper source of this shallow copper. Both camps are charging ahead with drilling in the region, and the success of one will surely help the other by bringing lots of media attention to the region. However the potential uplift in stock price if a big discovery is made benefits NML more than Stavely, when you take into account that NML is capped at less than $5M... You can have an in-depth look at NML in our original article ‘Tiny ASX Company in Race to Discover the Australian Andes ’ but in this article we’re going to update you on all the very latest action out in the Miga Arc. It’s a fast race out there in country Victoria to find a red metal behemoth and NML is powering ahead. Let’s catch up!

Deeper Drilling Now Underway

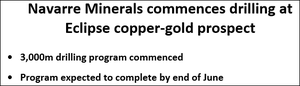

NML has kicked off its deeper drilling campaign, with results expected in a matter of weeks:

Back in the 1990s a former exploration company and tenement holder drilled at Eclipse and just missed the copper porphyry that IP chargeability results show might be lurking there:

Damn close, but now NML is armed with these IP results... You can see in the above image the lower bulging red IP electrical chargeability target is connected by a narrow straw (the “feeder structure”) to an upper IP chargeability layer containing abundant copper mineralisation. Could this just be the tip of the iceberg? In January this year, NML had been drilling down into this shallow layer in an effort to get an idea of what lies below and to identify the most promising areas to target. As follow-up, an IP geophysics survey revealed the massive target below and another two targets nearby but slightly deeper. The shallow drilling has been successful with lots of intercepts showing copper and gold close to the surface – a very good indication of something larger below... a porphyry?

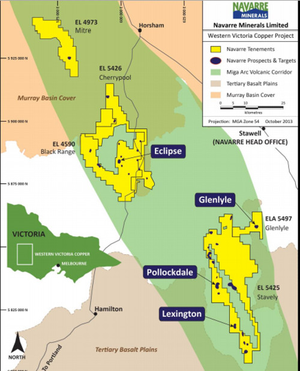

NML has now embarked on a deeper 3,000m RC drilling program at Eclipse to probe the big red blob lurking below – hopefully they can find the source of this shallow copper and gold mineralisation. Holes will be drilled down to 200m depth to pierce the top of that glowing red target. With assay results from the drill program expected within weeks, NML investors won’t have to wait long for an indication of what lies beneath the shallow copper and gold mineralisation. Stavely Minerals currently has a $23M market cap with just one modest inferred shallow copper resource in the Miga Arc but it is yet to discover a deeper porphyry source to this mineralisation. NML has four confirmed porphyry targets, two of which have similar shallow copper blankets. NML has more land in the Miga Arc, more volcanic strike length – but only a sub $5M market cap... You can see the southern half of NML’s dominant land holdings below, along with the purple ‘areas of interest’:

You can see above that NML’s holdings surround Stavely’s in this region. When Stavely launched we said it was good news for NML because anything that a cashed up company finds in the Miga Arc will reflect well on our undervalued company. The publicity surrounding Stavely’s market debut and high valuation could very well lead to a significant re-rating for NML if the market wakes up and recognises its full potential. This may happen in the next few weeks as drill results from both camps start to emerge. Stavely are currently drilling too. They are planning some very deep diamond drilling holes to find that elusive porphyry target with six 500 – 700m drill holes planned at Thursday’s Gossan. These targets are deep, time consuming to drill and more expensive than the drilling required at Eclipse’s shallower target (although Eclipse has some deeper targets too). Even with Stavely around, NML is not hanging on the coat-tails of its news flow but instead taking the bull by the horns and charging ahead. If the deeper RC drilling program at Eclipse is successful then NML may well be onto something that indicates a porphyry system. If that happened, we wonder how the market would react... Stavely currently have a market cap of $23M for just one modest inferred shallow copper resource in the Miga Arc. What could NML end up with if just one of its four porphyry targets delivers pay dirt?

NML Cashed Up – Over $800k Banked

With so much drilling to do, NML has recently completed an SPP to existing NML shareholders at 6.5 cents each, raising an impressive $544k:

Add that to the recent share placement with Crocodile Gold Corporation, at the same issue price as the SPP that’s put $300,000 into its coffers:

The total of $844k is a fairly decent war chest to fund NML’s near-term drilling program.

Junior resources investment supercharger on the way

At a recent Resources Investment Symposium held in Broken Hill, the Honourable Ian Macfarlane MP had some big news to announce...

Minister MacFarlane gave one of the keynote speeches and outlined the coalition government’s policies for Australia’s resources and energy sector. You can read the full thing here . The shorter version is that part of current policy is an initiative called the Exploration Development Incentive. This AUS$100M capped program allows investors to deduct mining exploration expenses against their taxable income! Yes, you read that right. Investing in resource exploration in Australia will soon be a tax write-off.

The initiative is limited to juniors with no taxable income – perfect for emerging exploration companies like NML who are still working hard toward their goals. The way it works is that an Australian taxpayer who invests in a junior like NML will then have that investment assessed by the Australian Tax Office to determine how many tax credits it earns under the scheme. If it’s greenfields, in Australia and being conducted by a company without a taxable income then it qualifies. The EDI is set to launch on the 1 st of July 2014 – right around the time we could have the first results from NML’s deep RC drilling program at Eclipse. We told you NML has excellent timing – NML investors will soon get a tax credit for investing with NML as long as they are an Aussie taxpayer.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in reporting on high potential stocks. To note just a few:

- Following the Next Oil Rush article on ASX:TPT – Drilling Just Weeks Away for Tiny Explorer Targeting 1.6 Billion Barrels of Oil

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

NML wows the crowds in Broken Hill

As well as Minister MacFarlane, NML was also one of the delegates at the same Resources Investment Symposium held in Broken Hill. Fifteen Australian mining juniors gave talks on their projects and NML was one of them – Managing Director Geoff McDermott did the honours – here’s a copy of his presentation :

The big news for NML was the announcement that it will be starting a 3,000m RC drilling program at its Eclipse prospect in the Miga Arc in June 2014. They have delivered on their promise with drilling currently underway. The current drilling focus, Eclipse, contains the shallowest of four porphyry prospects NML has identified to date and we understand each angled hole will be drilled to depths of up to 200m:

You can see where Eclipse sits in the map below:

This copper rich region in Western Victoria has only just been opened up and NML saw the potential before anyone else, securing a dominant 1,278 km2 land holding. The target in the Miga Arc is to find a porphyry – a huge deposit of copper and sometimes gold or molybdenum. They were formed by ancient volcanic activity and the Miga Arc may well contain several like nuts in a chocolate bar. The region holds so much potential that the Victorian and Australian governments realize this and are investing public money into exploring the region to provide plenty of geological information to encourage investment for new mines, jobs and a huge boost for the local economy.

The bottom line is that NML is targeting porphyries of greater than 300 Mt – just one of this size could support a mine for over 50 years and create over 1,000 jobs...

NML gets media darling status

NML’s deeper RC drilling program and ambitions to turn its Miga Arc holdings into a porphyry playground have been getting quite a lot of media attention lately. In the Herald Sun, a Melbourne-based newspaper, the highly respected business writer John Beveridge wrote this article on 27 th May all about NML’s efforts out in Western Victoria.

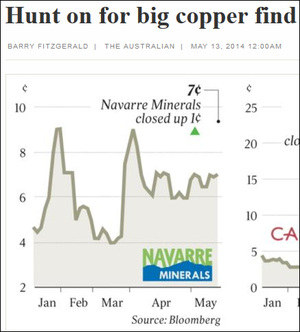

Beveridge says it is possible the Miga Arc could become the world’s next copper mining region and the success of Stavely and NML’s drilling programs are being watched very closely. He goes on to say that NML’s four copper porphyry targets – Eclipse, Pollockdale, Glenlyle and Lexington – all have potential and the current 3,000m of angled drilling at Eclipse will soon inform the markets of what’s in the ground. NML is certainly getting on the radar in Victoria – but nationwide it’s also getting some traction. The Australian, the country’s only national broadsheet, published this write up of NML’s ambitions on the 13 th of May. It was written by Barry Fitzgerald, one of Australia’s best-known mining journalists.

Fitzgerald says the idea of an ‘Australian Andes’ where copper deposits are as plentiful in Victoria’s Miga Arc as they are in the highlands of Peru is gathering momentum. He says Stavely’s $16M IPO has focused lots of investor attention on the emerging mining region and many eyes are now swiveling to NML’s play. Fitzgerald says NML was an ‘honest toiler’ hunting gold until it switched to copper porphyries in the Miga Arc to go after what he calls ‘the big one’. And he adds NML’s small market cap gives it ‘extreme’ leverage with even a ‘sniff of success.’ The Next Small Cap tends to agree... With deeper drilling set to start very soon at NML’s Eclipse prospect we could soon see a follow-up piece!

So, what’s next for NML?

Drilling! Lots of it! 3,000 metres of RC drilling in 25-30 drill holes at NML’s Eclipse prospect in the Miga Arc has started. The angled holes will be up to 200m deep across the prospect. Results will start to flow in the coming weeks so NML investors should strap themselves in for the ride.

Will it be a porphyry? If NML can uncover some solid drill results, it may well see a re-rate. Remember that Stavely is currently sitting on a $23M market cap with just one modest inferred resource in the bag... NML has four targets and a market cap less than $5M. If NML’s drilling delivers the goods then NML investors will be glad they got in early. NML is cashed up after its recent capital raisings and with the Australian Government’s tax credit scheme about to come on stream for junior mining investments, it’s potentially shaping up to be a very rewarding time for NML investors. The suspense is killing us!

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.