A Market Bounceback? New Portfolio Additions and more...

Published 15-JUL-2023 13:00 P.M.

|

12 minute read

Did the small cap market actually feel bullish again this week?

A fair bit of green in our Portfolio and watchlist.

Another tick for our July bounceback prediction (but “one good week does not a bounceback make”).

This week we kicked off our coverage of IVZ’s upcoming drill campaign - it’s going to be an exciting few months watching it unfold and we will be following closely.

We saw that MNB went into a trading halt pending “an announcement in relation to an offtake agreement” - we are looking forward to MNB coming out of halt on Tuesday.

We also announced a new Portfolio addition Heavy Minerals (ASX:HVY), a “mineral sands” developer with three projects, with a tiny market cap of less than $11M.

Here is why:

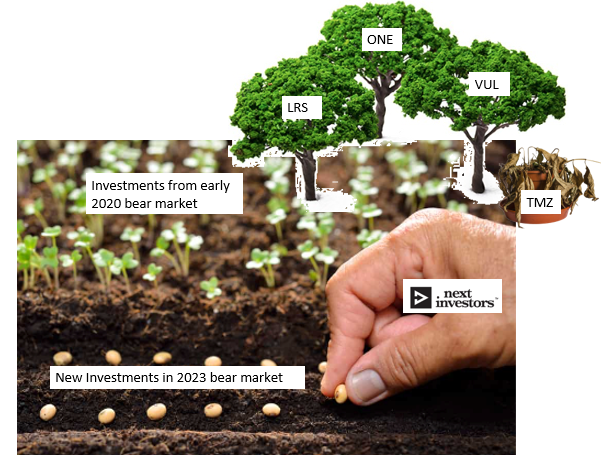

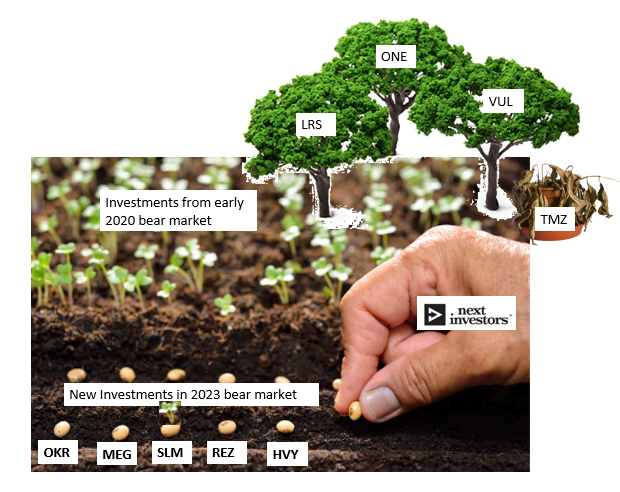

We have been banging on about the idea of an Investment “planting season” for weeks now.

At a very high level it's a reflection of how we currently see the micro cap market conditions.

Valuations have come back to reality from the 2020-2021 highs.

For over a year we have seen the share prices of companies on our watchlist go lower and lower despite them making great progress at a project level.

Market caps and enterprise values have come down to a level where we want to accelerate making new long term Investments.

We are calling this period of increased due diligence and Investing a “planting season”.

We are making new Investments in beaten up stocks that we think have interesting ideas and projects with potential that can deliver us returns over time.

Of course - this is high risk investing, and success is no guarantee. We fully expect a number of these Investments to NOT deliver success.

At its core, we aim to back companies for the long term and hope that the management teams can deliver on their goals of building a business and deliver material returns to shareholders.

Our latest Investment: Heavy Minerals (ASX:HVY)

On Monday we announced our latest Investment Heavy Minerals (ASX:HVY).

HVY is a “mineral sands” developer with three projects, with a tiny market cap of less than $11M.

HVY’s most advanced project is a garnet-rich deposit located in WA, in very close proximity to two other garnet producers valued much higher than HVY.

Garnet is an important industrial material, specifically used in abrasive sand-blasting to treat and prevent rust on ship hulls, bridges and other large metal structures.

Garnet is also used in “abrasive water-jet cutting” of metals, glass and other materials in the automotive, aerospace and electronics industries.

HVY is a micro cap stock - capped at less than $11M at Friday’s close, despite its project having a scoping study completed showing:

- Net Present Value (NPV) = $253M (~25x HVY’s current market cap).

- CAPEX = $110M.

- Payback Period = 4.2 years.

- Internal Rate Of Return (IRR) = 33%.

This week HVY released a 23% upgrade to its JORC mineral resource, which now includes 5.4Mt of contained garnet - which is ~ 5 years of total garnet global demand.

That bigger resource was not included in the above scoping study NPV calcs, so we would expect that NPV to grow and economics to improve with a bigger resource included.

HVY’s project is next door to Resource and Development Group, a company with an enterprise value close to ~$220M. Resource and Development Group is also ~65% owned by Chris Ellison’s $13BN Mineral Resources.

We are hoping that HVY can re-rate off its current sub-$11M valuation over time as it moves forward in the development phase of its project, and secures all important offtakes and project financing.

We are Invested in HVY for the long term, and our Investment Plan is to be holding the stock when its garnet project gets into production and generating cash flows.

Our “Big Bet” for HVY:

“We want to see 20x return as HVY moves into production by 2026 and become a profitable garnet mine”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list below. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Here are the 13 reasons why we are Invested in HVY

- Tiny market cap after lots of progress: HVY is currently capped at less than $11M (as of Friday), with a scoping study already completed for its project.

- Tight structure low shares on issue (SOI): HVY only has ~57.6 million shares and ~18 million options on issue. The top 20 shareholders hold ~75% of these shares.

- Management skin in game: HVY directors hold ~11% of the company, with chairman Adam Schofield holding 7.2% himself.

- Garnet is an important niche material: Garnet is leveraged to big industries like the maritime and aerospace industries to allow for rust removal, industrial cutting and anti-corrosive paint to be applied to surfaces. It cannot be easily replaced.

- Favourable long-term pricing environment for garnet: Supply side is decreasing with Indian garnet production being banned. On the demand side, bans are being considered for garnet alternatives (copper slag/coal slag) due to ESG concerns. We expect to see demand outstrip supply in the coming years leading to higher prices.

- US is spending ~US$40BN on upgrading old rusty bridges: The US has budgeted US$40BN of new funding for bridge repair, replacement, and rehabilitation. We expect this to increase demand for garnet as a sandblasting product.

- Quick, viable pathway to becoming key garnet supplier: HVY’s project has an established JORC resource, a completed scoping study and is just about to start a pre-feasibility study. HVY is targeting first production in 2026.

- Close proximity to two producing garnet projects: HVY’s projects sits next door to the GMA mine which supplies ~35% of the world’s almandine Garnet and Resource and Development Group’s newly constructed mine.

- Neighbour RDG trading at a ~$220M enterprise value: Resource and Development Group next door is capped at ~$150M and has an enterprise value close to ~$220M. Resource and Development Group is also ~65% owned by $13BN Mineral Resources.

- Project economics stack up, plenty of room for upside: HVY’s scoping study shows an after-tax project Net Present Value (NPV) of $253M, a payback period of 4.2 years, and an after tax Internal Rate of Return (IRR) of 33%. The project CAPEX is also relatively modest at $110M.

- Upside to its existing JORC resource - HVY could double its existing JORC resource with more drilling to the north/south of its existing JORC resource and at its Red Hill project where it has a 90-150Mt (4.1 to 5.4% THM) exploration target.

Update: On Monday, HVY released a 23% mineral resource estimate upgrade which brought the resource to 5.9Mt of contained garnet - which would be equivalent to 5 years of current annual demand. - Project financing support from Dutch Export Credit Agency: HVY recently received a “Letter of Support” for project funding from Atradius - the Dutch Export Credit Agency.

- ESG focus and Australian project attractive to European/US garnet buyers: Western companies are seeking sustainably produced materials, which will increase interest in sustainable produced garnet, especially given the cloud surrounding garnet that was previously produced in India.

We want to see HVY quickly enter into garnet production, in time to help address a potentially widening supply demand imbalance and capture higher prices for a project which already has strong economics.

Read our initiation note on HVY here

We will be publishing our HVY Investment Memo in the coming weeks, which will include our Investment Plan and Objectives for HVY.

Before that though, we can confirm a core part of our Investment Plan is that we will be holding 100% of our current HVY Investment for the next 12 months at a minimum.

To follow our Investment in HVY, and get all of our updates as soon as they are released, make sure that you are subscribed to our Wise-Owl Portfolio.

Our other new Investments during Planting Season

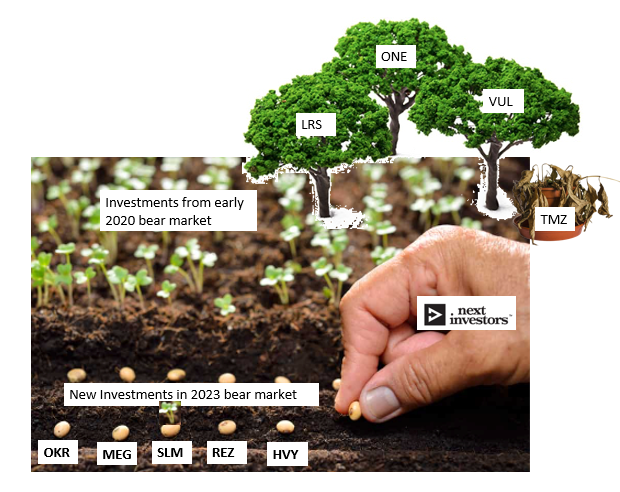

HVY is the fifth Investment we have made in what we are calling the small cap market “planting” season.

In May we announced Solis Minerals (ASX: SLM) as our 2023 Small Cap Pick of The Year.

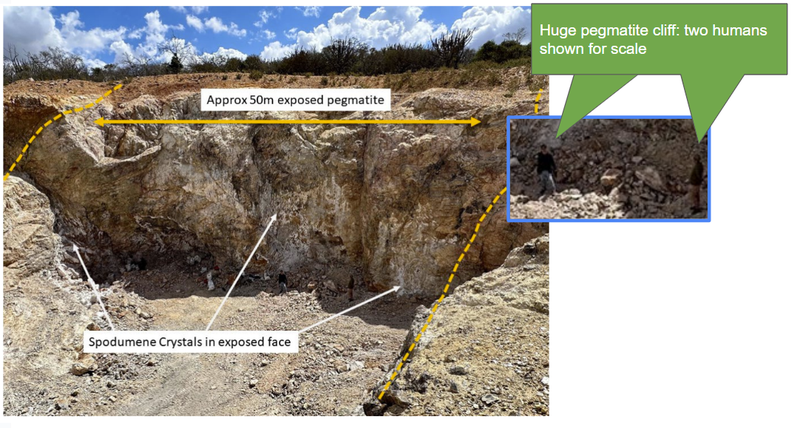

SLM is currently drilling what we have called pegmatite “Grand Canyon” in Brazil.

SLM is looking to make a lithium discovery and replicate the success Latin Resources (ASX:LRS) has had with its Brazilian lithium project.

For context - LRS made its discovery in February 2022.

Since then LRS’s share price has gone from ~3c per share to now trade at ~37c.

~$80M capped SLM wants to become the $970M “LRS 2.0”.

SLM is backed by the same team that delivered LRS’s success - Latin’s Managing Director Chris Gale is SLM’s non-executive Chairman.

LRS is also SLM’s biggest shareholder owning ~17.79% of the company.

SLM also has Matthew Boyes as its Managing Director.

Boyes was the Managing Director at Red Dirt Metals (Delta Lithium) where he oversaw early development of the Mt Ida lithium project - Red Dirt’s market cap went from ~$15M to >$200M.

Delta now trades at ~$490M.

Our SLM Big Bet is as follows:

“SLM discovers and defines a large resource, leading to a long term re-rate in the company’s share price by >1,000%”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - some of which we refer to earlier in today’s note. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

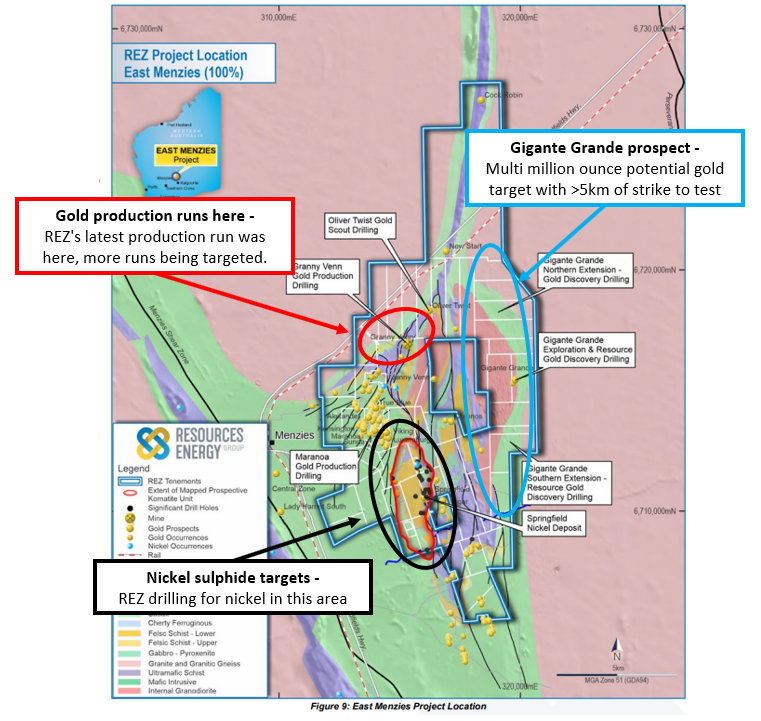

In June we announced our Investment in Resources and Energy (ASX:REZ).

REZ is exploring for nickel in Western Australia near Kalgoorlie AND advancing a set of gold projects where the company has previously run small scale mining operations from.

We are Invested in REZ because:

- REZ is chasing a WA nickel discovery, which are high in demand - think Andrew Forrest’s recent buyout of nickel miner Mincor Resources for $760M.

- REZ Chairman is also Chairman of Vulcan and Kuniko - A team that has delivered success for us in the past

- REZ has a low Enterprise Value (EV) - any exploration success could re-rate the company’s share price higher.

- REZ’s ground has never been consolidated into one landholding before - this is the first time a company can apply modern exploration on the projects. Previous exploration was done by BHP and Rio Tinto.

Our long term REZ Big Bet:

“REZ’s share price re-rates by over 1,000% off the back of a new discovery and the definition of a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our REZ Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

We are actively looking at new opportunities

These days we are spending ~75% of our time looking at new opportunities and doing due diligence on potential new Investments.

We are still on the lookout for Investments and hope to announce some new Investments in the coming weeks.

By the way, If you know of any unloved, early stage copper plays please let us know by replying to this email.

Subscribe to make sure you hear about our new Investments first.

What we wrote about this week 🧬 🦉 🏹

HVY: Introducing Heavy Minerals (ASX: HVY)

Our latest Portfolio addition is HVY which has an advanced garnet project next to two producers. Read about the 13 reasons we Invested in HVY.

IVZ: IVZ drilling Mukuyu-2 this quarter - gas discovery this time around?

IVZ is now just a couple of months away from drilling again, with all the lessons and data from its first well. We’re hoping Mukuyu-2 is able to bring hydrocarbons to the surface and IVZ can declare a discovery.

Quick Takes 🗣️

FYI: FYI appoints engineering contractor for HPA plant

OKR: OKR’s data shows Colorado uranium project has potential

BOD: Phase IIB Insomnia Trial Complete

RAS: Lithium assay results from RAS’s NT projects

Macro News - What we are reading 📰

Critical minerals:

Critical Minerals Market Review 2023 (International Energy Agency)

Biotech

On conference circuit, biotechs lobby for their identity as new IRA drug pricing reforms take hold (Fierce Biotech)

Gold

Russia confirms BRICS will create a gold-backed currency (Kitco)

Hydrogen

PM pushes to supply Germany with Australian green hydrogen (AFR)

Lithium

ASX pushes Patriot Battery Metals to address short seller claims (AFR)

Patriot says there is strong inbound interest in its Corvette project (AFR)

US-Based Commodities

Forrest poised to open battery making hub – but in the US (AFR)

Graphite

Natural graphite prices fall by 20% on China supply increase (Benchmark Minerals)

⏲️ Upcoming potential share price catalysts

Updates this week:

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- IVZ finalised the drilling location. We also launched our new IVZ Investment Memo, read our full note here.

- MNB: Offtake agreement for its phosphate fertiliser project.

- MNB went into a trading halt on Friday “pending the release of an announcement in relation to an Offtake Agreement”. See that announcement here.

- BOD: Phase III clinical trial for CBD insomnia treatment.

- BOD put out a new Investor presentation this week. Check out the presentation here.

No material news this week:

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- GAL: Drilling at its Jimberlana & Mission Sill prospects at its PGE project in WA.

- TG1: Drilling at its NSW gold project in May.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q4 2023).

- LCL: Drilling at its primary PNG copper-gold target.

- LNR: >10,000m drill program at rare earth’s project in WA.

- SLM: Maiden drill program at its Brazilian lithium project:

- TMR: Maiden JORC resource estimate for its Canadian gold project.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.