Is Graphite Set to Make Waves on the AIM?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Graphite is making headlines and creating significant market interest largely on the back of its integral part of lithium ion batteries in electric cars.

The world is shifting to electric cars at a quick pace, driven by the likes of Tesla and traditional car makers fast realising that the game has changed.

Beyond just electric cars, lithium ion batteries are expected to feature prominently in the next wave of consumer products such as mobile phones, laptops, power tools, and medical devices.

What this means is a rise in demand for graphite given its use as anode material in lithium ion batteries – and therein lies the opportunity for investors.

It is no wonder then that small cap explorers are jumping into the fray – we have seen many mining juniors launch very successful and high growth graphite exploration campaigns on both the TSX and the ASX – but strangely this buzz has not fully arrived on the AIM – yet.

Armadale Capital (LSE:ACP), a resources investment company currently building a strong commodities portfolio in Africa, is one of the few AIM listed companies out there with its hands on potentially high value graphite ground, in an emerging exploration hot spot.

ACP is set to add the Mahenge Liandu Graphite Project in Tanzania to its portfolio via a recent heads of terms agreement struck with the project vendors.

The important thing to note here for ACP and its shareholders is that the Project is located right next door to emerging ASX listed graphite explorers Kibaran Resources (ASX:KNL) and Black Rock Mining (ASX:BKT), both valued at multiples of ACP’s current market cap.

Both Kibaran Resources A$41.1M (£20.29MN) and Black Rock Mining A$13.97 (£6.9MN) now have grown significantly on the back of their graphite projects surrounding ACP’s new project.

Kibaran has bagged binding offtake agreements to the tune of 30,000 tpa, including 20,000 tpa with ThyssenKrupp – the €11.18BN multi-national conglomerate – validating the quality of the graphite in these parts.

ACP represents a compelling graphite opportunity for the small-cap UK investor, currently capped at just £1.43M.

The Aussie explorers around ACP confirm that there is a growing market for graphite coming online, and if you can strike some significant graphite mineralisation, things can move very fast.

Before we go too far, it should be noted that for political and social reasons, this is a very high-risk stock. Getting mining projects up and running in countries such as Tanzania is no simple feat, and there may be challenges ahead.

The growth in the world’s need for graphite has convinced dozens of companies to pursue its exploration around the world...

...and ACP is an early mover defining this changing trend on the AIM market.

Armadale Capital PLC

If a host of tiny Aussie companies can get their hands on quality graphite tenements in Africa, and raise their valuations on the back of the lithium battery revolution, can Armadale Capital (LSE:ACP) repeat the form in the UK?

We certainly think so given the impressive tenement package ACP has snagged, and the positive initial results already seen.

ACP is right next door to its higher valued Aussie counterparts Black Rock and Kibaran, and within the same geologic units. Take a look at the map below, for further evidence of just how close they are.

We will look at the map in more detail further down, but given the company’s position set amongst a hive of exploration, and of course its tiny market cap, with ACP, we think we’ve found a strong candidate to become a significant UK-based graphite starlet over the coming years, and emulate its Australian small-cap cousins in the meantime.

Of course, it is early days here, due diligence between the project vendors and ACP is underway now, and ACP will likely need to raise some funds to progress with exploration. But when that exploration has the potential to transform the company to a market cap of multiples of where it is today, especially if it can go and define a significant graphite resource, it makes this stock a compelling proposition.

If you’re looking for a brief introduction to graphite, check out this video:

Lithium-ion batteries gobble up incredibly high amounts of lithium, graphite and cobalt – its three key ingredients – and given the anticipated mass adoption of electric cars, there has been significant pressure placed on supply chains for these materials.

Demand for graphite for use in lithium batteries, is set to go through a significant upscale between now and 2020 that will see battery manufacturers offtake 250,000 tonnes per annum (tpa) by 2020 — compared to 80,000 tpa today. That’s an increase of over 200% over the next four years.

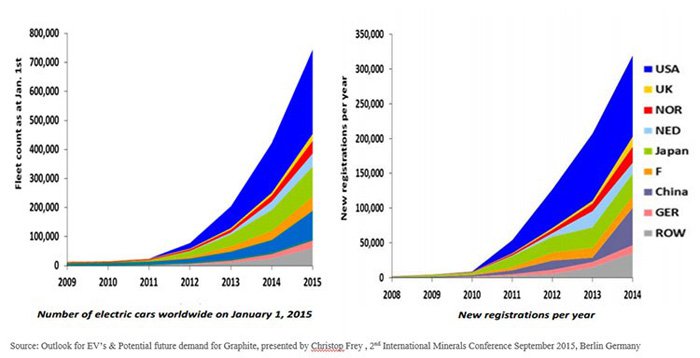

Led by US-based Tesla and Chinese-based BYD (partially owned by Warren Buffett), it’s clear that sales of electric vehicles (EVs) are increasing exponentially. Here’s a taster of the growth in EV sales:

Are we seeing the initial sparks of a graphite market boom on the AIM?

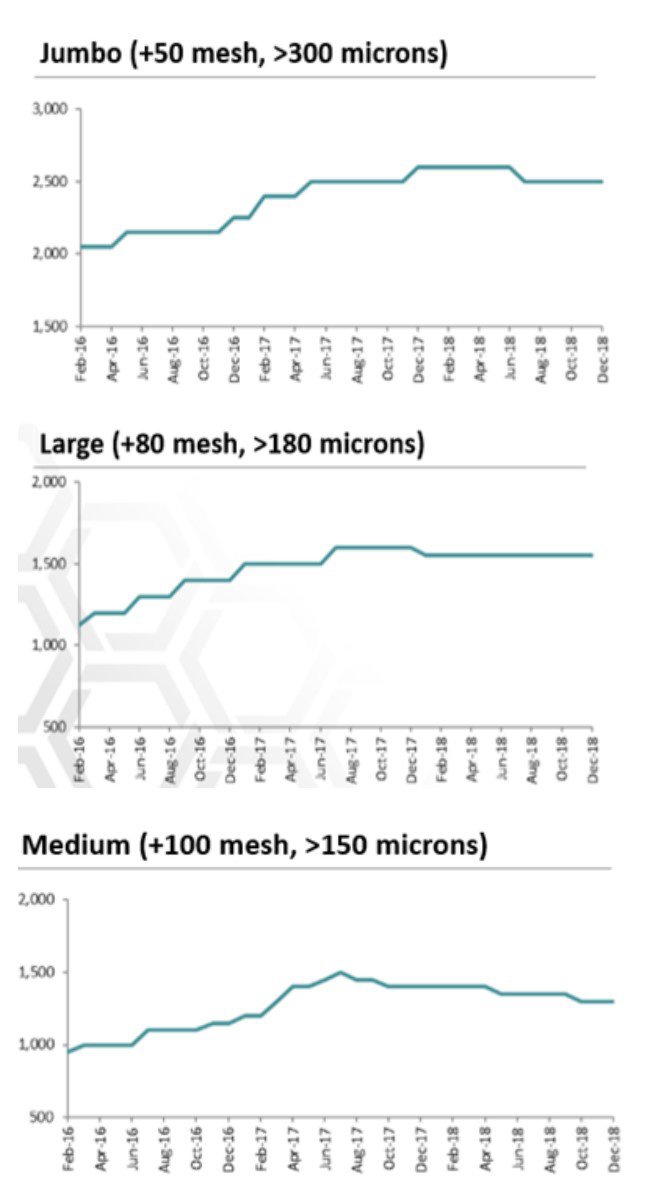

Graphite prices have perked up, although it is still too early to tell exactly what kind of specifications most graphite end-users will be looking for – what we do know for sure, is that the world is going to need a lot of it, and a number of offtake deals for African graphite have already been sealed.

Here’s a snapshot of where graphite prices are expected to head over the next 2 years:

In terms of company valuations, graphite explorers on the ASX and the TSX that have defined significant graphite resources have been trending upwards for the past 12 months or so, on the back of greater investor awareness of this impending commodity sea change.

In the UK, graphite is a very niche part of the commodities sector, with barely a handful of companies putting their feelers out for graphite... so far

But if we take a look at Commodities Central — otherwise known as Australia — it would seem graphite is getting significant traction.

Take a look at how Syrah Resources (ASX:SYR) has performed over the past 12 months:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Syrah is Australia’s largest graphite explorer currently valued at A$1.25BN (£612MN).

Syrah’s story began with humble beginnings via the acquisition of the Balama Project in Mozambique in 2011. Since then, Syrah has made one of the world’s major graphite discoveries, diligently progressed exploration and published a completed Definitive Feasibility Study (DFS) last year.

This is the type of progress ACP is hoping to emulate in Mozambique’s next door neighbour Tanzania, with the added bonus that ACP still has its Congolese Gold Project waiting in the wings just as gold prices have started inching their way north again.

Whilst a Syrah like valuation is a long way off, ACP’s neighbours point the way for what could be in store for this stock in the short term.

ACP’s neighbours such as Kibaran Resources (ASX:KNL) and Black Rock Mining (ASX:BKT) now have significant market caps from where they started being A$41.1M (£20.29MN) and A$13.97 (£6.9MN) respectively.

Kibaran recently announced it had executed an off-take agreement with one of the world’s leading commodity trading companies ThyssenKrupp, for an exclusive long-term commercial agreement between the parties for the sale of a minimum 20,000 tonnes per annum of refractory grade natural flake graphite in Europe, Turkey, Russia, Ukraine and Korea.

Remember ACP is currently capped less than £2M (at the time of writing).

Here at The Next Small Cap , it’s in our DNA to keep our antennae trained for small undervalued companies such as ACP who may have a rather bright future, especially considering its position.

To give you an idea of how quickly graphite stocks can grow, take a look at Volt Resources (ASX:VRC) – we have been telling our readers about VRC since February 2015 when it was trading under the ticker code ASX:MOZ and was capped at a similar level to ACP’s current value.

The company’s share price has risen over 630% since it first entered graphite exploration and ticked all the boxes to make a major graphite discovery in Tanzania:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Back when we first wrote about VRC, it was in the very early stages of project development, with a very small market cap. ACP have a hold on something very similar in a similar early stage – and we see striking similarities between ACP and where VRC was 18 months ago.

Of course, ACP will need to fire up the drill rig in the near term in an effort to try and hit some of the mineralisation that has caused ASX:BKT and ASX:KBN’s market caps to stir, and we will find out a whole lot more over the coming months.

Suffice to say, this is still an early stage play and caution is required if considering this stock for your portfolio.

Operating in a graphite wonderland in East Africa

East Africa has more graphite locked up under its ground, than the rest of the world combined.

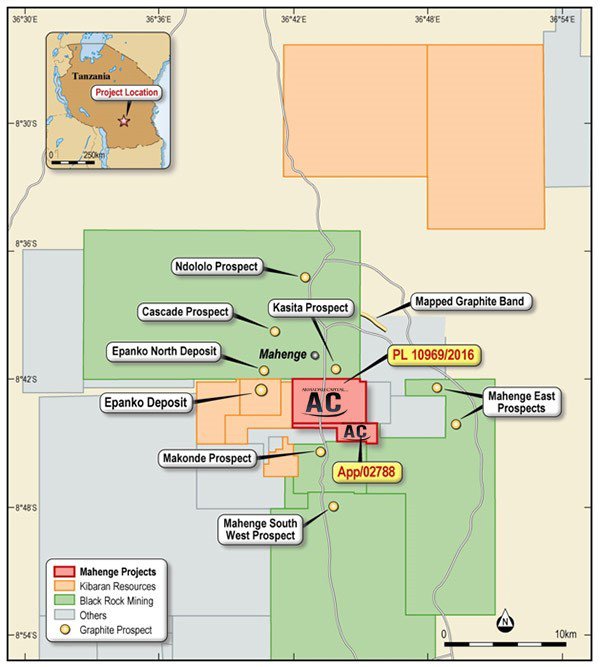

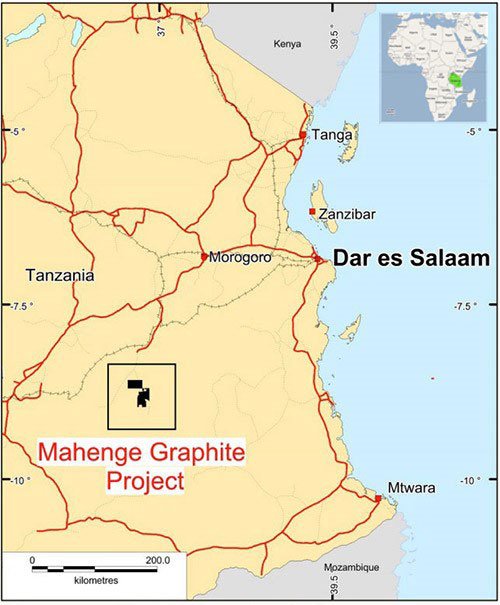

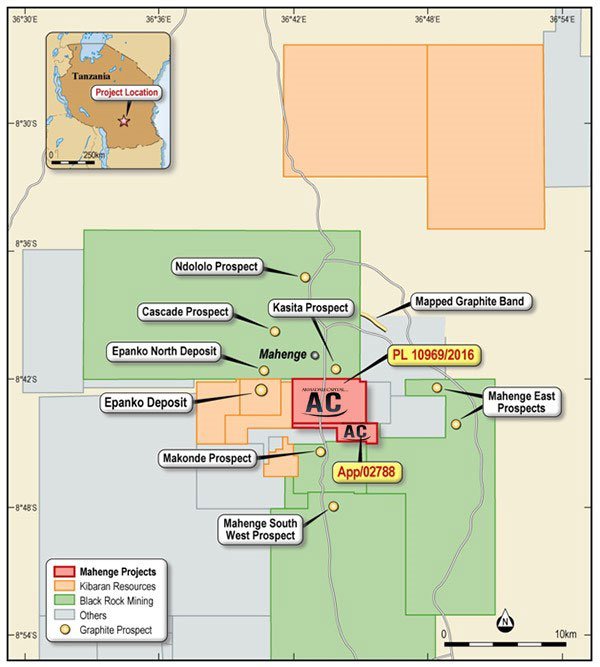

The Cabo Delgado region contains the world’s largest known schist of graphite mineralisation in the world with its veins stretching from Mozambique, further north into neighbouring Tanzania and west into Malawi. Here’s a map of the region, and where ACP’s latest project sits:

Zooming further in, here is where ACP will be exploring – the Mahenge Liandu Project, which consists of 2 tenements covering 29.9 km2, adjacent to the town of Mahenge.

As you can see above, ACP has snagged prime real-estate right in the middle of existing graphite projects that have completed advanced studies: a Bankable Feasibility Study, plus offtake agreements in place for Kibaran (the orange ground on the map), whilst Black Rock has completed a positive Scoping Study (the green shaded areas).

Nearology factor in play for ACP

As we have indicated, one of the major plus points for ACP’s newly acquired tenements is their close proximity to existing (and defined) graphite resources in the vicinity.

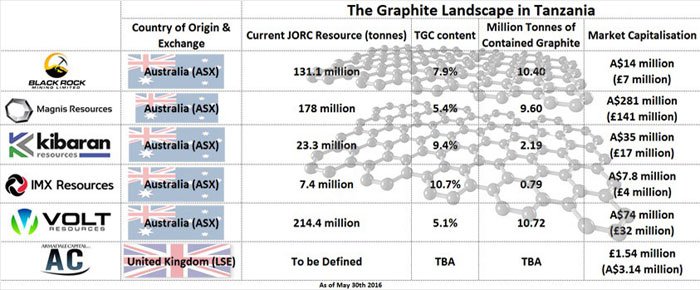

With ACP now settling into its new digs, let’s take a look at the Tanzanian graphite pool compared and contrasted. You can see the stark differences in valuations and the gap that ACP are looking to grow into over the coming months:

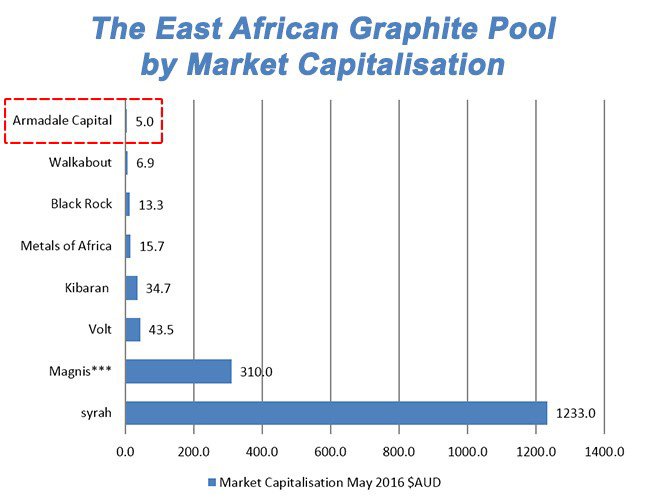

And here’s the entire East African hoard of graphite explorers, compared by market cap. As you can see, ACP is the equivalent of a tadpole swimming with whales in the form of Syrah and Magnis.

Note, ACP’s market cap shown above is actually bigger than the current value, which at the time of writing is actually around the $2.55M AUD mark.

For small-cap investors, ACP represents an early-stage stock packed with potential and the real possibility of walking the African graphite development path already carved out by its peers.

ACP’s tenements are surrounded by over 150 million tonnes of “JORC’d” graphite resources which raises hopes of ACP’s exploration eventually defining a strong resource in the hundreds of millions of tonnes – and that would result in a rather large share price appreciation.

Of course, exploration hasn’t begun in earnest yet, so caution is advised when making an investment, please consider your own personal circumstances and risk profile.

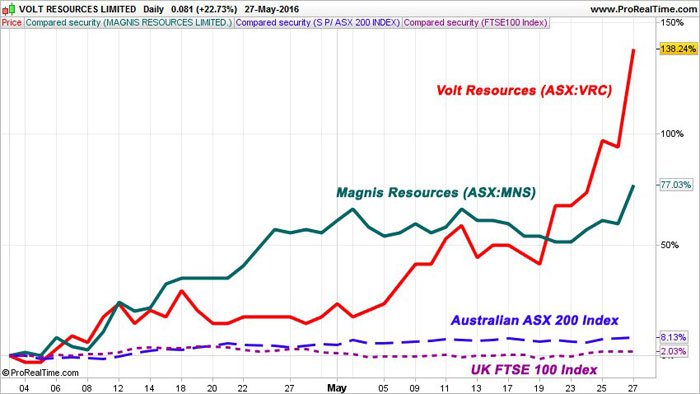

The roll-call of graphite explorers in East Africa is expanding at a rate of knots, and despite any production being some way away, the share price performance of most of the stocks listed above has outperformed major index benchmarks in both Australia and the UK – let’s take a look at Volt and Magnis for instance:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Volt Resources (ASX:VRC) first started its graphite hunt in Mozambique, before moving to Tanzania last year.

A larger player in Tanzania is the fully diluted $337MN-capped MNS which is slightly further ahead in its development than the rest of its peers.

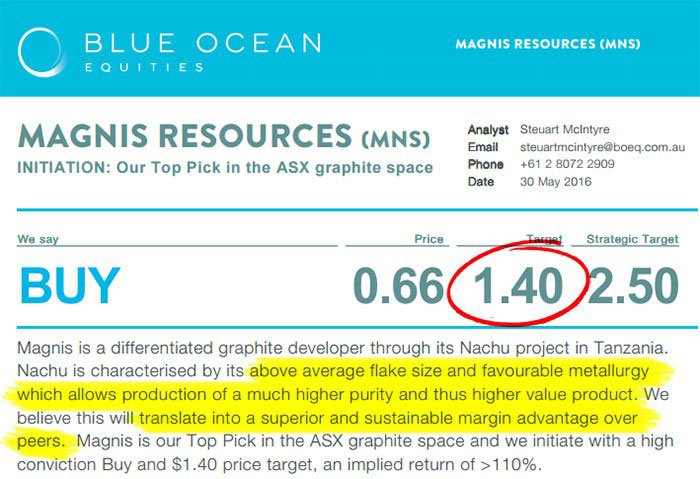

Take a look what Blue Ocean Equities has to say about MNS in research note published in May 2016:

Indicating how the path to successful graphite mining goes, Blue Ocean analyst Steuart [sic] McIntyre, sees MNS pushing on from its current price of $0.78 per share, up to as high as $1.40 — that’s a gain of almost 80% from its current A$312M (£156M) market cap. In the report, Mr. McIntyre cites “above average flake size” and “favourable metallurgy” as the two standout factors that could deliver superior margins and performance.

At the same time, analyst predictions are no guarantee to eventuate – so don’t consider just these reports when you are investing. Consider your personal circumstances and seek professional advice.

ACP is exploring in East Africa – which is synonymous with jumbo flake and natural graphite that can compete with its artificial rival, but at lower prices. MNS is looking to move into production over the next 12-18 months and is anticipating strong margins by producing high-grade natural graphite — whilst early days, ACP would hope to do something similar in the not too distant future.

Initial exploration results on ACP’s project indicate Total Graphitic Carbon (TGC) grades of 13%-24% TGC

Despite just announcing its intention of acquiring the Liandu graphite project, ACP already has some historical drill data to play with.

Reconnaissance mapping done late last year defined a mineralized trend >1.5 km in strike length and up to 500m in width. From this initial mapping, ACP has been able to obtain some initial drill hole data as an indicator of future potential.

Three RC drill holes drilled late last year by the previous vendors showed intercepts of 24m @ 12.9% TGC, 5m @ 21.5% TGC and 10m @ 6.54% TGC.

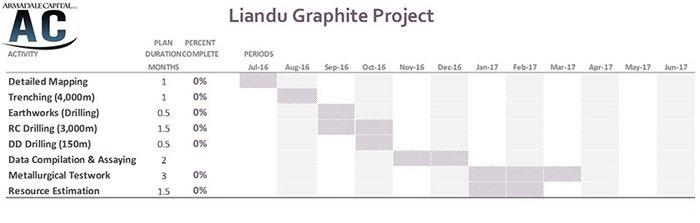

ACP’s next step is to initiate a comprehensive work program at Liandu, set to kick off in July; including mapping, trenching, RC drilling, DD drilling, metallurgical test work, and resource estimation – so there should be plenty of news flow for this stock in the near term.

As assay results come in, ACP could see its valuation rise as long as the TGC grades are sufficiently high and the mineralisation extends.

On the flip side, if its exploration results are deemed insufficient, ACP’s valuation could fall, so seek professional advice when seeking further information about this stock. It’s all part and parcel of commodities investing, and it’s why we would recommend all potential investors to do their own research if considering this stock.

Liandu scheduling puts ACP on track for a Defined Resource in early 2017

One of the most exciting times for any Resources company is the build-up to, and publication of its official JORC Resource.

To give you an idea, Black Rock Mining, ACP’s much higher valued neighbour, defined 80% of its resource in just 8 months.

ACP hopes to prove up a JORC Resource in early 2017 which it can then use to secure offtake agreements, institutional funding and possibly a joint-venture partner depending on the Project specifics.

Here’s a brief outline of ACP’s schedule for the coming 12 months:

As you can see, ACP is currently gearing up to get started in the coming weeks...

...but in less than 12months, we could see a JORC Resource at Liandu thereby helping to revalue ACP significantly.

Not forgetting the glitter of Gold in the Congo

With fast moving times ahead for ACP in the graphite stakes, one could be forgiven for forgetting that this investment company also has an existing JORC’d gold resource that’s on the cusp of entering production.

We are of course talking about the Mpokoto Gold Project in the DRC, and the company is currently awaiting a $20M USD funding package to be finalised.

Let’s take a quick whiz through ACP’s Congolese asset, as this project also has significant upside potential for later this year.

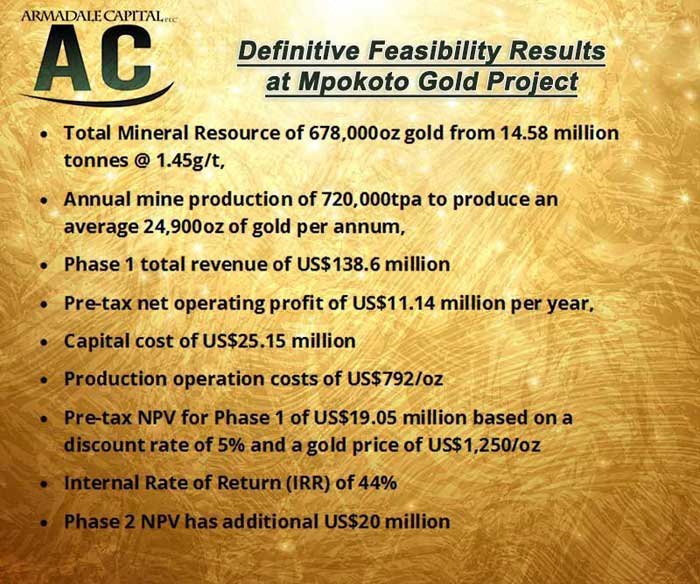

Mpokoto has continued to demonstrate it is a robust low cost gold development project with attractive fundamentals

Here are the highlights of APC’s Mpokoto DFS, published in February:

Recent auger drilling and qualitative sampling of 150 auger holes at Mpokoto shows extensions to previously identified mineralisation, to both the north-west and south-east. This tidy bit of news means ACP’s resource at Mpokoto can grow even larger once ACP does more fieldwork.

The objective of the overall exploration programme is increasing the planned life of mine, which currently stands at four years for Phase 1 production, expanding the current Total Resource beyond the current 678,000oz.

The other interesting aspect here for ACP is the spot gold price

Since the start of the year (YTD), spot gold prices have risen as high as $1,306/oz., a gain of 23% since January.

The higher gold price goes, the more economically viable ACP’s Mpokoto Project becomes without ACP lifting a finger.

ACP’s Feasibility study assumes a gold price of $1,250/oz., but has an expected production cost of $792/oz. So despite gold suffering from a stronger US dollar since 2013, the good news is that ACP can remain competitive even at the lowest gold price we’ve seen since 2013 ($1,046/oz.).

The only outstanding issue is the US$20MN required to construct the necessary infrastructure at Mpokoto which ACP hopes to do imminently after the necessary vis-à-vis due diligence is done between ACP and development partner A-MCS .

Key components of the capital cost include US$8.25 million for the processing plant, US$3.75 million for associated infrastructure and US$8.5 million for other infrastructure.

The US$20 million to be invested in ACP by A-MCS includes financing provisions to fund the processing plant as well as a mining contract to govern provision of mining services moving forward.

In total, ACP has 4 mining licenses valid for 30 years which means ACP could see even further exploration upside at the Mpokoto Project.

ACP’s exploration target is 2.4-3.0 million tonnes grading 1.25-1.5 g/t Au, according to the company. ACP also estimates this should yield an additional 120,000-150,000 oz. to the 225,000oz already earmarked.

With gold and graphite in hand, ACP is pushing on development

With its priorities now squarely in focus, ACP is on the right track.

Gold from the Congo is in its grasp, while its newly acquired graphite project in Tanzania has all the early signs of being a strong high-value asset.

ACP has a diversification mantra built into its operations which should give investors some comfort considering the operational space is Africa — which does carry additional risk compared to more stable parts of the world.

Furthermore, ACP can take heart from seeing lots of plucky Australian explorers, previously of a similar size to ACP, progress their graphite projects to much higher valuations over the course of the last 12-18 months.

With virtually no early stage graphite projects being considered by currently listed AIM companies and given ACP’s latest acquisition, the stock could prove to be rather undervalued at current levels.

It’s worth remembering that the band of Aussie explorers including Volt, Magnis, Kibaran and Black Rock, have all achieved substantial re-ratings as progress towards production was demonstrated to investors.

ACP could be a good stock to leverage the impending graphite/graphene revolution that’s already seen several explorers reach multi-hundred million dollar valuations without a single gram of production.

Can the graphite hype make an antipodean shift over to the UK? We think there is a strong chance.

It would seem those that take early positions could be the first to reap the commercial benefits once graphite begins to be sold in bulk to audacious lithium-battery manufacturers.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.