Introducing Our Next EU Battery Metals Portfolio Investment – Our Previous Pick is Up 311%

A once in a generation shift to electric vehicles is happening right now, and significant investment opportunities abound.

This titanic shift in transportation and energy will set the tone for the coming decades.

Furthermore, COVID-19 has fast tracked the biggest spend since post-WW2 to get the economy back on track. Much of this spend is on decarbonisation, through switching to electric cars.

Over €24BN in investments in European EV and battery supply chains are underway right now, and the continent has emerged as a major electric vehicle production hub.

It is also worth noting, the EU has coined the “European Green Deal” – a set of policy initiatives that have the overarching aim of making Europe climate neutral by 2050 – and government, corporates and consumers are all focused on making the switch.

There is one issue Europe hasn’t been able to fully solve yet – and that’s securing its own local supply chain of raw materials to go into each and every battery.

Currently, China produces ~93% of lithium-ion battery-grade manganese, made mostly from manganese ore produced in Africa.

Here at the Next Investors, we are big on the EV thematic – having made an early, successful investment in Vulcan Energy Resources Ltd (ASX: VUL).

In fact, the Australian Financial Review this morning covered this emerging thematic as well.

VUL has the largest lithium resource in Europe and is developing the world’s first Zero-Carbon LithiumTM process – something both EU battery makers and the EU environmental policy makers are very interested in.

Despite a depressed lithium market, VUL has performed well, and is one of the highlights of our portfolio. VUL is currently valued at $47M, hitting a high of 74c yesterday. We first alerted readers to VUL way back in August 2019 when it was trading at 18.5c – that’s a gain of over 311%.

We continue to hold a significant position in VUL, as we still see significant upside from its current $47M market cap.

Over recent months we have been hunting for similar undervalued ASX stocks that complement VUL in our portfolio, as well as the EU battery metals thematic.

After extensive Due Diligence, we have made a large investment in EuroManganese Ltd. (ASX:EMN), a battery metals developer that is relatively unknown on the ASX.

EMN intends to produce battery grade manganese by reprocessing tailings in the Czech Republic and has already signed five memorandums of understanding with major customers, which are intended to evolve into long-term offtake agreements.

Of further note, the preliminary economic assessment of its project indicates the net present value after-tax of nearly $600 million.

BREAKING NEWS: At the time of publishing, the European Union has just announced a plan to secure supply of critical metals (especially battery metals) by focusing on developing a complete supply chain within the EU, this is massive news (especially for EMN) and is all over mainstream media today.

I'd like to say that this is 'skill' on our part, but this perfect timing is pure luck for our investment in EMN:

What does this mean for EMN?

Effectively the company will be waste recycling from historic mines, delivering high purity manganese to EU battery makers, whilst at the same time cleaning up what is currently a polluted site for the local community.

- Just like VUL, EMN’s project is in the heart of Europe’s battery metals hub, on the doorsteps of multiple battery makers’ European factories.

- Just like VUL’s lithium resource, EMN has the largest manganese resource in Europe.

- Just like VUL, EMN’s processing of manganese is extremely socially and environmentally friendly and attractive to the tidal wave of institutional money mandated for ethical investments with a financial return ... particularly in Europe.

- VUL is up 311% since we invested and now capped at $47M... we think it is going a lot higher... we have invested in EMN today and its capped at just $14M.

Aside from the manganese products being produced – there is one stark difference to these European battery metals developers – and that is their current market valuations.

EMN is currently capped at A$15M. As investors, we are looking for EMN to start catching up to VUL over the coming months (which we believe is still undervalued) as EMN continues to execute on its strategy, and market awareness continues to grow.

EMN’s project has been in development for a number of years, and now permitting looks to be in the final stretch, the project will soon be ‘shovel ready’.

The company recently raised C$4.1M (AU$4.2M) and will be investing this to advance permitting and to continue advancing the project. It also plans to get Demonstration Plant (DP) up and running, which will showcase the quality of EMN’s manganese to customers. This is expected to cost ~ US$2.5M (AU$3.4M), plus US$1.5M installation and commissioning costs. Most of the output for the first year of production has already been allocated to several Tier-1 customers, as a prelude to potential offtake agreements.

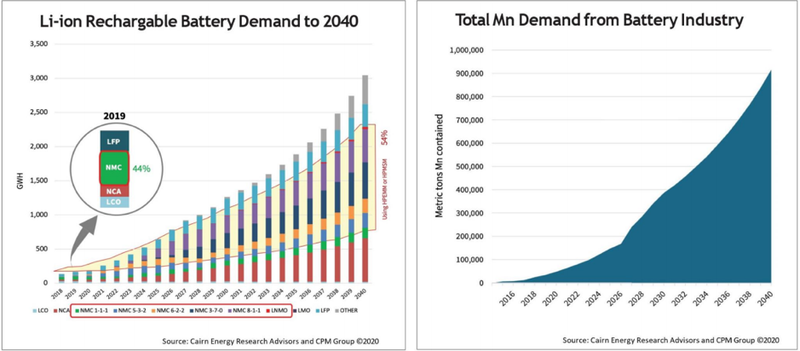

As the name suggests, a decent amount of lithium is required for lithium ion batteries, but what is lesser known is the amount of manganese required for a Li-ion battery.

In particular – ultra High Purity Manganese (HPM). The vast majority of Li-ion batteries use manganese in their cathodes and require HPM. This is precisely the finished product that EMN will produce.

Europe currently imports 100% of its manganese requirements.

EMN has a clear development plan and is led by a highly experienced management team and Board, with whom we have been extremely impressed in recent meetings.

It has built a pilot plant which has confirmed the ultra-high purity nature of its product and amenability of process flowsheet for this deposit.

EMN has a feasibility study in progress and strong customer interest for the DP products to be built in 2020/21.

Here is Euro Manganese’s CEO Marco Romero speaking with Proactive Investors about the project and upcoming news:

Now, let’s take a closer look at EMN’S project and how it can influence the European EV sector.

Euro Manganese could dominate supply of high-purity product in Europe

It makes sense for Australian investors looking to gain exposure to the EV thematic to focus on companies positioned within Europe, particularly those with strategic advantages and ready access to the large automotive manufacturing hubs.

EMN is one.

However, with regard to some input materials, that is easier said than done.

For example, the majority of the world’s cobalt supply comes from Africa with most areas falling under the ‘’sovereign risk’’ banner, another reason to opt for a company operating in a safe jurisdiction.

High profile battery manufacturers are already ahead of the game as they have either established mega-factories or are in the process of building plants to service the industry.

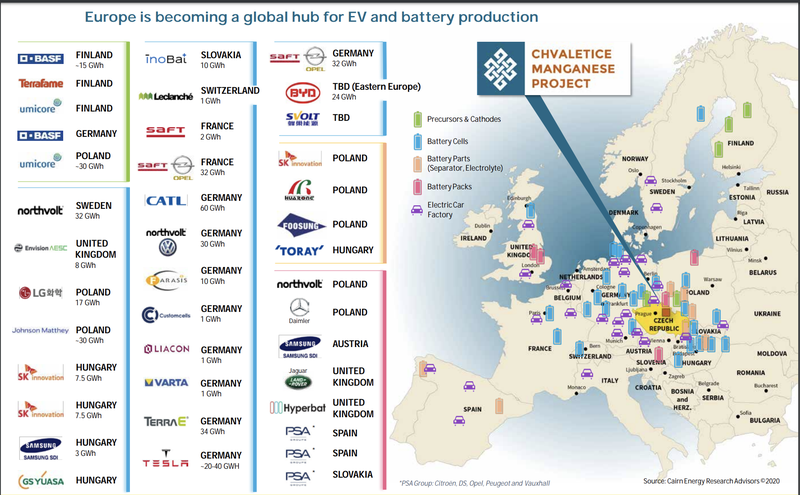

The following map shows the proliferation of battery plants and the extensive network of automotive and battery manufacturers in mainland Europe.

The above map also shows the location of the EMN’s Chvaletice Manganese Project (CMP) in the Czech Republic, relative to the major European EV and battery manufacturing hub.

While nickel, copper and cobalt readily come under the microscope, manganese is a metal that tends to fly under the radar despite being the fourth most traded metal in the world.

There are several reasons for this:

- 93% of high-purity manganese products are produced in China.

- It’s the lowest value battery raw material.

- Little is known about HPM outside China.

Many people assume that manganese is abundant. What they don’t know is that not all manganese deposits are made equal. Most are not suitable for HPM production.

However, it could be argued this makes it even more attractive for investors as the growing demand relative to previously moderate production pushes prices up.

The high-purity manganese products industry is a very new one, and its demand growth, driven by a White Paper published by deep.green estimated that an electric vehicle with a 75KWh battery and NMC 811 (nickel-manganese-cobalt) chemistry needs 56 kilograms of nickel, 7 kilograms of manganese, 7 kilograms of cobalt and 85 kilograms of copper for electric wiring.

This is where EMN comes into position.

As stated above, the company’s principal focus is the development of the Chvaletice Manganese Project (CMP). The company’s plan involves the re-processing of Europe’s largest manganese deposit, which is hosted in historic mine tailings in the Czech Republic, in order to produce high-purity manganese products (HPM) in an economically, socially and environmentally-sound manner.

EMN will not be mining manganese.

It will be recycling waste to produce highly refined manganese metal and salts. These are the finished products that producers of lithium-ion battery cathodes require.

Through its subsidiary Mangan Chvaletice, EMN owns 100% of the rights to the Chvaletice deposit and has entered into an option agreement to acquire a 19.94 hectare parcel of land, located immediately south of the highway and rail line that bound the Chvaletice tailings deposit.

This strategic land parcel, which is connected to a major rail line, is adjacent to an 820 MW power plant and will be the site of its proposed state-of-the-art HPM processing plant.

Prospective customers for high purity manganese products

In terms of location though, the most important factor revolves around the electric vehicle revolution occurring in Europe.

EMN noted that 30 battery and battery precursor and cathode factories, with no fewer than 25 electric car factories are already operating, under construction or have been announced in Europe recently. Europe currently imports 100% of its manganese requirements.

Europe is expected to become the second most important centre (after China) of the global electric car and battery industries.

At least six large battery factories that will consume manganese inputs are located between 200 kilometres and 500 kilometres of the Chvaletice Manganese Project. Others are being built across Europe.

Several prospective customers have expressed interest in procuring high-purity manganese products from the Chvaletice Manganese Project, and in conducting supply-chain qualification of the products of the proposed Chvaletice demonstration plant.

Euro Manganese has already signed five memorandums of understanding with major customers, which are intended to evolve into long-term offtake agreements.

EMN has reported that these customers are attracted by the strategic European position of Chvaletice, by the incomparable environmental footprint of the project (no mining or new solid waste generation) and by the exceptional purity of the products that Euro Manganese has produced in previous pilot plant trials.

These parties have included manufacturers of electric vehicle batteries and related chemicals who aim to design precursor and cathode formulations, in combination with available nickel, cobalt and lithium products, as well as chemical, aluminium and steel companies that require ultra-high purity manganese products for high-technology applications.

A waste recycling project that delivers positive environmental outcomes

The environmental features of the CMP development are a major differentiator for this project. EMN’s plans not only involve the production of a key battery raw material, but these will also result in the environmental rehabilitation of a site polluted by former mining activity, with considerable benefits for local communities.

The manganese in the Chvaletice tailings deposit principally occurs as manganese carbonate minerals, unlike the vast majority of manganese deposits in the world, which are made up of manganese oxides. Manganese oxides are refractory to acid leaching and require roasting or chemical reduction pre-processing in order to become soluble and amenable to processing into high-purity manganese products. This can create substantial environmental challenges. Manganese carbonates are readily leachable, without prior processing.

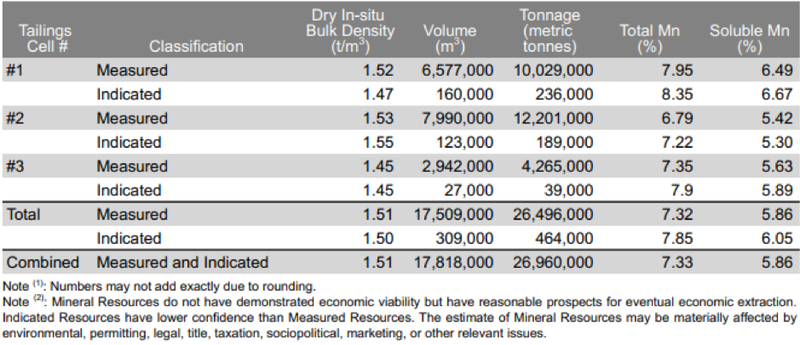

In 2019, EMN filed a Technical Report prepared by Tetra Tech Canada Inc., which reported an updated Mineral Resource Estimate and the results of a Preliminary Economic Assessment (PEA) for the Chvaletice Manganese Project. Remarkably, 98.3% of the resource is now classified as Measured under JORC and NI 43:101 codes. This proportion is exceptionally high for the mining industry and attests to the homogeneity of the deposit and to the attention to detail that has gone into the evaluation and planning of this project.

CMP is targeting production of ultra-high-purity electrolytic manganese metal (HPEMM) with specifications exceeding 99.9% manganese and ultra-high-purity manganese sulphate monohydrate (HPMSM) with a minimum manganese content of 32.34%, both of which exceed typical industry standards.

These products will be selenium, fluorine and chromium-free, and are designed to contain very low levels of deleterious impurities.

Only primary producer of high-purity manganese in the European Union

EMN sees the Chvaletice Manganese Project as becoming an important and environmentally-sustainable part of the international and European lithium-ion battery supply chain.

Management expects that EMN will become the only primary producer of high-purity manganese in the European Union, where 100% of manganese requirements are currently imported.

Given the large scale of the project one would normally expect long development times.

However, EMN has completed five years of work on the CMP and, in late June 2020, filed an environmental impact assessment notification with the Czech Ministry of the Environment, triggering the project permitting process.

It has initiated a definitive feasibility study and expects construction of the full-scale facility would take between 18 months and 24 months. The company is targeting commercial production by late 2023 or early 2024.

EMN’s focus on producing very high purity product is another key differentiator. The purity of raw materials is critically important in the new generation of lithium ion batteries. It greatly influences battery performance and safety.

The company has demonstrated the suitability of the Chvaletice tailings for the production of very high quality HPEMM and HPMSM in extensive bench and pilot scale metallurgical tests, during an intensive two-year process design program.

The technology used in the CMP process is commercially-proven and is being adapted through innovative approaches to meet or exceed demanding customer and European Union environmental standards. The entire process will use no selenium, chromium or fluorine, which are known to cause significant environmental and health impacts.

The CMP process entails concentrating the manganese in the tailings using simple, clean and low-cost magnetic separation, followed by dissolution of the manganese and production of highly refined manganese metal, using electrolysis, which is then converted into high-purity manganese sulphate powder.

Increased performance and recharging benefits

High grade, high purity manganese is used as a primary cathode material in lithium-ion nickel-manganese-cobalt batteries or NCM batteries, and research has indicated that it increases performance and recharging capabilities.

High-performance NMC Li-ion batteries are being increasingly used in electric vehicles and other energy storage applications.

The manufacturing processes and formulations for Li-ion batteries require reliable, high-purity sources of manganese and other battery raw materials to ensure that the batteries meet increasingly demanding performance, safety and durability standards.

The high-purity manganese materials for the precursor cathode materials of NMC batteries can be supplied in the form of HPEMM and HPMSM.

As a result, demand for high purity manganese is growing rapidly around the world, driven by the growth of the electric vehicle and Li-ion battery industry.

Compelling metrics for long life project

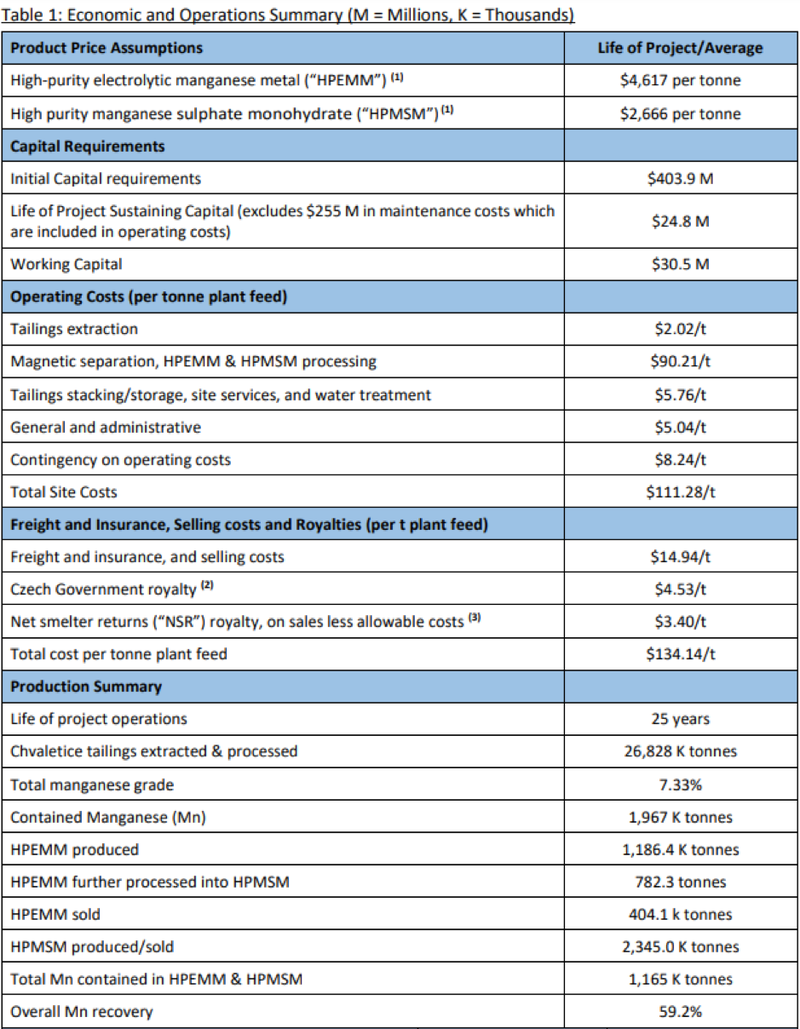

EMN’s Chvaletice manganese tailings deposit is western Europe’s largest known manganese resource, with about two million tonnes of manganese contained in the tailings.

Although the 27 million tonne mineral resource grade is only 7.33% manganese, EMN has reported that mining or milling is not required to liberate the manganese minerals prior to leaching the tailings, as the primary ore from which they were made was crushed and finely milled when it was originally processed. The manganese minerals at the CMP are also ideally suited to produce a manganese concentrate, using conventional and very low cost magnetic separation technology.

Management envisages a 25-year project operating life producing 1.19 million tonnes of HPEMM, two-thirds of which is expected to be converted into HPMSM.

The saleable products over the life of the project include 404,100 tonnes of HPEMM and 2.35 million tonnes of HPMSM, focusing principally on Europe's rapidly emerging electric vehicle battery industry, while remaining flexible to supply either product to suit customer preferences.

Note the significant uptick in demand from around 2026, indicating that production from CMP will be well and truly in train when demand surges.

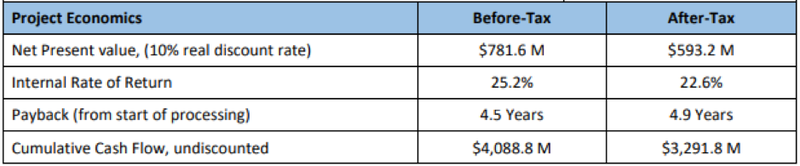

PEA indicates the net present value after-tax of nearly $600 million

The metrics from the PEA were impressive, particularly in terms of highlighting the project’s low-cost, premium product, long life features.

These factors all contributed to outstanding headline numbers as featured below.

The PEA is targeting production of ultra-high-purity electrolytic manganese metal with specifications exceeding 99.9% manganese and ultra-high-purity manganese sulphate monohydrate with a minimum manganese content of 32.34%, which exceeds typical industry standards.

Based on these metrics the project is valued at $593.2 million on an after-tax basis with an implied discount of 10%. (In early 2020, EMN was granted a package of investment incentives by the Czech Ministry of Trade and Industry in the form of tax credits, further enhancing project economics.)

Given EMN’s market capitalisation is hovering around $15 million, it isn’t difficult to mount a case that the company is extremely undervalued.

From an operational perspective, this is a summary of the PEA that provides a snapshot of the proposed development.

Commenting on the market dynamics for manganese and Euro Manganese’s strategic benefits in servicing the fast growing battery industry EMN’s president and chief executive Marco Romero said, "The PEA demonstrates the compelling potential of the Chvaletice Manganese Project.

“Euro Manganese is in a unique position in the battery industry, with its 100% holding of Western Europe’s most significant and strategically-located manganese deposit.

“What makes this project even more significant for an automotive industry focused on making our world greener, and for other consumers striving to secure sustainably produced raw materials, is that these products would be produced by recycling waste.”

Key milestones that could provide share price momentum

Environmental studies, planning and project permitting are highly advanced for the Chvaletice Manganese Project with extensive baseline and other environmental studies having been completed since 2017.

The EIA Notification for the project, which was filed on June 30, 2020, is a significant milestone as it initiated the EIA (environmental impact assessment) regulatory review process.

EMN has completed all planning and design for the construction and commissioning of a demonstration plant (DP) in the Czech Republic in order to provide bulk, multi-tonne finished product samples for customer evaluation and supply-chain qualification. The demonstration plant is a 700% scale-up of the company’s 2018 pilot plant.

The DP is intended to replicate the entire process flowsheet proposed in the PEA and the definitive feasibility study, and will produce the equivalent of 100 kilograms per day of manganese sulphate monohydrate.

The DP will also enable process optimisation and testing for final product development and serve as a testing and training facility for future operators.

In December 2019, the company entered into a fixed-price, turnkey contract with CRIMM for the supply and commissioning of a technology, equipment package for the demonstration plant, which includes performance guarantees, as well as commissioning services and an operator training program.

Management estimates that the cost, including fabrication, delivery, commissioning, laboratory set-up and an operator training program, as well as the cost of operation for one year, will be approximately US$5 million (A$7.0 million).

Subject to financing, the company is targeting the completion of the demonstration plant construction and commissioning in calendar 2021, followed by the delivery of the first finished product samples to potential customers.

Once permitted and offtake agreements have been entered into with EMN’s potential customers, the company expects to turn its attention to project financing in order to commence construction of the full-scale commercial Chvaletice processing plant and related infrastructure.

Management believes that the capacity for project financing is likely to compare advantageously to the majority of mining projects given its safe jurisdiction, quality of offtake agreements, environmental benefits and strategic position within the European battery supply chain.

COVID - short-term pain, long-term gain

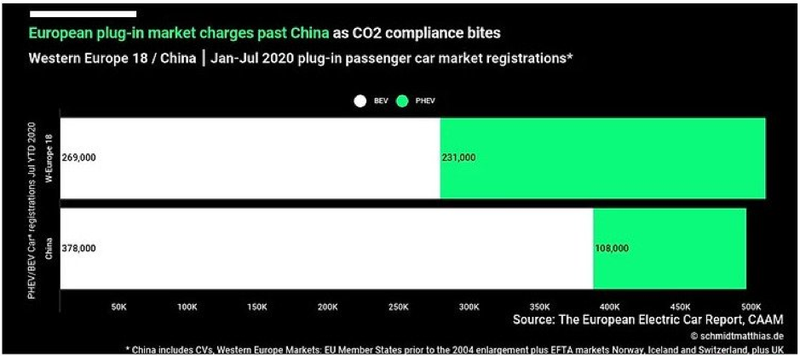

It is difficult to find an industry that hasn’t been impacted by COVID-19, and the EV sector is no exception, but this hasn’t affected the China/Europe metrics.

Moreso, it is the medium term impact that investors should be focused on as growth of the electric vehicle manufacturing and related battery industry is seen by countries such as France and Germany as being central to a multi-billion post-COVID Euro economic recovery package.

It was recently reported in Renew Economy - Clean Energy Use and Analysis that French president Emmanuel Macron will seek to jump-start the local auto industry decimated by the coronavirus pandemic with an €8 billion ($A13.2 billion) plan that includes a major boost for electric vehicles.

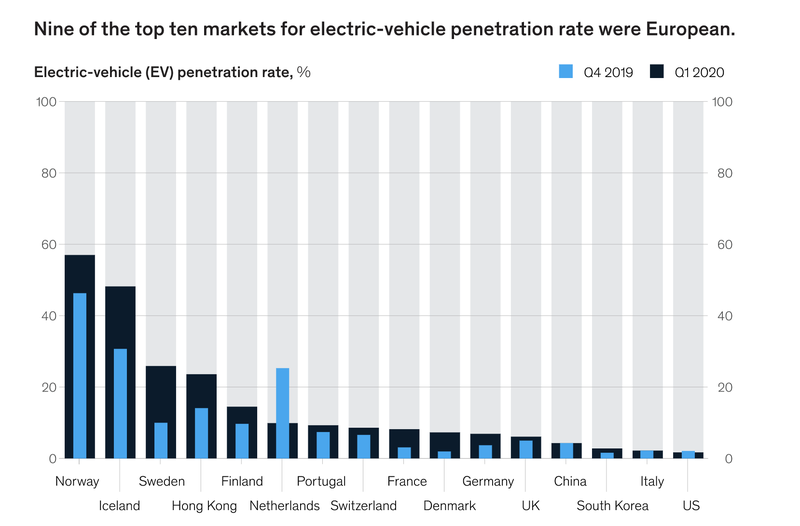

Harking back to the beginning of this article and Matthias Schmidt’s observations, he highlighted that the increase in sales in Western Europe means that the region is on target to achieve 1 million electric vehicle sales with a large push expected in the second half 2020 to meet stricter CO2 compliance regulations.

The following chart produced by Schmidt tells the story.

Schmidt expects that increased availability of Tesla and other brands of electric cars, as well as the release of the Volkswagen ID.3 electric hatchback will be behind the escalation in sales.

Interestingly, shares in Tesla Inc (NASDAQ: TSLA) surged past US$1800 per share of the first time in mid-August. It is currently sitting at $2213 and continues to climb.

As an indication of the quantum of this gain, the group’s 12 month low is US$211, an increase of more than 750% since August 2019.

Tesla’s Elon Musk recently unveiled the first image of his planned gigafactory in Germany which will be situated near Berlin.

From a broader perspective, the increased focus on the renewable energy industry has been highlighted even further with the European Union unveiling a €750 billion ($A1.2 trillion) plan for a climate-led economic recovery from COVID-19 that puts investment in renewable energy, clean transport, smart energy and emissions reduction at front and centre.

EMN could provide Australian investors with a focused entry point into this market and is why we welcome it as the next company in our growing portfolio.

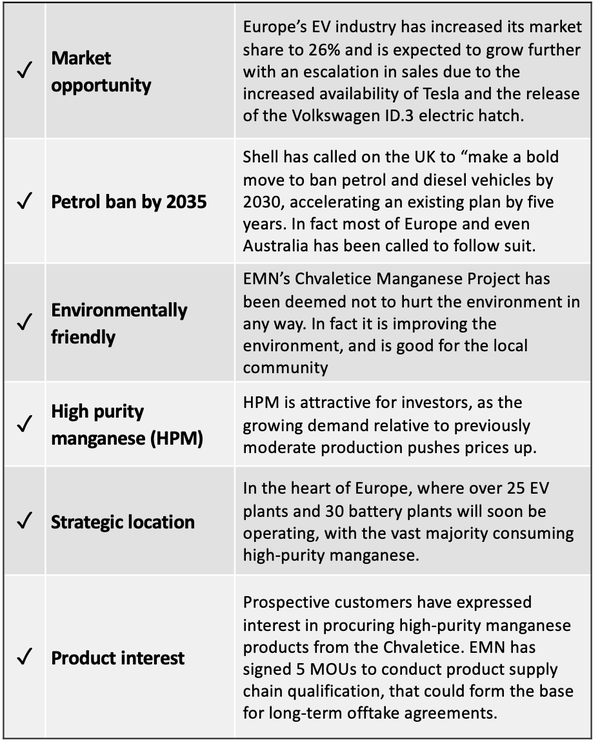

Reasons to consider EMN:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.