Share price catalysts we expect in the next 12 weeks

Published 23-SEP-2023 12:00 P.M.

|

11 minute read

There are ~12 weeks left to go before the market effectively shuts down for the Christmas break.

The lead up to Christmas is traditionally a busy time in the small cap markets.

Companies are working hard to deliver long awaited material news to the market before everyone stops paying attention around mid December.

There is usually a flurry of IPOs, capital raisings, partnerships, mergers and acquisitions and other deals done during October and November.

It’s often said “if you haven't got your deal done by the start of December, it won’t happen till after February next year”.

Which is why we see this artificially high rush of activity in the lead up to the Christmas break, as deal making gets compressed into this small, finite pre-Christmas window.

The next ~12 weeks promises to be busy across a particular basket of our Portfolio companies too.

By “busy” we mean there is an expectation of material catalysts that could have a significant impact on share prices - positive OR negative, depending on the result.

Kicking things off this week was IVZ, who officially won our unofficial “race to start drilling” with its high-impact frontier oil & gas well this week.

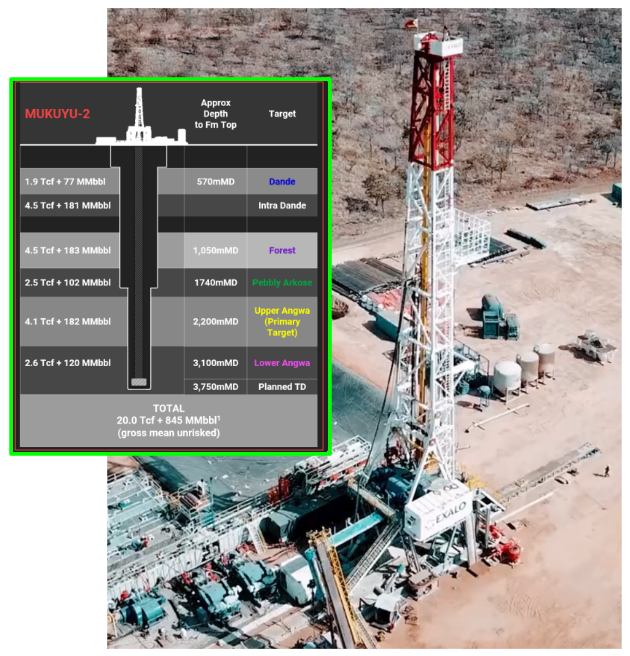

IVZ started drilling its Mukuyu-2 oil & gas well in Zimbabwe’s Cabora Bassa Basin - one of the few basins across east Africa yet to see an oil and gas discovery.

IVZ is drilling a prospective resource of 20 trillion cubic feet (TCF) of gas +120m barrels of oil.

Drilling is expected to take ~50 to 60 days, which means we should know the results from the program before Christmas.

And if the share price activity in the lead up to IVZ’s 2022 drilling of Mukuyu-1 is anything to go by, its should ver a very interesting 50 to 60 days ahead (interesting = exciting and terrifying):

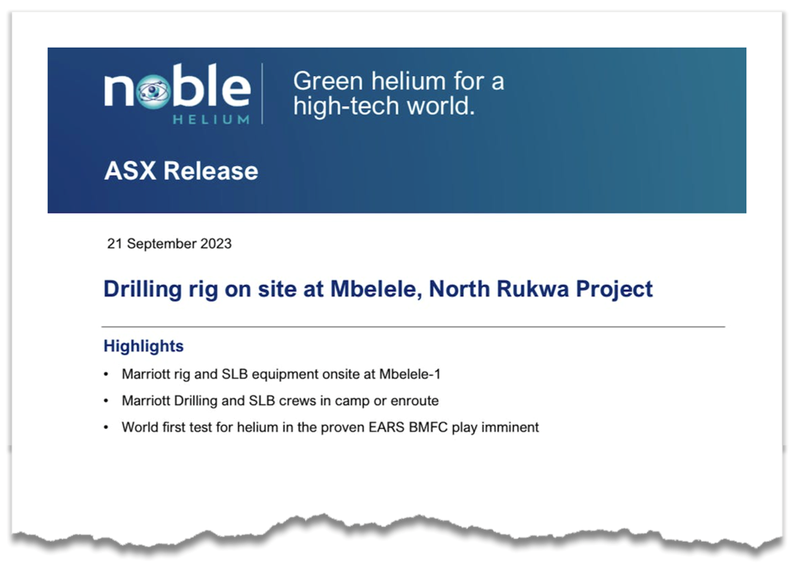

NHE is not far behind in starting its drilling, announcing on Thursday that its drill rig is now on-site and preparing to drill what could be a globally significant helium discovery if successful.

Also on Thursday, EXR announced progress on its gas well in Queensland, which is expected to start drilling next month.

Years of work has gone into these projects with the main events - the drilling - culminating at effectively the same time for these three companies.

It’s rare to have three drilling campaigns of this significance happening at the same time, and we hope to know the results before the Christmas break.

With the small cap market crying out for a new success story to get investors active and excited again, we hope that one of our three current drillers will deliver that elusive “incredible result”.

(Dare we dream that all three will deliver...? Surely not).

Drill programs that deliver that elusive “above expectation result” are company makers and provide the share price catalysts that small cap investors seek.

AND we should start to see results from all three of them before the end of the calendar year.

Speaking of imminent major catalysts...

Like our three oil & gas drillers above, small cap companies generally raise capital and use the money to put in months and years of work on a project.

This effort (and spending of investor money) culminates in the release of a key “result”.

In oil & gas and mineral exploration it's a drilling result.

In biotechs it’s a clinical trial result.

These “share price catalysts” can be good or bad, depending on the results versus market expectations, and share prices will go up OR down.

Here are the other companies in our Portfolio where a key share price catalyst is expected in the next 12 weeks:

- Lycaon Resources (ASX:LYN): is currently drilling its Bow River nickel-copper-PGE project in WA. So far, LYN has hit sulphides from its first hole, which is typically a good sign LYN is peppering holes in the right place. LYN is now drilling its second hole.

- Galileo Mining (ASX:GAL): is drilling next to its Callisto PGE-nickel discovery, chasing NEW discoveries.

- Neurotech International (ASX:NTI): has clinical trial results due from its phase I/II PANDAS/PANS trial. Results are expected in the coming weeks.

- Solis Minerals (ASX:SLM): has more assay results pending from its first 12 holes, and is getting two more drill rigs on site for more drilling at their “pegmatite cliff”, which after the first couple of holes is so far proving to be a puzzle to unlock.

- Tyranna Resources (ASX:TYX): is expected to kick off its long awaited second lithium drilling campaign in Angola next month, it’s been a long wait and we are excited for this one.

- Pursuit Minerals (ASX:PUR): is looking to produce battery grade lithium carbonate from its pilot plant AND kick off a drill program at its lithium project in Argentina.

- Tempus Resources (ASX: TMR): has a maiden JORC resource due for its gold project in Canada. We are also looking forward to TMR completing the acquisition of its new lithium projects in Canada. Aside from the JORC gold resource, the key catalyst we hope to see before christmas is getting a lithium assay done on one of the historical pegmatite cores from its new Canadian lithium project.

- Latin Resources (ASX:LRS): has a preliminary economic assessment in the works which will reveal some early numbers on the potential commercial scale of its lithium project in Brazil, and also further drilling results and a resource upgrade.

Speaking of LRS...

LRS last week released a video celebrating their 15 year anniversary of operations and sharing its story of how they came to deliver a near 10x share price run over the last 2 years.

An “overnight success” that was 15 years in the making.

The video is a must watch if you want to get an idea of how a 10 bagger actually comes about.

Here is the link to the video, a nice victory lap for LRS and hinting at much more still to come:

We were actually at an LRS investor event in Melbourne last week where we were lucky enough to be shown an early pre-release screening of the video.

The original video we saw had a pretty epic drilling and exploration video montage backed by the “Immigrant Song” by Led Zeppelin but unfortunately it looks like it didn’t make the cut in favour of a more glossy corporate version, which we think is a shame but probably appropriate given that LRS has now graduated to the upper echelons of institutional Investors and high ranking government stakeholders.

LRS reckons its preliminary economic assessment will be out this quarter, and to expect its JORC upgrade pre-christmas. Drill results can come out at any time.

LRS has come a long way since we first added it to our Portfolio back in 2020 at 1.8c, now trading at around 30c.

Speaking of new Portfolio Additions...

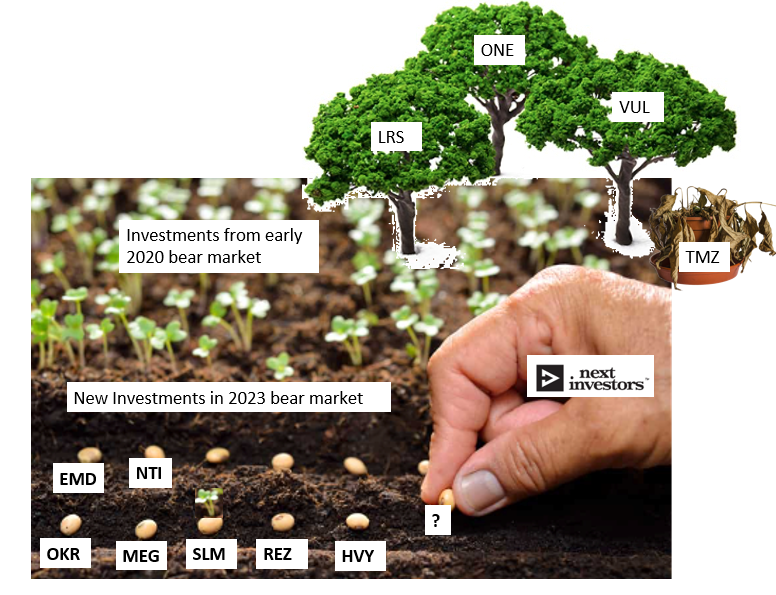

We have been busy over the last 6 months adding new “bear market” Investments while market conditions (and share prices) are broadly terrible.

Like we did during the market crash of 2020, the plan is to hold on and wait for the market to cycle back to normal, or even bull conditions.

We are calling it the “2023 bear market planting season”.

So far this year, we have added 7 new Investments, the most recent being two new early stage biotechs:

- Emyria (ASX:EMD): EMD is an integrated clinical drug development and care delivery company. EMD’s focus is on psychedelics such MDMA and psilocybin for the treatment of mental health disorders. Just this week EMD’s peer announced successful results in its Phase 3 clinical trial for MDMA assisted therapy (read the quick take).

- Neurotech International (ASX:NTI): Clinical stage biotech company following the playbook of $1.4BN Neuren. NTI is developing treatments for rare neurological diseases in children (read our invitation note).

Like in oil & gas exploration, where the results are big and binary, early stage biotechs running clinical trials can deliver the same kind of big share price re-rates we are seeking as Investors.

In our Investment Memos for EMD and NTI we outline why we Invested in these companies, what we want to see them achieve over the next 12 to 18 months and the potential risks we have identified and accepted.

Speaking of Investment Memos....

Yesterday we published a new Investment Memo for our 2021 Tech Pick of the Year Oneview Healthcare (ASX:ONE).

You can read our new ONE INvestment Memo here.

We think that there is a big opportunity in the healthcare space and we recently Increased our ONE Investment in line with the most recent capital raise for the company.

With another ~$23M in the bank, ONE is now primed for growth in the Australian and US healthcare markets.

The blue sky scenario for our Investment is ONE is that it can deliver a sustained re-rate in its share price like $7.6BN capped ASX listed Pro Medicus - over an 8 year period between 2015 and today, Pro Medicus’ share price rose ~7,100%.

Speaking of price surges....

The price of uranium has surged over the last few months and is sitting at decade long highs.

Sometimes a macro theme gets so strong, capital flows into a specific sector cascade into higher share prices for companies with exposure to that thematic.

We have two North American uranium stocks in our Portfolio:

- GTi Resources (ASX:GTR): Growing its uranium resource in Wyoming to a size and scale where it becomes an attractive takeover target to potential uranium peers in the region.

- Okapi Resources (ASX: OKR): uranium explorer and developer with projects in Colorado, USA and Canada, with a cornerstone stake in a uranium enrichment technology company.

Macro themes can take a long time to kick off - we may have been a bit early to the battery metals party in 2019, but when it kicked off it really kicked off.

But once they take off the moves can be exponential - think the lithium industry after 2021.

It produced some of our best ever Investments.

In the same vein, we Invested in these North American uranium early to get in before the macro theme hit the mainstream.

Better early, than late, is our mentality.

What we wrote about this week 🧬 🦉 🏹

Introducing our new Portfolio Addition: Neurotech International (ASX: NTI)

We Invested in NTI because it has three major share price catalysts coming in the next 6 to 12 months.

Its backers and management have delivered success for us in the past.

And it has spent the last few years building the groundwork to emulate the strategy of a similar company (Neuren Pharmaceuticals) that delivered a 1,300% price rise over the last three years.

On top of that, it’s helping treat nasty paediatric neurological disorders - which is a noble cause indeed.

LYN to get to work in the West Arunta - Land Access Signed

Our micro cap exploration Investment LYN now has land access agreements signed for its West Arunta project in WA.

One of the big exploration stories of 2023 was WA1’s rise from ~13.5c to a high of $7 off the back of a niobium-rare earths discovery in the West Arunta region.

LYN is taking a similar approach to WA1 - it's in the same region and has a similar magnetic anomaly on its ground...

IVZ is drilling now, 50 to 60 days of serotonin and cortisol incoming...

Mukuyu-2 has spudded. Drilling has officially commenced at IVZs long awaited second well in the Cabora Bassa basin.

Drilling will take around 50 to 60 days, where we are expecting regular updates from IVZ... and then the drill results.

TMR announces new Canadian lithium projects

TMR acquired new lithium exploration projects in Canada. One of its new lithium projects was previously drilled for base metals (NOT lithium) back around 1975, but instead hit pegmatites with thickness up to ~33m.

Will assays of historical cores uncover high grade lithium mineralisation, and help open up a new lithium province in Canada?

We Just Increased our Investment in ONE

We think there’s lots to look forward to from ONE - we recently increased our Investment.

ONE raised $20M at 18c back in July, followed by a heavily oversubscribed SPP that raised a further $2.8M.

Our blue sky scenario for our Investment is ONE is that it can see a sustained re-rate in its share price like $7.6BN capped ASX listed Pro Medicus - over an 8 year period between 2015 and today, Pro Medicus’ share price rose ~7,100%.

Quick Takes 🗣️

EXR: EXR QLD gas project update

88E: 88E flow test now scheduled for Q1 2024

EMD: EMD’s peer announce breakthrough results for MDMA therapy

GAL: GAL finds more nickel-PGE targets south of its discovery

LYN: LYN secures land access in the West Arunta, near WA1 Resources

Macro News - What we are reading 📰

Oil & Gas

Global inflation fears as oil price rises towards $100 a barrel (Guardian)

An Apparently Unstoppable Oil Price Rally (Oil Price)

Oil pushes closer to $US95 a barrel as global market tightens up (AFR)

Oil Steadies Near $95 as Risk-Off Mood Vies With Upward Momentum (Bloomberg)

Uranium

Uranium surges to 12-year high on coup, decarbonisation (AFR)

Bowen’s attack a sign nuclear support is growing: Libs (AFR)

Hyped up uranium investors face political fallout risk (Reuters)

Lithium

Rio Tinto’s stealth moves in WA lithium grab (AFR)

What They're Not Telling You About the McDermitt Caldera Discovery (Wealth Daily)

Cannabis

Kerrisdale Targets Tilray On Short Report: 'Structurally Unprofitable’ (The Deep Dive)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.