Up the Road from Tesla: ASX Junior Moves into USA Lithium

Published 14-APR-2016 09:32 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The lithium market has recently astounded market analysts, miners and investors alike, posting double-digit growth since the start of the year.

Even The Economist has weighed in on this typically peripheral market – one that’s going mainstream rather quickly.

One ASX junior that’s blipped up on our radar is set to acquire two lithium projects in Nevada, USA...

...both situated near to one of the most gluttonous lithium players out there: Tesla

One asset is a potential ‘district scale’ lithium project, with strongly anomalous lithium up to 1000ppm Li in a lithium clay deposit.

The other is a lithium brine project, just 40km from the only producing lithium mine in the US – owned by the US$7BN capped Albermarle...

The lithium brine project already looks immediately appealing, as brine projects are the kind where capital and mining costs are typically less.

And there are catalysts coming beyond the project acquisition – including the commencement of ground gravity surveying over the coming weeks as this company continues its due diligence.

There are a number of explorers chasing lithium in Nevada, and our A$2.4m capped ASX stock is hoping to catch up to its bigger peers, such as Western Lithium (TSX:WLC), currently capped at CAD$240M...

Our company hopes to quickly scale the ranks to progress its lithium projects through to production and raise its valuation.

However it should be noted that this is still an early stage play, and a speculative stock, so professional advice should be sought if considering making an investment.

Tesla’s preference for North American lithium could help this company with its cause...

Over the next five years, Tesla is expected to ramp-up its consumption of battery-grade lithium by over 25,000 tonnes per year – that’s 6% of global supply.

That’s just Tesla’s alone – without including other battery manufacturers that are also jostling for position to dominate energy storage.

With a potential lithium boom seemingly opening up, now could be the time to secure lithium exploration assets with a view of developing them – in time for the looming widespread take up of electric cars and energy storage solutions heavily dependent on lithium.

This company is of exactly the same view.

Introducing:

Lithium is being earmarked for a rapid growth phase on the back of increasing demand for lithium-ion batteries and lithium stocks are therefore rising.

Take a look at Global X Lithium ETF – a solid broad measure of how lithium stocks and stocks with lithium exposure are performing as a basket:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The trend at least since the start of this year is clear.

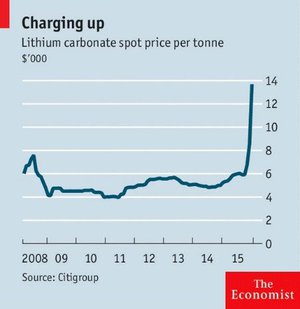

Valuations amongst lithium producers, and their respective trading volumes are rising as lithium prices are doing this:

Mainstream news reporters caught onto the lithium story as early as October last year:

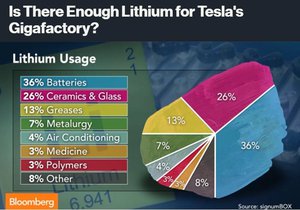

A key roadblock for companies looking to produce lithium-ion batteries en masse, is the currently low annual supply of their key ingredients including lithium, graphite and cobalt.

This has roused dozens of resource companies into digging for lithium and graphite as the two most important elements in future battery technology.

Here at The Next Small Cap we’re all about finding undervalued companies that have something up their sleeves for early investors.

Caeneus Minerals Ltd (ASX:CAD) is one such company whereby its previous forays into nickel have unfortunately come to a pause following the nickel downturn in recent months.

CAD still has a nickel project that will be progressed in the future, but while nickel prices remain low CAD has moved to diversify its portfolio by acquiring two potentially lucrative lithium projects in the heartland of future lithium demand: Nevada in the US.

CAD currently represents a ground floor entry on the US lithium wave – the stock is trading at $0.001 – the same price as sophisticated investors bought in when the company recently raised $482,645.

At the same time, this is a speculative investment, and there is no guarantee of success – investors should consider their own personal circumstances if considering investing.

Let’s take a look at what exactly CAD has acquired.

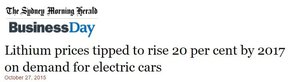

CAD’s Muddy Mountain and Lida Valley projects are situated near the US$50 Billion Tesla 350Gwh Gigafactory

Here’s the lay of the land in Nevada:

As you can see, CAD’s Muddy Mountain and Lida Valley projects are situated near Tesla – a company that is leading the global energy storage renaissance.

Tesla has publicly said it will prioritise North American lithium supply when looking for offtake deals.

Muddy Mountain is a potential high impact ‘district-scale’ lithium clay project, with strongly anomalous lithium up to 1000ppm Li.

Historically, the project has proved up strong drill results; here’s what accredited geologist J. Dahrouge had to say about Muddy Mountain:

![]()

The Lida Valley Project is a significant regional Intermontane Basin with a drainage area of approximately 150km2.

It is considered by CAD to be an ideal location for the development of lithium rich brine deposits.

As we mentioned earlier, capital and mining costs can be significantly less when dealing with brine deposits and the lithium can be extracted from a liquid rather than hard rock.

About two thirds of the world’s lithium resources are within brines/salts, which bodes well for CAD.

Historically, Lida Valley has identified gravity and resistivity consistent with lithium rich brine deposits and further ground gravity details indicate a stratographic and structural setting favourable for lithium brine deposits.

The really positive play with regard to Lida Valley is that it is drill ready, with work scheduled to begin on the project once the acquisition deal is finalised.

Funding

As is the case with any junior explorer, funding becomes a key aspect when there’s exploration afoot.

For CAD, a recent placement of $482,645 will go directly towards progressing Muddy Mountain and Lida Valley as the two high priorities.

The stock is currently trading at $0.001 – the same price the latest capital raise was completed at...

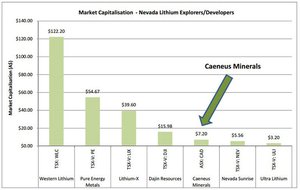

If looking at its competition, CAD is rather undervalued

If CAD’s proposed acquisition of Muddy Mountain and Lida Valley goes through over the coming weeks, it will be operating among six other lithium explorers in close vicinity.

Here’s how they stack up in terms of valuation:

CAD has some catching up to do, and given the change of priority from nickel to lithium, we expect busy times ahead for CAD’s lithium exploration.

Currently, the only lithium mine in the US belongs to Albemarle Corp (NYSE:ALB), a US$7BN juggernaut with operations 40km from CAD.

This is how Albemarle shares have performed over the past few months:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Could it be that lithium allure is translating into higher valuations for lithium miners and explorers?

Quite possibly although it is still too early to tell.

CAD wants to emulate this market leader by progressing its lithium projects through to production –which would raise its valuation many times over from current levels.

Here’s the Financial Post’s take on Albemarle:

Tesla’s Model 3 and its broader energy storage mission plan has most definitely put the cat amongst the pigeons in lithium circles – which makes CAD’s move into Nevada all the more interesting.

Man about minerals

Steven Elliott has been in geology for over 30 years, specifically in mineral exploration and has worked all over the globe.

He was the co-founding director of Helix Resources Limited and listed Talisman Mining Limited in 2005 – now capped at $85 million.

While Helix is still a small company, capped at just under $10 million, it had some big wins with Mr Elliott there and has gone onto bigger things since.

With Mr Elliott as a driving force, CAD is looking for success in dealing with potential partners and sales, particularly with interest in lithium so high...

Looking for offtakes

Tesla’s most recent lithium supply agreement was with Canadian-based Pure Energy Minerals who will supply only a portion of Tesla’s needs with the remainder to coming from other sources .

Tesla’s plans are to build around 500,000 EV cars per year so the deal with Pure Energy is likely to be one of many other deals given that one company will not be able to cover all of Tesla’s lithium demand.

A couple of months before that, Tesla signed its first conditional supply deal with Bacanora and Rare Earth Minerals to obtain lithium from a mine in Northern Mexico.

It would seem that as Tesla is preparing its huge production line, it is gradually cherry picking the most attractive lithium projects close to its gigafactory in order to keep costs low and supply lines well stocked.

It may also be shoring up its stocks because the company is facing stiff competition from other American car manufacturers as well as Asian competitors who also want a slice of the EV pie.

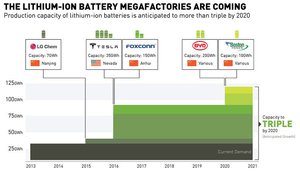

Take a look at how many gigafactories are in the pipeline:

Tesla isn’t the only energy storage/electric car manufacturer out there, so the outlook for lithium and graphite is looking positive given the above estimates.

Did Elon Musk let the cat out of the bag?

Following Tesla’s launch of its new Model 3 electric car, Elon Musk tweeted the following message to the millions of people keeping track of him on Twitter:

Definitely going to need to rethink production planning...

— Elon Musk (@elonmusk) April 1, 2016

The admission came after Tesla managed to take pre order deposits for almost 300,000 EV cars at a unit price of $35,000-$42,000 in 3 days.

Just to put that into perspective, the best-selling US car for the entirety of 2015 was the Toyota Camry with 361,111 unit sales, priced at $21,000 – $28,000.

And the incredible thing is that these Tesla pre-orders will only be delivered to buyers around 2017...

What this demonstrates is that Tesla has quite possibly pushed electric cars from the periphery directly into the main vein of consumer sales.

If people are willing to spend almost double for a brand new Tesla EV car, compared to a comparable combustion engine version it could possibly mean that electric cars are rapidly surfacing as the preferred option for new car buyers.

Just a quick one, here’s the Model 3 pre-order queue in Australia as pre-orders ramp up globally for Tesla’s new EV car:

Model 3 order day starting in Australia pic.twitter.com/T6aUnG5BCv

— Elon Musk (@elonmusk) 30 March 2016

That’s great news for Tesla...

...but also for other EV manufacturers based in the US and Asia.

Also benefitting from the EV car revolution are lithium, graphite and cobalt suppliers because those are the three key elements in producing lithium-ion batteries used in EV cars.

For more information on the lithium market, we highly recommend this short-video from Bloomberg that runs through all the important points, so get ready to take notes....

Not forgetting about Nickel

With all the attention shifting to lithium, CAD’s other asset is a potential high-value nickel project, also recently acquired as part of a JV deal with Segue Resources (ASX:SEG) – who regular readers may well be familiar with, as it’s a company we have covered a few times previously.

If the nickel prices heads north again, this project in CAD’s back pocket could start to really come in handy.

The deal was made in October last year through the takeover of Port Exploration Pty Ltd, which was finalised in December .

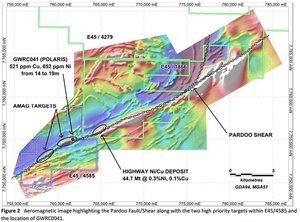

CAD’s Pardoo Project is located in northern Western Australia, adjacent to Port Hedland:

The project has recently had a detailed aeromagnetic survey completed with results showing several high priority anomalies and ultramafic rock – the preferred host rock to many primary nickel sulphide deposits.

Pardoo already has an Inferred Resource of 44.7Mt @ 0.3 Ni % 0.13% Cu, which makes progressing this project more straightforward considering the historical data already available.

Here is that initial aeromagnetic survey mapping out those all-important exploration targets:

CAD’s current focus is firmly on lithium in Nevada, but if and when nickel prices recover sufficiently, the Pardoo project can be progressed with SEG as the development partner.

One other noteworthy point about the JV deal is that CAD has reserved the option to scale-in further , up to 100% subject to conditions.

For the time being, the plan is to conduct a detailed assessment of the project’s largest intrusions including detailed ground-based gravity surveys and moving loop EM surveys.

These will be followed up by well targeted RC and diamond drilling programs which could turn out to be strong catalysts down the road.

Metals aplenty for CAD

CAD has flown in and grabbed our attention courtesy of its well-timed move into Nevada and lithium exploration.

With lithium prices now making their move higher on the back of battery demand, we think now could be a great time to look for well located, compelling lithium projects with a high potential of offtake at some stage in the future.

Capped at just A$2.4M but with excellent lithium (and nickel) projects under its belt, CAD is a cheap entry point at $0.001, considering the estimates flying about regarding future energy storage and demand.

However investors should not base their investment decision on estimates alone, seek professional advice in any decision you make.

CAD’s upcoming catalysts include the commencement of more ground gravity surveying over the coming weeks as part of the Company’s due diligence process– a common move by junior explorers having just acquired a flagship asset.

As lithium prices grab more headlines and generate more interest from investors, CAD is well positioned to intercept this trend and snuggle itself right into the inner sanctum of tomorrow’s lithium oasis in Nevada.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.