Are we at the start of a multi-year uranium bull market?

Published 29-SEP-2023 14:00 P.M.

|

12 minute read

Anyone who has been in markets for longer than a decade will have specific moments they remember and will probably never forget.

Three of the most recent ones, without a doubt, are:

- The tech boom of the early 2000s when internet companies were trading in the billions of $ in market caps despite having nothing but a website. ASX small caps were certainly getting in on it.

- The battery metals boom of 2017-18 and then 2020-now - we’re all living through this one right now - a few lithium 100 baggers have been around. New people entering the markets from the last few years will be telling their grandkids about this one.

- The uranium bull market of 2006-2008 - Paladin Energy went from 1.3c to touch a high of $9.46. Bannerman Energy was the best performing stock on the ASX in 2006.

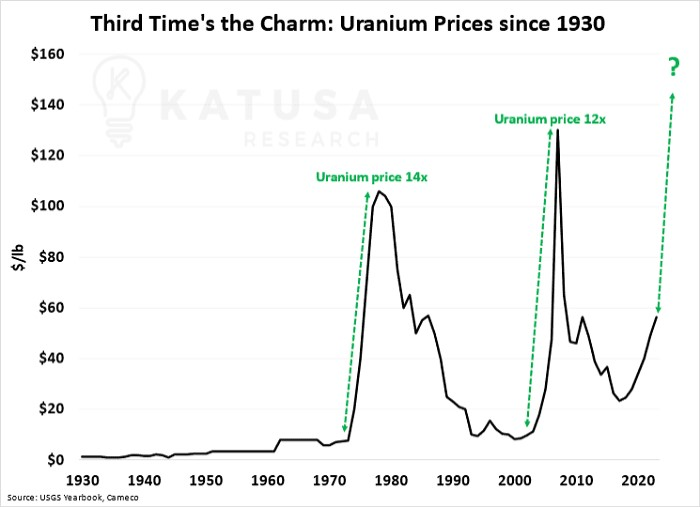

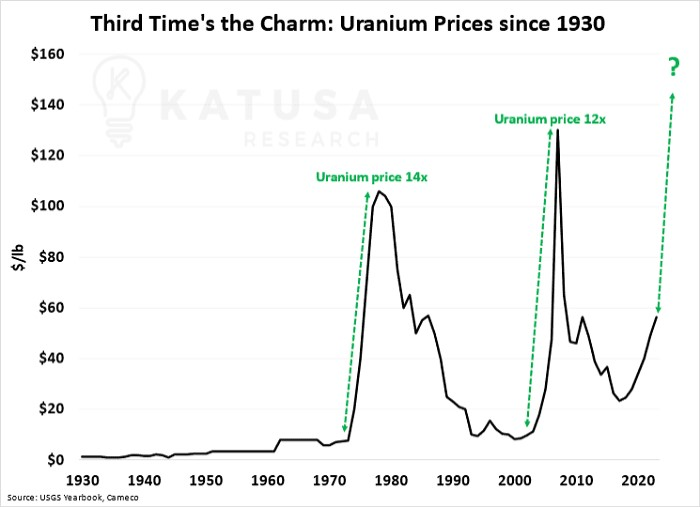

Between 2004 and 2008, the uranium spot price went up by over 12x to ~US$140/lb.

Then the global financial crisis followed by Fukushima snuffed out the price run.

In the last few weeks the uranium price has hit its highest point in over a decade.

We are betting that we are at the start of a new uranium bull market.

Now we certainly could be wrong... remember there was a false start uranium price run back in 2020.

But we are small cap Investors and our job is to make bets on long term macro themes... ideally before they happen.

A few days ago we made a new Portfolio addition in uranium - Haranga Resources (ASX:HAR) - a junior explorer defining a uranium project in Senegal, West Africa, led by ex-Bannerman Energy MD Peter Batten.

You can read our launch note and why we Invested in HAR here

We are also Invested in two other uranium companies:

- GTi Energy (ASX:GTR): Growing its uranium resource in Wyoming to a size and scale where it becomes an attractive takeover target to potential uranium peers in the region (new update coming soon, read our earlier GTR note here)

- Okapi Resources (ASX:OKR): uranium explorer and developer with projects in Colorado, USA and Canada, with a cornerstone stake in a uranium enrichment technology company (read our most recent OKR note here)

Are we at the start of a multi-year uranium bull market?

Uranium’s price run from 2006 to 2008 was so strong and so fast that it still gets talked about today:

(you’ll know this if you’ve ever been cornered by a die-hard uranium bull at a party)

Back in 2006, the reason for the uranium move was put down to three main things:

- Energy security - Energy security concerns and a rush to try to find cleaner renewable alternatives to high carbon-emitting fossil fuels.

- Demand to increase - On the demand side, the theory was that nuclear power uptake would increase exponentially worldwide, which would increase demand for uranium.

- Lack of supply - On the supply side, the theory was that the world had been living off stockpiles mined in the 1980s and that existing supplies wouldn't be enough to fill forecast demand.

Some even blamed the floods at Cameco’s Cigar Lake mine in Canada for the price surge.

No matter the reason, during 2006 to 2008 uranium companies, big or small, reached nosebleed levels and FAST.

Now we are seeing the same scenario play out, except this time, the uranium market has suffered from a further ~20+ years of under-investment in new supply, supply out of Kazakhstan decreased during COVID, and the world has been busy building more nuclear reactors.

So we have a situation where demand is increasing and expected to increase a lot more as new nuclear reactors come online.

New mines aren’t being built, and new discoveries aren't being made.

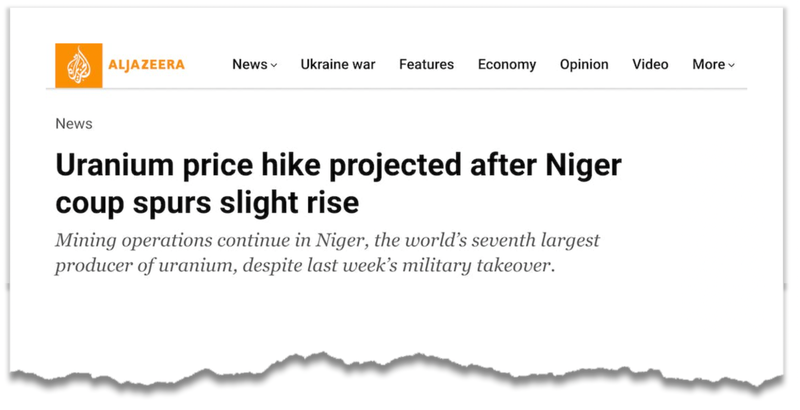

And just like we did in 2008, we have a potential supply shock with the coup in Niger.

Niger is responsible for ~5% of global production and ~20% of supply into France, which has the second biggest nuclear reactor fleet in the world.

For some context - Niger is a top 7 producer of uranium globally.

(Source)

Add to this the potential disruptions that could come off the back of the Russia/Ukraine conflict, and the uranium market is faced with an almost identical scenario to the one it faced in 2008.

Russia is just ahead of Niger and is the world’s 6th largest producer of uranium.

We think this time, the macro thematic is even stronger...

This is because the uranium market is heading into a period of structural shortages, made worse by the Russia/Ukraine conflict, which threatens to hit the enriched uranium supply chain.

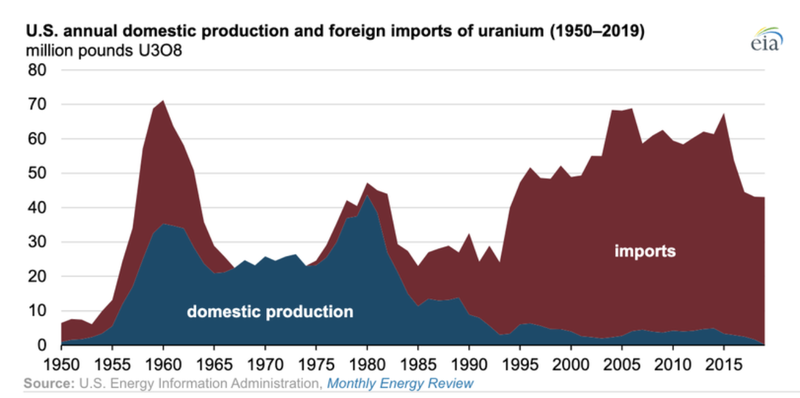

For some context USA, which has the world's biggest nuclear reactor fleet, purchases ~20% of its enriched uranium from Russia.

At the same time, the US is almost solely reliant on imports for its uranium supply.

Basically, the US finds itself in a position where it has no control of its uranium supply chain and in need of uranium to power the reactors that produce ~30% of its electricity.

(Source)

We think the recent run in the uranium spot price is in part due to the market's sudden realisation that all of the above matters.

(by “sudden” we mean over the last 12 months or so).

The US government also seems to be trying to get ahead of any problems and has already introduced up to ~$10BN in funding support for the domestic uranium/nuclear industry:

- US$6BN to maintain and upgrade existing nuclear power plants

- US$4.3BN to wean itself off Russian uranium supplies.

AND has potential bans on uranium supply out of Russia (which we think could put more pressure on uranium prices).

- Bill #1- Seeks to ban Russian uranium (read more)

- Bill #2- Seeks to invest ~US$3.5BN in onshore nuclear fuel supply chains. The US Senate voted 96-3 in favour of this.

The question is.... Are we about to see a third uranium bull market?

The uranium price has just hit decade highs and is signalling a potential third bull market.

The first uranium bull market was in the 1970s-80s when the price increased by 14x.

The second was in 2007-2009, when the price increased by over 12x.

Are we about to see a third, and IF we do, how much will the price increase?

What does a capital flow macro tailwind mean for share prices?

In the past, we wrote about what makes share prices go up for small cap companies.

One of the reasons (and oftentimes the strongest) is the capital inflows chasing a new macro theme.

🎓 Click here to read that educational article: Why do share prices go up?

Macro capital flows refer to when any particular story/theme gets strong and investors start piling into the sector.

The best way to think about it is like that video of that one guy dancing at a music festival, and then as things heat up and more people get involved, it cascades into a major mosh pit.

It's no different in the stock market - when a macro theme gets hot, people s pile in, and the more people pile in, the more momentum it builds and turns into a positive feedback loop of ever more increasing interest:

Lonely long term believers and “evergreen”, die hard bulls - don’t stop believin’:

Early entrants - “hey this macro theme could be actually be pretty good in the long term”

Interest starts to build - companies in the sector start delivering share price returns, Investors see other people having big wins in the sector:

Larger funds and institutions start getting into it, mergers and acquisitions start happening:

Now we have a bull market:

This is basically how bull markets work for any macro theme.

You can watch the full video here

IMPORTANT: make sure to watch this video in reverse to see how a bull market dissipates into a bear market - this usually happens much faster than a bull market starting.

As the uranium spot price starts to increase, the guys who were there when the price was at its lows start to make noise about the big wins they have had in the sector.

That brings in new people who are looking to replicate that success, and eventually, it can all boil over in a FOMO rush into the sector by investors.

Right now we think capital is flowing into companies that are the closest to production, already in production OR just directly into physical uranium (like the Sprott physical uranium trust).

Eventually, we think that as the uranium price moves higher, we expect to see investor capital shift from the bigger companies into the higher risk/higher reward junior companies, hopefully like the ones we hold in our Portfolio.

On Wednesday, we added a new Investment to our portfolio that we think fits this criteria: ~$10M capped micro cap Haranga Resources.

Read our launch article: Our New Investment (ASX: HAR)

We are also Invested in two other uranium companies:

- GTi Energy (ASX:GTR): Growing its uranium resource in Wyoming to a size and scale where it becomes an attractive takeover target to potential uranium peers in the region.

- Okapi Resources (ASX:OKR): uranium explorer and developer with projects in Colorado, USA and Canada, with a cornerstone stake in a uranium enrichment technology company.

We think there are a lot more chapters to play out in the uranium story for 2023 and beyond. We will be watching this thematic closely.

Update on major catalysts coming up in our Portfolio:

In last week's weekend email, we touched on the imminent major catalysts across our portfolio that we are looking forward to over the coming months.

The major catalysts are a culmination of months and even years of work and often have a big impact on the future of small-cap companies.

These “share price catalysts” can be good or bad, depending on the results versus market expectations, and share prices will go up OR down.

This week, one of the catalysts we were most looking forward to was announced:

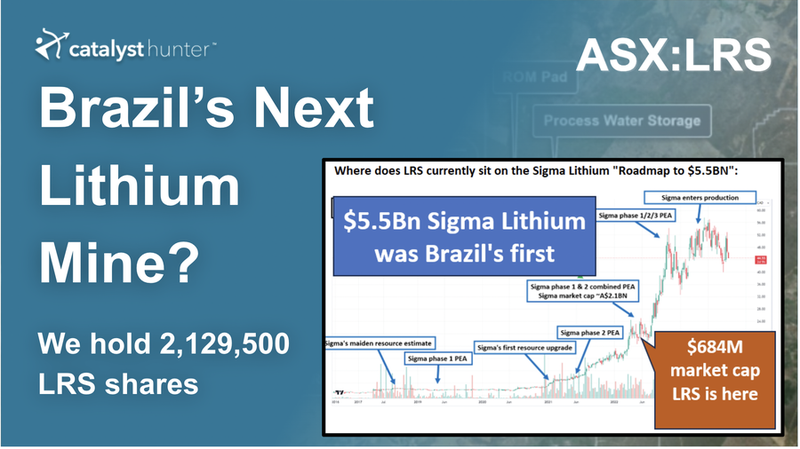

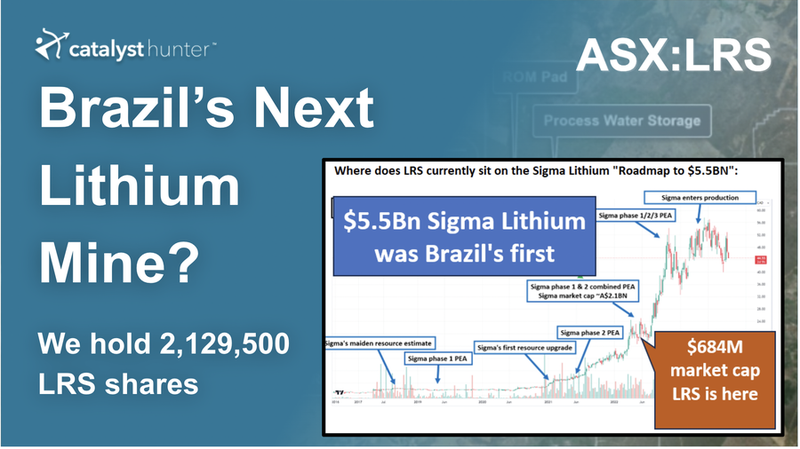

Latin Resources (ASX:LRS) Preliminary Economic Assessment (PEA) for its Brazilian lithium project:

LRS announced A $3.6BN Net Present Value (NPV) for its project based on an initial CAPEX of only ~$400M.

The study came in a lot higher than even the most optimistic scenarios we had run internally.

We think LRS delivered above our expectations on its major catalyst, especially given LRS’s market cap of $684M compared to the project's $3.6BN NPV.

Keeping in mind, LRS is drilling to increase the size of its project, which could add to project economics even further.

Read our full LRS note on the news here:

Here are the other companies in our Portfolio where a key share price catalyst is expected in the next 12 weeks:

- Invictus Energy (ASX: IVZ) - Is currently drilling its Mukuyu-2 well, targeting 20 trillion cubic feet of gas + 120m barrels of oil. IVZ is looking to officially declare a discovery with this well.

- Noble Helium (ASX: NHE) - Drilling its 16.5 billion cubic feet pure play helium target in Tanzania. NHE is now weeks away from drilling its well.

- Lycaon Resources (ASX: LYN) - Assay results and downhole EM survey results from its drill program at its Bow River nickel-copper-PGE project in WA. So far, LYN has hit sulphides from both holes, now it's about seeing what the assays bring.

- Galileo Mining (ASX: GAL) - is drilling next to its Callisto PGE-nickel discovery, chasing NEW discoveries.

- Neurotech International (ASX: NTI) - has clinical trial results due from its phase I/II PANDAS/PANS trial. Results are expected in the coming weeks.

- Solis Minerals (ASX: SLM) - has more assay results pending from its first 12 holes and is getting two more drill rigs on site for more drilling at their “pegmatite cliff”, which, after the first couple of holes, is so far proving to be a puzzle to unlock.

- Tyranna Resources (ASX: TYX) - is expected to kick off its long awaited second lithium drilling campaign in Angola next month, it’s been a long wait, and we are excited about this one.

- Pursuit Minerals (ASX: PUR) - is looking to produce battery grade lithium carbonate from its pilot plant AND kick off a drill program at its lithium project in Argentina.

- Tempus Resources (ASX: TMR): has a maiden JORC resource due for its gold project in Canada. We are also looking forward to TMR completing the acquisition of its new lithium projects in Canada. Aside from the JORC gold resource, the key catalyst we hope to see before Christmas is getting a lithium assay done on one of the historical pegmatite cores from its new Canadian lithium project.

- Emyria (ASX:EMD): is a small cap biotech working on psychedelic assisted therapies using MDMA, ketamine and psilocybin to treat difficult mental health problems - in their announcements they shortly expect to dose their first ever clinic patient with MDMA for treating PTSD. This will be the first in Australia.

What we wrote about this week 🧬 🦉 🏹

Our newest Investment: Haranga Resources (ASX: HAR)

We introduce HAR to our Catalyst Hunter Portfolio - a junior explorer defining a uranium project in Senegal, West Africa.

Brazil Lithium: LRS reveals $3.6BN Net Present Value for $400M CAPEX

Yesterday LRS published a study detailing the economics of its Colina Lithium project in Brazil. With an attractive NPV and low CAPEX, we believe LRS could be the next billion-dollar Sigma 2.0.

Potential for large nickel-copper mineral system

Lycaon Resources (ASX: LYN) this week completed its second drillhole at its Bow River nickel-copper project in WA hitting sulphides over 43m - we give our take as well as what we want to see next.

Quick Takes 🗣️

EV1 - Mining Licence renewed for 10 years

GTR - Uranium prices at decade highs - GTR drilling for more uranium

NTI - completes Rett Syndrome Recruitment

MNB - Minbos launches fertiliser brand in Angola

PFE - acquires more land in Smackover near Exxon’s lithium project

NHE - is now days away from drilling its helium well

Macro News - What we are reading 📰

Uranium

Is Momentum Building for Changes in Uranium Mining & Nuclear Energy Laws? (Money of Mine)

Lithium

US billionaire snaps up Aussie engineering firm for $900m (AFR)

What They're Not Telling You About the McDermitt Caldera Discovery (Wealth Daily)

Rare Earths

Where do the separated rare earths produced by Lynas actually go? (Livewire Markets)

Biotech

After NASH Hopes Are Dashed, Intercept Pharma Agrees to $794M Buyout (MedCityNews)

Gold

Chinese Gold Buying Is Driving a Paradigm Shift in Bullion (Bloomberg)

FMCG

Orange Juice Might Fizz to Another Record High as Hurricane Risks Linger (Investing.com)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.