RTR Days Away From Fraser Range Diamond Drilling

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Rumble Resources Ltd (ASX:RTR) is charging ahead like the raging bull in its logo, with drill bits set to turn at its Big Red prospect in the Fraser Range – Australia’s hottest nickel exploration province.

Drilling is scheduled to commence on Friday November 7 th . The Fraser Range is where you’ll find the 13.1Mt Nova-Bollinger nickel discoveries that catapulted Sirius Resources from a $6M junior to a $1.3BN player almost overnight, and sparked a rush to find the next big one.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

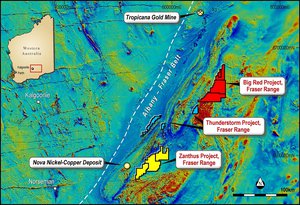

RTR has eleven highly prospective nickel tenements in the same area as Nova – Bollinger and has worked up compelling drilling targets in less than a year of operating in the region.

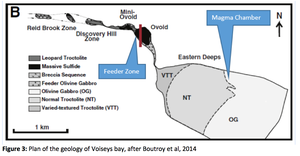

The big focus for RTR is a Voiseys Bay style target at Big Red. Voiseys Bay is a 35Mt nickel resource in Canada’s Thompsons Bay nickel province and the geological model there appears similar to what RTR has found so far at Big Red.

This four hole drilling programme could establish whether a large nickel system, like that found in Canada, is present on RTR’s ground

Drilling is set to start on November 7 th with a timetable of two weeks, assays will follow as they come to hand. We could know within weeks what RTR has in the ground.

The Fraser Range has the attention of the global markets now that the giant $55M Brazilian nickel miner Vale is understood to have applied for tenements there.

The tenements Vale is applying for are adjoining tenements RTR have applied for. Vale is the world’s second biggest nickel miner so this is a big tick of confidence for the region, and for RTR’s ground

So it has to be said – let’s get ready to rumble!

We first entered the ring with RTR in September when we published the in-depth article So You Think Sirius Is Big? $5M ASX Explorer Drilling in Weeks.

Well, it’s been a few weeks, and right on time RTR’s plan is being turned into action with drilling about to commence at Big Red on November 7 th . We could have results in our hands within weeks.

RTR is going to drill four holes at Big Red, right down into the guts of what may be a large feeder zone it’s detected above a large EM conductor. These structures are said to be very similar to those found at Voiseys Bay, a huge nickel deposit up in Canada that makes Nova-Bollinger look like small fry.

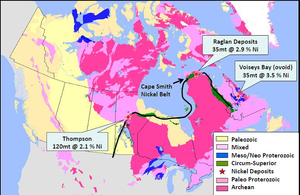

The 13.1Mt Nova-Bollinger discovery started the Fraser Range nickel rush, but as any seasoned geologist will tell you, the first discovery in a nickel belt is not always the biggest. One can lead to more – the nickel discoveries in Canada that dwarf Nova-Bollinger led to the establishment of the Thompsons Bay Nickel Belt:

- Thompsons Bay: 120Mt at 2.1% Ni

- Voiseys Bay: 35Mt at 3.5% Ni (ovoid)

- Raglan Deposits: 35Mt at 2.9% N1

Source: Rumble Resources

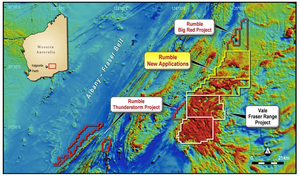

The Nova-Bollinger discoveries revealed a very similar type of mineralisation to Voiseys Bay – something never seen in Australia before – and RTR’s targets also show similarities to the huge Canadian resources – especially at Big Red where drilling is about to begin. All in all, RTR has eleven tenements in the Fraser Range grouped into three projects – Big Red, Thunderstorm and Zanthus:

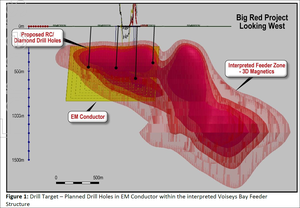

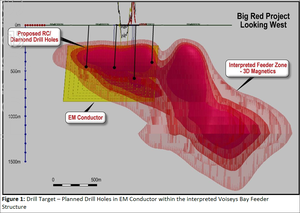

All of them are highly prospective but it’s Big Red that has our attention right now. It’s where you’ll find this 2.2 km EM conductor (in yellow) leading to an interpreted feeder zone:

This is arguably the largest bedrock conductor in the Fraser Range.

Extensive 3D and aerial surveys have shown it has a large ‘feeder zone’ (the red areas above) which is thought to contain big amounts of nickel and copper sulphides.

Does all of this point to a nickel deposit? Only drilling can tell, and that’s exactly what RTR is days away from doing.

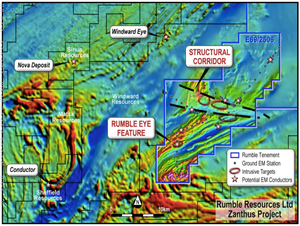

The other RTR project in the limelight right now is Zanthus, which is just 18km away from the Nova-Bollinger deposit and has five bedrock conductors across a Nova style eye feature:

The image below shows the five conductors identified to date (ZC1 to ZC5):

Once again, only drilling will tell what is really in the ground there, and RTR is working on a campaign to follow Big Red’s.

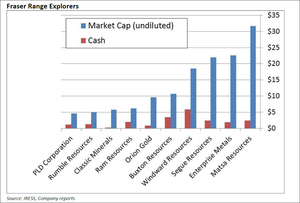

With a tiny market cap compared to other Fraser Range explorers, RTR appears leveraged to success, you can see it over to the left on this chart:

A recently released research note from Breakaway Research’s analysts Grant Craighead and Mark Gordon rates RTR as a ‘Speculative Buy’:

Remember, analysts research notes can make for interesting reading but we don’t solely rely on them as sources of information.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks. To note just a few:

- Last week we released a Next Tech Stock article on Ziptel (ASX:ZIP), $1.7 Trillion Telco Market: ASX Tech Company Weeks Away From Global App Launch , since this release, ZIP has risen as high as 120%;

- Since the Next Small Cap article on Segue Resources (ASX:SEG), Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets , SEG has been up as high as 200%;

- Since the Next Oil Rush article on Real Energy (ASX:RLE), International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar , RLE has risen as high as 110%.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Drilling in days at Big Red

RTR is set to commence its maiden drilling effort in the Fraser Range with a four hole drilling programme at its Big Red project.

The goal of this drilling is to intersect the EM plate detected, within the interpreted feeder structure.

The drill rig will be a high-powered multipurpose truck mounted unit with 2,500m depth capacity. RTR plans to drill four RC/Diamond holes totalling 1,600m.

Now this feeder structure is interpreted as being very similar to one found at Voiseys Bay in Canada, a world-class 35Mt nickel resource that’s part of the huge Thompsons Bay nickel province.

You can see RTR’s feeder structure, the bedrock conductor and its planned drill locations here:

The feeder zone (shaded in red) has been interpreted as both conductive and magnetic by 3D inversion modelling. The zone is north plunging and coincident with the large EM conductor (shaded in yellow) and feeds into a 6km gravity body to the northwest, which RTR says could be a large magma chamber.

Now with all of that in mind, let’s compare RTR’s Big Red geological model to that found in Canada’s Voiseys Bay:

You can see a feeder zone target model leading in to what’s called the “Ovoid” deposit where you’ll find both magnetic and conductive material including magnetite, pyrrhotite, and nickel and copper sulphides. This all leads to a large magma chamber – a deeper intrusion.

So on November 7 th when drill bits start turning at Big Red, RTR’s model will tested in the field, and we should start to find out what it really has in the ground.

Does the feeder zone above the EM target amount to a large nickel deposit like at Voiseys Bay?

We may find out in a few weeks – When the drilling’s done around two weeks after the November 7 th start date, assays should follow quickly.

When the drill bits stop, RTR says it will also look to schedule a down-hole EM survey to provide a diagnostic test of the bedrock conductor.

And just to wrap things up very neatly, RTR has been awarded $150,000 to co-fund exploration on the Big Red Project through the WA Government’s Exploration Initiative Scheme (EIS).

This is a big milestone for RTR. It’s been in the Fraser Range for less than a year yet in that short space of time it’s amassed eleven tenements and worked up compelling drilling targets – the first of them are set to be drilled very soon and we could have results shortly after.

Big Red gets even bigger

RTR increased its footprint in the Fraser range by 71% in one stroke by applying for two strategic exploration licenses at Big Red:

These new land applications expanded Big Red to 1491km2 and make the project one of the largest in the Fraser Range.

This is a sign of RTR’s increasing confidence in Big Red and the drilling programme that’s about to start there. After all, more in the same area could follow one big find and now RTR is starting to sew it all up.

But something else caught our attention in RTR’s expansion:

A big fish enters the pond

This is the talk of the town in the nickel game right now:

Brazil’s Vale is the world’s second largest nickel miner and worth a cool $55BN. It’s a very big fish and there’s lots of chatter that it’s now active in the Fraser Range.

That is yet to be confirmed by the company – but according to this article in The Sydney Morning Herald, lots of signs point to Vale’s involvement in the region. This is a clear tick of confidence for the region’s potential value and for RTR’s involvement.

There is a clear connection for why Vale would be interested in the Fraser Range. Nova-Bollinger has very similar mineralisation to the massive 35Mt Voisey’s Bay nickel deposit in Canada – which is owned by Vale.

The Sydney Morning Herald article says it’s understood Vale has now acquired a claim area in the Fraser Range that is located slightly off the main mineralisation trend on its eastern edge...

And it’s also next door to RTR’s tenements.

Rumbling forward

Kick off for RTR’s maiden drilling programme in the Fraser Range at the Big Red Project is set for November 7 th – that’s just days away. It’s set to take two weeks to complete, with assays released as they come to hand, so we could have results by the middle of November.

The track record for the Fraser Range is that the first, and so far only, discovery – Nova-Bollinger – catapulted Sirius to a $1BN plus market cap almost overnight.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

There is the possibility this could happen again, and as shareholders in RTR we’ve got our fingers crossed its drilling at Big Red repeats that success. But we’re also focussed on the bigger picture.

A discovery at Big Red could lead to more at the tenement’s newly expanded boundaries, or maybe Zanthus and Thunderstorm have something more to offer. In less than a year RTR has implemented an aggressive exploration programme culminating in the imminent drilling programme.

And with the entrance of Vale, the $55BN Brazilian mining whale into the Fraser Range, the region may have a greater global focus...

With a commanding land bank, aggressive exploration programmes and now a maiden drilling programme about to start, RTR is certainly in for an interesting couple of weeks.

Now, let’s get drilling!

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.