Drilling Underway for Navarre Amid New Victorian Gold Rush

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

“For the best part of 50 years Victoria’s historically rich goldfields have been a basket case, given lack of government support and disastrous big-ticket attempts to revive the underground Bendigo and Ballarat mines. Now, the region is in the midst of a latter-day gold rush”, reports The Australian.

This regional gold revival was headed by Canadian miner Kirkland Lake Gold (TSE:KL | ASX:KLA) that has developed the Fosterville Gold Mine, 25 kilometres from Bendigo, into one of the world’s highest grade, most profitable gold mines.

Fosterville has ore reserves of 2.7Moz at 31 g/t gold and expected production of up to 610,000oz per year over the next couple of years.

Yet the C$10+ billion capped gold major is far from being the region’s only gold play.

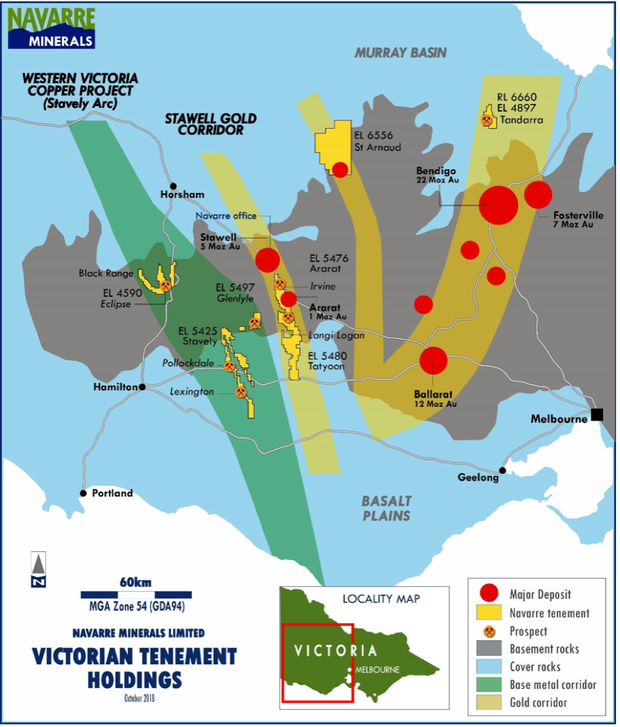

ASX junior Navarre Minerals (ASX:NML) is wasting no time in executing its gold strategy across its portfolio of projects with exposure to Victoria’s two exploration hotspots – north Bendigo as well as the emerging Stavely Arc mineral province.

Navarre has a well-defined and fully funded drilling program focussed on multiple strategic areas.

The company's aggressive 50,000m drilling program is using four drill rigs focused on five key project areas, including exploration in the Stawell Gold Corridor, best known for the 4Moz Magdala gold deposit, at Tandarra and within the Stavely Arc.

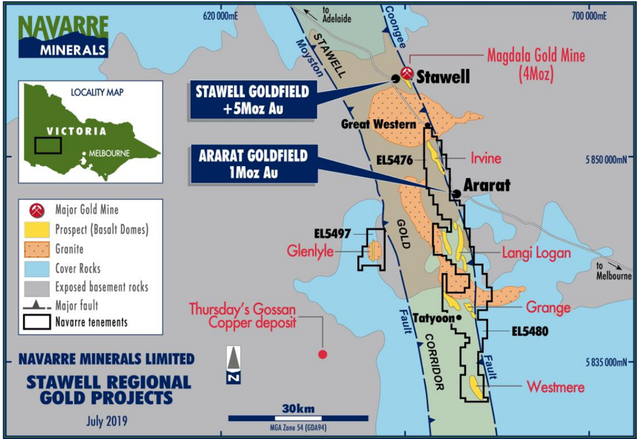

At the Stawell Corridor Gold Project, NML is searching for large gold deposits in an extension of a corridor of rocks that host the 5Moz Stawell and 1Moz Ararat goldfields.

A 17,000m drilling program is underway at NML’s 60 kilometre long Stawell Corridor Gold Project and first results were received in December, enhancing the potential scale of mineralised systems.

Navarre’s second of its advanced projects, the Tandarra Project, a Joint Venture (JV) with Catalyst Metals (ASX:CYL), is in the Bendigo Gold Corridor and located close to the Fosterville Gold Mine, owned by its largest shareholder, Kirkland Lake Gold. A 25,000m drilling program has resumed at its Tandarra JV recently, with a strong flow of drill results expected in 2020.

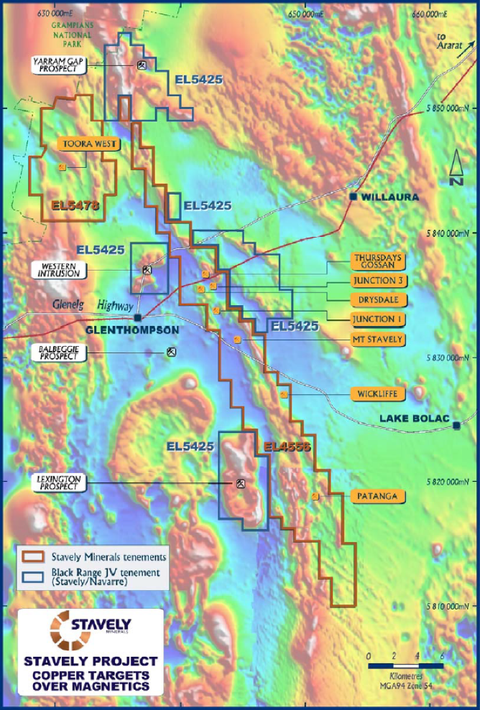

Additionally, Stavely Minerals (ASX:SVY) is earning up to an 80% interest in Navarre’s EL 5425 Stavely property by targeting volcanic massive sulphide (VMS), epithermal and porphyry copper-gold deposits in the Stavely Arc volcanics.

Navarre has also embarked on a 9,000m drilling program at its other two copper – gold properties within the Stavely Arc in December 2019 where it has drill ready targets. This follows a significant shallow high-grade copper-gold discovery by SVY at the Stavely Copper-Gold Project in September 2019 that saw the company’s share price rally by more than 45%.

With plenty more drilling in store, it’s worth keeping an eye on Navarre as it progresses exploration amid the current strong sentiment toward the Victorian gold and base metals industry.

Catching up on all the latest from...

Share Price: $0.11

Market Capitalisation: $52.6 million

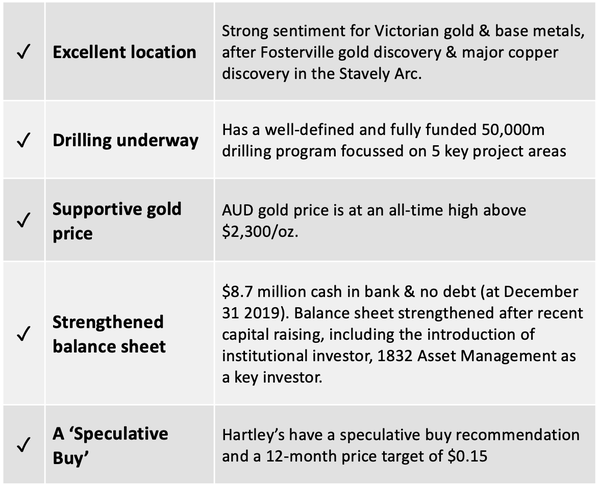

Here's why I like Navarre Minerals...

Navarre Minerals Limited (ASX:NML) is creating shareholder value from a portfolio of early to advanced stage gold projects in Victoria, Australia.

The rise in NML’s share price has been supported by a number of recognisable investors. Kirkland Lake is a 10% shareholder and the Victor Smorgon Group has 9%, while reputable Canadian fund manager 1832 Asset Management invested in two placements in 2019 to become an 8.5% shareholder.

The interest in Navarre and its exploration projects has been supported over the past five years by the rise in the AUD gold price.

Navarre operates across a number of gold-copper projects in western Victoria. It is currently targeting volcanic massive sulphide (VMS), epithermal and porphyry copper-gold deposits in the Stavely Arc volcanics.

Navarre is also searching for gold deposits at its 60-kilometre-long Stawell Corridor Gold Project, located in an extension of a corridor of rocks that host the 5.0 million ounce Stawell Goldfield and the 1.0 million-ounce Ararat Goldfield.

Here, the company’s primary focus is the discovery of gold on the margins of NML’s most advanced prospect, the Irvine basalt dome, and high-grade gold in shallow drilling at Langi Logan. These projects are located 20 kilometres and 40 kilometres respectively south of the operating Stawell Gold Mine.

Here’s Morgans Senior Analyst Chris Brown speaking to Navarre Minerals’ MD Geoff McDermott at the Noosa Mining & Exploration Conference 2019 in July last year about its Stawell projects:

Stavely Arc Projects

At Navarre’s Stavely Arc Projects, or Western Victoria Copper Project, Navarre is targeting large volcanic massive sulphide (VMS), epithermal and porphyry copper-gold deposits.

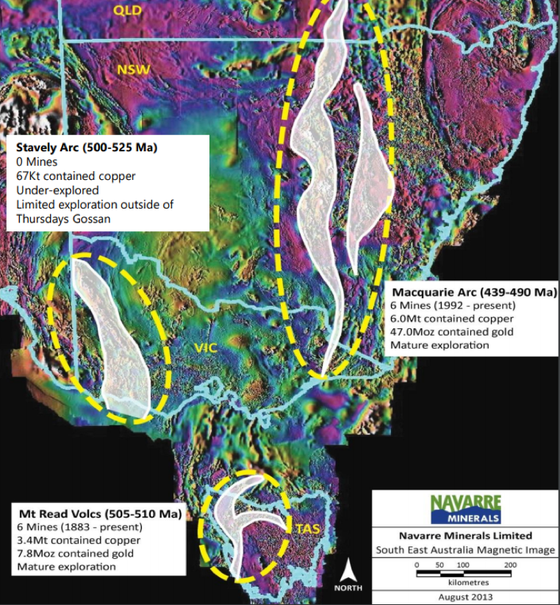

Stavely Arc is one of three volcanic arc systems in SE Australia:

Volcanic arcs host large mineral deposits, including:

- Porphyry copper (Macquarie Arc: Cadia Valley & North Parkes)

- Epithermal (Mt Read: Henty; Macquarie Arc: Lake Cowal)

- VMS (Mt Read: Mt Lyell, Rosebery, Hellyer)

- Ultramafic shear-hosted nickel (Mt Read: Avebury)

Stavely Arc is said to be comparable to Macquarie Arc and Mt Read Volcanics, but at an earlier stage of exploration. It is also recognised as a continental margin arc setting similar to the Andes in South America, host to some of the world’s largest known copper deposits.

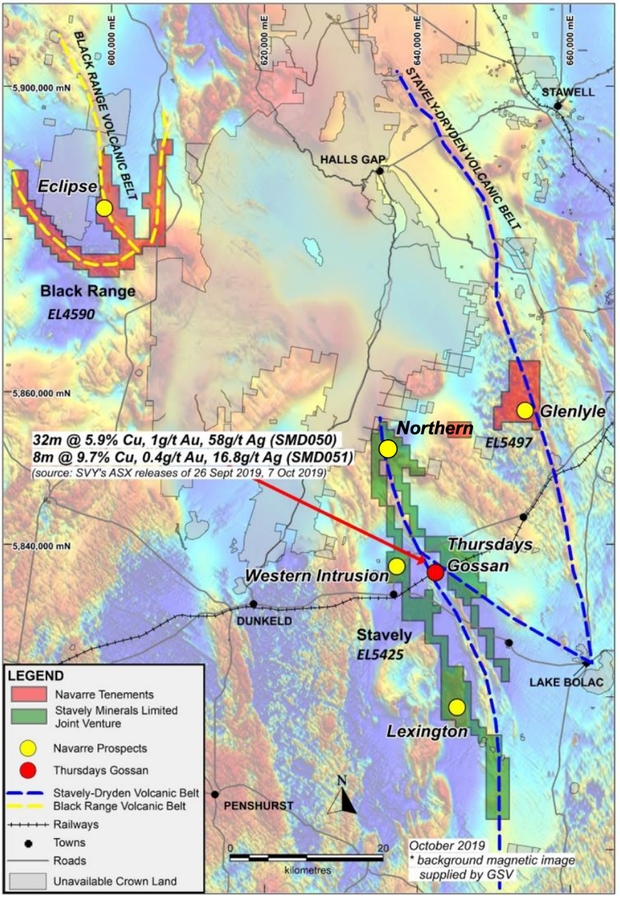

Navarre’s project area captures multiple polymetallic targets in three 100% owned project areas — Glenlyle (EL 5497), Black Range (EL 4590) and Stavely (EL 5425).

EL 5425, is subject to a farm-in agreement with Stavely Minerals Limited (ASX:SVY), where SVY may earn an 80% interest by spending $450,000 over five years.

EL 5425 surrounds Stavely’s wholly owned EL 4556 tenement that contains the recent Thursdays Gossan copper discovery.

Last September, SVY reported a stunning shallow high-grade copper-gold discovery, the first significant find in the Stavely Arc volcanics. Assay results from the first diamond hole, SMD050 intersected semi-massive sulphides assaying 32m @ 5.9% copper, 1 g/t gold and 58 g/t silver with some assays grading up to 40% copper.

Those results were a major exploration win, alongside visual observations of drill core from a second step-out hole located 160 metres to the south-west that also encountered a thick zone of massive to semi-massive mineralisation over a down-hole width of around 60 metres.

SVY shareholders liked the news, sending the share price to 86 cents from 24 cents prior all within a single day’s trading.

A fortnight after this discovery (that featured 32 metres at 5.9% copper, 1 g/t gold and 58 g/t silver from 62 metres, including 12 metres at 14.3% copper and 2 metres at 40% copper), SVY released further results from step-out diamond drilling located 160 metres along strike to the south-east of the discovery hole with assay results (of 8m at 9.7% copper, 0.4 g/t gold and 16.8 g/t silver from 177m).

Those further results have since seen the company trade as high as $1.42 — a gain of around 500% since the discovery was announced in September 2019.

Here’s the performance of Stavely Minerals over the past year. Note the sharp spike (in price and volume) following a high-grade copper-gold discovery at the Thursday’s Gossan prospect, part of the Stavely Copper-Gold Project, including “stunning grades of up to 40% Cu”.

A quick look back over the Navarre chart earlier also reveals a spike in NML’s share price on news of SVY’s results.

In the map below you can see the Thursday Gossan copper deposit, surrounded by EL5425 (shaded in green) — the subject of SVY’s earn-in.

Stavely Arc projects drilling program

Navarre is targeting large VMS, porphyry copper-gold and epithermal deposits similar to Thursdays Gossan. Stavely Arc mineral systems are likely, yet they remain undiscovered due to 99% of the volcanics being concealed by shallow younger cover.

In October 2019, Navarre completed a $4.74 million Share Placement to pursue exploration programs at various prospects within the emerging Stavely Arc mineral province, as well as providing flexibility to expand the scale of drilling activities in the Stawell Corridor Gold Project.

In late December 2019, diamond drilling commenced at two properties within the Stavely Arc: at the Eclipse prospect within the Black Range Project; and at the Yarram Gap (formerly Northern) prospect within the Stavely Project.

Navarre commenced a 1,200m drilling program of up to 3 diamond holes to test an IP chargeability anomaly as a possible source of a shallow enriched copper blanket at the Eclipse prospect. At the end of December 2019 the first diamond hole was at a depth of 105m. The drilling program at Eclipse is expected to be completed this quarter.

Separately, Stavely Minerals, as manager, is interested in looking for Thursdays Gossan analogues at the Yarram Gap prospect as part of their earn-in commitment on Navarre’s EL 5425 property.

We can expect results of the current drilling operations once the program is complete later in the quarter.

To assist with drill hole targeting, Navarre recently completed an airborne VTEM survey at the 100% owned Glenlyle Project. On receipt of results from the VTEM survey, Navarre will also commence AC (~6,000m) and diamond drill (~2,000m) testing of geochemical and potential geophysical targets.

While at the Stavely Project (EL 5425) a downhole electromagnetic (DHEM) survey will also be conducted on the recently drilled holes at the Yarram Gap prospect to detect if there are any off-hole conductors within a radius of ~200m of the drill holes. Selective sampling and assaying on both completed diamond holes will also take place.

Stawell Corridor Gold Project

Navarre has a dominant position at its Stawell Corridor Gold Project, with 100% ownership of 60 kilometres of strike located within 50 kilometres of existing mining infrastructure.

It is searching for gold deposits in an extension of a corridor of rocks that host the 5Moz Stawell goldfield and the 1Moz Ararat goldfield, “The Stawell Gold Corridor”.

A key feature of major gold deposits along the Stawell Gold Corridor is that they are hosted in meta-sediments on the margins of Cambrian basalt domes, the best example of this style of mineralisation being the 4Moz Magdala gold deposit at Stawell.

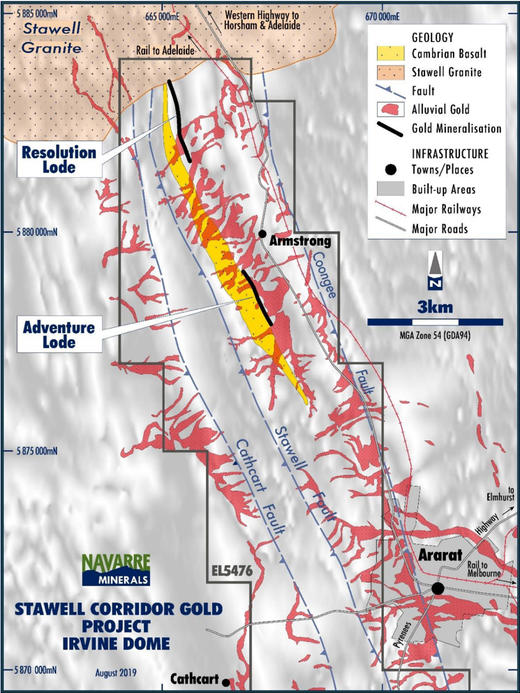

To date, Navarre has identified seven basalt dome structures within its 60km long tenement package. Specifically, the significant regional potential of the Stawell Gold Corridor is demonstrated by Navarre’s discoveries at the Irvine and Langi Logan prospects where gold is proximal to large basalt dome structures.

In mid-October 2019, the company commenced a 17,000m drilling campaign comprising:

- 6,000m of diamond drilling targeting depth extensions to shallow gold mineralisation at Resolution and Adventure lodes on the Irvine basalt dome; and

- 11,000m of air-core (AC) drilling to test multiple targets on the margins of the Langi Logan basalt dome and to expand the strike length of the gold mineralisation north of Resolution Lode.

First drilling results at Stawell Corridor Gold Project

In December, Navarre announced that it had received first results from diamond drilling and air-core drilling for two prospects within its long Stawell Corridor Gold Project where it is testing the potential for multi-million-ounce gold systems.

This initial drilling focused on testing depth extensions at the shallow Irvine gold discovery as well as testing priority targets identified at the Langi Logan prospect to enhance the potential scale of mineralised systems. These projects are located 20 kilometres and 40 kilometres respectively south of the operating Stawell Gold Mine.

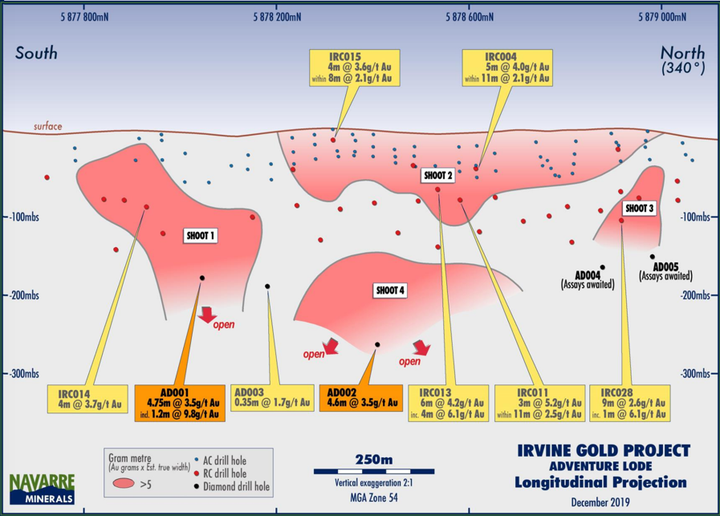

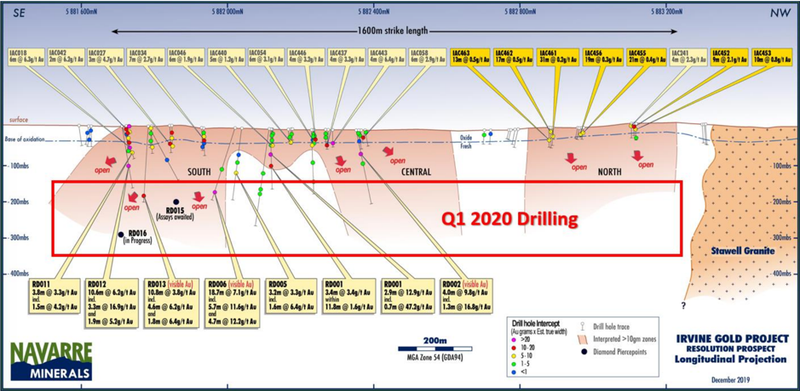

Irvine prospect – Resolution and Adventure lodes

The Irvine basalt dome is Navarre’s most advanced prospect.

Previous drilling here confirmed extensive shallow gold footprints at the Resolution and Adventure lodes with a combined strike length of 2.9km along the eastern contact of the Irvine basalt dome.

Navarre is now testing the depth extents of the gold shoots at both lodes down to approximately 300m below surface through a 6,000m diamond drilling program.

Two diamond drill rigs have been operating since mid-October 2019: one at Adventure Lode and one at Resolution Lode. Navarre has also completed a 1,000m air-core (AC) drilling program to expand the known mineralised strike of the Resolution Lode.

Drilling already confirms the mineralised quartz–sulphide structures occur in geometries similar to the gold shoot patterns of the on-strike 4Moz Magdala Gold Mine.

Down-plunge extensions of gold mineralisation confirmed at each of the Resolution and Adventure lodes, with first three deeper diamond holes confirming gold mineralisation continues to at least 300m depth and remain open.

Results for three of five diamond holes completed at Adventure Lode have been received —

significant intersections include:

- 4.75m @ 3.5 g/t Au from 206.9m downhole, including 1.15m @ 9.8g/t Au in AD001

- 4.6m @ 3.5 g/t Au from 327.3m downhole in AD002

All five diamond holes targeted the interpreted down plunge positions of four identified gold shoots:

Shallow air-core drilling at the northern end of Resolution Lode provides evidence of a potential new gold shoot which will now be assessed with diamond drilling. A best result of 9m @ 2.1 g/t Au from 6m was returned.

Navarre expect for the first round of deeper expansion drilling at Adventure and Resolution lodes to be completed during the first quarter of 2020, with results to be reported over the coming months as they become available.

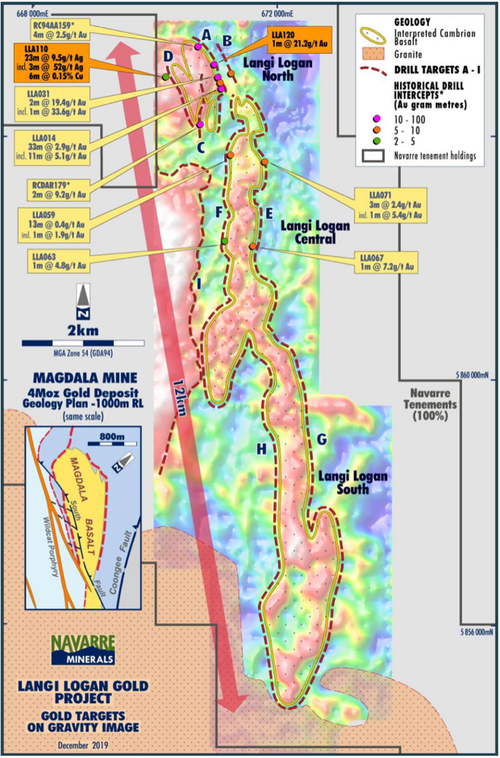

Langi Logan prospect

The Langi Logan basalt dome is the next major prospect for Stawell Magdala-style gold mineralisation 20km south of the Irvine basalt dome within the Stawell Corridor Gold Project.

It consists of the Langi Logan North, Langi Logan Central and the Langi Logan South Cambrian basalt domes with a combined 12 kilometre strike length and occurs in an area of significant historical Deep Lead gold production (133,000oz of gold recorded).

While at an early stage of exploration, the Langi Logan prospect is already showing good potential to be a new gold system similar to the Magdala gold deposit at Stawell.

Along with the Irvine prospect results, first results from an ongoing 10,000m AC drilling program that commenced in November 2019 and is testing multiple priority targets on the margins of the Langi Logan basalt dome were received in December 2019.

A highlight intersection of 1m @ 21.2 g/t gold confirms shallow high-grade gold mineralisation over a strike length of 650m at Target A for follow-up diamond drill testing.

Five drill rigs (four on NML’s 100%-owned projects and one on Tandarra JV) are now active across Navarre’s 100%-owned Victorian gold and base metals properties as part of the 50,000m drilling campaign, providing strong news flow in 2020.

Over the coming quarter, NML plan to complete current phase of reconnaissance AC drilling (~6,000m remaining) to assess various targets along the 12km strike length of the Langi Logan basalt dome, receive results for a recently completed VTEM survey, and commence diamond drill testing on Target A (~1,000m).

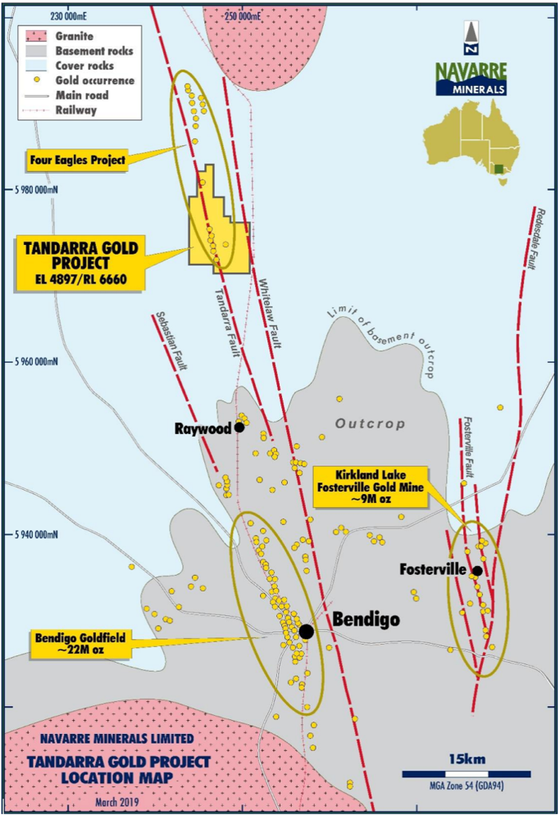

Tandarra Gold Project

The high-grade Tandarra Gold Project is located in the nearby Bendigo Gold Corridor, 50 kilometres northwest of Kirkland Lake Gold’s world-class Fosterville Gold Mine, and 40 kilometres north of the 22Moz Bendigo Goldfield.

Exploration at Tandarra, a JV with project manager Catalyst Metals (Navarre 49%), is targeting the next generation of gold deposits under shallow cover in the region.

Tandarra is an advanced Bendigo analogue exploration project under shallow cover with high gold grades associated with several quartz reef structures. It has similar gold footprint to the Fosterville (~9Moz) and Bendigo (~22Moz) goldfields.

Assays up to 131 g/t Au have been returned from recent drill programs covering a 1.1 kilometre strike length.

Upcoming drilling will follow up a successful six diamond hole program at Tandarra while there are several lines of reef that require further exploration.

The 25,000m campaign of AC, RC and diamond drilling is targeting extensions to the Tomorrow and Macnaughtan prospects as well as testing several regional targets in basement rocks under shallow Murray Basin cover.

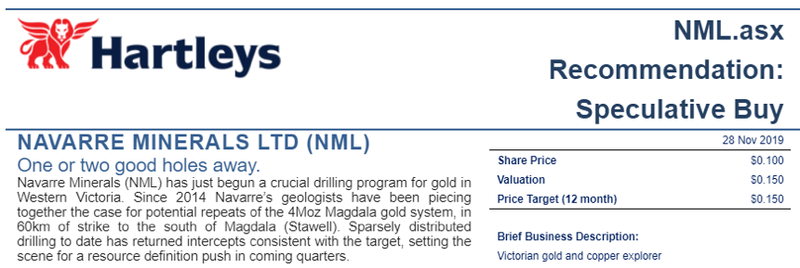

Hartleys say ‘Buy’

Hartleys initiated coverage on the company back in November with a Speculative Buy recommendation and a 15 cent price target — a 50% premium to the $0.10 share price.

The broker notes that since 2014 Navarre’s geologists have been piecing together the case for potential repeats of the 4Moz Magdala gold system, in 60km of strike to the south of Magdala (Stawell). Sparsely distributed drilling to date has returned intercepts consistent with the target, setting the scene for a resource definition push in coming quarters.

Finfeed summarised the report:

2020 is looking bright for NML

Navarre is on track to execute its drilling campaign of approximately 50,000m by June 2020. It has a clear and strong outlook for the near term driven by:

- Strong sentiment toward the Victorian gold and base metals industry, not only from the phenomenal finds at Kirkland Lake’s Fosterville but now also the major copper discovery by Navarre’s earn-in partner, Stavely Minerals, at Thursday’s Gossan;

- Well defined and fully funded drilling program focussed on multiple strategic areas;

- Potential for Navarre to be in a position to declare a maiden mineral resource at the Stawell Corridor Gold Project during 2020; and

- Strengthened balance sheet from the recent capital raising, including the introduction of institutional investor, 1832 Asset Management as a key investor.

Navarre’s recent share price performance reflects this outlook and provides good momentum, while the company may be just one or two good holes away from a significant discovery.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.