Exploration Programme Ready for RMX’s Cobalt Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Red Mountain Mining (ASX:RMX) is rapidly progressing its cobalt ambitions at the Mukabe-Kasari Cobalt-Copper Project in the Democratic Republic of Congo (DRC).

The DRC, and in particular the prolific Central African Copper belt, is the world’s largest supplier of cobalt.

The Mukabe-Kasari Cobalt-Copper Project offers significant potential and has artisanal mining that has already demonstrated mineralisation at the location.

The project is located in the Congolese part of the prolific Central African Copper belt, comprising artisanal licenses over approximately 116 square kilometres.

RMX now has its due diligence on the project complete, funding secured, and an exploration programme designed, and intend to commence a systematic exploration programme by the month’s end.

RMX designed the exploration programme at the Mukabe-Kasari Cobalt-Copper Project with the assistance of its technical advisor CSA Global Pty Ltd.

The company has also completed a capital raising of $735,000 to help fund exploration, and completed due diligence on the tenure package to ensure there’s opportunity for sufficient scale, assess geologic prospectivity, and scope future exploration work. The exploration programme will see RMX follow up on its due diligence work which identified excellent cobalt and copper grades at surface.

The upside for RMX here is that no previous systematic exploration has been conducted in the project area, meaning this could be an open book for the company.

Keep in mind that it is early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

All the latest from...

The Mukabe-Kasari Cobalt-Copper Project area is located in the Congolese part of the prolific Central African Copper belt, comprising 12 artisanal licenses over approximately 116 square kilometres.

The project is situated approximately 250km northwest of Lubumbashi and 70km north of the giant Tenke-Fungurume Copper-Cobalt mine. It is approximately 150 kilometres from Ivanhoe’s Kamoa-Kakula project, a stunning and recent world class Copper discovery.

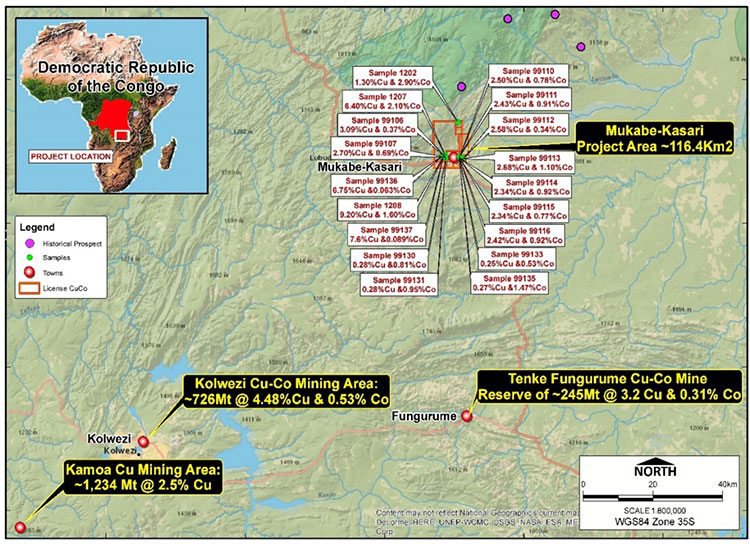

The location of the project within the DRC can be seen in the map below along with its artisanal licences and nearby mining areas:

Figure 1: Mukabe-Kasari Project with selected grab samples as provided by local project vendor

Since we last updated you on RMX back in May , the company has made some important strides at the Mukabe-Kasari Cobalt-Copper Project in the DRC...

Due diligence establishes presence of cobalt mineralisation

The due diligence included a short reconnaissance site visit by RMX’s technical advisor, CSA Global Pty Ltd, who carried out validation ground-work across the tenure package to ensure there’s opportunity for sufficient scale, assess geologic prospectivity, and scope future exploration work.

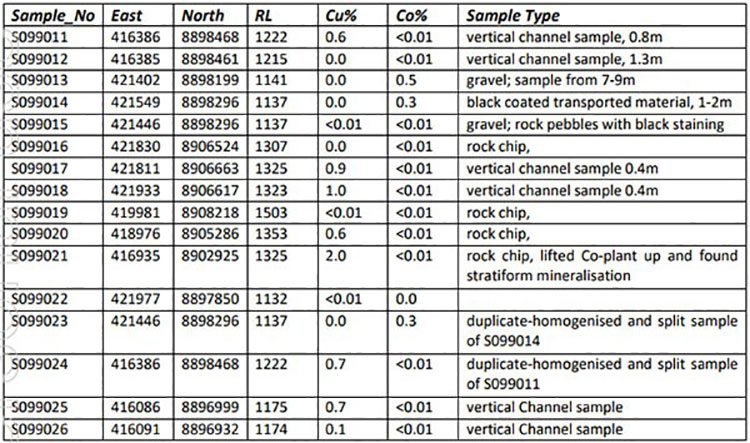

The below samples were taken, including cobalt grades of up to 0.5%.

Capital raised will support exploration activities at Mukabe-Kasari

RMX also announced that it had completed it share placement , receiving firm commitments from professional and sophisticated investors to raise $735,000 (before costs) via the issue of 66,818,182 new fully paid ordinary shares.

The funds raised will go towards earn-in exploration activities at the Mukabe-Kasari Cobalt Copper Project, ongoing identification and due diligence on additional asset and project opportunities, as well as general working capital and costs of the offer.

The Mukabe-Kasari Cobalt-Copper Project area overlies the slopes of the Katanga Plateau where gently folded sedimentary strata of the Upper Nguba and Lower Kundelungu formations are outcropping.

Secondary copper-cobalt mineralisation (malachite, azurite, chalcocite and heterogenite) as disseminated and strata-parallel mineralisation was mapped. Significant secondary cobalt mineralisation was also sampled in palaeo-channels.

The mineralisation occurs on the periphery of the Lufilian Foldbelt of the Congolese Copperbelt which historically was not considered to be mineralized. However, the mineralisation in the Mukabe-Kasari area shows all the typical properties and the geological setting of sediment-hosted copper-cobalt mineralisation.

During its due diligence, CSA Global established that the mineralisation was hosted in at least one, possibly multiple, gently-dipping, interbedded and weathered shallow-marine siltstones and sandstone layers.

Mineralised layers up to 1.4m in thickness were recorded at surface. Disseminated grains and stringers of chalcocite within sandy beds were common and probably represent weathering products of primary sulphide mineralisation.

Anomalous supergene cobalt mineralisation was sampled in several artisanal pits dug into old riverbeds and sampled at a depth of 7 to 9 metres below surface. The mineralisation is open at depth. There was no copper mineralisation observed with this type of mineralisation.

The following image shows secondary copper mineralisation within interbedded shale and siltstones:

This technical due diligence conducted by CSA Global Pty Ltd concluded that the Mukabe-Kasari Cobalt-Copper Project area is sufficiently prospective to warrant systematic exploration work to assess the full prospectivity and the potential of the area to host economic copper-cobalt mineralisation. Several highly anomalous copper and cobalt sample analyses and the discovery of several new locations of outcropping mineralisation resulted from this assessment.

It should be noted, however, that any further catalysts are speculative at this stage and should not be taken as guaranteed. Investors should seek professional financial advice for further information.

RMX proceeding with earn-in agreement

On September 6, RMX announced that it was proceeding with its earn-in agreement in regards to the Mukabe-Kasari Cobalt Coper Project .

RMX was encouraged by the results of its final due diligence on the project, and on this basis decided to proceed with the earn-in to acquire up to 90% of the project in the world famous central African Copper belt.

The final stages of RMX’s due diligence took longer than planned. It wasn’t all bad however, as the delay did provide RMX the opportunity to renegotiate the economics of the staged deal.

The revised and improved commercial terms are as follows:

- The issue of 14 million RMX shares (7.5 million of which will be subject to 12 months escrow), issued pursuant to RMX’s existing placement capacity pursuant to Listing Rule 7.1;

- Payment of $70,000 on commencement of phase 1 exploration;

- Payment of $75,000 90 days after phase 1 exploration commencement, provided that RMX notifies the introducing party, CoCu Pty Ltd, that it wishes to continue with the Project; and

- Payment of US$100,000 on issue of Mining Licence (or equivalent) over the project area or portion thereof.

The announcement outlining the changes to the earn-in agreement along with the capital raising is summarised in the article below:

Planned Exploration Program

Until now, no systematic exploration has been conducted in the project area.

That’s all set to change shortly, with work programmes having been designed to test the copper-cobalt and cobalt only mineralisation targets that were identified during due diligence.

The overall objective of these programmes is to define targets for RC (reverse circulation) or diamond drilling.

The copper-cobalt mineralisation area will be targeted with a systematic geochemical surface sampling and pitting programme to establish the lateral extent of mineralisation, the number of mineralised beds and thickness of individual beds.

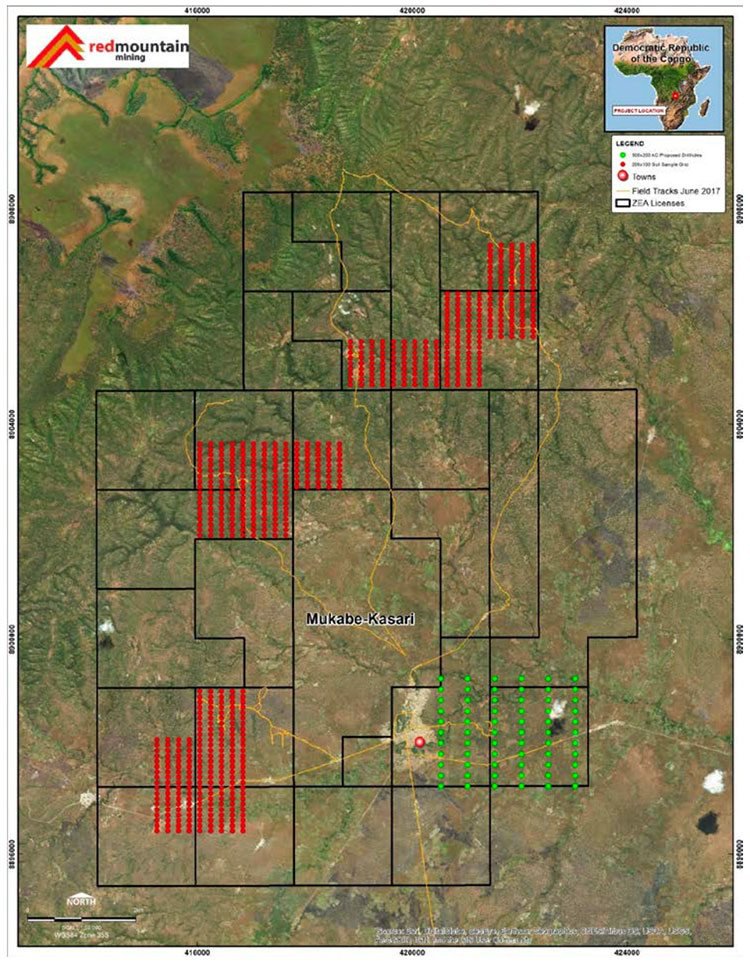

An AC (air core) geochemical drilling programme is planned for the cobalt mineralisation area. The objective is to determine the distribution, grade and host rock properties of this target area. The holes are planned to be drill on a 500 by 200 metre grid and to a depth of 20 to 30 metres. A total of approximately 1,000 metres of drilling is budgeted.

About 1,000 samples on a 200 by 100 metre grid over three areas will be surveyed as part of the phase 1 geochemical exploration work, as shown below:

RMX’s technical advisor, CSA Global, has reported that the mineralisation at the project is hosted in at least one, possibly multiple, gently-dipping, interbedded and weathered shallow-marine siltstones and sandstone layers. Mineralised layers up to 1.4 meters in thickness were recorded at surface.

The exploration plan stipulates work programmes designed to test the copper-cobalt and cobalt-only mineralisation targets, with the aim of defining targets for drilling.

Here is a summary of the announcement from finfeed.com:

It should be noted that this is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

Update on the Red Valley Lithium Brines Project

While the Mukabe-Kasari Cobalt Copper project is currently receiving most of the attention, RMX continues to progress its Red Valley Lithium Brines Project in the US state of Utah.

In late May, RMX published an update on it progress at Red Valley . Progress on drill hole 2 at the project was slower than had been anticipated due to inclement weather, including unusually late snowfall. Additionally, a hard basalt aquifier zone was encountered at 130 feet with higher than expected amounts of water overflow which ultimately caused a loss in circulation to the open hole rotary drill.

To address this, the drill was converted to a Reverse Circulation (RC) system and the Robit casing advanced tooling system was implemented.

This new strategy has meant further time delays, but that said, the most recent update from onsite personnel has been very positive.

RMX, along with its JV partner, has decided to extend hole 2 to a depth of 1300-1500 feet to test and determine the maximum amount of water producing zones available.

RMX powers ahead in DRC

While drilling is ongoing at Red Valley, the major focus remains on the huge potential in the DRC and its highly prospective Mukabe-Kasari Cobalt Copper project.

RMX is well funded following the successful completion of its capital raising, and with its exploration programme planned, it is looking forward to commencing Phase 1 exploration activities at the Mukabe-Kasari Cobalt Copper project.

The company is also keeping an eye out for complementary assets for acquisition as it continues to review new opportunities in the new energy metals, base metals and gold sector.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.