Zinc Drilling Begins for ZMI: Results Pending

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The zinc mining space has not seen many mines or advanced projects in the pipeline for quite a while. There has been virtually zero zinc exploration globally since 2011 , but all that is gradually changing as enticingly resilient zinc prices attract fresh zinc projects to supplement dwindling inventories.

One such zinc developer, Zinc Mines of Ireland (ASX:ZMI) has timed its market push nicely.

Having backdoor-listed on the ASX earlier this year, this Ireland-dwelling, leprechaun-sized zinc explorer has jumped straight into a high-impact drilling program, backed by an oversubscribed cap raise to sophisticated investors which has raised around $2.4M.

Clearly not in the mood to hang about, ZMI last month mobilised its drilling rigs to target shallow high-grade mineralisation and extensions at its Kildare Project located 40km south-west of Dublin.

The first assay results are expected by mid-October – just a month away – and if they post anything like the grades seen from historical exploration, ZMI could be set on its way north from its rather southerly $0.018 current share price.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The company is also buoyed by a new zone of sulphide in a previously untested area. In addition to the mineralisation the company is already targeting based on historical results.

However ZMI is still in the early stages of discovery here and anything can happen, so seek professional financial advice for further information about this stock and invest with caution.

ZMI is hoping its Kildare project will produce high-grade zinc concentrates to plug directly into the world’s supply tail off. Recent mine closures and production curtailments have tightened global supplies, and China’s return to its industrial prowess is also helping to boost zinc demand — and prices.

Should demand continue to increase and ZMI continue to hit its targets, it may well catch the eye of its globally significant neighbours – the London exchanged $1.4BN Vedanta and particularly the $12B Teck which has acquisition history in the region and has joint ventured with Ireland-based Connemara on its successful zinc project.

However, given its location, infrastructure, positive cash position and its ability to hit targets and come in under budget, ZMI could be in a powerful position to head towards production in its own right.

One positive miner-beneficial caveat is that spot and benchmark treatment charges for zinc concentrate are drifting lower. This is favourable for zinc miners, and is yet another aspect which is likely to help ZMI kick-off low-cost production in Ireland.

As one of the few zinc projects globally that is able to sustain economically viable production on a large-scale, Kildare presents a strong opportunity for ZMI to assert its zinc market position and hopefully ride the coattails of a base metals market revival currently going from strength to strength.

Keeping you dialled into:

Since we first wrote about Zinc Mines of Ireland (ASX:ZMI) in late July in the article To Be Sure: ASX Zinc Stock Set for Drilling in Coming Weeks, quite a lot has happened. The most significant milestone is ZMI has pulled the trigger on a high impact drilling programme at its flagship Kildare project in Ireland.

There are some intriguing results from this first round of drilling.

But first, let’s recap what, where, and when for ZMI...

...and more importantly, how this could benefit eagle-eyed investors looking for bargain-basement minnows with the wherewithal to potentially become an affluent top-trump.

Significant mineralisation detected

Probably the most pleasing news from Kildare is the fact that its exploration programme has kicked off with a strong round of drilling.

Since commencing its maiden drilling program on 16 August, ZMI has completed approximately 780m of a total 2000m at the Kildare Project. A total of three of four holes have now been completed and results are anticipated to be made publicly available sometime in October.

Snap...

That’s a catalyst early-warning indicator to us here at The Next Small Cap .

With ZMI’s assay results inward bound in October, corroborate what historical data and visual analysis has already shown, we could see a significant re-rating of ZMI’s $0.017 share price and meagre $12MN market valuation.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

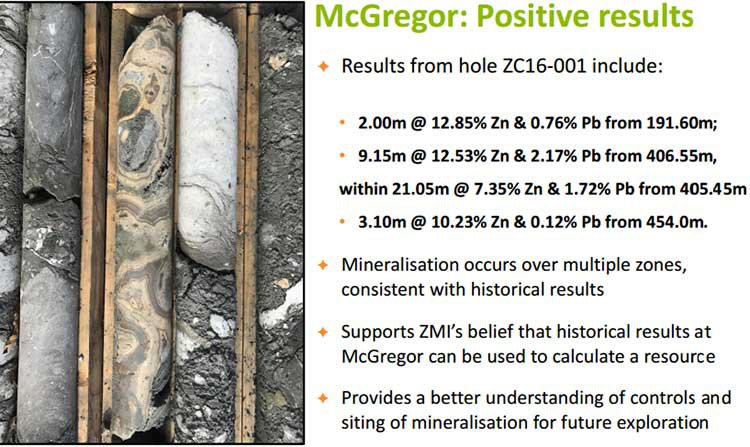

Based on visual logs, hole ZB16-003 intersected a zone of approximately 20m of oxidised sulphides from 16m and ZB16-002 intersected a zone of approximately 20m of brecciated zinc-bearing sulphides from 417m.

Here are those intersection drill cores:

Very intriguing, is ZMI’s assessment that the mineralisation at Kildare in Ireland is indicative of Mississippi Valley Type (MVT ). This tends to be a positive indicator and raises the chances of Kildare being a productive high-grade asset for several years. MVT is also indicative of a fairly simple geological system that should not prove overly difficult to advance.

Using the first three drill holes as a starting point, ZMI is collating data from across Kildare in order to define an exploration target and post an official JORC Statement as part of a maiden reserve at Kildare.

The bonus prize for ZMI, is if it runs through enough exploration to add other prospects to its total resource in Ireland.

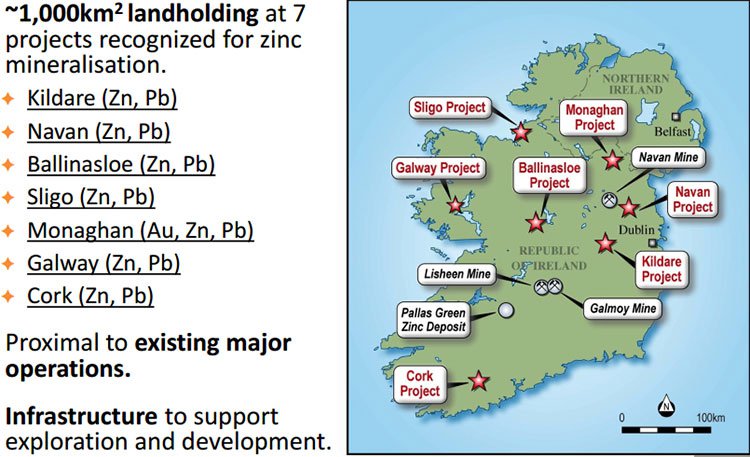

Take a look at ZMI’s project locations:

As you can see, the Kildare Project is located in the east, but ZMI has 6 other projects it can also pursue. Kildare is currently the most prospective and has the most potential, but that could change as assay results start to trickle in next month and ZMI puts emphasis on its recently discovered new sulphide zones.

If we consider ZMI’s recent drilling activity, its initial work provides confidence that the company is targeting the right areas, effectively minimising costs and advancing this prospect in the best way that’s conducive to an upward revaluation.

Equally important is the fact that the mineralisation intersected at 417 metres had not previously been tested , opening up a new target outside the historical drilling data ZMI has used to plan its exploration program.

Taking a look at the other Zinc contenders — in Ireland

In the centre of the map coloured dark blue is ZMI’s Kildare Project.

ZMI has nestled ever so gently right in amongst Swedish-born Boliden (red), Canadian-owned Teck Ireland (light green), and UK-based Vedanta (purple).

Let’s have a look at how the neighbours are getting on, to see if this neighbourhood is worth moving into.

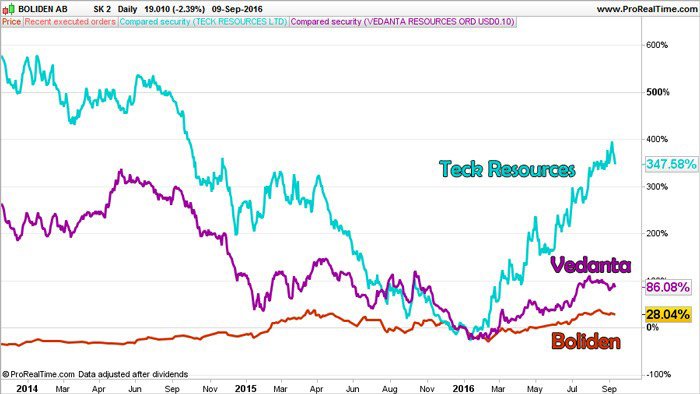

Charted below is how ZMI’s fair neighbours have performed since 2014. Each one has seen double-digit, or triple-digit percentage returns over the past 6 months on the back of metals prices recoveries — could ZMI join this peloton?

ZMI has some way to go before it can measure itself against its neighbourhood peers, so if considering this stock for your portfolio seek professional financial advice before making a decision.

By the looks of it, base metals are turning out to be the resources niche showing brightest outperformance

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Charted above is how ZMI’s fair neighbours have performed since 2014. Each one has seen double-digit, or triple-digit percentage returns over the past 6 months on the back of metals prices recoveries — could ZMI join this peloton?

Clearly, a bump-up in share price earlier this year is likely attributable to the broad improvement in metals prices, including zinc.

Boliden operates in the area through Tara Mines Ltd. Since the 1980s Boliden’s Tara Mines has mined more than 80 million tonnes of ore. Approximately 2.6 million tonnes of ore for zinc and lead concentrate production is mined and concentrated every year. Boliden Tara Mines is an underground mine, Europe’s largest zinc mine and the world’s ninth largest.

Ireland has a huge natural reserve of base metals, and there’s plenty of mills and processing facilities, so viability quickly becomes about cost

In the expansive land holding to the north, marked green belongs to Teck Ireland — a subsidiary of Teck, a US$9BN giant that spends big when it comes to exploration and tenement ground.

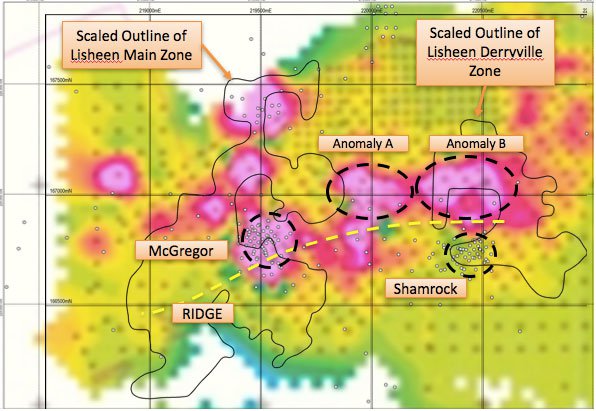

Last on the list is Vedanta — a mid-large size resources company based in the UK. Vedanta has recently closed its Lisheen mine, after 17 years of operations. This could yet turn out to be a blunder, just as zinc prices have started to recover in 2016. Globally, Vendata’s zinc operations generated an EBITDA of US$37 million in Q1 2016.

And now let’s take a look at the Aussie-based zinc contenders

With the local Irish contingent laid out, what about the ASX-listed zinc developers?

There are two names ZMI can be compared to and again zinc mining is showing strong investor traction, as measured by their northward-bound share prices so far this year:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

There have been some strong rallies by small-caps in the zinc space over the past six months.

Both Red River Resources (ASX:RVR) and Heron Resources (ASX:HRR) have posted 40% and 29% gains since the start of this year as zinc has moved back onto investor buy sheets.

Importantly in terms of peer comparisons, both of these companies are yet to bring their projects into production, indicating that investors are looking to move ahead of the curve which brings ZMI into contention.

And courtesy of fresh Chinese demand and a resumption of industrial heavy industry activity in Asia, the zinc industry could be a direct beneficiary.

On 29 August 2016, zinc prices recorded a 15-month high:

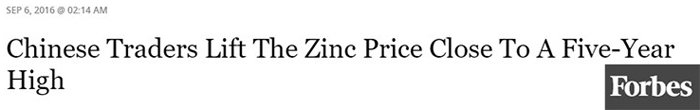

And less than 10 days later on 6 September, they had made a 5-year high on the back of some rumoured ‘Chinese traders’ getting into the mix.

Days ago, Forbes ran a piece on how zinc prices were being driven higher by happy-snatch Chinese traders, trying to get their hands on zinc futures contracts and buying up zinc stores at a noticeably higher rate.

Of course it should be noted here that commodity prices are subject to market fluctuations and as quickly as they rise, they may fall. Seek professional financial advice if considering a zinc stock for your portfolio.

One of zinc’s key applications is a rust-preventer in steel-making, which is what is causing the current shortages — steel-making is again chugging along and pulling in key elements in its processing (zinc) and production (iron ore).

The bottom line for ZMI is that it has achieved all its objectives so far, on time and on budget which gives it a great chance to be one of the leanest and meanest zinc producers in Ireland — ZMI is working towards being a low-cost efficient producer in Ireland that is able to undercut its larger rivals, desperately reining in costs and wasteful expenditure.

The global Zinc market — let’s see what all these aspirational zinc hunters are vying for

The zinc price outlook still appears strong with analysts at Macquarie Wealth Management highlighting that the commodity had hit a fresh 15 month high of US$2370 per tonne.

Zinc prices were under pressure for several years, but this year the tide seems to be turning as mining closures started to hit the supply chain and prices have consolidated their impressive rallies.

However, the important question is — is it a case of decreasing supply or increasing demand?

The shuttering of some zinc production has simply stabilized the oversupply situation and speculators could be getting ahead of themselves.

Zinc miners have shelved production as low prices made mining unprofitable.

Last October, Glencore announced plans to cut zinc production by 500,000 tonnes a year, about a third of its production. This year, China announced that it was curbing zinc output at some mines. While these developments have been good for the zinc market, zinc started 2016 off in really rough territory, with prices at a six-year low in January. They have since rallied about 60% but are still well off their pre-recession high of around $4,500.

Zinc inventories remain well stocked but they are being tapped faster than expected which means demand could be underestimated.

The projected ramp-up in demand in addition to few new zinc projects coming online is currently giving zinc prices a lift, and ZMI is perfectly positioned to take advantage over the coming months and years.

Finding a base in base metals

Having formalised the acquisition of 21 prospecting licences in seven project areas in Ireland for a 750 km 2 landholding in July, ZMI has bolted straight for the drill-bit as a means to accelerate development speed and market valuation.

ZMI’s exploration is still early-stage but the first geological signs are that Kildare is just as well-endowed as any other Irish province when it comes to zinc, lead and base metals. ZMI already has historical hits of 12.2% Zn and 10.3% Zn at close-to-surface level <10m.

As long as ZMI’s funding teat stays plump (which was recently restocked to the tune of $2.3MN ), it should establish a fairly meaty Resource that potentially encompasses all 7 of its project areas. And if ZMI stays the exploration course, it could start to close the valuation gap with its local neighbours in Ireland and ASX-listed cousins in Australia.

The prospect of price catalysts is also strong, given the ‘high-impact’ drilling program underway. Realistically, we could see assay results and (fingers crossed) a formal Exploration Target sometime in Q4 2016.

ZMI is only valued at around $15MN and yet has comparable assets to much larger rivals...

...and operating in a market niche that’s getting back into flavour and favour with investors.

They’re the kind of market opportunities we like to scout for our loyal Next Small Cap readers, and transmit them in a timely fashion focused on beefing up small-cap investor portfolios.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.