High-Grade Gold Results Pouring in from CLZ’s Forrestania Project: More to Come

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

High-grade gold results are flowing in from ASX junior Classic Minerals’ (ASX:CLZ) Forrestania Gold Project, in Western Australia’s Southern Cross Belt.

The results to date reveal mineralisation that suggests CLZ has an extensive gold system on its hands, one that spans at least two kilometres.

The Forrestania Project is situated in the heart of the abundantly mineralised Southern Cross Belt, which hosts a gold endowment of more than 10 million ounces.

The Phase 2 drilling programme was designed to target mineralisation outside of the current Resource model, as well as high-grade extensions below and adjacent to the current pit design.

The junior gold explorer’s sharply focused reverse circulation (RC) drill programme comprised 32 holes, spanning some 6,800 metres. It is two-thirds of the way through assay processing, with further assays from the project’s major deposits — Lady Ada and Lady Magdalene — still to be released in the coming weeks. And if results so far are any indication of what’s to come, CLZ shareholders could see rewards in the not-so-distant future.

Along with the remaining assay results, the company is awaiting approval for further drilling programmes to rapidly move into the next phase of exploration and development at the highly promising project.

This fits in with CLZ’s underlying strategy to aggressively expand its Resource to a size that supports establishment of an on-site processing facility.

Surely enough, drilling at the project’s Lady Ada deposit has returned additional high-grade results from outside the current scoping study pit design. Drilling at the Lady Magdalene deposit, meanwhile, saw thick zones of shallow-depth gold mineralisation.

Like Lady Ada, the more extensive Lady Magdalene deposit is a stacked, shallow dipping ore body which is open at depth and along strike, as confirmed by these latest assay results, reinforcing CLZ's contention that the Forrestania Project hosts a much larger high-grade gold system.

At the time of our last update in December 2017 — a mere six months after CLZ acquired the Forrestania Project — this quick-moving gold junior had grown its Resource some 60% through significant investment in exploration, and upgrading the Resource from Inferred to Indicated.

These recent results highlight considerable potential to increase and upgrade the existing JORC-compliant Mineral Resource Estimate (MRE) at Forrestania, which currently sits at 5.9 Mt at 1.25 grams per tonne for 240,000 ounces of gold.

It should be noted that this is an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

While these are still early days for this aspiring gold miner, it’s worth noting that CLZ has already made rapid strides in this department, wasting no time in firming up its Resource.

All in all, things are looking promising for this ASX small-cap... with a lot more in the pipeline.

Set to begin later this month is the drilling of strategically placed orientated diamond drill holes, with the goal of uncovering more Lady Ada-esque high-grade ore bodies between the existing drill lines at Lady Magdalene.

On top of that, additional assays for both Lady Ada and Lady Magdalene are expected back within weeks, so we’re anticipating waves of regular newsflow from this gold junior.

With gold being a safe haven in the face of geopolitical tensions and rising stock market volatility, and the fact that CLZ is looking for this most classical of metals in the gold-emblazoned Southern Cross, the ASX explorer could well be in the right place, at the right time... And it may not be long before investors cotton on to this $2.7 million-capped quiet achiever.

Without further ado, let’s check back in with:

For those of you for just hopping aboard the Classic Minerals (ASX:CLZ) train, the short video below gives an overview of the company’s flagship Forrestania Gold Project:

As we’ve mentioned, there’s an existing Resource here of 5.9 Mt at 1.25 grams per tonne for 240,000 ounces of gold, which CLZ is looking to significantly expand as the year unfolds.

A scoping study has reinforced both the technical and financial viability of the project. The study envisages open pit mining from both deposits, making for low operational risk. It also displays excellent margins at current gold prices, delivering significant cashflow, combined with low capital expenditure.

Bearing all of this in mind, let’s take a look at the most recent assay results returned from Phase 2 drilling at Forrestania ...

Drilling at Lady Ada: confirmation of CLZ’s Resource development model

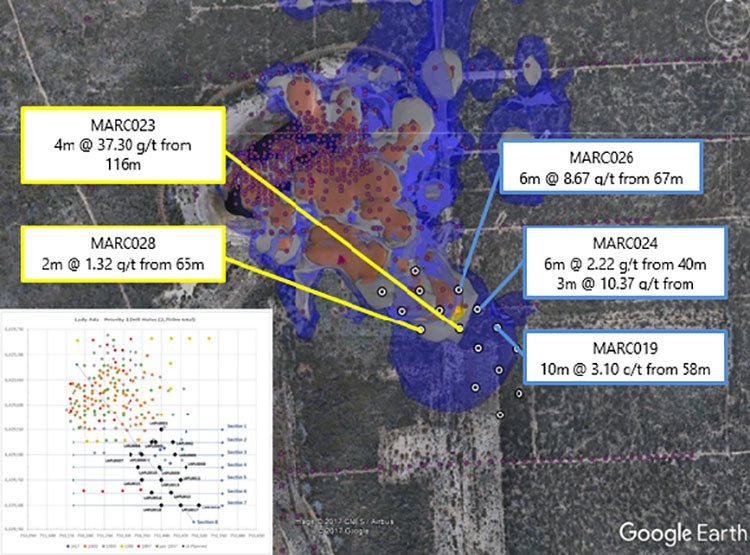

CLZ's Phase 2 drilling at Lady Ada has returned additional high-grade results from outside the current scoping study pit design.

Best results for Lady Ada from the most recent assays include:

-

4m at 37.30 g/t gold from 116m – including 1m at 76.8 g/t gold from 116m

-

2m at 1.32 g/t gold from 65m

These results confirm the geological model that the primary Lady Ada ore zone extends to the south-east of the existing ore body.

In the image below, Phase 2 holes (shown in white) at Lady Ada are plotted against previous drill collars (marked in pink) and the latest implicit model. The latest results are shown in yellow boxes:

The extent of the mineralisation remains open: CLZ drilled a hole (MARC039) some 200 metres along strike from MARC023 and MARC024 that is yet to be assayed but included promising zones of arsenopyrite, which seems to represent ore-bearing zones.

MARC023 was a standout hole at Lady Ada, yielding especially high-grade gold mineralisation (76.8 grams per tonne) at a relatively shallow depth (116 metres) in an area outside of the current optimised pit design.

It’s important to note that there are quite a few high-grade (that’s at least 70 grams per tonne of gold) hits here. This bodes well for the project, suggesting that CLZ will discover more in the way of high-grade lodes within the FGP gold system.

Here’s an example of visible gold in rock samples taken from around the Lady Ada deposit:

Meanwhile...

Drilling at Lady Magdalene

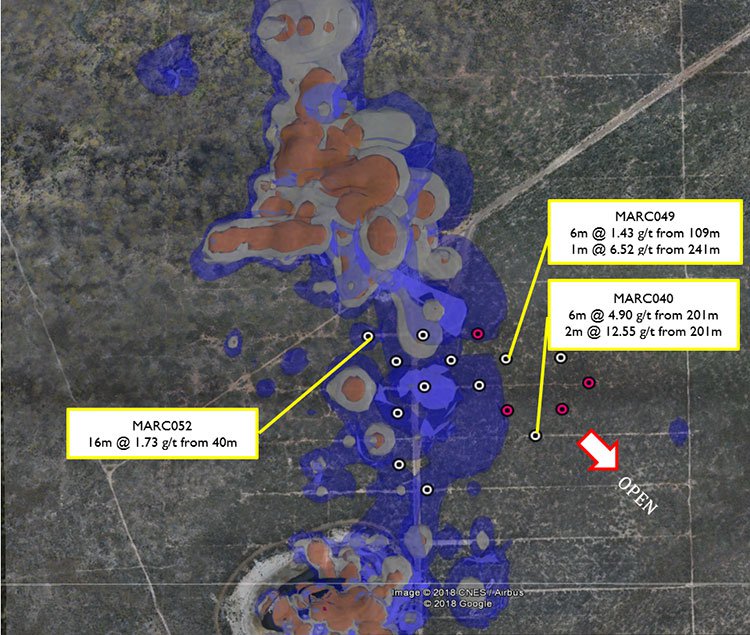

Thick zones of shallow-depth gold mineralisation were also encountered at the Lady Magdalene deposit.

Best results here include:

- 6m at 4.9 g/t gold from 201m, including 2m at 12.55 g/t gold from 201m

-

16m at 1.73 g/t from 40m

-

2.15m at 5.27 g/t gold from 24.85m

-

10.5m at 1.10 g/t gold from 54m

-

6m at 1.43 g/t gold from 109m

- 1m at 6.52 g/t gold from 241m

Particularly noteworthy was MARC052, which had an intersect of 16 metres at 1.73 grams per tonne of gold from 40 metres, in an area that’s again outside the current optimised pit design.

Moreover, the results from holes MARC040, MARC049 and MARC052 all confirm the geological model that the main ore zone continues to the south-east of the existing ore body.

The image below shows Phase 2 holes at Lady Magdalene plotted against the latest implicit model (the latest results are shown in yellow boxes):

MARC040, which is the most southern hole of the Phase 2 drilling campaign at this deposit, also contained some especially encouraging assay results — 6 metres at 4.90 grams per tonne from 201 metres including 2 metres at 12.55 grams per tonne of gold from 201 metres.

Interestingly, MARC052 also contained a thick zone of ore at a relatively shallow depth (40m), which will improve the economics of the scoping study once incorporated into an updated Resource model and pit optimisation.

Lady Magdalene is a far larger gold deposit than Lady Ada and, as CLZ expected, this deposit is continuing to deliver some very pleasing results. The company believes there are some additional high-grade shoots/zones here that are yet to be discovered.

CLZ is hoping to see Lady Magdalene transform from a modestly graded deposit into one that contains multiple high-grade zones that will support low-risk and profitable staged mining operations.

There is still a long way to go here, however, so investors should maintain a cautious approach when making an investment decision with regard to this company.

Bearing this in mind, CLZ is now around two-thirds of the way through assay processing and is anticipating further results for Lady Ada and Lady Magdalene in the days to come — and potential share price catalysts.

Lady Magdalene Diamond Drilling to Commence in February

In addition to processing the assay data from Phase 2 drilling at Lady Ada and Lady Magdalene, the Company is also focused on drilling diamond holes at Lady Magdalene in the near future with a view of discovering high grade gold lodes similar to what was mined at Lady Ada.

Approval has been received from DMIRS to carry out orientated diamond drilling within the existing Lady Magdalene resource in an attempt to locate high grade cross-cutting gold lodes similar to the Lady Ada deposit which yielded 95,865 tonnes @ 8.81 grams per tonne for 27,146 ounces gold. Currently, existing drilling at Lady Magdalene is too broad spaced to identify these potential high-grade cross-cutting lodes.

The Company expects to commence this drilling in mid-Feb 2018.

CEO Dean Goodwin reminded us that CLZ found Lady Ada 17 years ago by looking closely at the drilling sections, where you could see high-grade gold lode cutting through from section to section on an angle. It wasn’t running parallel to the main lower grade material and once CLZ changed the drill orientation, the high-grade zone was instantly apparent and the rest was history.

CLZ says there is very strong evidence to suggest that similar things are happening at Lady Magdalene than is happening at Lady Ada. The company is looking for multiple Lady Adas hiding within the existing data.

“Before we looked closely at Lady Ada, both Lady Ada and Lady Magdalene were deemed large low-grade gold resources. It was only after we looked closely at Lady Ada that we saw the high-grade cross cutting lode – I hope to repeat this methodology and discovery at Lady Magdalene,” Goodwin said.

Phase 2 drilling: 90+ priority targets identified

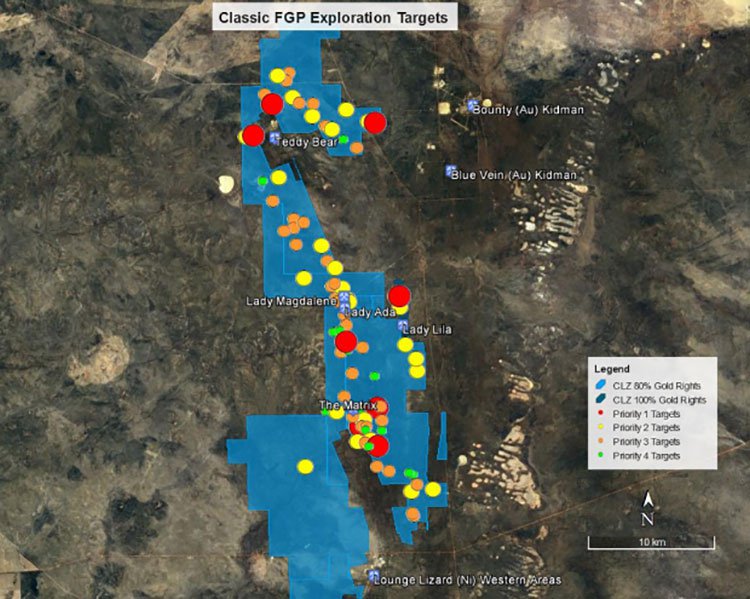

All in all, detailed mapping of the entire Forrestania Greenstone Belt has identified more than 90 priority targets within the Forrestania project area.

As we touched on earlier, results returned from Phase 2 drilling so far highlight strong potential to expand the current Resource, and this fits in nicely with CLZ’s broader strategy to rigorously develop a sturdy base.

In addition to Lady Ada and Lady Magdalene, CLZ also holds additional JORC resources in the region and a cluster of exploration targets.

These include the BIF-hosted Lady Lila deposit, which is seen as analogous to the nearby Bounty and Blue Vein ore bodies, which are held by the $635 million-capped Kidman Resources (ASX:KDR). There’s also an untested target, aptly named the Matrix, that’s considered to be analogous to the high-grade Lady Ada ore body.

Below are CLZ’s ranked exploration targets:

Numbers don’t lie

There are good numbers all round for CLZ. Strong assays bode well for its overall position in the region.

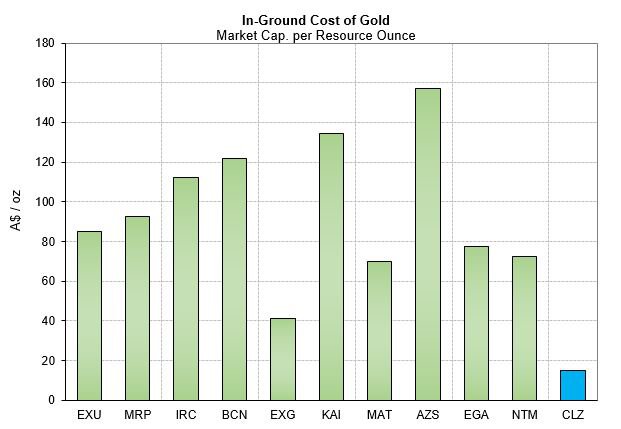

Stacked against its peers, CLZ is a solid performer although its market capitalisation per resource ounce remains well below that of its peers — as evidenced in the chart below.

If we look at similar companies (junior gold explorers or early stage developers, under 500,000 once gold resource, financial analysis completed but not BFS) you can see a huge discount on CLZ’s share price that will not go unnoticed for much longer.

For example, Egan Street Resources with ~300,000 ounces and a PFS underway, currently has a market cap of $24 million. Explaurum Limited, with its Tampia project not more than 100km from CLZ’s FGP (current resource of ~600k oz, scoping study completed, PFS underway) has a market cap of $53 million.

However, CLZ remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

As CLZ continues its resource development, and keeps delivering excellent results to the market, we could see a re-rate on the cards that might see the $2.7 million market cap change dramatically.

The gold-hued road ahead

With the year only just beginning, CLZ has plenty to keep it busy at the Forrestania Gold Project.

Bear in mind that CLZ has only received some 50% of assay results so far, and considering how encouraging these have already been, there’s a strong chance the rest will be equally impressive.

In parallel with its regional exploration program, CLZ will be looking for high-grade cross-cutting lodes within the Lady Magdalene resource envelope similar to that of Lady Ada.

Following DMP (Department of Mines and Petroleum) drilling approval later on this month, CLZ will throw itself full-throttle into some orientated diamond holes at Lady Magdalene. Discovery of these kinds of zones could be a major game-changer for Forrestania, drastically increasing the financial viability of the project through the hefty addition of some serious high-grade ounces.

This, in turn, will enable CLZ to rapidly move to the next phase of exploration and development at Forrestania.

Given that we’re now looking at a sustained gold rally that saw the metal rise some 7.5% since mid-December on the London Metals Exchange, and is continuing to sparkle as broader stock market volatility rises, CLZ’s timing could scarcely be more salient.

Whatever happens, here at the Next Small Cap, we’ll be eyeing the movements of this $2.7 million-capped ASX gold explorer closely in the days to come.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.