Mining Legend Klaus Eckhof Joins CLZ to Help Fast Track Kat Gap Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a big tick of approval for junior gold explorer Classic Minerals (ASX:CLZ), the company has bagged respected industry figure Klaus Eckhof as a corporate and technical advisor.

The geologist, who has more than 25 years of experience developing mineral deposits worldwide will be advising Classic on its Forrestania Gold Project in Western Australia’s Forrestania Greenstone Belt with particular focus on its Kat Gap Project. Eckhof brings technical and international fund-raising expertise and he will be responsible for marketing Classic and its projects throughout North America and Europe.

With an impressive track record dating back decades, Eckhof has proven time and again that he can deliver for small caps, particularly for small cap gold explorers.

This is the man behind Moto Goldmines’ legendary success. After founding Moto Goldmines in 2003, Eckhof oversaw the company’s share price rise from $0.04 to $4.00 per share — an almost 10,000% return.

Moto went on to delineate more than 20 million ounces of gold at the African Moto Gold Project, delivering a feasibility study within just four years of exploration. That success spurred a $502 million takeover by Randgold Resources, which itself was later acquired by Barrick Gold (NYSE:GOLD | TSX:ANX) in a US$6 billion deal.

Eckhof also made a name for himself during his time at AVZ Minerals (ASX:AVZ) where the share price of the lithium-focused exploration company surged 2,500% in the 12 months to January 2018, rising from 1.4¢ to 37.0¢.

Eckhof also previously vended the high grade Bisie Tin discovery into a TSX-V listed company, Alphamin Resources (ASX:AFM). Here, Eckhof was instrumental in identifying the Bisie Tin — one of the largest and most significant tin deposits globally. That project is now the highest-grade tin project in the world and is about to begin production.

He has also worked for Mount Edon Gold Mines Ltd before it was acquired by the Canada’s Teck Resources (TSX:TECK | NYSE:TECK). While in 1994, Eckhof founded Spinifex Gold (ASX:SPX) and Lafayette Mining (ASX:LAF), both of which successfully delineated gold and base metal deposits.

Eckhof is currently the chairman of Okapi Resources (ASX:OKR), a company focused on the discovery and commercialisation of mineral deposits in the Africa and Western Australia, and the Chairman of gold exploration company, Amani Gold (ASX:ANL), as well as being a director at Carnavale Resources (ASX:CAV).

In short, there’s no doubt that he is extremely well-connected and more than capable.

And now — highlighting his confidence in Classic and Forrestania’s potential — Eckhof is providing his expertise to Classic in lieu of any cash-based remuneration. He will receive performance rights only once Classic’s share price reaches certain target levels — even the first tranche (of three) being at a significant premium to the current share price.

This comes as Classic continues expanding its exploration programs and advancing drilling at its Forrestania Gold Project.

The Forrestania Project holds 5.36 million tonnes of gold, grading 1.39g/t, for nearly 241,000 ounces — a figure that could soon be significantly expanded given recent drilling results from its 100% owned Kat Gap tenements.

At Kat Gap, which was acquired back in January and sits just 70 kilometres south of its existing Forrestania Project, Classic has completed a series of drilling rounds.

In early September, the company reported high-grade gold intercepts at Kat Gap, found to be extending down dip with increasing width — a fact that prompted CEO Dean Goodwin to declare that the prospect has “potential to grow significantly at depth”.

Another factor working in Classic’s favour is the strong gold price. Gold has been on a tear this past few months and gold priced in Australian dollars even hit an all-time high less than a month ago thanks to the combination of the weak Aussie dollar and surging gold prices.

Now with Eckhof on board, Classic has all the pieces in place as it advances explorations. The gold price is at record high levels for Australian producers and exploration results just keep getting better.

All the latest from,

Share price: 0.3 cents

Market capitalisation: $14.7 million

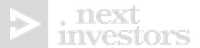

Here’s why I like Classic Minerals:

Klaus Eckhof joins CLZ

Effective immediately, Classic Minerals (ASX:CLZ) has appointed Klaus Eckhof as a corporate and technical advisor.

Classic shareholders and Eckhof both have reason for optimism here. Assuming all goes to plan, the share price should hit the performance rights target prices as drilling advances at Classic’s Forrestania Gold Project.

Keep in mind that Forrestania already holds 5.36 million tonnes of known gold, grading 1.39g/t, for nearly 241,000 ounces

Classic Chairman John Lester said he was “delighted that Klaus has accepted to join Classic Minerals as a trusted and capable advisor who brings a new and exciting vision to the Board and Management of Classic as Dean [Goodwin] progresses with extensional drilling at Kat Gap.

“We are privileged that Klaus with his integrity, dynamism and international network has agreed to guide, direct and enhance the vision of Classic Minerals Limited.”

Classic has agreed to issue performance rights to Mr Eckhof in lieu of any cash-based remuneration as follows:

- Tranche 1: 50 million performance rights which will vest and convert into Shares if the company's shares trade at a volume weighted average price (VWAP) of at least $0.004 for a consecutive period of at least 15 business days.

- Tranche 2: 50 million performance rights which will vest and convert into shares if the company's shares trade at a VWAP of at least $0.006 for a consecutive period of at least 15 business days.

- Tranche 3: 50 million performance rights which will vest and convert into shares if the company's shares trade at a VWAP of at least $0.008 for a consecutive period of at least 15 business days.

These performance rights will expire on 31 December 2020 and each tranche issued after the company’s placement capacity is refreshed, which is expected to occur at the AGM in November 2019.

You can read more on Eckhof’s appointment in this Finfeed article:

Yahoo! Finance also covered the news:

Given the impressive recent run in the gold price, particularly in Aussie dollars terms, it’s not surprising to see promising junior explorers attract major attention. Gold’s performance has been nothing short of impressive this year, especially when AUD weakness is factored in. The precious metal recently hit record highs of A$2,290 and is now buying A$2,188.

Forrestania Gold Project

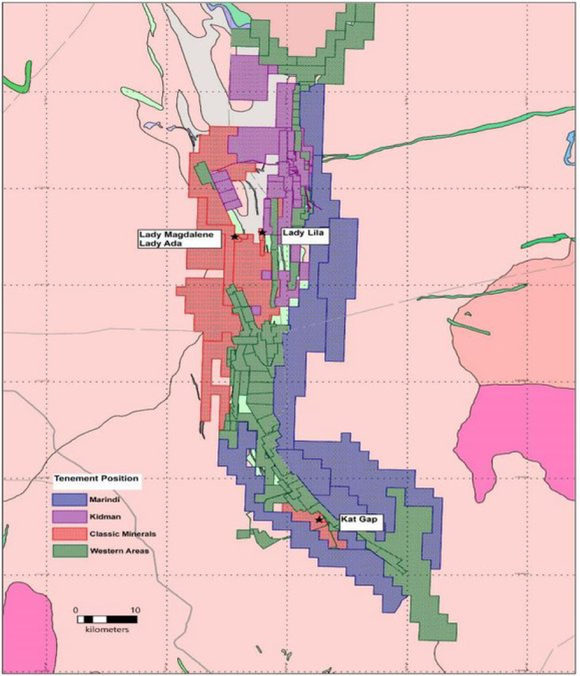

Classic Minerals’ Forrestania Gold Project (FGP) contains the Lady Magdalene, Lady Ada, and Lady Lila gold resources, plus the Kat Gap Project.

Classic added Kat Gap to the Forrestania Project when it purchased 100% of its tenements in January this year from Sulphide Resources Pty Ltd for $250,000, plus a 2% net smelter royalty (NSR) fee.

The company has an 80% interest in the gold rights of the Forrestania Project (excluding Lady Lila and Kat Gap, of which it holds 100%). CLZ also owns a 100% interest in the non-gold rights on the Kat Gap and Lady Lila tenements, including nickel, lithium and other metals.

The Forrestania Gold Project contains a Mineral Resource of 5.3 million tonnes at 1.4 g/t for 240,000 ounces of gold, with a Scoping Study indicating both the technical and financial viability of the project.

Kat Gap

The Kat Gap Gold Project (exploration licences E74/422 and E74/467) covers 37.5km2, over a 10km section of the western granite/greenstone contact at the southern end of the Forrestania Greenstone Belt.

Kat Gap is just 70 kilometres from Forrestania and it adjoins the Forrestania Nickel Project, operated by Western Areas (ASX: WSA). Kat Gap and Classic’s other tenements at FGP — Lady Magdalene, Lady Ada, and Lady Lila — are marked in red below:

In early September, Classic released extremely impressive exploration results from its Kat Gap Project.

These drilling results, doubled the strike length to 400 metres — with significant gold mineralisation intersected. The results included 9 metres at 21 g/t gold from 123 metres, including one metre grading 125 g/t gold.

One of the widest intersections to date — in what must be remembered is an early stage exploration program — was 13 metres grading 4.9 g/t gold from 33 metres including one metre grading 22 g/t gold, also close to surface.

The open-ended deposit lies within a five kilometre long geochemical gold anomaly that has seen very little drill testing, and management sees the potential for the discovery of a substantial gold deposit within the project area.

As Finfeed.com said of those results, “the continued strong results highlighted today suggest that Classic could be one of the best emerging sub-$10 million market cap plays based on the value of its assets, management’s astute exploration strategy and the quality of the ore in ground that has already been established.’’

Classic is still gaining an understanding of the geology, and it is rare to find projects that consistently produce such stunning grades so early in their life. Yet still, and particularly given the value to be attributed to Classic’s other assets, the company’s market capitalisation of $8 million indicates there is scope for substantial upside.

A final word

At Kat Gap, Classic see strong potential for additional mineralisation to be identified up-dip, down-dip and along strike, both outside of and within the existing RC drill coverage.

The next stages of exploration will be to extend the known gold mineralised zone further north and south from the current drilling area.

At Kat Gap, Classic will extend the known gold mineralised zone further north and south from the current drilling area. This would entail testing the northerly extensions for another 300m and the southerly extensions for 300m. If successful, this will give a combined strike length of one kilometre.

Classic will also probe at depth down dip along the entire 400 metres of gold mineralised granite-Greenstone contact delineated to date. The plan is for several deep orientated diamond holes, designed to collect valuable structural data, to probe the system to 300m vertical below surface.

The impressive drill results reported by CLZ at Kat Gap so far, combined with the company’s ongoing aggressive exploration program at the project, and now the addition of Klaus Eckhof, — all backed by a strong gold price — suggests further positive newsflow is likely to continue rolling in as the exploration program proceeds.

From here, the next step is to drill deeper holes and follow the system down to get a better idea of size of the prize. Classic has plans for follow up RC and diamond holes with drilling scheduled for mid-October.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.