The Quarterly Results Are in For Our Tech Pick Of The Year

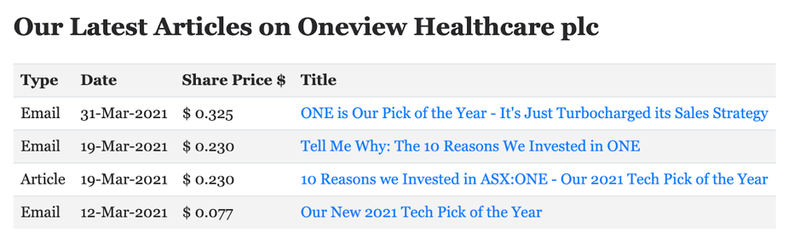

Results are in for our 2021 Tech Pick of the Year and biggest initial investment we have ever made - Oneview Healthcare (ASX:ONE).

ONE is a health tech company that provides hospital patients with a “virtual care and digital control centre” at their bedside to deliver the best possible patient experience during their stay.

ONE just released their quarterly results and we are extremely happy with their progress of increasing revenue, significantly decreasing costs and expanding several existing clients.

Revenue Up. Costs Down.

The key thing that jumped out at us on first scan was that revenue for the quarter was up 64% to $4.37M and costs were down a whopping 84%, showing that the company burned $857k in the quarter (numbers here are converted from Euros to AUD and compared to previous corresponding quarter).

The quarterly shows $8.97M in the bank - so at $857k quarterly cash burn ONE has 10 quarters (2.5 years) to deliver on its plan before (or if) it needs to raise again.

ONE was a cash hungry beast for several years (before we invested) and many of the previous shareholders got impatient with the spend versus growth and left the building. This pushed the share price down to a level we thought was extremely undervalued given its revenue and mature tech developed for the health tech space (ONE spent a lot of money to develop the tech).

We invested because we believed ONE had the right tech, at the right place, at the right time, and because of management's commitment to a cost reduction program. We are delighted to see that program come to fruition in the quarterly - probably more than we were expecting.

What to watch for next: as the company continues to release quarterly reports we want revenue to increase and costs to stay the same.

Existing Customers Expanding

A red flag in early stage technology companies is when new customers don’t renew their contract after using the product for a year - it means they didn’t get value out of the product and has implications for the broader value of the product to other customers.

On the other side of the coin, a huge positive sign that you are onto a winner is when existing customers expand their use of a product - it means that they have found value in the product, enough to buy more.

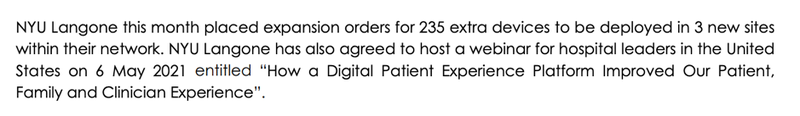

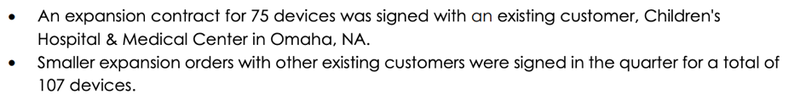

ONE reports multiple customers expanding usage of their product:

And also subsequent to the quarter:

What to watch for next: We are watching closely for more customer expansions to be announced in the coming months.

Samsung Partnership

The Samsung deal was signed in the quarter just gone and the partnership is formally launching this month.

Essentially, Samsung in the USA has a big sales team that is tasked with selling Samsung tablets and its other hardware.

By bundling ONE’s software onto Samsung tablets, the Samsung sales team can approach hospitals with a full package (tablet + tech) for each hospital bed, which is way easier to sell to a hospital than just hardware or basic tablets.

We found the Samsung tablet + ONE software sales brochureon ONE’s website (if you know any hospital CEOs please send it to them, thanks).

We welcome the Samsung USA sales team onboard and look forward to you hitting your sales targets...

What to watch for next: A lot of times these partnerships can sound great but don’t yield results - we are watching for any early deals that come through the partnership.

Cloud Offering Launched

ONE launched a cloud version of their product that will now enable a “land and expand” strategy for ONE.

In summary this cloud offering allows ONE to start by selling smaller, makes it easier to close deals to hospitals to let them test the product (LAND), and then EXPAND the deal once the client is happy.

ONE already said that existing clients are expanding... now to “land” a few more.

In the quarterly, ONE also says they have “added two additional SaaS salespeople in the US this month to further capitalise on the first-mover advantage of this product”.

What to watch for next: We want to see ONE start signing LAND deals, and eventually EXPAND them.

Our Investment Approved

Obviously we are very happy that our investment into ONE and our mandate for promotion services was approved by ONE shareholders with a 99% YES vote - we look forward to the journey as ONE investors for the next few years and also supporting the company in its promotional activities to reach new investors.

Long term positions in quality companies + wide investor awareness + successful execution of the company business is our formula for long term investment success.

...What We Don’t Like in The Quarterly

We noticed a pretty chunky payment of 177k euros ($276k) as a payment to an outgoing director as a “retirement fee” - pretty big golden parachute if you ask us.

Also we are not huge fans of the court case initiated by ONE against Regis healthcare for $21M - these kind of court cases can be a distraction from the main game of selling tech, especially if they drag out and cost money - although we won’t be complaining if ONE manages to get a couple of million $ settlement out of it.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.