Sirius went from 5c to $5… New Upstart Explorer Has More Land, More Drilling Targets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Sirius Resources sparked “The Great Nickel Rush” in WA’s Fraser Range when it hit not one, but two mammoth Nickel Deposits, resulting in its share price rocketing from 5c to $5 in matter of months.

That’s a 100-bagger. Not surprisingly, no less than twenty explorers are frantically jostling to make the next monster nickel discovery in the region. And we think we’ve found the most promising one of them all... This tiny nickel explorer controls almost TRIPLE the landholding in the Fraser Range than that of the big kahuna, Sirius. We are talking over 3,500km 2 . They have pulled off a major upset by leaping to the front of the Fraser Range pack – the tenements they have acquired come with expensive PRE-COLLECTED high res data. Just in case you have been living under a rock for the last 12 months, here is what happened with Sirius (ASX:SIR): This chart shows Sirius plodding along at 5c – then with two huge nickel discoveries, first Nova, then Bollinger, it became a 100 bagger, creating fortunes for those who bought in on the ground floor.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. This discovery single-handedly brought the speculative mining sector back to life, with Sirius surging to a $1 billion market cap by March 2013. The remote Fraser Ranges became the new final frontier, lined the pockets of Sirius shareholders, and sparked a nickel rush of grand proportions. Since then, twenty explorers have fought in a land grab for the tenements of the Fraser Range, hoping to uncover another earth shattering discovery on par with that of Sirius. The Next Small Cap has studied each one carefully and we have come to our conclusion. The company we have added to our portfolio today has 16 high probability drilling targets that bear an uncanny resemblance to Sirius’ Nova-Bollinger discovery. This is quite simply the largest number of ‘eye feature’ targets released by ANY explorer, EVER, in the Fraser Range. ... including Sirius. Yes, we are serious. And one leading research house agrees... An ‘eye feature’ is a magnetic ring below the earth’s surface, detectable via electromagnetic ground imaging. The ring is a geological feature which may indicate a late stage intrusion that has thrust up into the existing fabric of the Fraser Ranges. This late stage intrusion could contain particular metals. Such as Nickel. Drilling an eye feature is how Sirius discovered the deposit that took them from 5c to $5 in a matter of months . In fact Sirius went from $2 to $5 in just a matter of days following their second discovery. Seriously. Other companies in the area may also have large land holdings – but check their market caps, you’ll find they are more than double that of our tiny company... and with fewer drill targets. With a market cap of just $6 million, this tiny company has high impact, high probability drilling coming later this year, and is located smack bang in the epicentre of the hottest nickel sulphide exploration province in the WORLD . It’s no wonder that the two heavy hitting, major shareholders of this tiny explorer hold 54% of the company... We are champing at the bit to reveal our “little secret” – introducing our newest portfolio addition:

Investing in speculative explorers carries high risk – there is simply nothing certain with these companies. But when we heard that Segue Resources (ASX:SEG) had snagged these significant nickel assets , (and for just $200k and $1.1 million in SEG shares) our multi-bag sensors started going off like firecrackers. SEG’s 16 priority eye targets all have a similar magnetic signature to Sirius’ Nova-Bollinger nickel deposit... and their average size is more than 5 times that of the Nova feature. That last part deserves repeating – SEG has 16 eye targets – these are the high probability targets, narrowed down from 40 – and their AVERAGE size is 5 TIMES that of the enormous Nova-Bollinger-nickel-copper-whopper. We did a double take when we first pored over the data, and compared SEG’s market cap of $6 million against the other companies in the region. SEG has multiple near term price catalysts, with a focused, progressive, and impressively organised exploration campaign that is already in progress . This campaign will evaluate and prioritise the eye targets. Later this year, the eye targets with the very highest prospectivity will be drilled. RM Research recently initiated coverage of SEG, rating the company as a speculative buy:

Perhaps you are thinking that the current unfavourable sentiment towards mining stocks means limited upside for junior metal explorers like SEG. We disagree. As somewhat contrarian investors, we invest in assets and commodities when they are shunned by the “herd”. Right now is a potential opportunity to scoop up the best exploration companies at undervalued, bargain prices. Once the commodity cycle turns, these companies could quickly multiply in value. This doesn’t look too far away now, especially for nickel.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in reporting on high potential stocks that we uncover. We published a report on Swala Energy (ASX:SWE) titled The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months . SWE has traded as high as 150% since.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance Another report on Rey Resources (ASX:REY), revealed them to be the mystery third man in the Canning Basin , and following our article release, REY has been up nearly 75% since.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance Our latest report on Citation Resources (ASX:CTR) titled Junior oiler gearing up to drill a giant Guatemalan oil kitchen... and will puncture the behemoth reservoir in just days...

, showed CTR to be cooking up a storm with the share price rising over 40%The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. TSX:AOI was our ‘tip of the decade’ in February 2012 at around CAD$1.8 and has been as high as CAD$11.25 since – that’s over 600%!

Following our report on Pura Vida (ASX:PVD) titled Why has this stock got analysts predicting four thousand percent gains? the PVD share price rose as high as 40%. We have also covered Trafford Resources

(ASX:TRF) which has been up 30% and Tigers Realm (ASX:TIG) which has been up over 20%. The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.Wholesale Shopping: SEG’s remarkable acquisition in the Fraser Range

In late 2013, SEG acquired three companies, Fraser Range Resources, Becrux, and Distant Island for just $200,000 in cash, and $1.1 million in SEG shares. The majority of the holdings are 100% owned by SEG, except for four tenements. These are subject to a JV with International Goldfields Ltd. SEG can earn a 60% interest in these tenements by spending $1 million on exploration by 31 January 2015 .

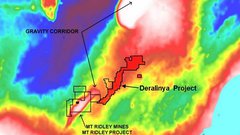

With this acquisition spree, SEG suddenly became the third largest tenement holder in the Fraser Ranges, with control of 12 tenements totalling 3,538km2 . The tenements are divided into two projects:

- the Plumridge Nickel and Gold projects in the northern portion of the Fraser Range, and;

- the Deralinya Project in the southern Fraser Range.

The Plumridge Nickel Project is SEG’s immediate exploration focus as it is the most likely to host Nova-style magmatic nickel-copper deposits. Plumridge lies 120km north-east of the Nova-Bollinger deposit along the Fraser Range Belt, covering an area of c. 2,200 km 2 , and includes over 100km of strike length. The Plumridge project has previously been explored for gold, before Sirius made it apparent that nickel is the main game here, but very little base metal exploration has been conducted. SEG’s acquisition of these tenements in the northern Fraser Range came with a near-complete coverage of high-resolution aeromagnetic data. The time and cost of reproducing, processing and interpreting this dataset would be significant, and these savings have added to the incredible value of SEG’s purchase. The tenements have no native title claimants, no nature reserves and no pastoral leases... there are unlikely to be any complications or delays during the exploration program. You may ask why the former tenement owners let their ground go so cheap... well it’s all in the deal terms. Rather than accepting all cash, the vendors were given shares in SEG... so they still stand to reap the benefits of any large nickel discoveries. In fact after doing some digging, we have found that SEG have two big investors that together hold 54% of SEG , which gives SEG solid financial backing.

Their shares are escrowed until December 2014, which will take SEG through the full exploration program. These top two investors will be on the sidelines the whole time and wont exit. This structure provides a backstop level of investment and should not see the company share price go down. In fact, in addition to the two major backers, it is clear that SEG is a tightly held company – the top 20 shareholders own 75% of the company.

Staged Exploration

SEG’s exploration program is a continuous prioritisation process, where more intensive work is to be conducted on a smaller number of progressively more prospective targets. Whilst being a relative latecomer to the region, SEG have leapt ahead of the pack due to the high resolution data that came with the acquisition of their tenements. Currently SEG’s aim is to systematically reduce the number of targets, honing in on those with the highest potential nickel sulphide prospectivity. Here is SEG’s technical expert and nickel sulphide specialist Dr Howard Carr, outlining SEG’s exploration plans and exactly how to find an “eye”:

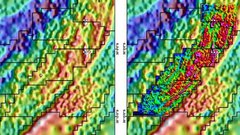

As Dr Carr explains, the best way to identify an eye is to get your hands on the highest resolution ground magnetic images you can. The greater the resolution of the magnetic data, the easier an eye is to identify. Here is Sirius’ Nova eye as it showed up on the Aeromagnetics, and below the soil sampling results with EM conductors:

Taking the high resolution data which came with the tenements, SEG contracted Newexco Mining & Exploration Services to review, improve and evaluate the data. It’s important to note that Newexco was responsible for the SIRIUS Nova-Bollinger discovery and Western Areas’ Forrestania nickel sulphide deposits.

Newexco know an eye when they see one. SEG passed on the data to Newexco who were able to re-process it with greater sophistication, and comparing to the original targets, rejected about 70% of them, so that of the original targets, 30% remained. In addition, of the final targets, 70% were new targets , which only became apparent on the 100m high resolution data. This is important, as without the high resolution data, other explorers might go down the wrong path. Through their thorough exploration program, with Dr Howard Carr and Newexco’s expert guidance, SEG have advanced quickly in the identification of genuine drilling targets, and have jumped ahead of the pack.

Fraser Range Neighbourhood Watch

As we mentioned earlier, Sirius’ discovery sparked a “nickel rush” in the Fraser Range as explorers clamoured to be part of the action. Have a gander at SEG’s key competitors... SEG’s tenements are outlined in black:

Source: Segue Resources Ltd

The chart below shows the twenty explorers all looking for the next big nickel discovery – the blue columns are market cap, and the black line is how much area (km 2 ) they have. Check out SEG in red:

It’s easy to see that SEG (shown in red) have an attractive balance between low market cap and a very large area to explore in. Orion (ASX:ORN) and Windward (ASX:WIN) do have larger holdings... but their market caps are double that of SEG . Whereas SEG have a 100% ownership of the majority of their tenements, Orion and Windward only own 70% of their tenements – for the remaining 30%, they will have free carry to the completion of the Bankable Feasability Study. And their targets pale in comparison to SEG’s in terms of number AND size, as well as similarity to the Nova eye target. Not only that – SEG has the highest number of targets , the highest number of Nova-like eye targets , the largest sized targets , and somehow, a tiny market cap . Talk about under the radar! As targets are refined, fieldwork commences and drilling programs draw closer, SEG’s activities should increase, leading to potential for a market re-rate.

What’s next for SEG’s 16 eye targets

SEG’s flock of 16 separate eye targets throughout its Plumridge project in the Fraser Range are shown below. To get an idea of magnitude, the little box on the left shows the Nova eye target discovered by SIRIUS, at the same scale:

Now that SEG have identified their 16 eye targets, prioritised according to their Nova-like magnetic signature, SEG intend to carry out the following:

- Blanket ground Electro Magnetic survey over all identified eye targets – this will search for massive nickel sulphide conductors within the bedrock;

- The strongest, most continuous conductors will be air core drilled , searching for anomalous nickel bedrock geochemistry;

- The strongest bed rock nickel anomalies coincident with the strongest ground conductors will be subject to reverse circulation drilling .

This exploration work should culminate in multiple, high prospectivity, drill-ready targets with the following attributes:

- A magnetic eye body;

- Electromagnetic conductor plates; and

- Continuous surface bedrock nickel anomalism.

SEG’s targets have a similar magnetic signature to Sirius’ Nova-Bollinger nickel deposit, though their average size is more than five times that of the Nova feature. If SEG’s upcoming electromagnetic surveys identify a conductor inside an eye it could prove be a massive nickel-cobalt-copper sulphide body... just like Sirius.

More on Sirius Resources’ discovery of the decade

The Australian nickel landscape was reshaped forever when Sirius made their truly epic discovery in outback Western Australia, sparking a new “nickel rush”. Renowned prospector Mark Creasy was the genius behind the discovery, which he held in joint venture with Sirius. The chart below shows the rise from 5c after the initial discovery at Nova, followed by the dramatic rise from $2.10 to $5 in two weeks after the second discovery at Bollinger.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance SEG has 16 of these targets , that all bear similar geological characteristics to the Nova and Bollinger discoveries. And, SEG’s targets are much, much bigger. If you need more evidence about the imposing mineralisation in the Fraser Range, then Mark Creasy is the guy to listen to. Mark Creasy owns 20% of Sirius, and also owns 30% of the Nova Bollinger project. When Sirius was valued at $1 billion, Mr Creasy was worth circa $430 million on this project alone. The Sirius share price has since calmed down, however he is still sitting on a rather large fortune.

PPR Media tracked the man himself down at the pub one Friday afternoon to hear him talk about the Fraser Range – can SEG discover another deposit similar to Sirius?

Why Nickel?

You might think the current sluggish sentiment towards mining stocks means limited upside for junior metal explorers... But what it actually means is an opportunity to scoop up the cream of the crop at bargain prices – that could quickly multiply in value as the commodity cycle turns – which doesn’t look too far away now, especially for nickel. Even if nickel prices stay where they are, a good discovery could still light a fire under the share price – given that Sirius currently sits at over $2 per share – 45x what it was before they drilled the Nova eye. The Next Small Cap particularly likes nickel as a commodity play at the moment for a few reasons. As somewhat contrarian investors, we invest in assets and commodities when they are shunned by the “herd”. The fundamentals haven’t changed, just the price we pay for them. Simple really – but first a floor price must be established – ideally you don’t want to invest while the price is still falling. A quick peek at the chart below tells us that nickel has found a floor price at around USD$6 per pound:

It might bounce around there for a while, but, all else being equal, it’s unlikely to go much lower. Which means nickel explorers like SEG look to be as cheap as they are going to get, and should increase as the nickel price recovers. And we have good reason to believe that will be sooner rather than later... Reuters reported on January 10 th that an Indonesian ban on nickel exports is set to cause the biggest industry shake-up in years.

The ban is expected to be a boon for nickel miners, as Indonesia is looking to prohibit more than $2 billion worth of annual nickel ore and bauxite shipments. Indonesia supplies about half the nickel ore used for stainless steel in China. If the ban stays in place, nickel prices are expected to rally, as China is forced to source alternate supply. An additional factor in nickel’s favour is the fact that the price has been so low recently. When the nickel price is low, a lot of the higher cost nickel mines become unprofitable and are forced to halt production. If you are invested in Mirabella Nickel, you’ll know this all too well. This has the effect of further reducing global nickel supplies, and as demand picks up, the price rise becomes even more apparent, and sustained. As shown in the graph below, at today’s nickel prices, 40% of current production is uneconomic.

Source: Segue Resources

This puts a squeeze on supply and points to a potential rally in the nickel price. So whilst prices for nickel are currently at the bottom of a cycle, we are picking up SEG on the ground floor and will be watching with interest in the coming months.

Investor checklist – SEG reviewed

We’ve analysed SEG using our eBook checklist, which outlines key aspects to research prior to making an investment in any speculative resource stock. You can read about the Pre-Investment Check List (and a lot more) in the eBook: “How to Make Money Investing in Junior Resource Stocks”

If you’ve already read our eBook, you’ll know that potential profit is greatest when a small cap company is in its exploration phase – exactly where SEG is right now. It’s a two sided coin, however. There is always the chance that nothing exciting is found and the shares fall in value. But with research, you can pinpoint the explorers with a higher likelihood of tapping into a game changing mineral deposit. We believe SEG to be one of these “smart picks”.

Assets: What assets do the company own? Which asset is most important?

SEG now controls a huge proportion of the Fraser Range nickel province, with their Plumridge and Deralinya projects covering over 3500 km 2 . To put that into perspective, Sirius only controls 1400 km 2 . Undoubtedly, Plumridge is its most important asset... as such this is where SEG is focusing cash and exploration efforts. Just to recap a few of the highlights of Plumridge:

- 16 high priority eye feature targets closely resembling Nova/Bollinger;

- The highest number of eye feature targets of any Albany Fraser explorer;

- Average eye size is 5X the size of Nova (and look what that had inside), and;

- Largest eye target is 20 KILOMETRES LONG!

Is there takeover potential? Is there ‘nearology’? Who is operating in the surrounding area?

As you are probably aware by now, there is some “serious” nearology happening, with Sirius discovering and operating literally next door. Right now they have a monopoly in the Fraser Range as far as large, proven nickel deposits go. This type of situation is an especially fertile breeding ground for a potential takeover – if there is one thing worth protecting in any business, it’s a monopoly. We would expect Sirius to pounce on the first of the other “Fraser Rangers” to prove up an economic deposit, to maintain the monopoly and further improve economies of scale. They’d likely be willing to pay a substantial premium too, for an existing deposit within trucking distance of its own proposed mines and mineral processing facilities.

Price Catalysts: Are there upcoming catalysts?

Coming up this quarter are the crucial, “price sensitive” electromagnetic surveys over each eye target.

As we stated earlier, magnetic eye structures that are shown to also contain an electromagnetic conductor add to the case for a nickel-copper deposit. Conductor-bearing eyes will be singled out for follow up detailed electromagnetics. Air core bedrock drilling is scheduled to take place during the second quarter of 2014. Then, during the third quarter, the nickel conductor plates within eye structures will be tested with deeper reverse circulation drilling .

The Next Small Cap Conclusion

SEG stands out from the herd in several key areas, particularly:

- Genuine likelihood of a significant discovery, with subsequent share price appreciation;

- Potential takeover from Sirius, or possibly one of the other explorers jostling for pole position in the Fraser;

- Miniscule market cap, much smaller even than Sirius pre-discovery, and before the nickel potential of the Fraser Range was known;

- Savvy, focused management able to pick up quality assets at bargain prices, and;

- Level of market excitement expected in the lead up to and during drilling.

With high impact drilling later this year, likely to correspond with an upturn in the nickel price, investors (and prospectors) will be taking a very keen interest! To hear all the latest from SEG, as soon as it happens, like SEG on Facebook or follow them on Twitter

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.