MPJ Drill Rig Now Probing for Giant Nickel Deposits

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The time has arrived for MPJ. Many months of preparation and analysis by arguably the world’s best nickel geophysicists and geologists has led to precise drill target definition. Refined anomalies at MPJ’s Roe Hills project in Western Australia are this very minute being hunted by 5 to 10 KILOMETRES of diamond drilling. Multiple key prospects, contained within a 40km continuous strike of ultramafic rocks are being tested right now – Results are due in just a few weeks. At the same time – drill results may not be conclusive, and MPJ remains a high risk investment for now. MPJ have on the team Neil Hutchinson and Newexco, who are responsible for $2.5BN worth of nickel discoveries between them – that is the combined market cap of the holding companies. MPJ is fully funded for this 10,000m drill programme, and are also anticipating an R&D rebate as part of the work.

When we first wrote about MPJ, in the article Nickel Rock Stars Working For Shares: Twiggy’s # 1 Geologist Plus Sirius Masterminds Combine in One Fraser Range Micro Cap , the current nickel drilling campaign was one of the near term events we were looking out for. We stayed with the developing story as drilling drew closer and closer, in the article Fully Funded MPJ Reveals Big New Nickel Targets and 5,000m of Drilling in a 40km Known Fertile and 100% Owned Ultra Mafic Strike . Now that drilling has kicked off, the market is beginning to sit up and take note... CPS Capital Group Analyst Eddie King has just issued a “ Speculative Buy ” recommendation on the stock:

![]()

This “Speculative Buy” rating is a good sign, but analyst reports aren’t the only tool we use when making an investment decision, they are just one thing we consult. With 5 to 10 KILOMETRES of nickel sulphide drilling now underway at Roe Hills, along with downhole geophysics to test for additional conductors, it appears that MPJ is just warming up. It doesn’t hurt that the drill targeting has been designed and refined by Neil Hutchison from Poseidon Nickel, who discovered the Cosmos and Windarra nickel deposits. And Neil has been assisted by the founders of Newexco, Bill Amann and Adrian Black, who were integral in the discovery Sirius Resources’ massive Nova-Bollinger nickel deposits. As we mentioned above the total market cap of companies holding the discoveries led by Neil and Newexco amounts to $2.5BN . If MPJ is sitting on a large nickel resource, chances are that the team they have assembled will find it.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks. To note just a few:

- Since the Next Small Cap article on Segue Resources (ASX:SEG), Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets , SEG has been up as high as 200%.

- After we released the Next Mining Boom article on NSL Consolidated (ASX:NSL), Tiny Miner’s First Sales Days Away: Stockpiles Waiting to Be Processed, Delivering Instant Cash Flow , NSL has risen as high as 80%.

- Following the Next Mining Boom article on Apollo Minerals (ASX:AON), Drilling Results in Days: Billionaire Backer Hunting Mammoth IOCG Deposits with Tiny Explorer , AON has risen as high as 90% since.

- Following the Next Oil Rush article on Austin Exploration (ASX:AKK), $20M to $5.6BN: Can He Do It Again? Multiple Catalysts In Weeks , AKK has risen as high as 130% since.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Big Drilling for a Potential Big Prize

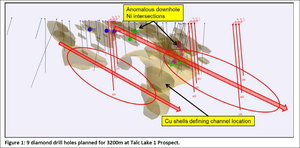

All the hard work by MPJ, Neil and Newexco, has culminated in the very extensive and comprehensive nickel drilling campaign at Roe Hills currently underway. The best way to find a big nickel deposit is by snapping up the best ground, hiring the best geologists and geophysicists, and then following it with copious amounts of targeted, well planned, drilling. Recent work completed by Neil Hutchison identified several significant nickel targets at the Talc Lake, Roe 1 and Roe 2 prospects. 9 holes are planned for the Talc Lake prospect, for a total of 3,200m, here is a cross section of the geological model – the red lines are the planned drill holes:

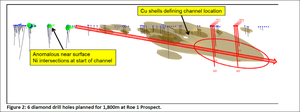

6 holes are planned for the Roe 1 prospect, for a total of 1,800m:

So initially, MPJ will drill a total of 15 diamond holes for 5,000 metres, along with down-hole electromagnetic surveys to be managed by Newexco. MPJ may elect to extend the campaign to 10,000m. As MPJ recently raised $1.398M , they have the funding capacity to execute this work. OnQ Drilling has been contracted to complete this initial phase. Additional drilling over and above 5,000 metres will be at a discounted rate, and as is the case with most contractors involved in MPJ’s nickel exploration, OnQ is taking a substantial portion of their fees in MPJ shares... Hint hint.

Three Nickel Projects

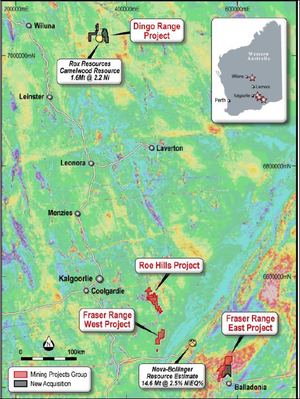

The current drilling at Roe Hills is a big deal – but it’s far from being the only saucepan MPJ has on the stove. MPJ’s Fraser Range East Project is bordered by Sirius to the north and Fortescue Metals to the south. Initial geophysical work has been conducted by Newexco, and further work is anticipated in the near term. MPJ has also secured a significant tenement holding in the Dingo Range nickel region to the north, with projects straddling Rox Resources. Rox has a growing Camelwood nickel deposit along with several significant discovery holes:

MPJ is almost like three nickel exploration companies in one – over the next few months we should start to learn more and more about these other projects.

Talk of the Town

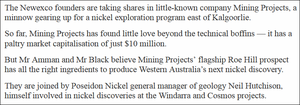

MPJ has been a hot topic in recent times... even The Australian featured an article on their world class technical team, who are involved with MPJ and are supervising the current drilling at Roe Hills.

The Australian focused on the very interesting fact that for MPJ, Bill Amann and Adrian Black are easing their long held policy of not taking shares in their clients. In the case of MPJ, both will be taking shares as part of their service fee, giving them increased exposure to any discoveries. Bill and Adrian founded Newexco way back in 1999 to help exploration companies discover economic nickel deposits. And help find economic nickel deposits they did! They were behind Sirius’ massive nickel discoveries of Nova and Bollinger, as well as Panoramic Resources’ more recent discovery hole at Savannah North of 89.3 metres at 1.6% nickel. They also engineered Peel Mining’s Mallee Bull polymetallic intercept of 84 metres at 5% copper equivalent, and the company-making Spotted Quoll and Flying Fox nickel deposits for Western Areas. For a tiny $10 million nickel explorer, MPJ sure is getting a lot of coverage...

Conclusion

It’s show time in the WA nickel sector and MPJ is playing leading man. With 5 to 10 kilometres of diamond drilling at the Roe Hills Project, including downhole electromagnetics, there are multiple price sensitive price catalysts lined up to potentially enthuse the market as the programme comes to completion over the coming months. MPJ management, cornerstone investors and the nickel genius of Bill Amann, Adrian Black and Neil Hutchison are all locked and loaded with MPJ shares. And this is just one of three major nickel projects in MPJ’s arsenal. MPJ is still a small exploration company and is a high risk investment. But as MPJ investors ourselves, we are glad we are not on the sidelines.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.