Investment Memo:

Titan Minerals Limited

(ASX:TTM)

-

LIVE

Opened: 01-Mar-2022

Shares Held at Open: 4,249,250

What does TTM do?

Titan Minerals Ltd (ASX:TTM) is an exploration and development company on the hunt for world class gold and copper assets in the emerging global minerals hotspot, Ecuador.

What is the macro theme?

Gold remains a safe haven investment and hedge against inflation, and has historically outperformed in times of volatility (e.g market bubble crash, armed conflicts…).

Bullish gold market conditions persist, particularly with the go-to response to the pandemic being unprecedented worldwide monetary and fiscal stimulus (i.e. ripe conditions for sustained inflation).

Copper demand is set to grow from its already robust position on the back of unprecedented stimulus spending on infrastructure and construction projects globally.

Our Big Bet for TTM

We want to see TTM prove up a $1BN plus copper or gold discovery in Ecuador which is so attractive that a mining major acquires the company

Why did we invest in TTM?

Prime gold/copper real estate

TTM is an early mover in securing prime real estate within one of the world’s latest exploration and mining hotspots - Ecuador. TTM owns several exploration and development assets in the country. Ecuador has only recently become an attractive exploration and mining jurisdiction through improved and stable legislation. With Ecuador mirroring the geology of several of its mining-rich neighbouring nations, there is a good opportunity for big discoveries still to be made here. TTM could appeal to larger mining groups now seeking to attain or grow a significant land position within this hotspot.

Flagship project already with a big resource base

TTM’s Dynasty gold project has a “foreign resource estimate” of 14.5Mt @ 4.53 g/gold + 36g/t silver for a total contained resource of 2.1Moz gold + 16.8Moz silver. TTM is drilling in order to re-classify the resource to JORC standards, with potential upside of further growing the deposit. This could form the basis of a possible local mining operation down the track.

Copper side bets

TTM has two highly prospective copper projects in their pipeline, not far from where several major copper discoveries have been made of late. These provide blue-sky potential upside, should a discovery be made.

What do we expect TTM to deliver?

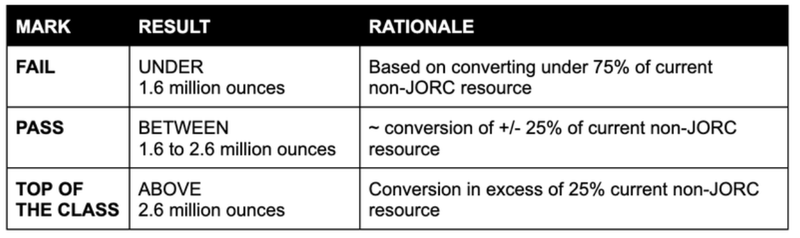

Objective #1: Resource conversion to JORC standards at Dynasty

- We would like to see TTM convert their existing ‘foreign estimate’ resource into a maiden JORC resource estimate this year.

- We also want to see extensional drilling produce an expanded exploration target that highlights the potential to grow the current resource base.

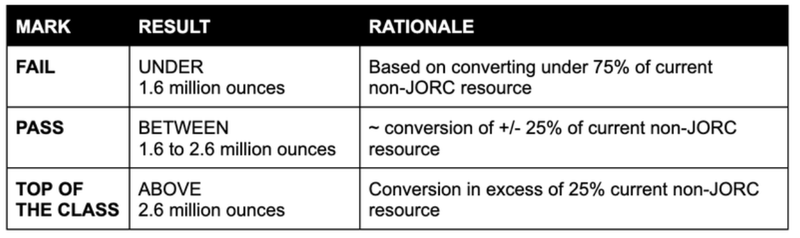

Here is how we will rank the JORC resource estimate result (our opinion only):

Objective #2: Follow-up drilling at Linderos

- With promising early exploration results late last year, it shouldn’t take too long for TTM to prioritise the prospects at Linderos, and generate numerous drill targets.

- Follow-up drilling at the targets is already underway, and we anticipate assays in 2Q22.

Objective #3: Commence drilling at Copper Duke

- Following the recent recon-drilling program alongside ongoing geophysical surveys and geochemical soil sampling, TTM should be in a position to define drill targets for 2H22.

- We want to see an extensive drilling program later this year, with initial assay results before year-end. This will shed light on the potential for Copper Duke.

Capital requirements

TTM is not a producer, remaining an explorer, and so requires continuous funding as it continues to advance its assets. As such, the company will be required to raise capital for survival when the current cash at bank drains. However, there is no guarantee that capital markets will be conducive at that point. We note that they have a substantial cash balance at present, which minimises this risk for 2022.

Underlying commodity risk

TTM is exposed to commodity price risk, which depends on macroeconomic factors and demand and supply dynamics of the underlying commodities, i.e. gold and copper. Market sentiment closely correlates with commodity prices, and hence TTM’s valuation will be impacted by commodity prices as well. There is no guarantee that gold and/or copper sentiment will trend positively this year.

Geological risk

The resource for the flagship project is an estimate only, and there is no guarantee that the current “Foreign resource estimates” is substantially converted into JORC resources. Even if the JORC reclassification occurs, it could be at a much lower grade, size or level of confidence, which would impact its value.

Sovereign risk

TTM’s prospects are all located in the developing nation of Ecuador. There is no guarantee that local authorities and/or communities will favour development of TTM’s prospects, and so could hinder advancement.

What is our investment plan?

We first invested in TTM at 6.67c and increased our position again at 10c in anticipation of the JORC resource estimate on its Dynasty gold project.

We intend to de-risk our investment keeping 80% of our position in the lead up to the JORC resource definition.

We plan to sell up to 50% of our investment in TTM if the share price increases 4-fold from our initial investment price in the lead up to the JORC resource.

Depending on the outcome of the JORC resource estimate, our investment strategy for TTM will change:

- TOP OF CLASS OUTCOME - We will de-risk our position if the share price increases 4-fold from our initial investment price.

- PASS OUTCOME - we will likely hold on to our TTM position and evaluate the project's merits going forward based on the gold price at the time.

- FAIL OUTCOME - we will need to evaluate the merits of TTM’s other projects at the time, either buying back into the stock at a lower price or selling a portion of our holding to de-risk.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 4,249,250 TTM shares at the time of publication. S3 Consortium Pty Ltd has been engaged by TTM to share our commentary and opinion on the progress of our investment in TTM over time.