Introducing Heavy Minerals (ASX: HVY)

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,750,000 HVY shares at the time of publishing this article. The Company has been engaged by HVY to share our commentary on the progress of our Investment in HVY over time.

Today we are announcing a new Portfolio addition.

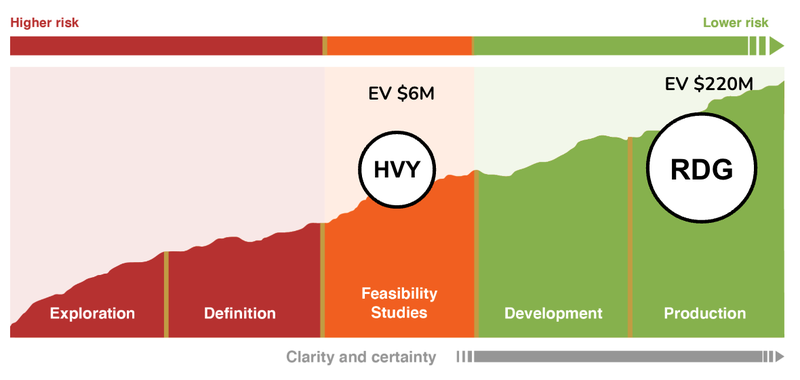

This company has a tiny $6M market cap, a big project, operates in a tight market where demand is fast out-pacing supply and production is anticipated in 3 years.

Our May Portfolio addition SLM went from 16.5c to $1.17, touching a high of $1.34.

Our June Portfolio addition REZ went from 1.2c to 2.2c, touching a high of 3.7c.

Remember that the past performance of our recent portfolio additions does not mean future portfolio additions will perform in a similar way.

Today we are welcoming Heavy Minerals (ASX:HVY) to our Portfolio.

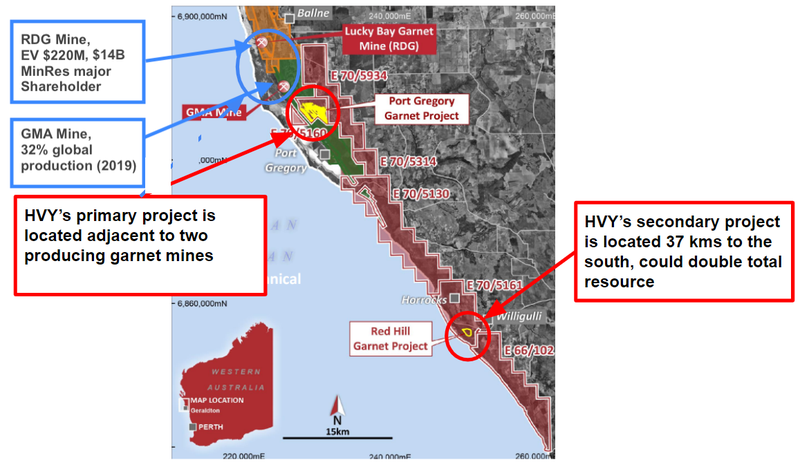

HVY is a “mineral sands” developer with three projects. The most advanced project is a garnet-rich deposit located in WA, very close proximity to two other garnet producers.

Never heard of garnet before?

We hadn't either until we started doing due diligence on this company over a year ago. We have since done enough research to make an Investment.

Garnet is an important industrial material, specifically used in abrasive sand-blasting to treat and prevent rust on ship hulls, bridges and other large metal structures.

It is also used in “abrasive water-jet cutting” of metals, glass and other materials in the automotive, aerospace and electronics industries.

Garnet is one of only a few materials that can be used in industrial sandblasting AND cutting.

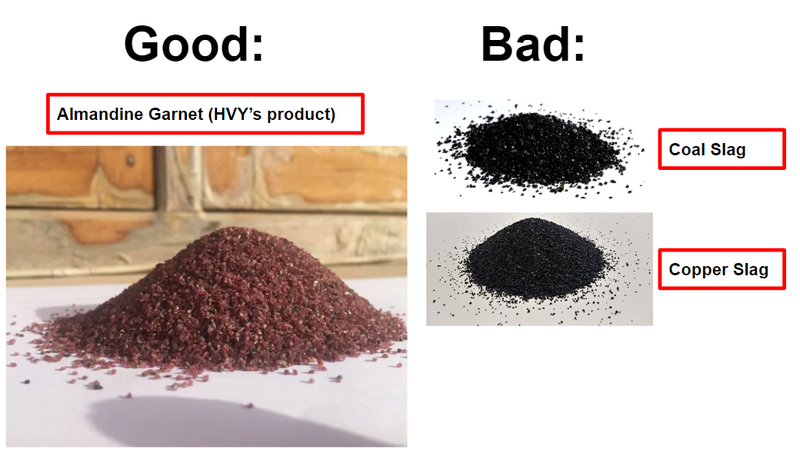

Importantly, garnet is eco-friendly compared to alternative industrial abrasives like dirty coal slag or carcinogenic copper slag.

As the world focuses on becoming environmentally friendly we expect the shift towards industrial garnet to further accelerate.

Why HVY, why garnet and why now?

HVY has a large garnet resource and a fast track mine development plan.

The garnet price is rising and global supply is dropping.

We think the garnet demand increase will continue for several reasons:

- Unlicensed garnet mines in India were damaging the environment, so the government completely banned any garnet mining in India, removing a key global supply source.

- Western buyers under pressure to “go clean and green” are seeking alternative ESG friendly garnet from environmentally friendly operations (like HVY).

- Last week at a summit of the global shipping industry, 175 nations agreed to a net-zero commitment to reduce greenhouse gas emissions by or around the year 2050. This included removing pollutants used in shipping - where coal slag and copper slag could be replaced by eco-friendly garnet for ship hull cleaning.

- The US administration has introduced an Infrastructure & Jobs Act. The bill includes a total of $40BN of new funding for bridge repair (source), replacement, and rehabilitation, which is the single largest dedicated bridge investment since the construction of the interstate highway system. This includes US$2BN to fix some 30,000 steel bridges, including removal of rust - the key use of garnet (source).

We think the garnet demand is going to be strong over the next decade, which is why we are adding HVY to our portfolio today.

HVY also has two further permits that could materially increase their current garnet resource with some further drilling.

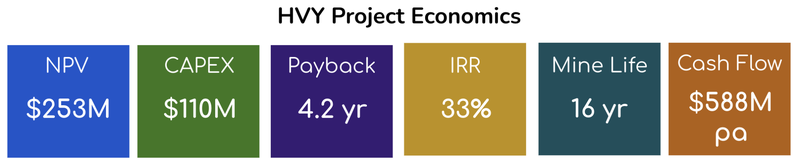

A scoping study based on HVY’s resource had a $253M NPV, on a CAPEX of $110M.

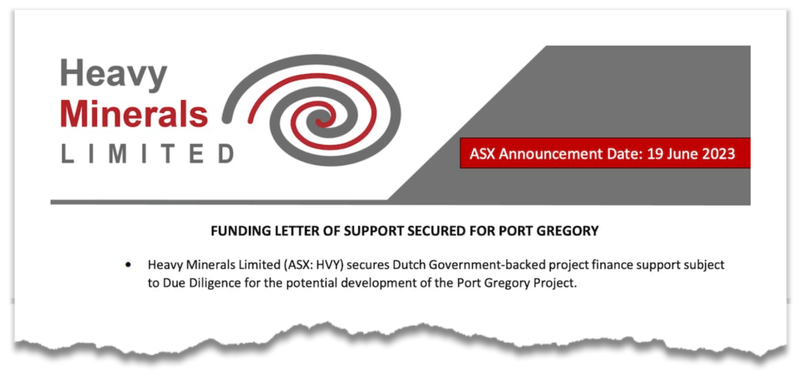

HVY’s scoping study numbers were enough to secure Dutch government backed finance support for the potential development of the project (subject to due diligence) through a “funding letter of support” that was announced to the ASX last month.

As a general rule of thumb, companies usually trade at around a third of their NPV, which is what attracted us to HVY in the current market conditions.

HVY’s focus is on quick production to capture the rising supply demand imbalance in the garnet market.

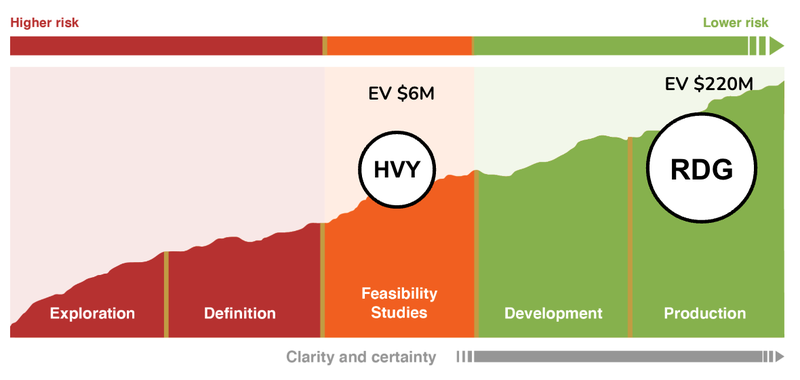

A later stage garnet producer next door to $6M capped HVY is capped at ~$150M and trades with an enterprise value of ~$220M.

There are only a handful of companies in this industry, we think HVY can enter quickly and it's got the support of a potential debt financier which is closely tied to a major ship company.

Obviously there are risks associated with every small cap resource investment - we will cover some of these later in this note.

In summary, here’s the quick rundown on why we Invested in HVY:

- Tiny market cap after lots of progress: HVY is capped at just $6M with a scoping study already completed for its project.

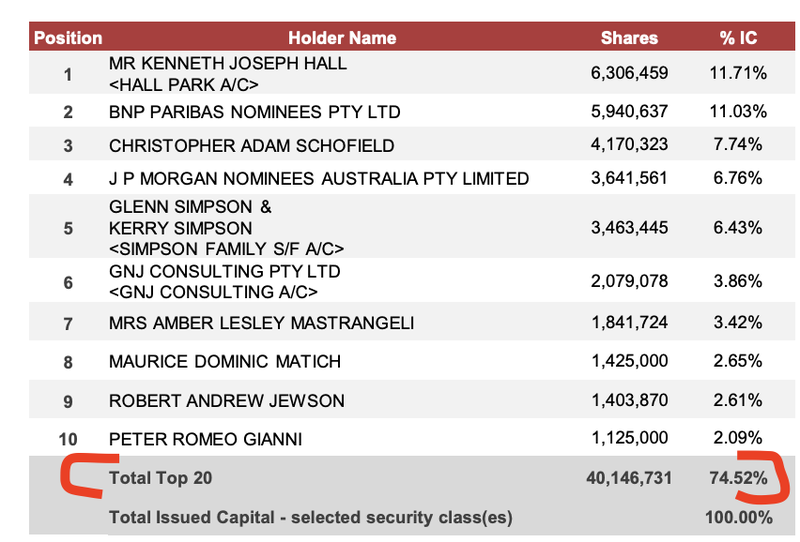

- Tight structure low shares on issue (SOI): HVY has ~55 million shares and ~18 million options on issue. Prior to our Investment, the top 5 shareholders held ~75% of these shares.

- Management skin in game: Before our Investment, HVY directors held ~11.6% of the company, with chairman Adam Schofield holding 7.7% himself.

- Garnet is an important niche material: Garnet is leveraged to big industries like the maritime and aerospace industries to allow for rust removal, industrial cutting and anti-corrosive paint to be applied to surfaces. It cannot be easily replaced.

- Favourable long-term pricing environment for garnet: Supply side is decreasing with Indian garnet production being banned. On the demand side bans are being considered for garnet alternatives (copper slag/coal slag) due to ESG concerns. We expect to see demand outstrip supply in the coming years leading to higher prices.

- US is spending ~US$40BN on upgrading old rusty bridges: The US has budgeted US$40BN of new funding for bridge repair, replacement, and rehabilitation. We expect this to increase demand for garnet as a sandblasting product.

- Quick, viable pathway to becoming key garnet supplier: HVY’s project has an established JORC resource, a completed scoping study and is just about to start a pre-feasibility study. HVY is targeting first production in 2026.

- Close proximity to two producing garnet projects: HVY’s projects sits next door to the GMA mine which supplies ~35% of the world’s almandine Garnet and Resource and Development Group’s newly constructed mine.

- Neighbour RDG trading at a ~$220M enterprise value: Resource and Development Group next door is capped at ~$150M and has an enterprise value close to ~$220M. RDG is also ~65% owned by $13BN Mineral Resources.

- Project economics stack up, plenty of room for upside: HVY’s scoping study shows an after-tax project Net Present Value (NPV) of $253M, a payback period of 4.2 years, and an after tax Internal Rate of Return (IRR) of 33%. The project CAPEX is also relatively modest at $110M.

- Upside to increase garnet resource: HVY could double its existing JORC resource with more drilling to the north/south of its existing JORC resource and at its Red Hill project where it has a 90-150Mt (4.1 to 5.4% THM) exploration target.

- Project financing support from Dutch Export Credit Agency: HVY recently received a “Letter of Support” for project funding from Atradius - the Dutch Export Credit Agency.

- ESG focus and Australian project attractive to European/US garnet buyers: Western companies are seeking sustainably produced materials, which will increase interest in sustainable produced garnet, especially given the cloud surrounding garnet that was previously produced in India

We think all of these 13 reasons we Invested in HVY see it capable of securing a big re-rate and take it to many multiples of its current market cap of $6M.

For context, a re-rate that is in line with its listed peer and neighbour would see it achieve the following Big Bet that we have for HVY:

Our “Big Bet” for HVY

“We want to see 20x return as HVY moves into production by 2026 and become a profitable garnet mine”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list below. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We intend to release a HVY Investment Memo in the coming months as the company outlines its strategy further following today’s resource upgrade.

To follow our Investment in HVY, and get all of our updates as soon as they are released, make sure that you are subscribed to our Wise-Owl Portfolio: https://nextinvestors.com/wise-owl/.

Below we’ve got more detail on the reasons we Invested in HVY and some key risks we’ve identified for this Investment:

Reasons why we invested in HVY (more detail):

1. Tiny market cap after lots of progress

HVY is capped at $6M.

We see this as tiny given the company’s relatively advanced stage and strong project economics on its primary project.

HVY listed on the ASX in September 2021 and since then has quickly drilled out its primary project, delivered a sizable JORC resource (that just got bigger today) then quickly moved that project into a scoping study.

2. Tight structure low shares on issue (SOI)

HVY has a tight capital structure, with less than ~55 million shares and ~14 million 25c options on issue prior to our Investment.

The top 5 shareholders held ~43% of these shares and the top 20 hold ~75%.

We like tightly held companies, as success can deliver swift re-rates as there isn’t much loose stock on issue.

3. Management skin in game

According to the last HVY investor deck, Directors of HVY held ~11.6% of the company.

Of particular note is non-executive chairman Adam Schofield’s ~7.7% holding.

We like it when the board and management are aligned with shareholders, due to high shares ownership.

4. Garnet is an important niche material

Recyclable and safe - HVY’s garnet is excellent for sandblasting, which allows for anti-corrosive paint to be applied to surfaces.

Basically anything that can rust needs garnet.

Garnet is leveraged to big industries like the maritime and aerospace industries as well as infrastructure projects.

5. Favourable long-term pricing environment for garnet

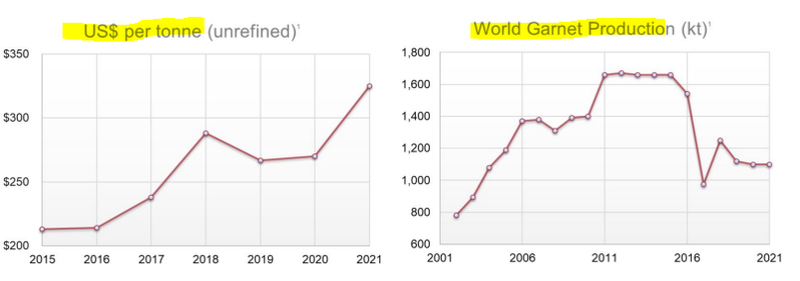

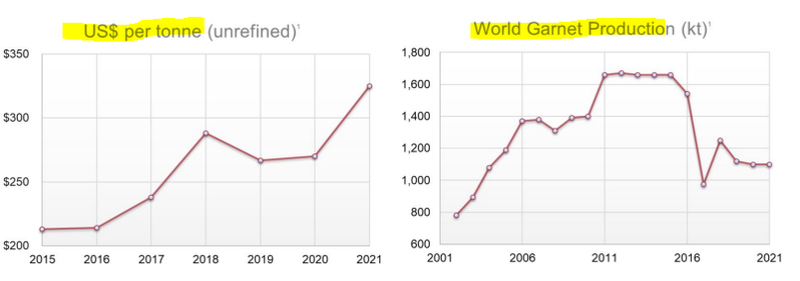

Garnet prices can fluctuate, but overall prices have increased over the last 7-8 years:

Global production declined in 2016 and hasnt rebounded.

There are also certain difficulties in the supply chain for significant producers. For instance, one major US supplier may have to shutter the company’s mine in the next six years amid permitting problems.

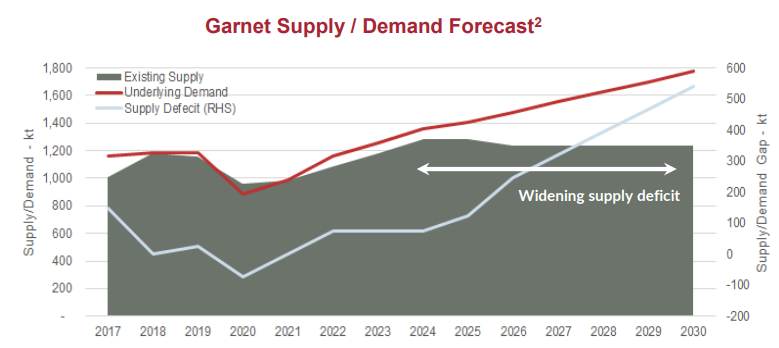

There is also a potential garnet supply deficit playing out in 2023, which threatens to grow wider each year through to 2030 if new supply is not brought online quickly:

In addition to this:

- India production ban - Indian garnet production has reduced dramatically over the last two years due to the country’s regulatory environment and industry pressures.

- Copper slag/coal slag (alternatives to garnet) expected ban incoming (carcinogenic) - major fashion brands such as Levis and H&M have committed to ban alternative sandblasting techniques using these products - a ban on alternatives to garnet sandblasting is expected given the health risks caused by these products:

6. US is spending ~US$1T on infrastructure:

The US is spending close to US$1 trillion on upgrading infrastructure that is falling apart - we expect the fixing of rusty bridges that are falling apart in the US to materially contribute to garnet demand.

There’s more than $2BN set aside for just these 4 bridges:

(Source)

7. Quick, viable pathway to becoming key garnet supplier

HVY is targeting production and cash flow by 2026 - that's only three years away.

HVY processing is relatively simple, and the company is at an advanced stage, with a Pre Feasibility Study being the next major milestone.

With production so close on the horizon, we think HVY can become a key supplier to the garnet industry.

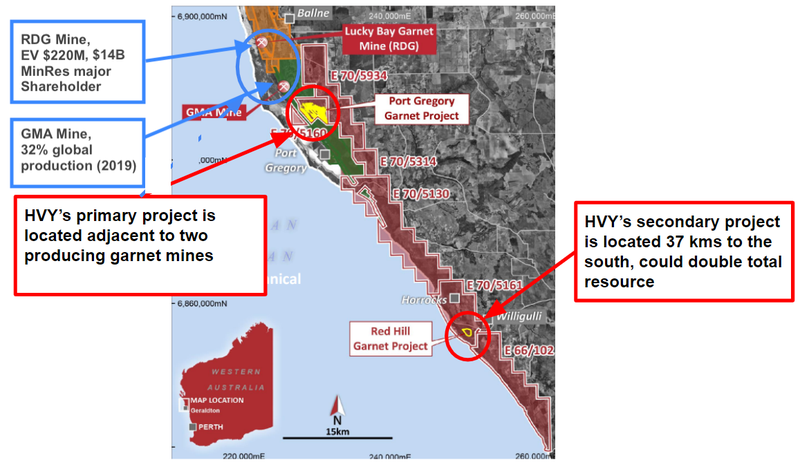

8. Close proximity to two producing garnet projects

There are two mineral sands producers, located in tenements adjacent to HVY’s primary project.

This demonstrates to us that HVY is in a desirable area conducive to economic projects.

Both of these two mineral sands producers are either fully owned or majority owned by large companies.

The GMA garnet mine is privately owned by Jebsen & Jessen - a multinational conglomerate which had revenue of ~$5BN in 2021. GMA accounted for 32% of global production in 2019.

The second is the ASX-listed Resource Development Group.

This type of big company investment in a niche but important raw material indicates to us that these companies see garnet as a source of significant cash flows.

9. RDG next door - $150M capped producer

Of the two nearby producers, the listed producer Resource and Development Group is capped at $150M and with an enterprise value of $220M.

$13BN capped Mineral Resources owns ~65% of Resource and Development Group and provided a $60M loan to advance the project.

Resource and Development Group produced its first garnet products in October 2022.

The company has an existing construction segment which generates revenues - but given the $80M loan from Mineral Resources, we think much of its valuation is tied to future garnet revenues and profits.

10. Project economics stack up, plenty of room for upside:

HVY’s scoping study indicates a low CAPEX of $110M against an after tax Net Present Value (NPV) of $253M, a payback period of 4.2 years, an after tax Internal Rate of Return (IRR) of 33% and Free Cash Flow of $588M across a 16 mine life.

We also note that HVY’s scoping study was based on a garnet price of ~$750 a tonne, more recently prices have traded at ~US$900 per tonne.

We Invested in HVY as we don't often see a project as advanced as this with such a low market cap relative to a project’s NPV.

The scoping study NPV is more than 42 times HVY’s current market cap of $6M.

Additionally, our view is that the relatively low CAPEX means forecasted production in 2026 is achievable, particularly if further support via the the Dutch Export Credit Agency is secured (see reason #12).

11. Upside to increase garnet resource

The near-surface primary project could be complemented by a second project 37km to the south, Red Hill, where HVY has released an exploration target of 90 to 150 Mt of material at 5.4% to 4.1% THM.

If the second project is successfully defined, we think that could effectively double HVY’s total resources. This could be a source of potential upside.

5 years of global annual demand could expand to ~10 years in an upside case.

12. Project financing support from Dutch Export Credit Agency

HVY’s project study consultant IHC Mining is a subsidiary of Royal IHC (IHC) - a large Dutch shipbuilding company with 2021 annual revenue of €532M ($868M). IHC have sought project build investment finance support from the Dutch government.

We see this as an important endorsement of HVY’s project.

This project finance support was made explicit in June 2023, when a Letter of Support was received from Atradius Dutch State Business (Atradius) which manages the government credit guarantee scheme on behalf of the Government of Netherlands official Export Credit Agency (ECA).

We take this as a leading indicator of IHC Mining being able to help HVY secure funding for the project and a signal that potential end users of HVY’s product (such as Royal IHC) are interested in securing supply from HVY’s project.

It's hard to underestimate the importance of having support from an Export Credit Agency for development stage companies.

These agencies basically make potential debt funding cheaper by offering insurance and guaranteeing products for projects involving the export of capital goods.

Interest rates charged by lenders on debt guaranteed by ECA Cover are typically lower than commercial rates, because paying back the debt is insured, ECA facilitated debt tends to be over longer periods allowing more money to flow through the business.

13. ESG focus and Australian project attractive to European/US garnet buyers

After India has applied increased regulatory scrutiny to its mineral sands projects, Indian supply has dramatically decreased over the last two years.

(Source)

(Source)

Western companies are seeking sustainably produced materials, which will increase interest in sustainable produced garnet, especially given the cloud surrounding garnet that was previously produced in India.

What could go wrong?

Project Funding/Feasibility Risk

The CAPEX for the project is $110M according to HVY’s scoping study.

In order to move into production the company will need to find a way to finance this cost.

There is no guarantee that the company will be successful in this pursuit, or it may take a lot longer than planned.

Financing Risk

As a small cap exploration and development company HVY doesn’t earn any revenue, and therefore relies on the market to raise capital and advance its projects.

As of 31st March 2023 the company had $0.892M in the bank, which means that it is likely that the company will need to raise capital in the near time in order to progress the development of its projects.

Substitution/technology risk

While to our knowledge garnet is hard to substitute, it is possible that an alternative material is found or created, or a technology comes along which provides an alternative to garnet which decreases garnet’s value over time. This could impact the economics of HVY’s project.

Commodity Pricing Risk

The garnet market is opaque, where prices are dictated by private supplier contracts rather than an open liquid market.

There are a limited number of customers globally, which heightens the importance of offtake agreements to secure purchases for HVY’s products.

HVY is susceptible to supply and demand fluctuations in the garnet price, and as a niche material, it only has limited applications.

Our Investment Memo

We will be publishing our HVY Investment Memo in the coming weeks, which will include our Investment Plan and Objectives for HVY.

To follow our Investment in HVY, and get all of our updates as soon as they are released, make sure that you are subscribed to our Wise-Owl Portfolio: https://wise-owl.com/

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.