Kingston’s WA Gold Exploration Play Delivers More High Grade Intersections

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Between March and July, shares in Kingston Resources Limited (ASX: KSN) increased four-fold, largely driven by the exceptional news being delivered in relation to its 3.2 million ounce Misima Gold Project in Papua New Guinea.

However, Misima is only half of the story.

Kingston announced a 5000 metre reverse circulation drilling program had begun at its 75% owned Livingstone Gold Project on 15 July and the stock has since moved an additional 38% higher.

When upcoming drilling at Livingston was first announced in June, it highlighted how the project could have an impact of its own.

Historical mining at Livingstone, located 140 kilometres north-west of Meekatharra in the Bryah Basin of Western Australia, has previously demonstrated excellent mineralisation.

Today, that was proven further as Kingston announced high-grade drilling results confirming the potential of this WA gold project.

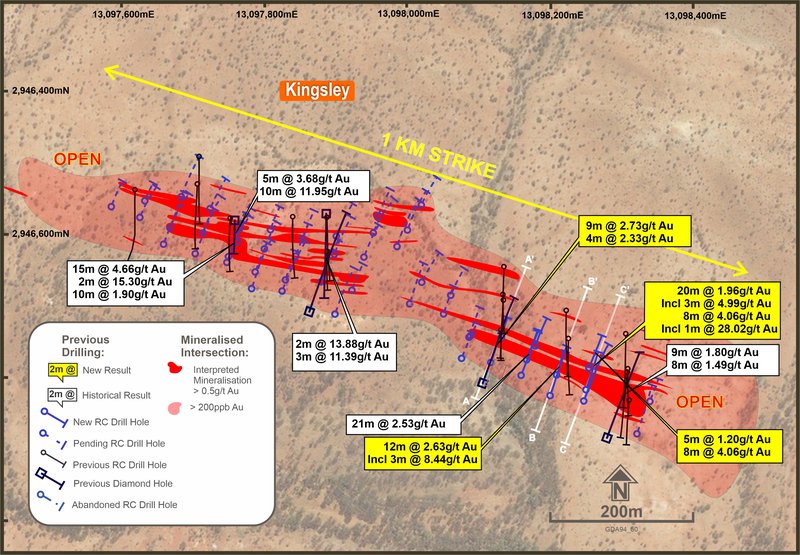

The company reported initial hits of up to 28.02g/t gold at the Kingsley Prospect at Livingstone from the first 11 holes (954m) of a 54-hole (4,525m) drilling program.

Importantly for KSN and its shareholders, only 800m of this initial discovery has been meaningfully drilled – with the mineralisation currently remaining open to the north-west and east, where a 1.2km strike length of known mineralisation is yet to be fully tested.

This points to a large amount of newsflow to come as Kingston makes its way through these targets.

The final results from the current program will be incorporated with results from prior RC drilling, diamond drilling and structural work completed in 2019.

It is intended this data will underpin a maiden JORC compliant Mineral Resource Estimate (MRE) for the Kingsley Prospect.

Notably, this RC drilling program is ideally timed with the Australian dollar gold price hovering in the vicinity of $2700 per ounce.

With that in mind, let's catch up with...

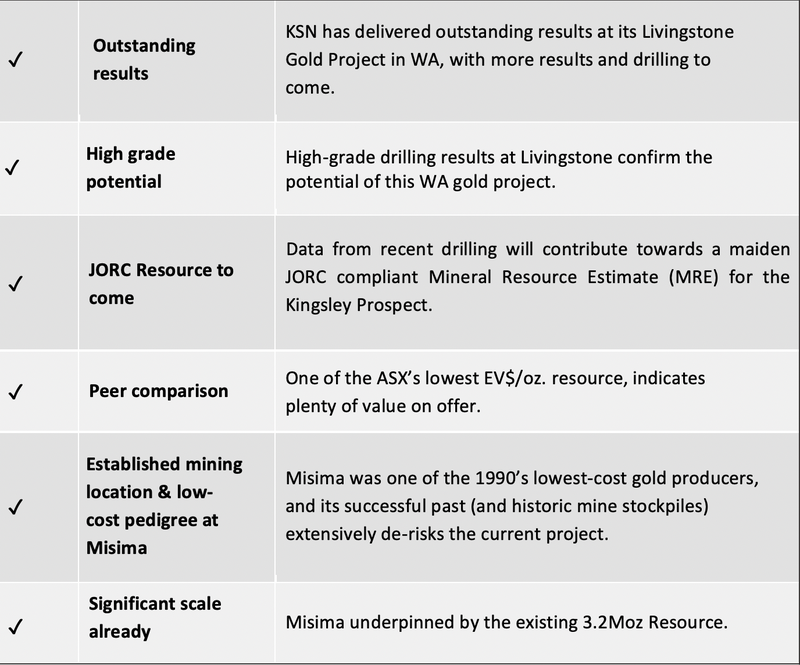

Here is why we like Kingston Resources ...

Company: Kingston Resources (ASX:KSN)

Share Price: 29.5¢

Market capitalisation: $65.71 million

Cash position: $6.5 million (at 30 June)

Drilling down to the details

In the following video, KSN MD Andrew Corbett explains the company’s optimism towards its Livingstone and Misima projects.

There is certainly a lot to look forward to as the cashed-up company ramps up operations at these projects.

It is Livingstone, however, that has our immediate attention.

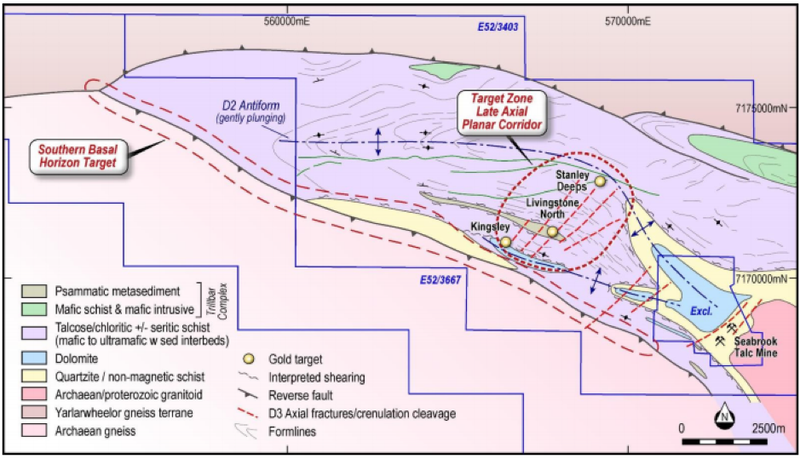

The drilling program at Livingstone was designed using knowledge gained from the structural geological review conducted over the wider Livingstone Project, including Kingsley, in late 2019.

The aim of the program is to define shallow oxide mineralisation that will contribute towards an initial JORC compliant Mineral Resource Estimate for the Kingsley Prospect.

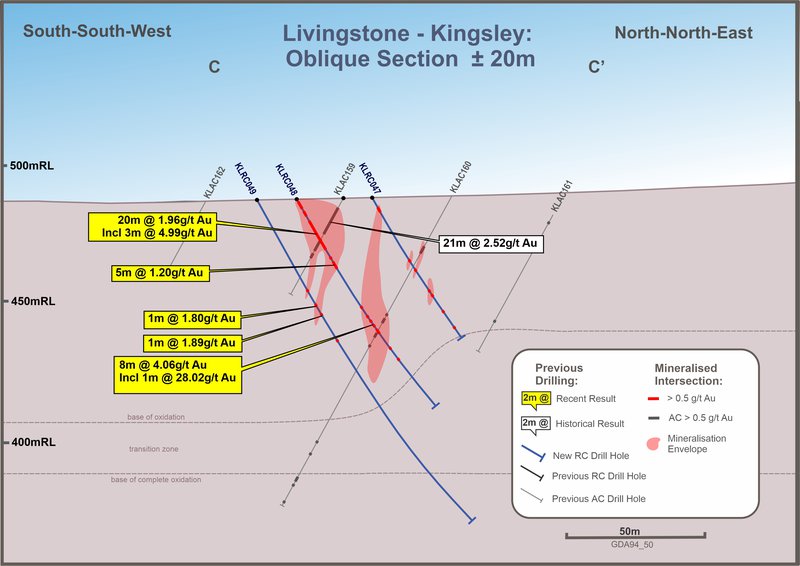

Several holes were also designed to further test potential depth extensions to the known mineralisation.

Kingston completed the Reverse Circulation drilling program at Kingsley in July, comprising 54 holes for 4,525m of drilling in 17 lines spaced at ~20m.

Key highlights from the recently completed program include:

- KLRC040: 9m @ 2.73 g/t Au from 67m, including 1m @ 15.84 g/t Au from 67m

- KLRC048: 20m @ 1.96 g/t Au from 1m, including 3m @ 4.99 g/t Au from 17m; and 8m @ 4.06 g/t Au from 49, including 1m @ 28.02 g/t from 55m

- KLRC046: 12m @ 2.63 g/t Au from 84m, including 3m @ 8.44 g/t Au & 90m

- KLRC042: 4m* @ 2.81g/t from 12m (*4m composite sample)

These initial results support the current geological model, with gold mineralisation related to a set of late quartz-carbonate-sericite-pyrite veinlets that have reactivated older steeply dipping abundant deformed quartz veins that strike at ~1100, within a mafic to ultramafic schist or “talcose” schist.

Corbett, said of the results, “Our 2020 exploration program at Livingstone is off to a flying start, with the first batch of assays from the recently completed RC program returning some outstanding high-grade intercepts, in several cases within broader widths of significant mineralisation. I am looking forward to receiving further results in the coming weeks.

“We are also looking forward to getting back into drilling at Livingstone in relatively short order to complete the co-funded drilling at the Stanley target and to undertake some further drilling at the Homestead Deposit, which hosts an historic shallow 49,900oz Au (JORC 2004) Resource, as well as at the high-grade Winja prospect, which is where Kingston first drilled at Livingstone after acquiring the project in 2017.”

On the subject of Stanley and Homestead, the former will see drilling undertaken in September after operations were suspended due to difficulties with ground conditions and a ~1,000m RC program will follow immediately after that at the latter.

Kingston’s 2017 RC drilling program at Homestead reported KLAC005: 7m @ 12.49 g/t Au from 35m, including 4m @ 19.56 g/t Au from 35m with mineralisation remaining open along strike to the east.

Prior results at Winja included KLRC014: 18m @ 3.03 g/t Au from 55m, including 7m @ 5.15 g/t Au from 49m in a chute like structure of high-grade mineralisation.

Suffice to say, there is a great deal to look forward to with regard to Livingstone in the back straight of 2020.

The exploration program at Livingstone is running concurrently with ongoing mining studies at Kingston’s flagship 3.2Moz Misima Gold Project in Papua New Guinea, where PFS work continues to make strong progress.

Misima continues on its merry way

Kingston should benefit from numerous share price catalysts over the next three months with one of the main ones being progress on the PFS for the Misima Gold Project .

This work has already commenced and is now in full swing, with the appointment of a dedicated Study Manager in early June, together with the appointment of mining, geotechnical, metallurgical and environmental consultants.

Analyst sees positive outlook

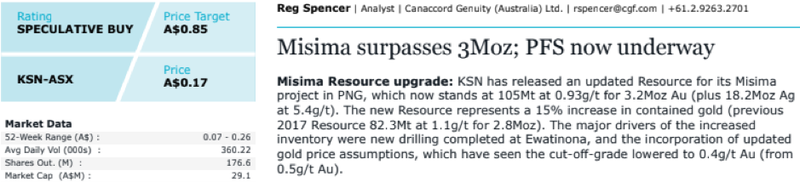

Reg Spencer from Canaccord Genuity is particularly upbeat on the company, particularly with regard to Misima, recently reaffirming his speculative buy recommendation and price target of 85 cents per share.

This implies significant upside from the company’s current price of 29.5 cents.

On one hand, the quantum of such a rerating may seem a stretch, but on the other, one only has to view the extensive newsflow that is imminent, particularly the PFS and reserve estimation work to understand that these could be the foundation for a significant rerating.

Macroeconomic conditions couldn’t be better for the company with the gold price at near record highs, and the volatile economic environment suggesting there will be further support for the traditional safe haven precious metal.

Crunching the numbers, Spencer said, ‘’Kingston’s enterprise value to resource multiple of A$9 per ounce is well below the peer group weighted average of $58 per ounce which we consider unwarranted given Misima’s (PNG project) scale and near-term development potential.

‘’A positive outlook for the gold price and relative dearth of advanced gold projects of scale on the ASX further supports our favourable view.’’

The gold price

There is a lot that has been written about the gold price recently. With good reason.

Though it dropped slightly last week, gold stocks could come back into favour as the precious metal again touched US$2000 per ounce at the beginning of this week.

Many analysts believe gold has a way to go.

Standard Chartered Private Bank’s Manpreet Gill told CNBC’s Street Signs Asia, “We think gold’s run ... hasn’t quite finished yet.

“It comes back to interest rates. One of the best explanations of why gold has surged the way it has through this year have been bond yields.”

Meanwhile, Carlo Alberto De Casa, chief analyst at ActivTrades said, “We will have a new bullish signal with a clear surpass of $1,965, in a scenario that remains dominated by coronavirus news and fears of further lockdowns. Expectations for further actions by central banks remain ever present and this is another supportive element for gold.”

With that type of support for gold, it is little wonder that Kingston is getting a move on at both its WA and PNG projects.

The final word

With Misima quietly going about its business in the background, Kingston turned its immediate attention to its Livingstone Gold Project in WA and has delivered excellent results.

The company reported initial hits of up to 28.02g/t Au at the Kingsley Prospect, results that will be used to help determine the Mineral Resource Estimate.

We expect a flood of news to be delivered in the coming weeks and months as the progress at Livingstone continues and the promise of the project is potentially fulfilled.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.