Venus joint venture strikes bonanza grade gold at Youanmi

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Venus Metals Corporation Limited (ASX:VMC) in conjunction with its Joint Venture partner Rox Resources Limited (ASX:RXL), has released exceptionally high-grade results from its Youanmi Gold Project exploration program.

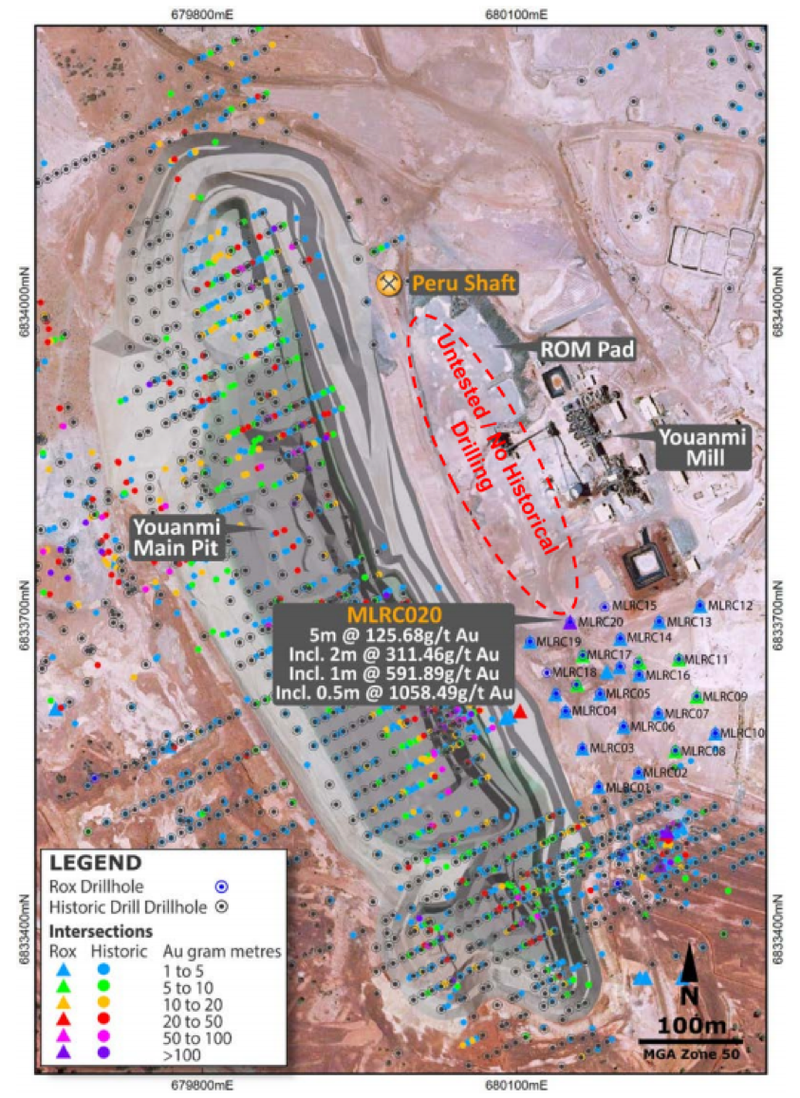

Shallow reverse circulation drilling was recently conducted across a series of shallow holes to the south of the Youanmi plant to test a laterite gold target.

Notably, near surface gold grading more than 1000 g/t has been discovered.

Interestingly, shares in Rox Resources who released the announcement on behalf of the joint venture are up more than 20%.

Consequently, as investors become aware that Venus has an equal share of the project, it could also experience significant momentum.

Importantly these results come less than a fortnight after the joint venture released promising results from the Youanmi South and Commonwealth drilling, including 4 metres at 11.2 g/t gold and 3 metres at 5.4 g/t gold.

The laterite zone appears to have an average grade of approximately 1.5g/t gold and thickness of about 2 metres and is continuous from historical drilling at the airstrip over an area of about 280 metres by 100 metres as indicated below.

As indicated above, drill hole MLRC020, located on the northern-most line of the drill plan, returned extremely high gold grades at and near surface with plentiful visible gold present in RC chips.

Less than a metre below surface, gold grading more than 1000 g/t gold was identified.

Other notable hits were at one metre and 2 metres below surface with grades of 591 g/t gold and 311 g/t gold respectively.

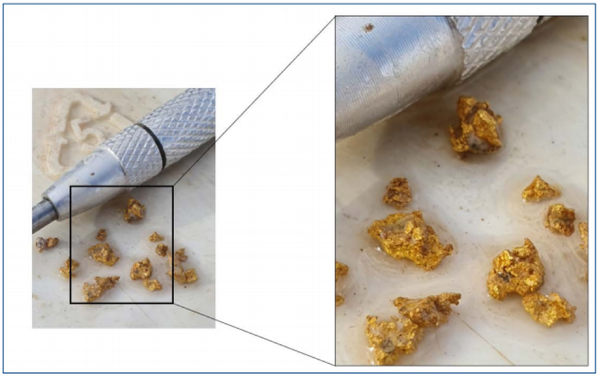

Examples of chips from drill hole MLRC020 are shown below.

Of significance is the fact that the area to the north is yet to be tested by drilling.

Although weathered, RC drill chips from the high-grade interval suggest the host rock is strongly altered granite with abundant vein quartz.

On this basis, the current interpretation is that the gold is from a primary source, rather than from supergene upgrading effects.

Visible gold presents as nuggets up to 2-3mm in size which are intergrown with translucent quartz that is interpreted to be vein quartz.

Historical mining indicates there could be more to come

While early stage, these results are considered highly encouraging.

In historical mine records there is reportedly free-milling gold mineralisation present within the Youanmi granite to the east of the Main Lode Shear Zone.

One such area is a gold lode developed in the footwall to the Main Lode, towards the northern end of the Main Pit.

Historic mining records (pre-1942) describe this as the Peru Reef (see above map), a narrow sub-vertical north-trending quartz vein with a mineralised strike length of approximately 100 metres.

While production figures were not recorded, the grade was reputed to have averaged more than 60g/t gold from near surface workings.

A series of holes has been planned to test down dip of MLRC020 and to the north-north-west along strike.

Given the shallow nature of the mineralisation encountered, a series of costeans will also be dug across the interpreted strike of mineralisation seen in MLRC020 to assist in geological mapping and to provide channel samples for assay.

This strategy appears to be practical, cost-effective and suited to the style and location of mineralisation encountered in MLRC020.

Costeaning is the process by which miners seek to discover metallic lodes.

It involves sinking small pits through the superficial deposits to the solid rock, and then driving from one pit to another across the direction of the vein, in such manner as to cross all the veins in the area under exploration.

Venus opened up stronger on Tuesday morning in response to news, and with further assay results from the joint ventures extensive drilling campaign due in coming weeks this positive share price momentum could continue.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.