KZR Acquires Highly Prospective Pilbara Gold Assets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having acquired a number of copper assets earlier this year, Kalamazoo Resources (ASX:KZR) has now added a further three gold projects in the Pilbara region to its asset portfolio.

The Pilbara is currently in the midst of a gold rush after a considerable number of gold nugget discoveries.

Artemis Resources (ASX:ARV) and Canada’s Novo Resources joint venture in the West Pilbara, and De Grey Mining (ASX:DEG) have each discovered gold nuggets in a similar geological environment to KZR’s newly acquired project area.

This Pilbara gold resurgence, plus the recent exploration success in the region have convinced KZR to undertake robust systematic gold exploration.

In addition to these new projects, KZR continues exploration work at its flagship Snake Well gold and base metals project.

When taken in aggregate, KZR is growing its metals footprint and building up to a fully-fledged mining operation throughout WA.

At the same time, this company is still an early stage gold play and therefore investors considering the company for their portfolio, should seek professional financial advice.

KZR look to be in the right place, at just the right time.

Catching up with:

Having only embarked on gold exploration this year, Kalamazoo Resources (ASX:KZR) is gaining momentum. In addition to its newly acquired Pilbara projects, it continues to progress its other WA gold assets, including its flagship Snake Well Project, while technical work is underway at the Cork Tree Project.

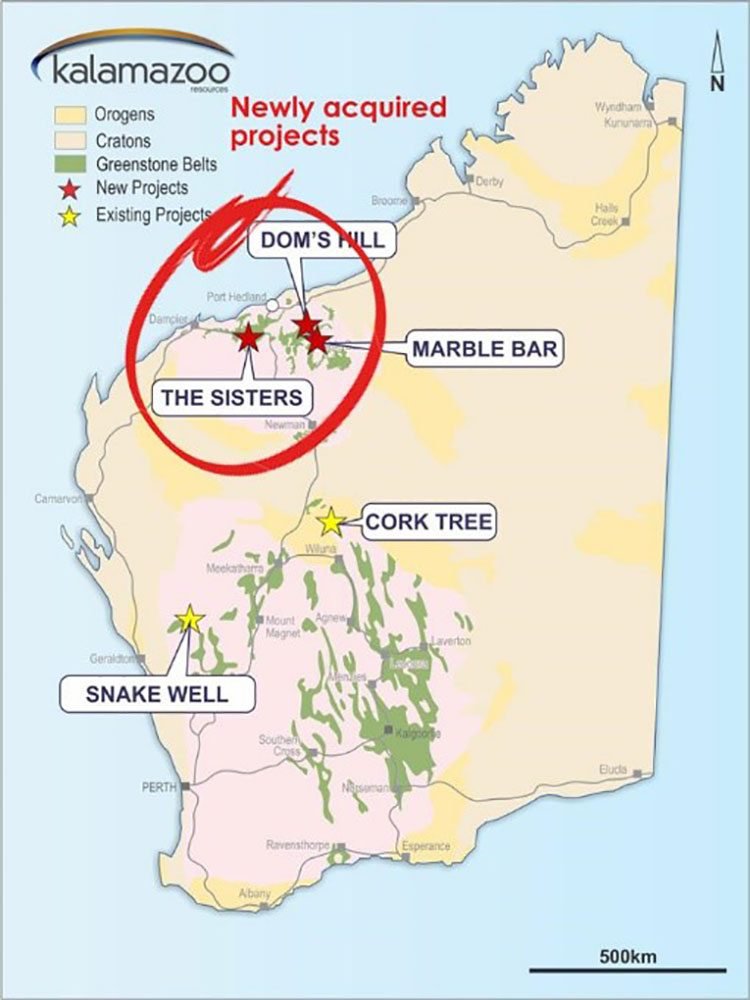

KZR plans to undertake exploration activities immediately at the three gold projects it bagged in WA’s Pilbara region. It has an option to acquire between 80% and 100% equity in the Pilbara’s DOM’s Hill Gold, Sisters and Marble Bar gold projects, covering some 252 square kilometres.

The company has acquired 90-day options across each of the three projects for the payment of $125,000 and the issue of shares in KZR to the value of $200,000.

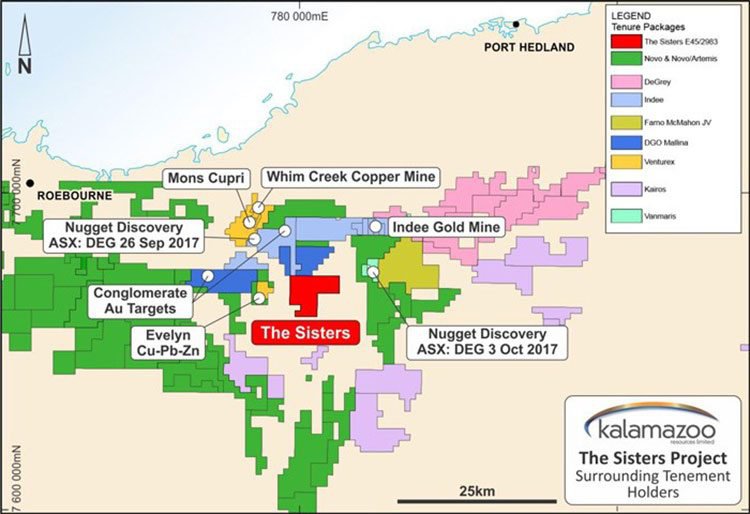

KZR’s newly-acquired projects are circled in red on the map below:

The DOM’s Hill gold project is 110 kilometres south-east of Port Hedland, in an actively explored area that’s prospective for gold. The project comprises one granted exploration licence and two exploration licence applications, covering 68 square kilometres.

The Marble Bar gold project is a granted 48 square kilometre tenement, located 11 kilometres north of the Klondyke gold project. It comprises a 12 kilometre strike of the prospective Archaean Warrawoona Formation. This project also has potential for containing basal sedimentary units of the Fortescue Formation.

The Sisters Project is in one of the Pilbara’s most actively explored areas, amongst eight other development projects. Recent nearby exploration has discovered significant shear hosted and conglomerate hosted gold mineralisation. It is adjacent to De Grey’s Pilbara gold project and is within 30 kilometres of De Grey’s proposed new purpose built processing plant.

You can see The Sisters Project sandwiched between half a dozen other projects below:

Impressive nearology

Each of the projects is close to other significant gold discoveries, owned by Novo Resources (TSX.V:NVO) and Artemis (ASX:ARV), De Grey Mining (ASX:DEG), Venturex Resources (ASX:VXR), Impact Minerals (ASX:IPT), DGO Gold (ASX:DGO,) and Calidus (ASX:CAI).

Being located amongst successful existing projects is an encouraging sign, and increases the likelihood of success for KZR in its hunt for grade and quantity. All these gold-focused companies are in WA for one thing and one thing only: extracting high-grade gold from very shallow deposits with expected cash-flow right off the bat.

Although be mindful of the fact that KZR remains a small-cap resources company that may not achieve its prescribed targets. Invest with caution.

KZR has immediately moved to commence gold exploration activities to determine the potential of advancing Dom’s Hill, Marble Bar and the Sisters project.

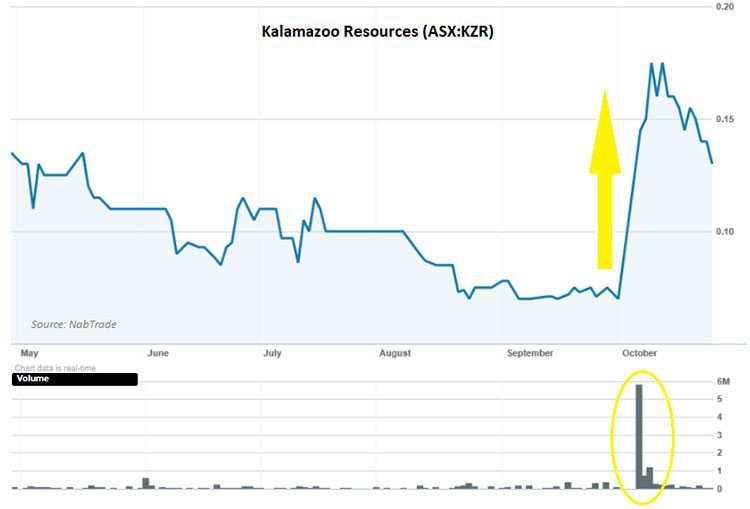

Investors were impressed by the news, evidenced by KZR’s share price more than doubling — up 121% to $0.155 with four million shares changing hands — immediately following news of its new gold exploration projects.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Such a rapid share price rise in response to the announcement confirms management’s decision to pick up Pilbara gold exploration projects.

Several other explorers have been exploring projects in the region, including juniors with whom KZR is most comparable.

Shares in WA-based De Grey Mining soared 150% after it revealed a gold discovery at its Pilbara project.

Just a month ago, shares in De Grey Mining (ASX:DEG) more than doubled on the day that it announced the discovery of gold nuggets at its Pilbara project and it is up almost 500% over the past three month.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This followed a Next Small Cap article in April, in which we highlighted the gold potential of DEG: ‘ DEG Hits 1 Million Ounce Gold Milestone: Drilling Imminent ’.

Kairos Minerals (ASX:KAI) was another explorer that’s seen its shares soar since we last wrote about it and it shifted its focus to Pilbara gold. We alerted you to KAI back in July in our article on the company ... right before it staged a 283% rally over the three months to date.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Copper Exploration

With its assets now assembled, KZR is jumping feet-first into exploration targeting both gold and copper at no less than four different sites across WA.

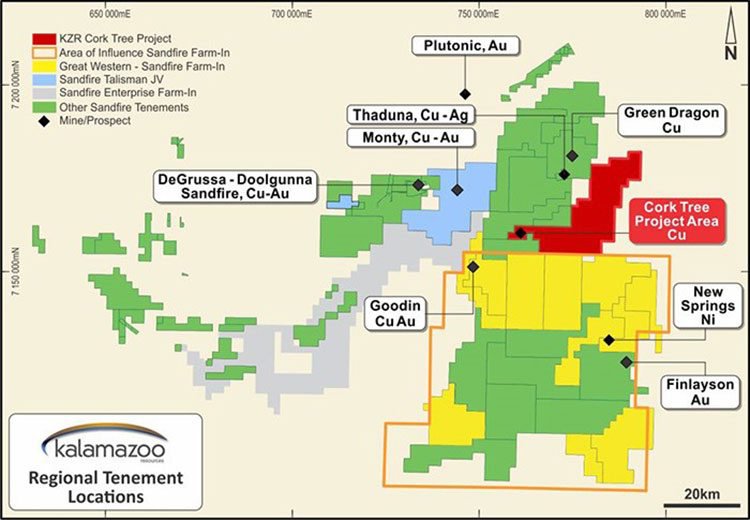

In July, KZR commenced its copper exploration programme at its Cork Tree Project, located in WA’s highly prospective Doolgunna region, where again it is strategically placed in close proximity to more successful neighbours

The Cork Tree project is located close to existing major deposits including the DeGrussa Copper Mine, the Thaduna Copper deposit, Horseshoe Lights Copper-Gold mine and the Enigma Copper prospect.

You can see the Cork Tree Project highlighted in red below, alongside these major deposits.

KZR’s tenements are less than 20 kilometres from the Thaduna Mine — a copper mine discovered in 1941 that has since produced a total of 30,290t at 8.7% copper.

Thaduna is also believed to have stockpiles of 48,400t at 2.74% copper and tailings of 20,500t at 2.5% copper. As you can see, the area is highly conducive for long-term, high grade copper production.

KZR’s exploration programme at Cork Tree covers an area over 40 kilometres of strike, and involves infill lag geochemistry, reprocessing and remodelling of historical geophysical data, including gravity, magnetics and electromagnetics (EM), geological mapping and rock chip sampling.

Further details can be found in the company announcement:

A review of the data from the exploration programme should lead to a better understanding of the regional geology so that exploration can be directed to specific target areas for follow up exploration.

If KZR reports high grade rock-chip samples and assays, the stock could gain significant investor interest. And if it can define a Resource at Cork Tree, KZR could have several decades of productive real-estate.

With KZR busy in WA, let’s take a look at the broader market conditions

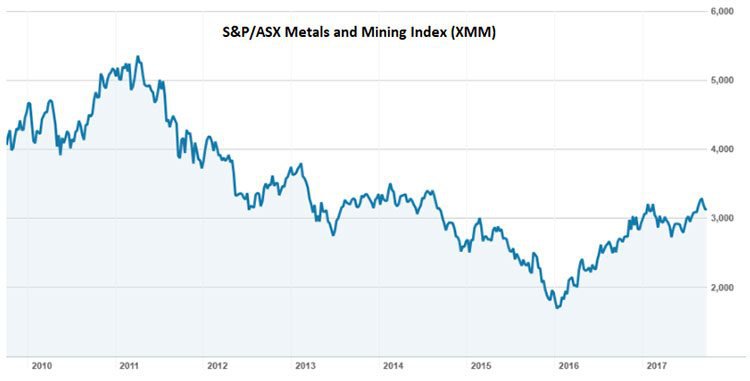

The last five years have been turbulent for resource investors. The S&P/ASX 300 Metals and Mining Index fell steadily from a peak in 2011 until early 2016, since when it began to stage a recovery that remains underway.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Precious metals such as gold and silver, as well as their base metal cousins such as zinc, nickel and copper have been volatile, suffering from a slowdown in Chinese economic growth.

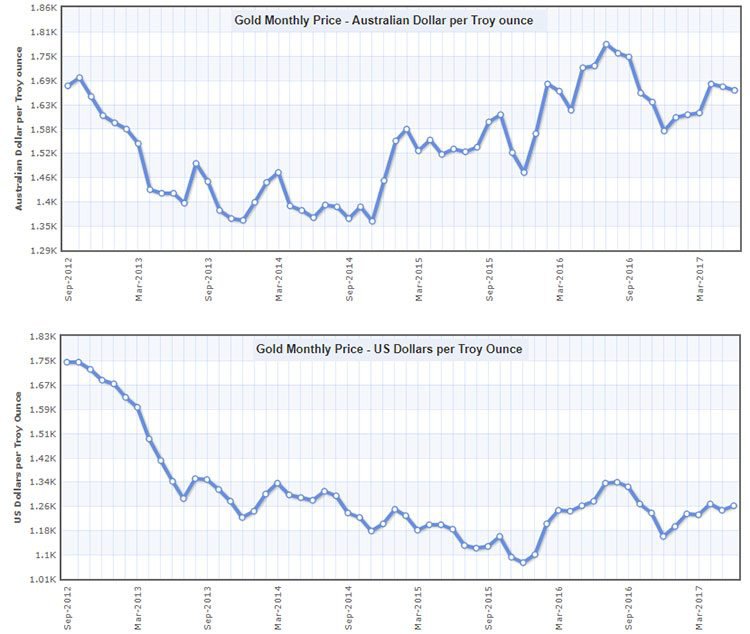

However, the weakening of the Australian dollar (vs the USD) since its 2011 highs has gone a long way to support prices received for commodities in Aussie dollars. Here is the five year gold price chart, first in US dollars, then in Australian dollars:

It should be noted that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

Gold priced in Australian dollars close to its all-time high of A$1780. Conversely, gold priced in US dollars reached a peak of US$2600/oz in 2012, and has been lacklustre since.

The broad-based recovery in metals markets, including gold and silver, has presented Australian-based gold explorers, such as KZR, with excellent opportunities to pick-up quality gold projects at the low end of the gold cycle, and develop them into profitable mining operations.

Riding the coattails of the gold recovery

The future is coming into view for $8 million-capped KZR. Its portfolio of projects is assembled and exploration has assertively kicked-off.

While it’s still early days and KZR is still to prove up exactly what it has in the ground, the prospect of first revenues is now in sight.

KZR’s newly-acquired tenements contain extensive gold in soil anomalies and numerous historical significant gold drill intercepts. In addition, recent prospecting has recovered an estimated 300oz of gold nuggets from poorly explored areas. This could just be the start of steady gold flow for KZR.

KZR has plentiful funding available, courtesy of Chinese behemoth Minjar Gold, a company that is spending big around the globe in order to advance its own market position. Support from Minjar’s is likely to bring many tangible benefits to KZR including quicker development time, guaranteed sales and possibly an out-and-out sale of its WA projects should the need arise.

Minjar has also agreed to an Ore Purchase agreement for all of KZR’s gold/copper production, conditional on various feasibility milestones.

As we wait and see how KZR’s evolution progresses, the improving gold price provides helpful tailwinds for all gold explorers. For teeny upstarts like KZR, the relative value could potentially be even higher, given its lower starting position.

The growing multitude of Pilbara gold explorers suggests that gold is back in vogue, for both producers, processors and explorers.

KZR is doing what many other aspirational gold explorers can only dream of: developing known high-grade metals projects in the heart of a historically abundant region.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.