US bans Russian uranium - GUE set to drill for uranium… in the US

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,205,598 GUE shares and 500,000 options at the time of publishing this article. The Company has been engaged by GUE to share our commentary on the progress of our Investment in GUE over time.

They had been talking about it for a while.

Last week they finally did it.

The US Senate has just approved a ban on Russian uranium imports.

The import ban starts in 90 days...

90 days for the US to figure out some new uranium supply sources.

But there are fears that Russia might retaliate by banning its uranium exports to the US immediately...

So the US needs to find new local or friendly sources of uranium.

This comes just as our Investment Global Uranium and Enrichment (ASX:GUE) is drilling for right now in the US.

The project that GUE is drilling right now is one of the largest underdeveloped uranium projects in the US which likely underpins a large part of GUE’s current valuation.

(Source)

...GUE’s broad goal is to grow their existing 49.8M pound JORC uranium located in the US resource to over 100M pounds.

And GUE have just announced plans to move into a scoping study on building a uranium mine, which is expected to be released in the next few months...

All this as the U price appears to be starting another leg up over the last few weeks.

GUE also owns a ~21.9% stake in a uranium enrichment technology company.

GUE’s enrichment tech is key to processing uranium to be usable in reactors and is one of the key reasons we Invested in GUE.

Russia and China control 63% of the world’s uranium enrichment capacity.

Not ideal in the current geo-political landscape where access to resources and technology are being used to apply political pressure.

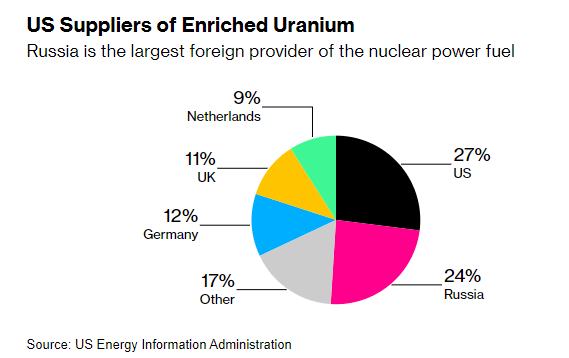

Meanwhile, in terms of the actual fuel for nuclear reactors, 24% of the US’ enriched uranium comes from Russia.

This is going to need to change quickly.

Over the course of the war the US government has sanctioned a variety of Russian commodities.

But the US government considered uranium too critical to ban, and avoiding damage to the US economy was considered a bigger priority than inflicting political and economic pain on Putin’s Russia.

Until now.

President Biden is expected to pass then ban into law soon. The act, approved by unanimous consent, would bar US imports 90 days after enactment.

But it’s possible Russia will respond with a unilateral export ban if the US bars imports, which could end deliveries of enriched uranium from the country immediately.

The impact of this is that the US uranium industry will be scurrying to shore up a local supply of uranium to feed their reactors.

In FY24, the US government plans to invest $2.4BN in the development of the domestic nuclear supply chain.

GUE already has an established resource base of 49.8 million pounds of uranium in the US across a number of projects.

Again, the company is aiming to double that to 100 million pounds by growing its existing projects, or targeted M&A.

GUE is currently capped at $29M with $6.2M in the bank as of 31 March 2024.

The more pounds in the ground, the larger the company’s value.

And then of course, there's GUE’s stake in an enrichment technology company.

Enriched uranium can be used for Small Modular Reactors - an exciting new type of reactor that can be built in a factory and sent anywhere as an emissions free energy source - think mining sites, industrial sites, or small towns.

(and data centers... the processing infrastructure used in the current artificial intelligence rush)

The US government sees this next generation nuclear power technology as critical, and wants to see a commercial supply chain evolve over time.

Funding of US$700M has been provided under the Inflation Reduction Act (IRA).

There are only two stocks on the ASX that have uranium enrichment technology assets.

One is Silex Systems - which has gone from a 30c share price in 2019 to now $6.04, and a $1.4BN market cap. It owns 51% of its enrichment technology.

We think GUE offers a powerful combination of uranium enrichment technology AND uranium supply in the right jurisdiction.

The recent US legislation makes domestic supply of uranium all the more important - and GUE is about to start drilling again at its US uranium project.

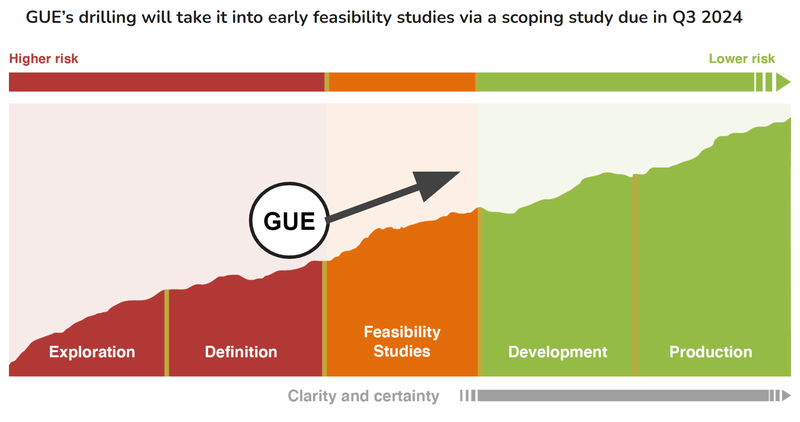

This drilling will set up a scoping study (due next quarter) which will give a first pass assessment of the economics of the project.

We think this will likely incorporate a strong uranium price - the uranium spot remains at a level not seen for 16 years:

The uranium price has popped up to US$92 in recent weeks and was as high as US$100/lb earlier in the year.

(Source)

A strong uranium should improve the desirability and economics of GUE’s large ~50Mlb JORC resource in Colorado, US.

Again, the project that GUE is drilling right now is one of the largest underdeveloped uranium projects in the US which likely underpins a large part of GUE’s current valuation.

(We don’t think the market has ascribed much value to GUE’s enrichment tech) - YET.

We think that enrichment tech could unlock a large Silex-style re-rate if and when progress is made on this front.

Click here to read our most recent note on GUE’s enrichment tech

But uranium enrichment is of course really sensitive stuff - it’s a US$6BN market dominated in large part by Russia and China.

So it's hard to get a grip on how this potentially crucial technology is progressing.

GUE’s only uranium enrichment peer, Silex Systems languished at a market cap of ~$100M for a long period between 2018-2020 before taking off in 2022 after ticking off a series of operational milestones that currently sees Silex trade at a market cap of ~$1.4BN.

Silex’s run gives a sense of how powerful the macro trends are around US uranium right now.

A couple months ago we attended Canada’s largest mining conference (PDAC) and can confirm that the talk of the town was US uranium assets - anyone with a project in the US was feeling buoyant.

But that enthusiasm has yet to fully seep down to the junior end of the spectrum.

And yet, GUE is waiting in the wings as the US uranium renaissance heats up.

Here’s what’s happening right now.

What do we want to see from GUE’s drilling?

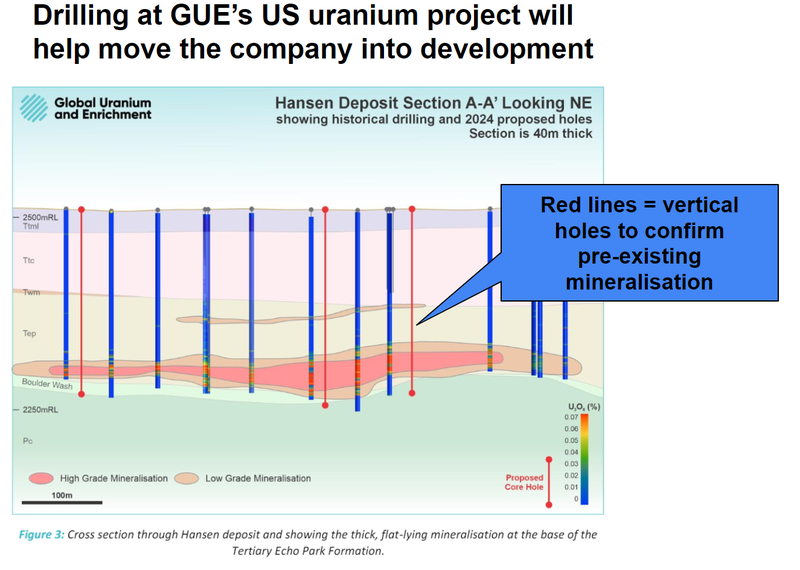

GUE is drilling a 10 hole 2300m program right now - these look to be vertical holes looking to follow up on the already existing 1000-hole set of data at this 49.8Mlbs JORC resource:

(Source)

GUE’s current JORC resource of 49.8M pounds at a grade of 540ppm sets the bar for what we want to see from this drilling - effectively more of the same.

GUE spent significant time engaging with the local government and stakeholders to secure the drilling permit for this drilling in Fremont county, Colorado - we followed the drill permitting process closely. (Read our Quick Take)

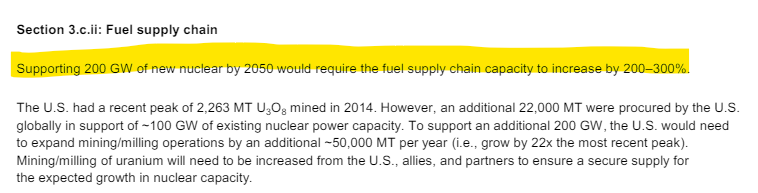

There’s renewed momentum behind US domestic uranium and the US Department of Energy calling for a 200-300% increase in a whitepaper on the uranium supply chain last year:

(Source)

Well, with the legislation banning Russian imports of uranium to the US on the cusp of becoming law, the stage is set for GUE to bring its large JORC stage resource into feasibility studies.

This is not swing for the fences exploration drilling - this is precise, disciplined geotechnical drilling to help move GUE towards the development stage at this project in Colorado USA:

By progressing along the mining life cycle during a period of high commodity prices (in particular, uranium) GUE will be hoping to get as far during this window of opportunity for the company.

🎓Learn: The Mining Company Life Cycle Explained

What does the US uranium import ban mean for GUE?

In the short term, we’re hoping the US legislative move should bring more attention from funds to companies like GUE that have large pre-existing asset bases.

GUE has stated its intention of chasing down a total of 100Mlbs of in ground resources - which we think is the right sized target for it to start attracting this kind of attention.

Some market watchers are suggesting that the U spot price run could have more legs too:

(Source)

In the medium term - we’re hoping a positive scoping study in Q3 at its JORC resource will be the beginning of more substantive conversations with funds seeking exposure to more advanced US uranium assets.

Noting that current GUE Managing Director Andrew Ferrier has a background in private equity where he was focussed on managing US uranium assets - we think there’s significant potential here.

In the long term - this our ultimate upside scenario for GUE:

Our GUE Big Bet:

“GUE re-rates to a +$250M market cap by achieving a major technological breakthrough with its uranium enrichment technology and/or is acquired at multiples of our Entry Price by a US focussed uranium major looking to gain access to its assets and technology”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our GUE Investment Memo.

What’s next for GUE?

Drilling at Tallahassee project (advanced JORC resource) 🔄

Drilling has commenced in the Tallahassee project, with GUE expecting this drilling to take x weeks to complete.

Results from the drill program will then be incorporated into the Scoping Study which will be completed in Q3 2024.

Drill permits pending for Maybell project:🔄

Drilling is expected to commence at this brownfields uranium project in August 2024, where GUE has an exploration target of 4.3 - 13.3Mlbs.

Historical grades and intercepts at this project are high and we think large enough to warrant a significant drill program (one hit was 7.3m at 2,200ppm).

GUE is planning for a 40 hole program at Maybell.

Good hits from this project shape as a potential catalyst for GUE and may catch the market off guard, if positive.

Further updates on uranium enrichment technology (Ubaryon) 🔄

At the fundamental level we want to see Ubaryon de-risk its enrichment technology both operationally and from a regulatory perspective :

🔲 Further validation and extend the enrichment performance (show how well it works)

🔲 Achieve continuous operation at bench scale (scale up process)

🔲 Regulatory approvals

At the same time we are hoping Ubaryon is successful in getting funding either from the Australian Federal government grant or through the US$700M program made available by the US Department Of Energy (DOE) .

Risks

With their $6M raise in Q1 2024, GUE put themselves in a relatively healthy position for their upcoming drilling project in Tallahassee.

As such we see the main risks for GUE to be “Exploration Risk” and “Technology Risk”.

In terms of exploration risk - the holes at the advanced JORC resource are vertical and we don’t expect too many surprises here.

But the July drilling at the other brownfields Colorado project (Maybell) could hit the low end of the exploration target, or fail to find any economic mineralisation.

With regards to technology risk it's possible that GUE’s stake in its technology partner doesn’t work out. GUE could fail to secure regulatory approvals, the technology could struggle to scale up, or the technology partner fails to validate the efficiency improvements it brings at scale.

Our GUE Investment Memo:

Click this link to see our GUE Investment Memo where you can find a short, high level summary of our reasons for Investing.

In our GUE Investment Memo you’ll find:

- Key objectives for GUE

- Why we Invested in GUE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.