KNI commences EM surveys - will they find EM conductors? Find out next month...

Vulcan Energy spin out Kuniko (ASX:KNI) holds a portfolio of battery metals exploration assets (copper, nickel, and cobalt) across three project areas in Norway.

Battery metals are in the spotlight at the moment as the world switches to electric vehicles and clean energy.

KNI has been trading on the ASX now for just over three weeks after its heavily oversubscribed 20¢ IPO and it has certainly grabbed the market’s attention.

We participated in the IPO and expected it to open strong, but we certainly didn’t think it would be trading where it is today, well over 10x above the IPO price.

Well done to anyone who got shares in the IPO or took a position on day 1 and day 2 of trading when it was still less than $1.

Since listing, KNI has been busy progressing its exploration plans, applying modern exploration methods to its historical battery metals projects in Norway. It has today provided an update on that exploration.

KNI reports that since completing a soil and rock chip sampling program in August, it has commenced a significant program of airborne geophysics, comprising magnetics, electromagnetics (EM), and radiometric components, across three project areas.

WHAT NEXT: In our opinion, a huge result for KNI would be if the current EM surveys on any of their 3 projects reveal large EM conductors BELOW OR NEARBY any historically mined areas. We expect EM survey results in about a month.

Remember: early stage exploration is risky and the EM surveys may return nothing.

Also we have dug up some old data about KNI’s cobalt exploration project from the company that ALMOST ran modern exploration techniques on it back in 2017... more on this below.

We have been waiting for the KNI share price to find a stable range before we release our deep dive analysis. We thought that would happen a few days after the IPO but it’s been a wild ride after opening at 80¢, to rise as high as $3.60, and dropping back to $1.65.

The share price appears to want to form a base at around $2.40 over the last few days on fairly low volume, but we will wait until it settles to provide our in depth analysis on why we invested in KNI. We have been waiting for the traders to finish trading and the share price to stop fluctuating so wildly first. We hope to release it in the coming weeks.

Since we launched KNI into our portfolio, the company has released an exploration update, announced the appointment of a Norwegian-based CEO, and today has provided an update on its exploration progress.

REMINDER: KNI’s Zero Carbon Nickel, Copper and Cobalt projects in Norway - historically producing mines

Skuterud - The Skuterud tenements are in a part of Norway known for its historically important Co, Cu and Ni production — a mining district that was previously the largest cobalt mining area in the world. Mining occurred from 1773 to 1898, with total estimated production of 1 million tons with 0.1–0.3% cobalt, up to 2.0% copper, and gold of up to several parts per million locally.

Feøy – The Southwest Norway tenements, the Feøy Project, encompass a 71km2 area across most of the Feøy islands group and the northern part of Karmøy Island. This part of Norway is known for its historically important copper and nickel production.

Copper projects – KNI’s copper projects (Vangrøfta, Undal, and Nyberget) have a long history of production. Sampling by KNI at Vangrøfta yielded up to 16.75% copper, 3.33g/t gold and anomalous concentrations of cobalt from waste dumps.

Exploration progress: What has been achieved, what’s next?

An initial program of soil and rock sampling at the Skuterud Cobalt Project was finalised at the end of August, with KNI’s field operations team collected a total of 714 soil samples and obtained structural measurements where quality outcrops were encountered. Initial laboratory results are expected to be received soon.

Cheaper than drilling, soil and rock chip sampling can be used to quickly establish the existence and extent of mineralisation near the surface, by collecting surface samples in a structured grid pattern across the site, which will help with the process of firming up drilling targets once EM survey results are known next month.

At the Vangrøfta Copper Project, a geochemical sampling program commenced at the end of August. As of 10 September, 488 soil samples had been collected with lab results expected in October.

KNI then commenced a significant program of airborne geophysics in September to provide coverage of the Skuterud, Vangrøfta and Undal Project areas, comprising magnetics, electromagnetics (EM), and radiometric components.

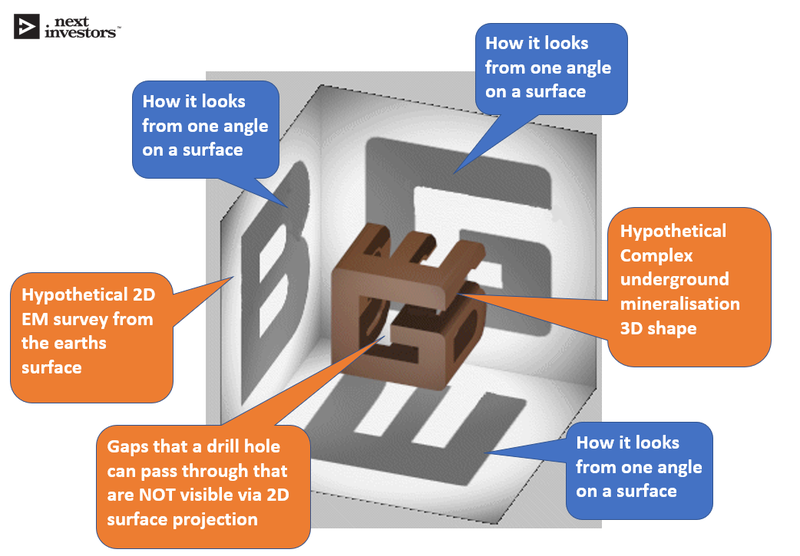

EM surveys involve sending an electrical current into the earth to detect conductive materials - it's a modern exploration technique that will hopefully return some deep underground EM conductors (colourful blobs) that will provide some juicy EM targets to drill.

KNI’s copper, nickel and cobalt projects were historically producing mines, and have not had modern exploration techniques applied to see if there is anything deeper than was originally mined. These modern EM survey techniques could return literally ANYTHING... including awesome EM targets OR a big fat NOTHING. Remember, early stage exploration is risky, even under historically producing mines.

Here you can see a video of KNI running electromagnetic waves into the ground (from a helicopter) hoping to find high conductive areas that are likely to host mineralisation (EM conductors):

Modern exploration techniques will show KNI if there are any EM anomalies underground.

We know that KNI’s projects have a history of production over one hundred years ago, so we can only imagine what might be revealed deeper underground using modern exploration techniques like EM surveys.

Here is our “artists impression” of how EM surveys (combined with down hole EM surveys after drilling has started) can begin to build a 3D picture of an ore body that MIGHT be underground... deeper OR nearby to the existing mineralization that was mined out using centuries old mining techniques:

Extending historically mined projects when commodity prices are high

There is a saying in mining circles that once a commodity price surges“the fastest way to develop a new mine is to start with an old mine”.

We know that KNI’s historical mines had economic mineralisation, so there is a good chance there could still be more nearby or deeper underground... if the commodity is surging in price then restarting historical mines becomes interesting.

KNI is looking to apply modern exploration techniques to historically producing ground for highly in demand battery metal Copper, Nickel and Cobalt - a demand we think will last for years to come.

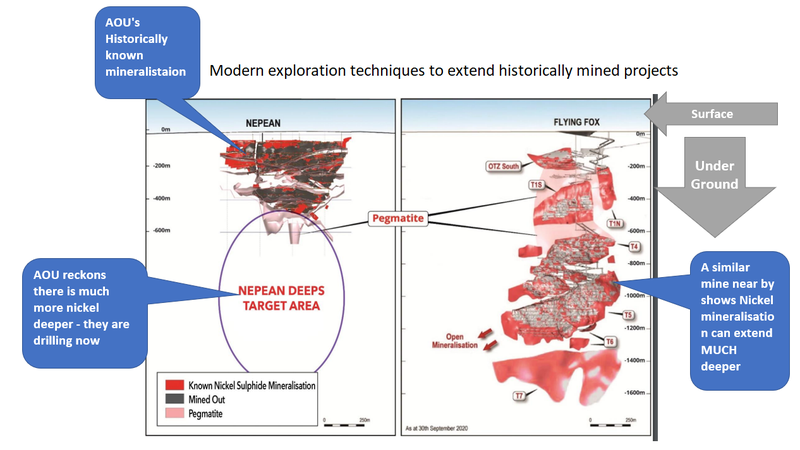

Here is an example of applying modern exploration techniques to a historically producing mine from one of our other investments (in our Wise-Owl portfolio) Auroch Minerals (ASX:AOU).

Similar to KNI, Auroch acquired a historically producing nickel mine in WA (when nickel prices were down) that used to sell nickel to BHP decades ago, but was shut down when the nickel price was weak for many years so it was a cheap acquisition for Auroch.

Now that the nickel price has surged on the back of its use in electric vehicle batteries, Auroch is applying modern exploration techniques to test if there is more Nickel deeper under what was already mined.

Here is a comparison of Auroch’s historical nickel mine (mined to a depth of 600M) compared to a nearby nickel mine with much deeper mineralisation extension to 1,600m. Modern exploration techniques are being applied and drilling is underway by Auroch now to see if it’s Nepean orebody continues deeper similar to what is seen at the flying fox mine:

The above is just an example to illustrate the kind of picture we hope to see at KNI’s projects — mineralisation extending from historically mined areas. As far as we know KNI has almost zero modern data on what lies beneath their projects.

KNI’s projects each had historical production, and now that modern exploration techniques are being applied we are very interested to see what they will reveal.

Exploration prep is a long process and it is hard to predict what the initial EM surveys and geophysical surveys will reveal. So it should be an interesting 2 months for KNI as we wait to see if any big colorful EM targets are revealed (or nothing).

What would be a huge result for KNI: if the EM surveys reveal large EM conductors BELOW OR NEARBY historically mined areas.

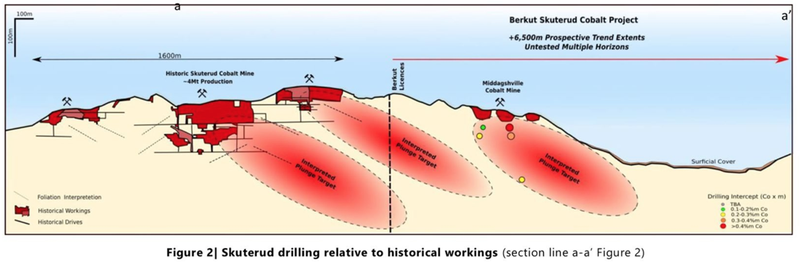

We dug up some historical data from the company that previously owned KNI’s Skuterud cobalt project. This company was called “Berkut Minerals” and it planned to apply modern exploration techniques to this cobalt project back when the cobalt price went nuts in 2017.

Berkut got close but never commenced the process as the cobalt price came crashing back down (false start in the electric vehicle battery theme... 5 years too early). But here is a snapshot from the Berkut presentation.

The best data we could dig up mapping out the historical workings on the Skuterud cobalt project was from this old Berkut announcement from early 2018 after they tried to pop a couple of exploratory core holes into known mineralization areas (prior to EM surveying).

The dark red shows the historical mining, and the faded red show interpreted extension of the mineralisation... unfortunately for Berkut the cobalt price tanked shortly after this announcement and work stopped before modern exploration techniques could be applied:

With the Cobalt price back on the up and looking to be stronger for longer, KNI’s helicopter team is currently flying EM surveys across these oval areas, and what we are really hoping for is some EM conductors to be found within those red oval shapes.

What is next after EM surveys?

After the EM surveys have been completed, hopefully we get back some big EM conductors. KNI’s geologists will then interpret the data and identify high priority drill targets to drill.

Then the exciting part - drilling to see what is underground.

What’s happening with the KNI share price?

KNI has had an immense run since it opened at around 80¢ three weeks ago. We think KNI’s share price action since listing is due to a combination of a few things:

- Tiny amount of KNI shares on issue: There are only ~53M KNI shares on issue, and VUL holds over a quarter of them. This, combined with other sticky holders, means there aren't as many shares to go around to anyone who wants to build a long term position.

- Long term investors and VUL holders/followers who missed out on the IPO or didn't get a big enough IPO allocation are trying to build a long term position in KNI by buying up shares on market and holding on to them, further reducing the KNI free float.

- Day traders rapidly buying and selling caught hold of KNI, amplifying the share price swings when combined with long term investors buying and holding their positions.

- KNI’s direct association to VUL’s rise: There is little doubt that VUL is the market darling of the last 2 years — now worth $1.7BN and about to enter the ASX 300 Index, so there was already going to be a huge amount of positive attention on KNI and its tiny 53M shares on issue.

REMINDER: 12 reasons we invested in KNI

(Deeper dive coming soon)

- "The next Vulcan": Vulcan has been hugely successful on the back of its Zero Carbon Lithium story. KNI has the same team as behind Vulcan, with VUL remaining 25.85% shareholders in KNI. The KNI narrative has powerful tailwinds.

- Our top investment thematic: Ethical, sustainable locally sourced battery metals in Europe is our top long term investment theme. As the world works towards zero carbon emissions, new investment opportunities like KNI are emerging.

- Zero Carbon copper, nickel and cobalt: Investment exposure to 3 key battery metals in one company. Like lithium for Vulcan, battery metals projects such as these are attracting increasing investment in the region, especially if they are sustainable and environmentally friendly. We will cover each KNI project in detail and how they will be Zero Carbon.

- Located in mineral-rich Norway: The projects are in close proximity to European vehicle makers that are seeking Zero Carbon EV and Li-ion battery ingredients. As Norway’s electricity supply is almost 100% renewable, these projects have potential to be carbon neutral.

- Historically producing projects: These are not greenfields projects. We know the mineralisation is there as they come with extensive mining histories that are still to be analysed with modern technology.

- Impressive management team and board: The KNI team’s experience and connections (including the same Chairman as Vulcan) are too great to be summarised here, but will be covered in our follow up deep dive.

- Platform to expand land holdings and projects: Management is open to acquiring further projects that could bring a huge uplift in KNI. KNI’s network would support this as would its team as good people attract good projects.

- Busy work program is now underway leading up to the Norwegian winter across its three project areas.

- Leverage off the global networks built by Vulcan: Having spun off from Vulcan, the KNI team has the established relationships and access to potential offtakers, major investors, bankers, technology, and advisors.

- Cap structure leveraged to growth: Low number of shares on issue (39 million free float), with VUL retaining one-quarter, means that the capital structure is leveraged to success. There are no options on issue to dilute shareholders positions.

- Aiming to be best in class ESG: We expect KNI to continuously disclose its Environment, Social and Governance to investors and stakeholders, to attract large ESG funds in the future.

- Scandinavia is mineral rich and highly supportive of clean energy projects and positioned to support Europe’s desire to have an autonomous and carbon neutral economy.

Kuniko Company Milestones

✅ ASX Listing

✅ $7.8M IPO Raise @20¢ per share

✅ Portfolio Initiation

i️ KNI Share Price Run

🔲 Key Board Appointment

✅ Norwegian Based CEO Appointed (Antony Beckmand)

🔲 Key Consultant Appointment

🔲 Existing Project Landholding Expanded 1

🔲 Existing Project Landholding Expanded 2

🔲 New Project Acquired 1

🔲 New Project Acquired 2

🔲 Zero Carbon Studies

🔲 ESG Disclosure and Progression

🔲 Unexpected Positive Announcement 1

🔲 Unexpected Positive Announcement 2

🔲 Funding at Higher Share Price 1

🔲 Funding at Higher Share Price 2

🔲 Unexpected Positive Announcement 3

🔲 Favourable European Regulations

Skuterud Project - Cobalt

✅ Field Studies - Geochemical Sampling

🔲 Assay Results (Geochemical Sampling)

🔄 Geophysical Program

🔲 Drill Targets Identified

🔲 New Milestones Added

Feøy Project - Ni-Cu-PGE

🔄 Field studies - mapping/sampling

🔲 Geophysical Program

🔲 Geochemical Surveys

🔲 Drill Targets Identified

🔲 New Milestones Added

Copper Projects

Romsas, Undal and Vangrøfta

✅ Field studies - mapping/sampling (Vangrøfta)

🔄 Geophysical Program (Vangrøfta, Undal)

🔲 Geochemical Surveys

🔲 Drill Targets Identified

🔲 New Milestones Added

Our Investment Strategy

✅ Initial Investment: @20¢ (Majority Escrowed for 2 Years)

🔲 Increase Position

🔲 Increase Position

✅ Price increases 500% from initial entry

✅ Price increases 1000% from initial entry

🔲 Price increase 2000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.