What Happened? Is The Small cap market back?

Published 09-MAR-2024 11:00 A.M.

|

16 minute read

For a third week in a row...

It feels like some interest is creeping back into the small cap end of the market.

Lots of back to back green days in our Portfolio and watchlist.

A welcome relief after almost 2 years of writing about how tough small cap markets have been.

Let’s not jinx it by talking about it anymore today, and see what next week will bring.

For this weekend, our roving analyst has filed their final report in this series, this time from the PDAC mining conference in Toronto, Canada:

Last stop, eh?

I’m in Toronto for the annual PDAC conference.

It’s certainly a different vibe to the Indaba conference in Cape Town.

And definitely very different from my recent experiences in Arkansas.

The mood is a bit less vibrant - except for the uranium people and maybe the copper folk.

Australians are easily the happiest people at the conference - I could almost sense the envy from the Canadian mining companies.

I heard from the inventor of the “Lassonde Curve”, Pierre Lassonde, learned first hand what Kazakhstan is doing to make itself a resource superpower and checked in on a few of our portfolio companies.

Here is the quick version of what I learned at the conference:

- Uranium people are pumped up in a big way - these people have waited a long time for this moment in the market and are working hard to capitalise on it.

- Australia remains a model for how to be a mining country - on multiple occasions, Canadians upheld Australia as an example of how to do mining well. Lassonde and others said mining in Canada has gone backwards over the last 20 years.

- Pierre Lassonde loves copper - Lassonde is one of Canada’s most famous mining and finance personalities. He had plenty to say about copper’s role in electrification.

- Kazakhstan is funding a nationwide geophysics project, good for investment - we have an Investment in Kazakhstan, and it was standing room only at this presentation. That’s good news for our graphite Investment, Sarytogan Graphite (ASX: SGA), who this week announced their graphite can achieve the purity required for use in nuclear reactors.

- Update from Pursuit Minerals (ASX:PUR) - I spoke with Aaron Revelle, CEO and MD of PUR. Drilling has just started at PUR’s Argentinian lithium project,

- Update from LCL Resources (ASX:LCL) - I spoke with Jason Stribinkis, former MD of LCL about the company’s projects in PNG.

- Update from Solis Minerals (ASX:SLM) - I spoke to Kevin Wilson, a NED at SLM. SLM has finished drilling for lithium in Brazil and is assessing its future plans.

Uranium people are pumped up in a big way

Tongues were wagging about uranium...

With lithium on the outer for now (hopefully just for a short period), everyone with a pre-existing uranium project was excited to talk.

Those looking to acquire a uranium project, were trying to find the best value in the best spot, naturally.

The uranium spot price remains strongly elevated after a pause for breath, currently sitting at around ~US$93/lb.

I stopped by the Energy Fuels booth to get a sense for the vibe.

Energy Fuels has announced its intention to “aggressively” restart uranium production in the US - with potentially beneficial impacts to interest in our US uranium Investments:

- Global Uranium and Enrichment (ASX: GUE) - GUE is a uranium explorer and developer with projects across four uranium districts in the USA & Canada.

GUE has also acquired a cornerstone stake in a uranium enrichment technology company.

GUE's enrichment technology uses a chemical process which could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies.

The only other ASX-listed company with uranium enrichment technology is ~$1BN capped Silex.

Read: GUE Investment Memo - Gti Energy (ASX: GTR) - GTR is an exploration company targeting Uranium discoveries in Wyoming, USA & Utah, USA.

GTR’s Wyoming projects sit near ~9 central processing plants, with five fully permitted for production. GTR’s projects have the potential to be a part of a regional “hub and spoke” production model.

Read: GTR Investment Memo

Another of our US based uranium Investments, Mandrake Resources (ASX: MAN) is exploring for uranium in Utah, USA recently finding “too hot to handle” highly radioactive rock chip samples - and positive assays from the rock chips that the lab could handle .

Energy Fuels’ White Mesa uranium mill is up and running, and it also has the La Sal mine which is nearby to both MAN and GUE’s projects in Utah.

The guy at the Energy Fuels’ booth was pretty enthusiastic - he said “we’ve been waiting a loooong time for this.”

And why not bask in a bit of uranium glow?

Last time uranium markets were this positive, French multinational nuclear company Areva/Orano was drilling in Senegal on the exact same ground now owned by our African uranium Investment Haranga Resources (ASX: HAR), where drilling is happening right now.

We’re hoping that as sentiment returns, big companies start moving down the value chain to pick up additional resources.

Australia remains the model for how to be a mining country

Despite the fall off in nickel and lithium prices, Australian exploration is still limping along better than Canada - at least as far as junior companies are concerned.

TSX listed juniors have been having a really tough time the last couple of years.

Or depending on who you ask, the last couple decades.

I’ve got the full story on this in just a moment.

But suffice to say, a lot of Aussies that I talked to in and around the conference were pretty comfortable with how things were placed - many were in Toronto seeking to seal a deal with Canadian companies’ projects which were struggling to raise cash in Canada, and bring the projects to the ASX, where risk capital is still available.

It’s fascinating to see how one country’s misfortune can represent a great window of opportunity for other countries.

While I hope Canada’s mining industry comes back stronger – relatively speaking it's good to hear that Australia hasn’t been affected as much by the poor market conditions since the 2021 peak of the bull market.

And a lot of it comes down to big forces at play in the capital markets...

I got to hear from a luminary of the Canadian mining scene, Pierre Lassonde.

Lassonde is the inventor of the “Lassonde Curve” which is often alluded to in our notes.

He had some choice words about the Canadian market.

He also singled out one metal that he thinks has a big future...

Pierre Lassonde loves copper

I was fortunate enough to attend a presentation at PDAC called, “Where will the money come from?” which was part of PDAC’s capital markets program.

Aptly titled presentation.

While there is consensus about the need for critical minerals coming online quickly to enable electrification and decarbonisation, capital markets have recently deserted companies looking to provide critical minerals.

What gives, eh?

High interest rates have made financiers gun-shy about doling out large sums of capital right now (part of the reason we like the idea of low CAPEX projects).

Even when we know that we NEED these projects.

Pierre Lassonde was just one of the guests at this presentation, which was in the form of a panel discussion:

Other members on the panel were no slouches either:

- David Halkyard - Managing Director, Head of Credit Funds at Resource Capital Funds a fund with US$2.5BN in assets under management

- Pierre Lassonde - (read bio)

- John MacKenzie - a copper guru - currently CEO of Capstone Copper

- Adam Lundin - Chair of $10BN Lundin Mining, comes from a long line of mining businessmen in Canada. He was also involved in Africa Oil Corp, our first ever 10x Investment (the Lundin family pulled the Africa Oil Corp deal together).

- Jacqui Murray - Partner, Head of Fund - same outfit as David Halkyard

It’s quite a cross section of Canadian and Australian perspectives.

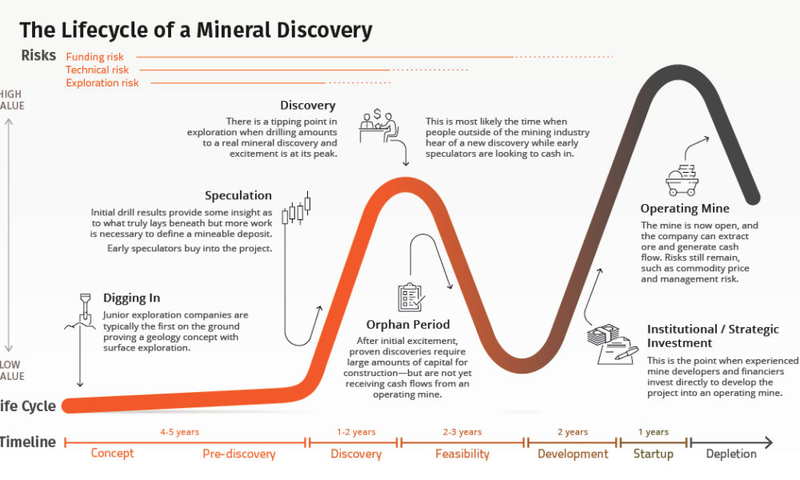

But I want to focus on Lassonde for a bit – he’s the one who came up with the chart that we often share, which can be seen below:

The chart shows the lifecycle of mining companies from exploration, discovery, and development through to production.

The Lassonde curve is a model that shows the typical share price cycle for mining exploration companies.

It outlines how share prices tend to rise sharply after an initial discovery, then decline during resource definition and feasibility studies before rising again as the company moves into production.

It’s very good at explaining phenomena we see every day in the small-cap market.

Lassonde has seen it all, and as a result, he easily had the spiciest comments on the panel.

Maybe because he’s already made his money – maybe because he has the most experience, or maybe because being blunt is what made him successful in the first place.

Lassonde was asked a question about why the Canadian market was so dire for mining companies right now.

He said a lot of it comes down to how the big pension funds allocate capital.

He rattled off facts and figures quickly - at one stage he said that Australia’s superannuation funds have more money in ASX listed lithium companies, than Canada’s pensions funds have in Canadian public equities.

Lassonde bemoaned the fact that so much capital is going overseas, rather than invested locally.

Australia is lucky in its mineral endowments, much like Canada.

It is also lucky that our superannuation funds keep a large amount of capital on the local index.

This has the effect of ensuring major industries like mining, continue to have access to capital that they need.

Even in the bad times.

Granted, the small end of the market in Australia is still suffering.

But we’re hoping the worst is behind us, and we’re looking for more Investments during this period of weak but improving sentiment.

Critical minerals have suffered a bit recently, with only uranium truly shining.

Later in the discussion, Lassonde was asked about critical minerals – a story we’ve been following closely for a couple years now.

Lassonde was straight to the point – he said that when you break it down, there’s only one critical mineral.

Copper.

All electrification efforts rely on it.

This is in all the wiring for just about every application of electricity in the world.

It’s a simple, but clear argument.

We’ve been keen on copper for a while now and are only more keen after hearing this.

If you know any copper companies that you think we should look at reply to this email (even private, unlisted projects)

Kazakhstan is funding a nationwide geophysics project, good for investment

I made an extra effort to make it to see the Kazakhstan program – we’ve got an Investment there called Sarytogan Graphite (ASX: SGA).

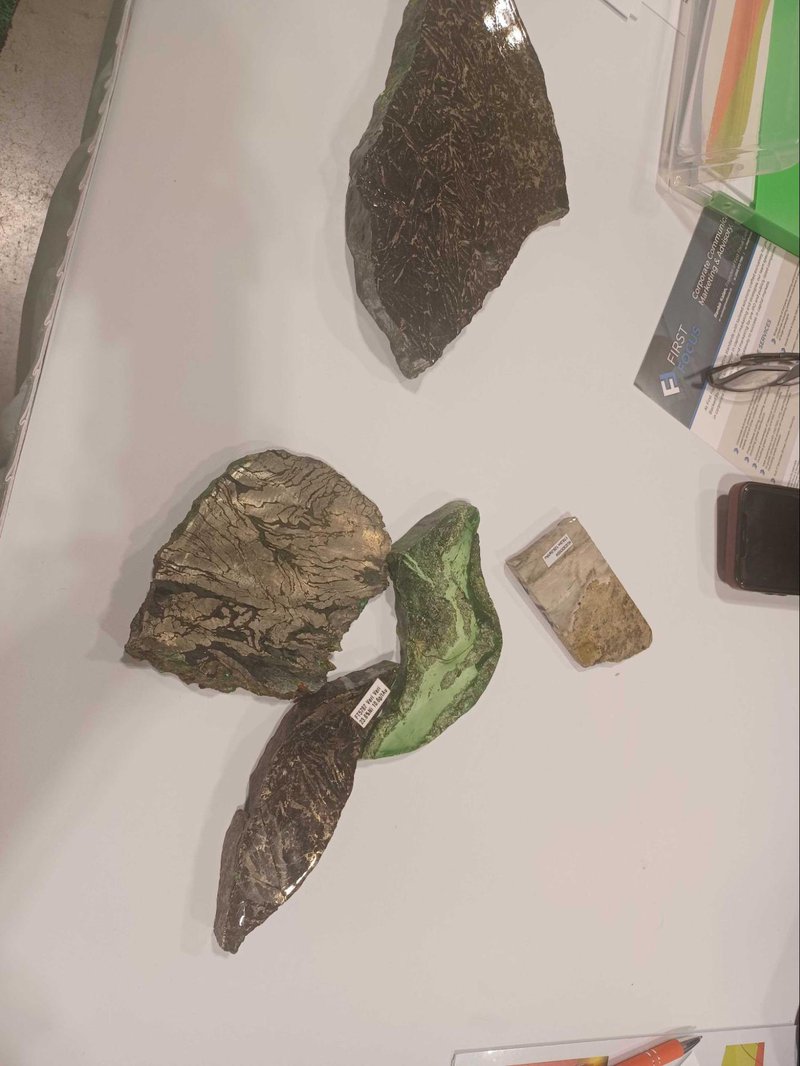

Just before attending the session, I stopped by the country booth which had an interesting array of minerals spread across a map of the country.

Including the amount of reserves found in the country:

For context, SGA has an inferred JORC Resource of 209Mt at a grade of 28.5% TGC (total graphite content) for 60Mt contained graphite. This makes it the highest grade graphite project on the ASX.

Making my way over to the room for the Kazakhstan country presentation, it was standing room only for the four-hour session.

A government official was outlining how they were modernising the industry in the country

After the official spoke – next up was Xcalibur Smart Mapping.

Xcalibur does a host of geological mapping services – including electromagnetic surveys and other geophysics surveys.

Kazakhstan is funding what is called “pre-competitive” geophysics – nationwide.

And Xcalibur is going to help them do it.

The hope is to attract a host of eager exploration companies that can draw upon pre-existing, government funded exploration work.

The perfect kickstart.

The Xcalibur presenter showed how Australia engaged in this kind of work, spending ~$70M which later blossomed into multi-billion dollar amounts of value being generated in the country.

More resources, means more investment and a more stable jurisdiction.

This is good news for SGA, and Kazakhstan could well become the Australia of the steppes if it keeps improving on the mining front.

While I wanted to stay for longer, I was thoroughly jet lagged and went back to the hotel to rest.

Update from Pursuit Minerals (ASX:PUR)

The next day I was able to catch up with a couple of our Portfolio Companies.

I spoke to Aaron Revelle of PUR, our Argentinian lithium Investment which had started drilling that very day at the conference.

Aaron is always upbeat, and I also got a chance to meet PUR’s COO, Alejandro who knows Aaron well from way back:

Alejandro manages PUR’s in country work.

I cheekily asked him whether he supports Boca Juniors or River Plate...

Boca Juniors was the answer.

Having played a lot of soccer with Latinos in my youth, I know that Boca is el club de la gente... (the club of the people).

Great news, Alejandro is easy to get along with.

Aaron is enthused about the next few quarters for PUR - he mentioned the Chinese Giant Gang Feng’s recent acquisition of 15% of the Pastos Grandes lithium project in Argentina’s Salta province for US $70M.

He also says the new Argentinian president (the chainsaw wielding Javier Millei) is keen on slashing red tape, and investing in anything that improves the country’s GDP.

That means infrastructure – especially for industry.

Which also means better roads, PUR’s project is a fair way out in the countryside, so this is a good thing to hear.

We joke about our varying levels of success (really failure) in our soccer careers.

Let’s hope PUR can deliver excellent lithium concentrations over the coming months.

Click here to read our PUR Investment Memo

Click here to read about what we are looking for from PUR’s current drilling program

Update from LCL Resources (ASX:LCL)

Later that day I was able to visit former LCL MD, Jason Stribinkis at the company booth:

It’s been a tough period for LCL, and Jason and the LCL board have arranged for Jason to step away from the company to help conserve funds.

He’s currently involved in a part-time capacity.

LCL has recently been on the hunt for the source of mineralisation for a 45.8% nickel boulder if found at its project.

See below a rock chip from this boulder (the green one):

LCL has been dealt a tough deck – not only has the nickel price cratered, PNG unfortunately has seen a flare up of security challenges.

Jason acknowledges that progress on the nickel front has not fully resonated with the market.

I ask him how the gold and copper side of the PNG projects is looking.

He thinks there’s plenty of potential – gold is at all time highs and copper is looking stronger than before.

Click here to read our LCL Investment Memo

Click here to read our note on LCL’s gold and copper in PNG

Update from Solis Minerals (ASX:SLM)

The morning that I was due to leave, I was able to catch up with Kevin Wilson.

Kevin is a non-executive director (NED) at Solis Minerals (ASX:SLM).

He’s been in the industry for a long time and speaks with a certain calmness over a coffee.

SLM has been drilling for lithium in Brazil, hot on the heels of Latin Resources (ASX: LRS).

We were hoping SLM would be “LRS 2.0” but SLM has failed to deliver any meaningful lithium discovery at two attempts in Brazil.

Compounding the pain has been a poor lithium price.

SLM has already said to the market that the company is looking at “new opportunities”.

Kevin notes that SLM remains well funded.

We both hope that third time could be the charm.

With caffeine sweats starting to form on my brow, I say my goodbyes to Kevin and walk back to the hotel to pack.

Blue sky outlook

Melbourne, Cape Town, Phoenix, Little Rock, Smackover,, New York, Toronto, Melbourne.

By this stage, I’ve seen enough to tide me over for a while.

On the flight back home, I notice there’s another analyst scanning reports in the seat front left of me.

A site visit and report on the German self-storage sector.

Yes.

Really.

The warehouse and cardboard box game.

In Deutschland.

A half smile crosses my lips.

Maybe it's schadenfreude, but I hope not.

Maybe it’s gratitude.

Maybe I’m glad to be headed back.

I look out the window.

Nothing but blue sky.

The stuff small cap dreams are made of.

What we wrote about this week

Emyria (ASX: EMD)

On Thursday, EMD was up 37% on no news.

BUT, the mental health organisation Reach Wellness published a page on its website detailing that it had chosen to partner with EMD.

ABC news then published a feature article and ~3-minute video on EMD detailing the partnership, which could see Reach Wellness fund 50 EMD treatments at $30,000 per treatment.

Read: EMD up 37% on no news yesterday... MDMA Therapy for First Responders

Heavy Minerals (ASX: HVY)

This week HVY signed a non-binding MOU for an offtake agreement that could see it sell ~15,000 tonnes of garnet per year.

A rough, back of the napkin estimate could mean the offtake brings in ~$10M revenues for the initial 3 year period to HVY.

Read: Microcap HVY developing garnet mine - first non-binding MoU offtake is in

Noble Helium (ASX: NHE)

NHE announced this week that the free gas cap found in its Mbelele-1 well could actually be “6x larger than originally mapped”.

A “Free gas” helium discovery is what the market has always wanted to see and now NHE is one step closer to delivering it.

The next step is an upcoming appraisal well...

Read: NHE’s Probable Free Gas Cap 6x Bigger Than Expected? This Upcoming Drill Will Find Out...

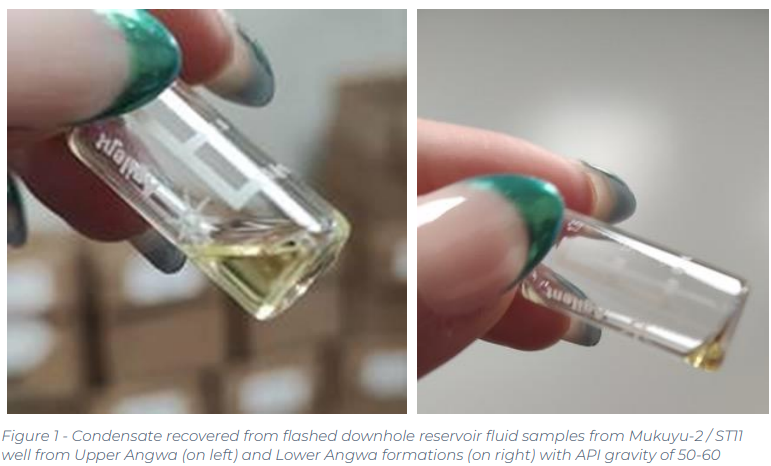

Invictus Energy (ASX: IVZ)

IVZ put out the photo we have been waiting years to see - a sample bottle confirming a rich gas-condensate discovery in their giant Mukuyu oil & gas field.

Read: IVZ Secures Gas Sample From Major Discovery

Pantera Minerals (ASX: PFE)

We put out an Investment Memo on our US lithium brine Investment PFE. In our Memo we detailed:

- Why we Invested in PFE

- Our long term bet for PFE

- The key objectives we want to see PFE achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Read: New PFE Investment Memo - and did lithium sentiment just return?

Quick Takes

PFE increases acreage at its US lithium project

SGA’s graphite now suitable for the Nuclear industry

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.