Graphite Whales Joined by Minnow MOZ

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

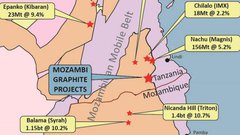

Mozambi Resources (ASX:MOZ) is the $4M capped minnow swimming alongside graphite whales Triton Minerals (capped at $130M) and Syrah Resources (capped at over $600M)...

And now MOZ has moved a step closer to towards what could be a genuine re-rating event – drilling for graphite at Cabo Delgado.

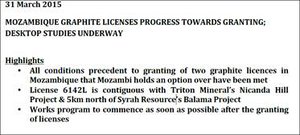

Things are starting to get real... in a recent crucial announcement, MOZ delivered the news that all conditions have been met for the granting of licenses that MOZ has the option to acquire. But more on that later.

The Cabo Delgado region in Mozambique is home of the biggest two graphite deposits on the face of the earth – Syrah’s Balama and Triton’s Nicanda Hill.

Syrah and Triton are the “BHP and Rio Tinto” of graphite...

Just as BHP and Rio are Aussie resource heavyweights that dominate the global iron ore game, Syrah and Triton are dominating the global graphite game.

Enter MOZ... it’s very early days of course but the end goal here is to become the “Fortescue of Graphite”.

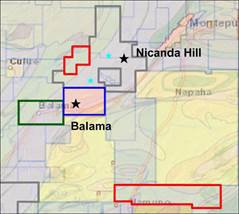

A picture tells a thousand words...

The battle to become the Fortescue of graphite is between MOZ, wearing red, and Metals of Africa (ASX:MTA) in green.

MOZ looks to have the most leverage, despite being at an earlier stage, being capitalised at just $4 million, compared to MTA’s $14 million.

On 31 st March, the vendors of the graphite projects MOZ has the option to acquire advised that all conditions required for granting of these licenses have been met:

This de-risks the acquisition process, and brings MOZ closer to its commencement of ground works and drilling.

MOZ will commence exploration immediately upon formal grant of the tenements, which is expected shortly.

The prize tenement is virtually within the TON tenement that hosts the world’s biggest single graphite deposit – TON’s Nicanda Hill.

The other is just to the southeast, and is around double the size of the tenement that hosts the world’s second biggest graphite deposit – SYR’s Balama.

Here is that map again – but zoomed in – remember MOZ’s ground marked in red:

Syrah’s Balama deposit is 1.15 billion tonnes @ 10.2% graphitic carbon and 0.23% V 2 O 5 .

Triton’s Nicanda Hill deposit is 1.457 billion tonnes @ 10.7% graphitic carbon and 0.27% V 2 O 5 .

These are the goliath resources that MOZ now sits directly above and beside...

MOZ’s $4 million market cap gives investors exposure to two projects surrounded by the biggest graphite deposits the world has ever seen.

Needless to say, the potential upside here is significant.

Triton Comes of Age

MOZ’s timing in securing control over these assets was impeccable...

Triton was trading at just 15c, and the graphite boom was seemingly taking a breather.

But then Triton released the first of a cluster of game changing announcements that singlehandedly revitalised the entire graphite sector.

Firstly, the revelation that Triton’s graphite is expandable, which makes it much more valuable and suitable for end uses such as batteries for electric cars.

Secondly, Triton formed a binding strategic alliance with German graphite heavyweight AMG Mining.

Then, enter one of the small cap mining deals of the decade... Triton signed a $2 billion, 20 year offtake agreement with Yichang Xincheng Graphite Co, the largest private producer of expanded graphite products in China.

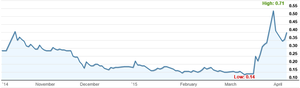

These announcements instigated a rise in the value of Triton shares, 5-bagging from 14c to 71c:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

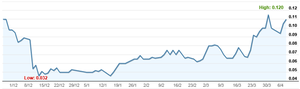

Fellow nearology play MTA has also multi-bagged based on TON’s resurgence, more than tripling from its lows of 3.2c:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

MOZ however appears yet to be discovered by the mass market, and has only increased 50% since inking the option to acquire the ground that is engulfed by TON and SYR – and since we first highlighted MOZ in our article $3M ASX Nano-Cap Next Door to the Biggest Graphite Resource Known to Man :

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

So we think MOZ has just a touch of catching up to do...

Triton is now capped at $130 million – over 30 x MOZ, whilst Syrah is capped at over $600 million – 150 x MOZ.

And even MTA is capped at approximately 3.5 x MOZ.

We believe further appreciation is likely in MOZ’s celebrity neighbours, and MOZ too – ground exploration is coming in the near future, now that all conditions precedent to the granting of licenses have been met.

We have invested in MOZ as the Mozambique graphite play as we believe it has the best risk/reward metrics, however any decision to make an investment should be based on your own research.

MOZ are now working with geologists in Mozambique and Australia and are carrying out desktop studies. As soon as the licenses are granted, MOZ will carry out fieldwork which should include drilling in the near term...

Stay tuned!

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.