Moto went from 4¢ to $4: This ASX Explorer has Same Backer, Same Country, Same Metal… Same Result?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Despite the untold amounts of undiscovered resource wealth beneath its ground, the Democratic Republic of the Congo (DRC) is not generally considered an easy place to do business.

However, there is one man on the planet that gets the job done in the DRC and has built serious shareholder wealth — time and time again for his investors.

His name is Klaus Eckhof.

While at the helm of Moto Goldmines, Eckhof grew the company from 4 cents to $4 per share — a 9,900% return and spurred a $502 million takeover by Randgold Resources on the back of the 17Moz Kibali gold deposit.

Randgold, itself, was later acquired by Barrick Gold (NYSE:GOLD | TSX:ANX) in a $6 billion deal in January this year.

The Kibali mine is producing 600,000oz per annum gold. It’s one of the largest gold mines in Africa and has some of the lowest production costs of all gold projects globally.

The takeover saw Barrick Gold acquire not only Randgold and its Kibali Mine, but it also gained Randgold’s CEO Mark Bristow. Bristow was appointed CEO of Barrick and tasked with applying his successful Randgold operating model to the entire Barrick Gold company globally.

So the same guy that executed the $502 million purchase of Klaus Eckhof’s prior DRC gold project is now at the helm of the world’s largest cashed up gold company and tasked with repeating his past success...

Today, Eckhof just so happens to be building up another DRC gold project in the Kilo-Moto Belt, right next door to Kibali which Bristow still oversees — 35 kilometres down the road to be exact.

We can’t help but join the dots here...

Whether Eckhof’s latest DRC gold venture attracts similar interest from Bristow/Barrick or other major players is still to be seen.

But as one astute Hartley’s analyst put it, “We are backing Klaus Eckhof in the DRC again and hopefully he can replicate the Kibali Mine which is now the Jewel in the Crown for Randgold/Barrick Gold”.

Here at the Next Small Cap, we are of the same opinion, and recently made a large, long term investment in this company.

It’s not just the success of Moto Goldmines and the Kibali Mine that Eckhof is known for.

Eckhof also made a name for himself during his time at AVZ Minerals (ASX:AVZ) where the share price of the lithium-focused exploration company in the DRC surged 2,500% in 12 months from 1.4c to 37c.

However, that is now behind him, and Klaus Eckhof has turned his focus back to his first love, gold — and another tiny unheralded ASX micro-cap stock with projects in the DRC.

It’s in the same country, the same metal, and dare we wonder — could this stock achieve a similar result as Moto?

With funds raised, an existing JORC resource, and the backing of a proven management team, we look forward to drilling to begin.... which is expected to kick off sometime next week.

Of course, there are no guarantees at this end of the market, but given our stock is currently capped at less than $20 million — a similar level to the very early days at Moto, it certainly has our attention.

Right now looks like the perfect time to take a closer look at this stock – the company raised $3 million in May, just raised another $2.5 million at $0.003 this week, and its most expects to kick off drilling next week.

When the company confirms to the ASX that drilling has begun, it should be the next major catalyst for this stock...

Introducing,

Share Price: $0.003

Market Capitalisation: $15.6 million

Here’s why I like Amani Gold:

Amani Gold’s (ASX:ANL) Giro Gold Project has an existing Resource base of 2.37Moz that the company is working to increase with infill and extensional drilling planned for one deposit and a Resource upgrade planned for another.

Drilling is expected to begin next week, while ANL is also looking to pick up more licences in the north-eastern region of the DRC targeting 5-10Moz of total resources.

Evidence of this can be seen with a MOU having just been signed to acquire a second project — the Gada Gold Project — that is strategically located not far from its flagship project or from Kibali.

With a focus on the country’s northern region and the well-endowed Moto Greenstone belt, ANL is operating in a proven gold mining province in a mineral-rich region of Africa. And it now has all the pieces in place as it heads into drilling and seeks to increase its landholdings in the area.

Assuming the Gada transaction gets completed, the $15.6 million capped ANL will become one of the major gold tenement holders in this proven gold producing part of the DRC.

As was the case with Moto and with AVZ, there’s significant early stage potential on offer and over the last few weeks, investors appear to be starting to catch on.

The share price recently doubled in just a few days, albeit from a low base of 0.2 cents, and volume was well above daily averages, with the most recent placement done at 0.3 cents.

However, it is still early days here, and the train hasn’t left the station yet — we would imagine a number of investors are waiting on the sidelines prior to the news of the launch of the Giro drilling campaign.

Another reason to suspect the share price could head north from here are the performance rights issued to Eckhof, which will only be vested and converted into shares (in three tranches) once reaching 0.75 cents, 1.0 cent and to 1.25 cents — well up from the current 0.3 cent share price.

Both Eckhof and ANL investors have reason for optimism. All is going to plan: with the gold price recently soaring to six year highs, the company is about to embark upon drilling at one project and is completing due diligence with the view of acquiring a second.

I expect market enthusiasm for this exploration stock to continue to rise ... and possibly other larger players will take a closer look at the ANL, especially given Mr Eckoff’s track record and high profile industry connections.

The Democratic Republic of Congo – a mining location

The DRC is prolific in natural resources wealth including gold, uranium, zinc, lead, copper, diamonds, phosphate, potash, iron ore and magnesium.

While it’s had a troubled past, the political situation in the DRC has improved significantly in recent years and the country held its first free elections in more than 40 years in 2006.

On 24 January 2019 new President Félix Tshisekedi was elected and took office and viewed to be a relatively positive figure for mining investment.

Barrick Gold executive chairman, John Thornton, said the new President’s vision of attracting foreign investment and supporting the development of the country’s mining industry was encouraging.

He said, “We look forward to continue making a significant and growing contribution to the DRC’s economy and to unlocking the enormous value of its mineral potential.”

However, not just anyone can navigate the DRC’s terrain – both geological and political. It takes decades of hard work and establishing relationships with the right people in the country.

That’s why I have confidence in ANL’s leadership which comes with a proven track record of successful discoveries and operations in the DRC.

A track record of success in the DRC

As I indicated above, along with projects in this highly prospective location, a large reason to back the success of ANL will largely be carried by one man: Klaus Eckhof.

In short, to call this mining veteran prolific would be an understatement.

Eckhof is an experienced geologist with more than 30 years’ experience identifying, exploring and developing mineral deposits around the world, and 20 years concentrating on the DRC.

He has spent years developing contacts within the DRC and has successfully executed several major mining deals in the region.

As former managing director and CEO of ANL (to 12 August 2014), and part-time Executive Chairman (to 11 July 2017), Eckhof oversaw an impressive share price run by the company in 2016 (prior to leaving), where the stock spiked by more than 500% within a six month period. (The company was trading under the name Burey Gold and ASX:BYR) until December 2016.

So what happened?

It appears that after Eckhof left ANL in mid-2017, the company’s Chinese management team running the company struggled to know what to do with the DRC assets, while the share price suffered as they couldn’t relate well to the Australian and Canadian market.

Eckhof returned to ANL as an executive director in January 2019 to turn it around again and in April he was named as company chairman.

The following companies are those which Mr Eckhof has had a significant influence in:

AVZ Minerals

Before returning to ANL, Eckhof was Chairman at AVZ Minerals (ASX:AVZ), another DRC exploration company, but with a focus on lithium.

Under Eckhof’s guidance AVZ had a sensational run in the year from January 2017 to January 2018 delivering shareholders a more than 2,500% gain when the stock rose from just above 1 cent to 37 cents in 12 months.

Much of this success can be attributed to Eckhof’s solid relationships in the mineral rich DRC.

Moto Gold Mines

After founding Moto Gold Mines in 2003, under Eckhof’s stewardship, Moto went on to delineate more than 20 million ounces of gold at the African Moto Gold Project, delivering a feasibility study within just four years of exploration.

That project was subsequently acquired for US$502 million by Randgold Resources. As mentioned, Randgold was then acquired by Barrick Gold in a US$6 billion deal to create the world’s largest gold mining company.

The project’s first gold was poured in 2013 and the Resource now stands at some 22Moz of gold.

Alphamin Resources

Eckhof also previously vended the high grade Bisie tin discovery into a TSX-V listed company, Alphamin Resources (ASX:AFM), located in what is considered a more “difficult” region of the DRC when compared to ANL’s projects.

He financed it with Denham Capital, a leading energy and resources global private equity firm, now with over US$8.4 billion of invested and committed capital.

After several years of drilling, the project is now the highest grade tin project in the world and is going into production any day now.

Okapi Resources

Eckhof is also the chairman of Okapi Resources (ASX:OKR), a company that is focused on the discovery and commercialisation of mineral deposits in the DRC and in WA.

As part of OKR’s strategy to seek out mineral resources investment opportunities in the DRC, it has taken a strategic stake of around 8% in ANL.

In March, 260.3 million ANL shares were allotted to OKR at an issue price of $0.002 each. This follows an earlier strategic private placement into ANL in December 2018, where OKR picked up 50 million shares at $0.004 cents each.

Eckhof’s other industry involvement

Eckhof is a director at Carnavale Resources (ASX:CAV) and has at his disposal an expansive network of industry contacts – including many in Africa — this will give ANL considerable leverage as it moves forward.

Previously he worked for Mount Edon Gold Mines Ltd before it was acquired by the Canadian Teck Resources (TSX:TECK|NYSE:TECK). While in 1994, Eckhof founded Spinifex Gold (ASX:SPX1) and Lafayette Mining (ASX:LAF), both of which successfully delineated gold and base metal deposits.

Giro Gold Project - An Advanced Exploration Project

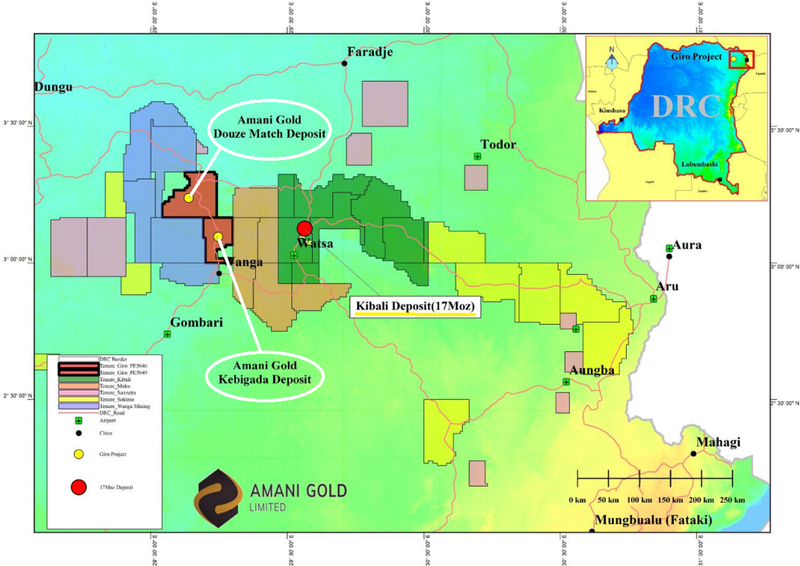

ANL’s flagship project is its 55.25%-owned Giro Gold Project, which comprises two exploration permits — the Kebigada and Douze Match deposits — over 497km2.

The project lies within the Kilo-Moto Belt in the DRC, a significant under-explored greenstone belt and with numerous major gold projects the 17 million-ounce Kibali gold mine group of deposits situated some 35 kilometres east of the Giro Project.

The Kibali mine, in the Moto greenstone belt in the northeast of the DRC, is one of the largest gold mines in Africa. It comprises an integrated open pit and an underground operation as well as a 7.2Mtpa processing plant.

First gold was poured in 2013 from open pit operations and commissioning of the full underground operation was completed at the end of 2017.

The 8Moz of proven and probable reserves at the Kibali mine averages 4.1 g/t gold, making it a world-class gold mine. While, over at Giro’s Kebigada deposit ANL has reported strong, high-grade hits including 47m @ 4.13 g/t from a depth of just 25m.

The mine is owned by Kibali Goldmines SA — a joint venture company effectively owned 45% by each of Barrick Gold and AngloGold Ashanti, and 10% by the state-owned Société Miniére de Kilo-Moto (SOKIMO). The mine was developed and is operated by Barrick/Randgold.

Note that AngloGold Ashanti last week reported a jump in profit which largely came down to a solid performance from Kibali...

In a move to acquire all prospective ground in the area — and confirming the favourable mining environment — Barrick holds all tenements between Kibali and ANL’s Giro Project.

ANL’s two deposits are circled on the map below, not far from the 17Moz Kibali Deposit.

Unsurprisingly given the location, the geology is pretty much the same as Kibali’s with the gold finely disseminated.

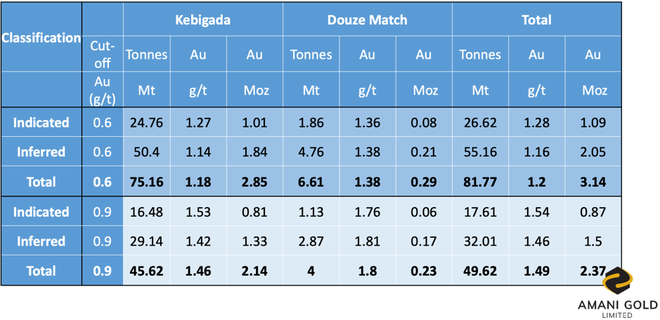

The Giro Gold Project global resource now exceeds 3Moz gold. The combined Indicated and Inferred Mineral Resource estimate for the Kebigada and Douze Match deposits is 81.77Mt @ 1.2g/t gold, for 3.14Moz gold, at a 0.6g/t gold cut-off grade.

At a 0.9g/t gold cut-off grade, the combined Indicated and Inferred Mineral Resource estimates for the two deposits is 49.62Mt @ 1.49g/t gold, for 2.37Moz gold.

The Kebigada Deposit features significant mineralisation over strike length of 1.5 kilometres, widths of 350-400m and open at depth and in all directions. The Douze Match Deposit features high grade near surface mineralisation and open at depth.

The company’s near-term plan is to test for deeper high-grade mineralisation at Kebigada, complete infill drilling at Kebigada and reconnaissance drilling north of Douze Match using a combination of reverse circulation (RC) and diamond core drilling.

Based on ASX announcements we have read so far, drilling at the Giro Gold Project, consisting of approximately 3500 metres, is set to kick off next week.

The following article from Mining-Journal.com provides a good overview of ANL DRC operations, including an interview with Managing Director, Jacky Chan who summarised that “the targeting of higher-grade gold at Kebigada offered the most exciting upside in the near term”.

Drilling is funded

Back in May, ANL raised $3 million through the issue of 1.5 billion fully paid ordinary shares at $0.002 per share.

This was followed by today’s news that ANL has received commitments to raise an additional $2.5 million through the issue of up to 833 million shares at $0.003 per share.

The funds raised together with the company’s existing cash balance will be used to advance the Giro Gold Project, including planned drilling (diamond drilling and augur scout drilling) and assaying.

These funds will also cover regional exploration and field costs, as well as geophysics and mining studies, plus financing due diligence on the Gada acquisition.

As we alluded to earlier, coming in as chairman, Eckhof will receive performance shares (subject to shareholder approval).

These are to be issued over three tranches of 80 million shares each. The first will vest and convert into shares if the company’s shares trade at a VWAP of at least $0.0075 for at least ten consecutive business days. The second tranche of 80 million shares will vest and convert into shares after the stock reaches a 10-day VWAP of $0.01, and the third to be vested and converted once the 10-day VWAP of $0.0125 is reached.

With 6.04 billion shares on issue, once the placement is complete, these targets imply a potential market cap in the region of $45 million to $75 million — a significant move above the current $15.6M capitalisation.

With ANL looking to build on its existing 2.37Moz resources, targeting a 5-10 million ounce discovery and resources portfolio, a market cap in this range looks not at all unreasonable.

Here at the Next Investors, we always like it when ASX company board members are aligned with the interests of other shareholders – and this is a big tick in the box for ANL.

Gada Project

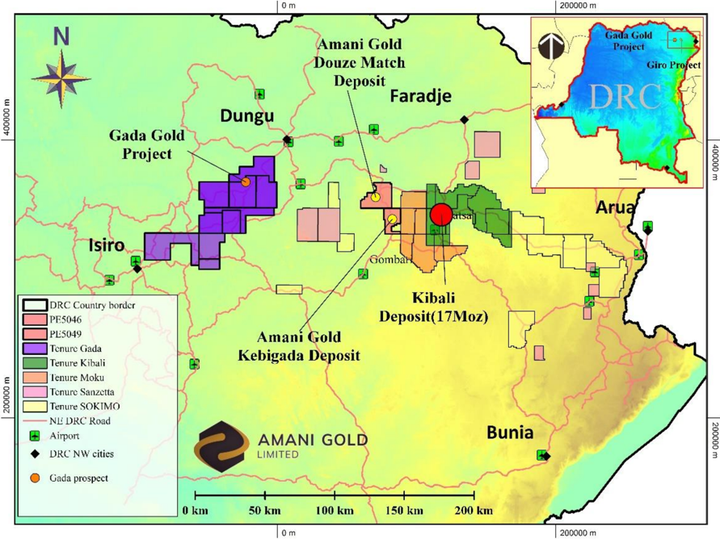

Also in May, ANL took steps to expand its portfolio, signing a Memorandum of Understanding to acquire a major gold tenement package in the DRC — the Gada Gold Project.

ANL’s MOU with Bon Génie N. Mining Sarl is for the acquisition of ten highly prospective gold Exploration Permits in the DRC, through an 85.7% interest in BN Mining.

The project and its ten exploration licences, over a total of 3,159.71 km2, is located in the north east of the country within the Naingara, Dungu and Rungu Territories of the Haute Uele Province. It lies approximately 100 kilometres to the west of ANL’s Giro Gold Project.

The Gada Project is a valuable strategic addition for ANL. Management are familiar with the geology, mineralisation.

And, as proven at Giro, they know how to explore and discover gold deposits in that region of the DRC.

Given the location, geology and scale of the tenement package, as well as the early stage scouting carried out across the project, management are confident that the package is highly prospective for large gold mineralisation.

Mineralisation is hosted in quartz veins and structures which are believed to be open at depth.

Local artisanal gold mining has been undertaken for many years within shallow pits of depth to generally less than 10 metres, and miners have identified quartz veins and associated structures at many places within the Gada Project area.

While high gold grades are mined by the artisanal miners, they have been unable to carry out mining below 40 metres or so, due to flooding and their inability to dig through hard fresh rock.

This won’t be a problem for conventional diamond core and/or RC drilling which will can determine depth extensions and widths of mineralised veins and structures within fresh rock.

Once finalised, the acquisition of this package would see ANL as one of the major gold tenement holders in DRC — in a proven gold producing region not far from the 600,000oz per annum gold mine at Kibali.

Here is the Gada Gold project (purple) along with the 17Moz Kibali deposit and the ANL’s nearby Giro Gold Project as labelled by its deposit names — Douze Match and Kebigada:

Gold hits a six year high

This all comes amidst a recent surge in the gold price that has seen it hit a six-year high of breaching the US$1500 per ounce level, and it isn’t showing any signs of abating.

As a safe haven asset, the ongoing US-China trade war heighten the appeal of gold, and the conflict looks far from being resolved as negotiations between the US and China appear to be stalling.

Along with those tensions, low rates, a soft US dollar, and geopolitical tensions along the Persian Gulf all support gold prices.

Goldman Sachs expect the precious metal to climb to US$1,600/oz over the next six months. The bank points to the weakening global economic outlook, fuelled by heightening trade tensions between the US and China in boosting gold’s appeal.

Its analysts said, “If growth worries persist, possibly due to a trade war escalation, gold could go even higher, driven by a larger ETF gold allocation from portfolio managers who still continue to under-own gold”.

Bank of America is also bullish, eyeing US$2,000/oz within two years amidst “the recent dovish tilt by central banks, accompanied by increases of negative yielding assets”.

ANL poised for growth

In addition to its extensive exploration program outlined above, ANL continue to assess and evaluate gold projects in the Moto Belt.

Eckhof explained that there are further prospective licences in the north-eastern part of the DRC, which are “very prospective”.

The plan is to pick up more of those licences, in addition to the ten exploration licences that make up the Gada Gold Project, to make it a bigger play.

As mentioned, ANL’s plan is to ultimately target a 5-10 million ounce discovery and resources portfolio.

This is a transformational period for the company as it plans to accelerate drilling and exploration programs across its highly attractive gold project portfolio, particularly given that its assets are in the heart of DRC gold territory.

Drilling at the Giro Gold Project is expected to commence next week, with a campaign consisting of approximately 3,500 metres, while the year ahead will see ANL primarily drill deeper at Kebigada.

Then, if the Gada Gold Project is added to the portfolio, ANL expect to soon carry out an initial 1500 metre exploration drilling program of several of the best prospects defined at Gada.

The stock is starting to get some recognition in the market, demonstrated by the recent share price rally and pick up in volume, however it’s early days and still possible to accumulate a meaningful position in this company.

We have taken a large position ourselves and will be keeping a close eye on the company over the coming months.

While we can’t draw direct comparisons to Eckhof’s prior successes at AVZ as well as at Moto, it’s more than reassuring to know ANL is progressing under such as experienced operator in the region.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.