MUS Edging Closer to Ruby Revenues

Published 21-SEP-2016 10:11 A.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

We are hot on the heels of a commercial mustang in this edition of The Next Small Cap .

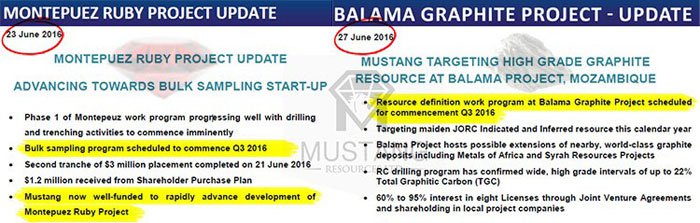

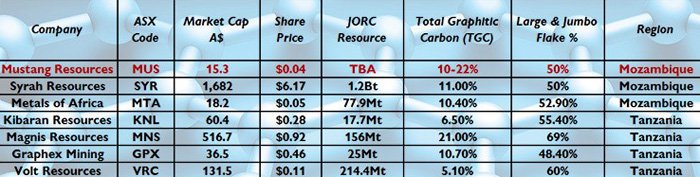

We are of course talking about Mustang Resources (ASX:MUS), an aspirational gemstone and graphite explorer that despite its sub $10MN market-cap, is on track to “JORC-up” both its prime assets by Q2 2017, and move into generating revenues as soon as Q4 2016.

MUS has masterminded a business strategy that will see it generate early cash flow from near term bulk sampling ruby sales...

...with all the proceeds used to advance an overarching plan to become a dominant gemstone company that rivals current industry pacesetter the 241M GBP (AU$414M) capped Gemfields PLC (LON:GEM), which continues to yield robust volumes of high-quality rubies.

If MUS can prove up the sufficient grade from its imminent bulk-sampling program, it will position itself to become a significantly larger gemstone producer over the coming 12 months.

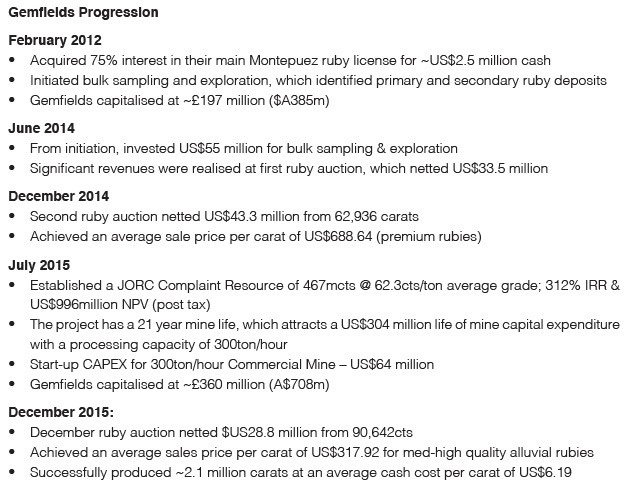

Take a look at how Gemfields PLC has performed after trotting through the same gauntlet a few years back, and which MUS is currently cantering through:

With over $3 million in additional funding now in the bag for MUS, all permitting hurdles cleared and bulk sampling at the starter-pistol stage — it all means that the company is now saddled to successfully barnstorm the cashflow-spouting ruby auctions that helped launch Gemfields into a multi-hundred-million-dollar gem powerhouse.

It will be helped by recent events, including locating a secondary ruby deposit at its Montepuez project and the recent announcement that construction of a bulk sampling plant was well advanced . Furthermore the bulk sampling pit was open with gravel being stockpiled for wet commissioning within the next fortnight.

Before we go too far, it should be noted that for political and social reasons, this is a very high risk stock. Getting mining projects up and running in countries such as Mozambique is no simple feat, and there may be challenges ahead.

Now could be a good time to back MUS as a future gemstone producer, especially as plenty of catalysts are coming over the horizon — including a scrumptious early resource boost and the macro gemstone and graphite markets galloping to new heights, as global commodities and resources markets begin to look rosy once again.

Updating our readers on:

For Mustang Resources (ASX:MUS), 2016 has been an eventful year so far.

Since buying into its now flagship Montepuez Ruby Project in Mozambique, in October 2015, MUS has given several exploration updates since, implying a plentiful multitude of ‘alluvial ruby traps’ that will very likely be defined as a bulky high-grade ruby deposit in early 2017.

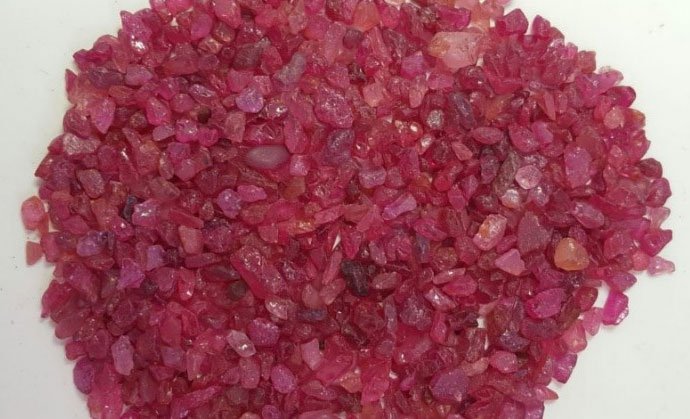

From the groundwork done so far, indications are that high grade rubies are present in many of the region’s ancient riverbeds, with MUS geologists routinely discovering high-quality gemstones from initial sampling.

Meanwhile, not too far away is MUS’s other resource focus — graphite.

MUS has a synchronistic and complementary graphite project, also in Mozambique, to provide an additional commercial spur for MUS.

Armed with some very strong ruby and graphite assets that sit adjacent to existing “JORC’d” tenements, MUS is now working overtime to prove up exploration targets and issue two maiden JORC Resources before mid-2017 — one for its ruby project and another for its graphite — and yet MUS remains firmly in the micro-cap bracket which is why it made it into our crosshairs.

We think that ‘micro cap’ tag may not be for too long.

That may sound optimistic, or even audacious — but here at The Next Small Cap , our attention has been grabbed to the extent that we feel confident that MUS is in with more than a fighting chance deliver on its aspirations.

In this article we will take a look at exactly how much potential MUS has, and whether investors should take the plunge in saddling this mustang.

To catch up on our previous articles, click here:

Tiny ASX Stock to Emulate $478M Neighbour in Ruby Race? Drilling Soon ; published on May 23 rd 2016.

Near Term Ruby Revenues and Near Syrah Graphite: MUS Now Freshly Funded ; published on July 5 th 2016.

Ruby Update

First and foremost on the update list is MUS’s ruby exploration at Montepuez.

The most recent news surrounds the advancement of its bulk sampling plant. The sampling pit has been opened (over the area where high quality rubies were taken out with recon samples) and the gravel is being stockpiled for wet-commissioning of the plant within the next 10-15 days.

The plant will initially operate at 1300tpd (feed) for one eight-hour shift and the goal of this phase is to demonstrate the grade of ruby mineralisation over a representative sample size, to recover sufficient rubies to form a marketable parcel and to give a further indication of quality.

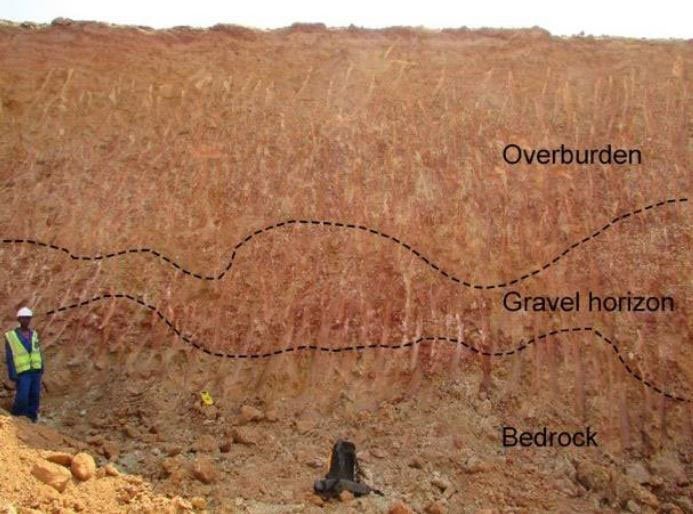

Here’s a look at what is going on:

Since our previous article, MUS has sampled a total of 29 rubies totalling 5.79 carats from small reconnaissance pits. At this early stage, this is very significant because recovery of high quality rubies from small sample sizes could be a leading indicator of a high-grade deposit once it is fully assessed.

MUS has thus far discovered some lively samples that corroborate the overarching goal of securing a plentiful ruby supply at low-cost due to close-to-surface deposits — but a potential new ‘deposit’ altogether.

This is exactly the kind of exploration progress we like to see our steeds make, here at The Next Small Cap .

The reason why, is quite simple.

MUS is attempting to emulate another gem generator in the form of Gemfields PLC, a UK-based company that has raised its valuation to £241M (AU$414M) in the space of 4 years.

Here is what brokers Baker Young estimate MUS being capable of achieving, in terms of cash flow and net profit after tax (NPAT).

Of course, these calculations are largely dependent on the carat grade MUS is able to extract.

But even when taking the lowest forecast of $100/ct, MUS could potentially generate around $27 million in annual cash flow, and $4.5 million in annual profit . If MUS beats expectations from its highly anticipated bulk sampling program, those estimates naturally inflate to much higher multiples.

However, it is still in its early stages and MUS has a long road ahead. It is recommended investors do their own research before making an investment decision and seek professional financial advice with regard to this stock.

Clearly, the next stage of MUS’s story will be crucial ...

MUS will initiate bulk sample mining using 16 foot rotary pans processing ore at a rate of 800 tonnes per day with a head feed of approximately 1300 tonnes per day. If sufficient ruby mineralisation is found, MUS will upscale its onsite plant capacity to 2,400 tonnes per day.

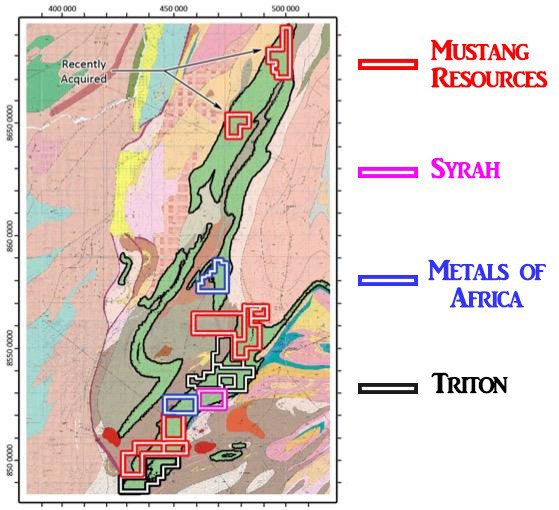

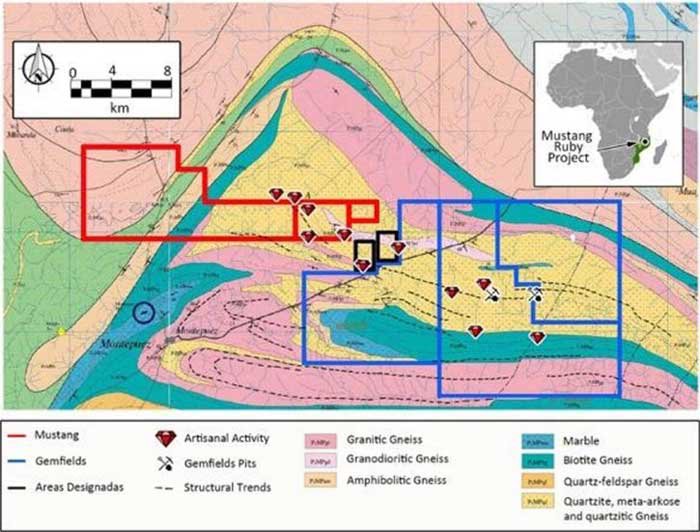

And here is the overall map showing how MUS tenements overlapping a clear ruby belt moving from SE to NW, as you can see indicated by the ruby symbols. MUS tenements are indicted in red.

So what is the next stage?

Full Scale Mining Milestone

Subject to MUS digging out sufficient quality rubies and defining a JORC Resource Statement, the next stage would be to scale up its bulk sampling activities to that of a full-scale commercial mine.

Currently, MUS expects to be in a position to make an investment decision whether to commence full scale mining in H2 2017, with ongoing ruby sales providing early revenues, that could turn into a torrent in a couple of years’ time when MUS raises its production output, much like Gemfields did as part of its early growth in 2012-2015.

We’ve said it before, and we’ll say it again — Resource exploration is about people and expertise

As we mentioned in our previous coverage, there is one outstanding factor in MUS’ favour that is likely to decide how far this mustang can run into the commercial wilderness of ruby market domination.

The bridle on this mustang comes in the form of Paul Allan

MUS has recruited Paul Allan, a former Gemfields consulting geologist who helped the company start its operations between 2012 and 2014 which developments and results have ultimately led that company to its current market cap of $241M GBP (/ AU$414M).

The good news for MUS is that Mr. Allen knows East Africa better than the lines of his hand, which means his expertise will provide an invaluable ‘edge’ for MUS, over its peers.

The latest capital raising round has brought in $3 million

On the funding front, MUS is galloping along pretty nicely.

One of the core stakeholders, Lanstead Capital has topped up its stake from 13.5% to 16.3% and brought in around $800,000 in additional funding.

A further $1.2M from a highly oversubscribed share purchase plan (SPP) means that MUS was able to raise $3M with which to fast track the Montepuez Ruby Project.

The capital raising also means MUS is now fully-funded through to its first ruby auction where it is hoped MUS will generate strong sales revenues given the ‘bulk’ sampling it will be doing over the coming months.

All in all, we’re of the opinion that MUS’s ruby market ambitions are lining up into a neat duck formation for early investors.

What MUS is gunning for, is a chance to pierce one of the best performing niche resources in the last decade

The price of high quality rubies has grown by around 63% since 2008. Not many other commodities, minerals or resources have been able to see their values rise over the past 5-10 years because of the commodities downturn — and yet the ruby market has been fairly well insulated.

However it could be even better. Previously the market suffered due to fragmented supply and unreliable suppliers including Myanmar, Afghanistan and Madagascar.

But with the growth in consumer demand and demand from countries and regions including the US, Europe, India, Thailand and China (all indications are that China’s insatiable growth will continue to add to the allure of rubies on a global stage) – and with plenty of organic demand, the tide has turned.

And the market has changed.

Globally, the ruby market is estimated to be worth around US$2BN per year.

Rubies are the most expensive gemstone after diamonds, with fine rubies of 5 carats or more attracting premium prices. The 25.59cts “Sunrise” ruby ring sold at auction for US$30M in June 2015 at Sotheby’s in Geneva.

Let’s not forget this mustang’s other spur — battery-manufacturer-wooing graphite, also from low-cost Mozambique

One very important spur for MUS is its graphite project based in Mozambique. Without going into all the nitty-gritty here, check out our previous article which ran the rule over the graphite potential locked up in this mustang’s saddle.

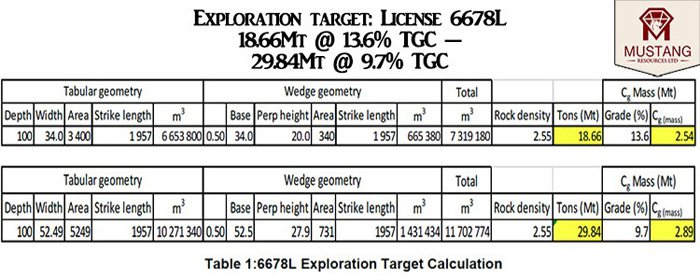

Here’s a snapshot of the ground MUS has —

— just like its ruby project, the graphite asset is close to existing JORC Resources, and MUS has its own Resource to define which it hopes to do so by the end of 2016.

Giddy up partner

MUS is an emerging gemstone developer with very near-term commercial aspirations.

At the same time, MUS is a high risk investment, and there is no guarantee an investment will be successful, so apply caution to any investment decision and seek professional financial advice.

MUS has been ticking all the right boxes up till now, with bulk sampling now expected to fully test the mustard of this mustang.

Having its Montepuez Ruby Project evaluated for bulk as well as beauty is something MUS has been waiting for like a well-behaved toddler waiting for his Christmas present.

All the signs point to Montepuez rubies matching the quantity with the requisite quality, and so the expert management and geological teams at MUS are understandably giddy as this mustang giddies up for its first ruby auction within the next 12 months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.