New financial year, new opportunity for small caps stocks

Published 01-JUL-2023 12:00 P.M.

|

12 minute read

The new financial year is finally here.

Now that June tax loss selling is finished, that means small caps are going to go up, right?

We don’t know.

No one does.

But we DO think things will be better now that the tax loss washout is finished.

With the weight of the May/June selling over, we think more small cap stocks should start rebounding from being oversold over the last few months.

Especially if they deliver material news, now that most final sellers were likely washed out in June.

One stock that looks like it's going to kick things off in July is our Norwegian battery metals explorer, Kuniko (ASX:KNI).

KNI is coming out of trading halt this Monday with a promised “announcement regarding a strategic investment and execution of an offtake term sheet”

We know the details of the deal.

$85 Billion global car company Stellantis is investing $8M in KNI for 19.99% of the company

Stellantis has also signed an offtake agreement for 35% of future annual production of battery-grade nickel and cobalt sulphate from KNI, for a nine-year term.

How do we know this?

Because Stellantis announced it on their website last night:

(Source)

And yes, this is the same Stellantis that signed an offtake agreement with, and investment into Vulcan back in 2021.

Stellantis is the parent company of the following well known car brands:

The Monday open should be interesting for KNI, we will be releasing our deeper dive commentary then.

With a low number of shares on issues, KNI moves up and down on fairly low trading volumes.

Another pair of companies we are watching for material news from (and have been standout performers during the recent depressed market) is our Brazilian lithium duo of companies:

- Latin Resources (ASX:LRS) - which is looking to publish its first Preliminary Economic Assessment (PEA) for its 45.2Mt lithium JORC resource - this should show the market how much the project is worth on a Net Present Value (NPV) basis.

AND - Solis Minerals (ASX:SLM) - which is running its first drill program at its Brazilian lithium project, hoping to make a new lithium discovery.

SLM is drilling right now, looking to do exactly what its major shareholder - and our previous big win in the Brazilian lithium space - LRS did only ~18 months ago.

For context - LRS drilled its first hole in February 2022 and declared a new lithium discovery in March.

Off the back of the assay results from that first drill program, LRS’s share price went from ~3c per share to ~21c per share.

Intraday yesterday, LRS hit a new all time high of 34.75c per share - 1,900% higher than our initial entry price of 1.8c per share back in 2020.

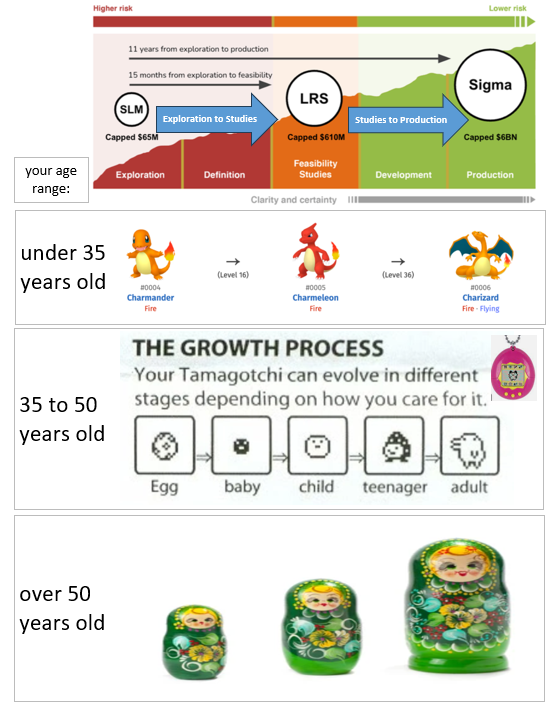

$82M capped SLM wants to become the $825M “LRS 2.0”.

$825M LRS wants to become the $6.4BN “Sigma 2.0”.

For those who aren't familiar with the Brazilian lithium story... the Sigma reference comes from the comparisons being made between LRS and Sigma Lithium which became Brazil’s first ever lithium producer in April.

LRS is following the same playbook, hoping to evolve into a Sigma 2.0.

SLM is following the same play book as LRS, that is following the same play book as Sigma Lithium...

Sounds complicated? Here is the analogy we use a couple of weeks ago:

If you are under the age of 35 you probably liked Pokemon, think of it as a Charmander first evolving to a Charmeleon, then finally to a Charizard.

If you are a bit older, think of it as Tamagotchi (remember those?) growing from an egg to a child, and eventually an adult over time (with the proper food and care).

If you are older still, you can probably think of it as a set of those babushka dolls where there is a tiny one, medium one and a big one... maybe?

Note: this image is two weeks old now, since then both LRS and SLM have increased by about 25% each

Whatever your age, and how you think of evolution based on your childhood experiences, the key point is, that for SLM to grow to an LRS 2.0, they need to achieve the following things:

- Successful maiden drill campaign

- Drill core photo with spodumene

- Over 1% lithium assays

- Multiple extensional drill campaigns at over 1% assays

- Maiden JORC

- More drilling

- JORC upgrade

SLM’s first drill in it’s maiden drill campaign is happening now.

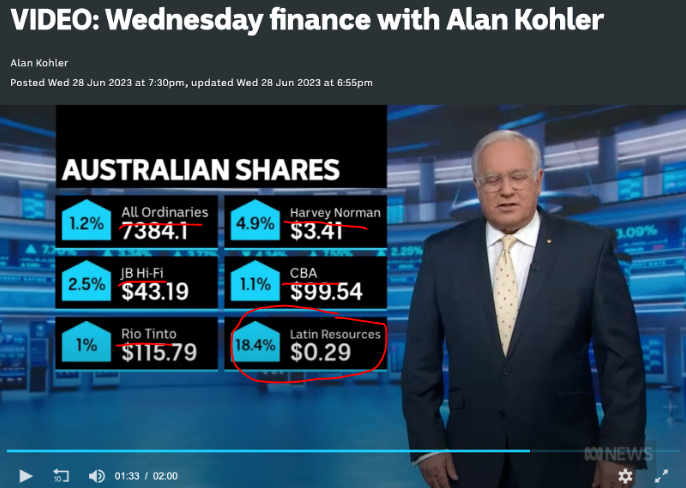

During the week LRS hit the mainstream finance news in Australia, an indication that the company has evolved well past microcap explorer into a bonafide mining investment for bigger players (skip to 1:30).

We were proud to see one of our Investments mentioned in the same sentence as some ASX household names”

Watch the video here

For more LRS and SLM commentary you can catch Chris Gale on the Global Lithium podcast:

Over to LRS and SLM to deliver the key milestones now...

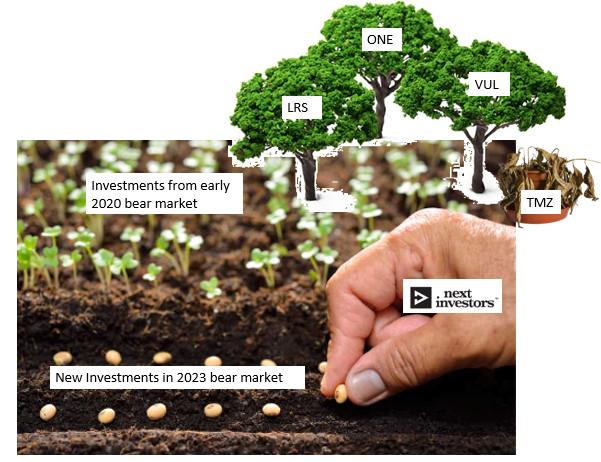

Market awful? It’s “planting season” (Investing Season)

We’ve been saying over the last couple of months that we are looking to make some new Portfolio additions while the small cap market has been in the doldrums.

We have been looking at a lot of bombed out small caps over the last few weeks, many now trading at sub $10M market caps, for no apparent reason other than the poor small cap market conditions.

We have observed an interesting trend that many small companies are “waiting it out” till the market improves before raising cash to accelerate their projects, leading to the share prices drifting down while the market is expecting a raise, combined with tax loss selling.

We see this as an opportunity.

At the end of the day we are conscious of the micro cap market being a lot riskier than the big cap end of the market.

Bigger companies are a lot more diversified and are mostly revenue generating meaning they have cashflows to fall back on when markets turn sour.

Just like the risks, we think the rewards for micro cap companies are a lot higher.

Ultimately we are looking to Invest in companies that have the potential to generate us a return of over 1,000%.

Returns like that are a lot easier to find when valuations are reset in the junior end of the market.

Juniors capped at $5M can go to $50M a lot easier than a junior capped at $50M going to $500M.

These days we are seeing a lot more companies capped at under $10M with prospects that we think have the potential to one day be capped at $50-100M+.

We have found a couple of companies we like (thanks to everyone who sent in suggestions) and we will be announcing some new Investments in the coming weeks.

Using a farming analogy - we are in “planting season”, laying the seedlings, hoping that in 3-4 years time we will be “harvesting” successful Investments at multiples of where we first Invested.

Just remember in small cap investing, out of a diversified portfolio of small cap investments, a few need to deliver outsized returns to balance out the ones that go sideways or fail.

Looking ahead at July and our overall market thoughts:

July is going to be busy.

So will the small cap market actually start going up just because it’s July, and tax loss selling is finished?

Again we just don’t know.

We THINK it will, because it often has in the past.

Also the bigger end of the market is having a strong run, and this is usually a leading indicator that small caps stock will follow.

Small cap market sentiment usually lags a bit behind sentiment in the larger end.

We also noted that the bigger end of the Australian market seems to be being driven by resources/commodities stocks (more on this later).

This bodes well for our portfolio which is heavy in resources, especially battery materials, assuming that the positive sentiment in larger resources will soon flow back into small caps.

There’s a fine line between optimism and pessimism in the market.

Which way will it move?

What about in the long run?

Anyone who tells you that they know what the broader market will do from one day to the next is missing something.

The market is very unpredictable but we’ve found that conviction is important.

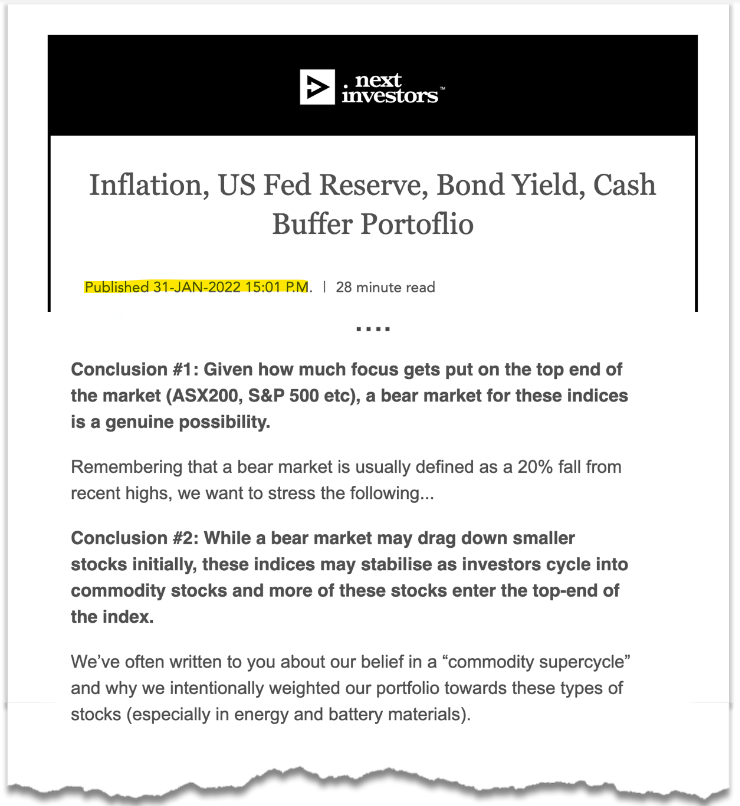

With that said, we do like to check in on our long term predictions every now and then and see how they are tracking.

One of them recently came up in an internal macro debate at our office, and this is our prediction from the end of the bull market in early 2022.

Here it is:

(Source)

Well, small stocks have been smashed and are definitely in a bear market, but what about the top end indices like the ASX 200 [XJO]?

It hasn’t been as bad in the ASX200 as it feels in the small end of the market and we’ve got the charts to show how both of these conclusions we had in January 2022 were pretty much spot on.

The ASX 200 shed ~15% from January 2022 through to the June-October lows and then bounced strongly, tacking on ~17% from October 2022 - February 2023:

The reason is simple - commodities came into the index and propped it up.

Here’s the ASX 200 Resources Index [XJR] in the same period:

So it looks like resources are materially contributing to the positivity in the ASX200.

A tick for our long held view that we are in the early stages of a commodity supercycle.

One way to confirm our theory would be to check quarterly rebalances (where new companies enter/exit the ASX200 index based on factors like market cap) where we would likely find that there would be more commodity companies in the ASX 200 now than there was in 2022.

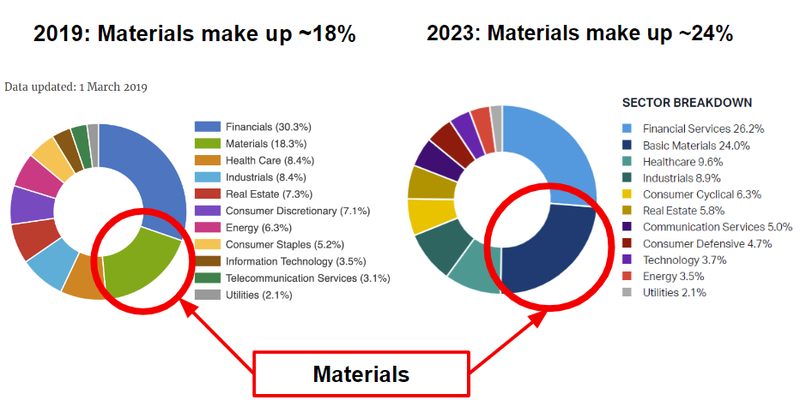

As a proxy for this change though we can see the current breakdown in sector weightings in 2019 and where we are now:

Materials is essentially comprised of resource and commodities companies and the shift is clearly evident in the market, the charts, and the general feeling in the market.

We’ve shifted away from a “service economy” and towards a “thing economy” - “things” need commodities to make them.

We’ve always had a high conviction about a commodities supercycle.

This is a potentially decade-long shift towards companies that actually make THINGS.

Preferably things that help the world decarbonise.

We think battery materials will make up a big part of this shift, and we’ve Invested accordingly.

We’re looking to add more small cap resources positions in a down market, with our intuition telling us it is time to plant “seeds” to “harvest” later in a better market.

We’re hoping the small cap market will turn soon, but there are no guarantees. This is our strategy and works for us, but may not be right for everyone.

We always appreciate reader suggestions as to companies that may fit well in our Portfolio, so please send through any ticker codes that you think are relevant by replying to this email.

There’s a lot, and we mean a lot, of beaten up companies out there at the moment in the small cap market.

We’ve talked about tax loss selling frequently and a swathe of companies that feel like they are down for what feels like no reason.

However, when sentiment feels like it is at its lowest ebb, that’s when we feel like we make our best Investments.

Recently, we’ve noted that certain biotech and tech stocks with strong narratives and operational success behind them can still thrive.

Take for instance:

Oneview Healthcare (ASX:ONE) charged up the charts as it signed a breakthrough deal with the largest hospital bed supplier in the US.

Arovella Therapeutics (ASX:ALA) announcing positive preclinical data, and securing a $4.1M placement. A $1M Share Purchase Plan (SPP) has been extended through to 6 July, which we participated in.

Throw into the mix a burgeoning appetite in Australia for M&A activity in the commodities space (which we called) - and it's entirely plausible that these things will filter down to the smaller end of the market.

It could cut the other way too.

But we’re “planting” new Investments with the intent to “harvest” them in the coming years.

The market “winter” has been cold, but we’d rather start planting early as the first signs of frost shake off than get caught planting in late summer when everyone agrees it's nice and warm.

Too soon? We’ll find out in good time - more Investments are in the due diligence pipeline and we hope to announce them very soon.

What we wrote about this week 🧬 🦉 🏹

ALA edging closer to clinical trials for “off the shelf” cell therapy cancer treatment

We are participating in the ALA Share Purchase Plan, which has recently been extended. In our note this week, we covered what we are waiting for ALA to achieve next and what they have done so far since we first Invested.

Microcap Cannabis Stock BOD has two major near term catalysts...

Our Cannabis microcap Investment BOD Science (ASX: BOD) has two near term catalysts (1) clinical trial results on its cannabis-based insomnia treatment and (2) Pharmacokinetic (PK) study results which will show if its “bioavailability” product can make cannabis medicine more potent and water-soluble.

Quick Takes 🗣️

88E: 88E Project Leonis update - Prospective resource estimate in Q3

ALA: A boost for ALA’s cancer fighting tech?

GTR: GTR - second US based JORC uranium resource due next week

IVZ: IVZ on track to drill its second well in Q3 this year

LCL: LCL expands nickel project in the PNG

PFE: PFE announce manganese assays as neighbour scores big

SGA: SGA to drill EM targets at second graphite project in Kazakhstan

TG1: TG1 picks up more ground next to its WA copper/gold project

Macro News - What we are reading 📰

Oil

The $2.1trn reason it’s time to worry about oil (AFR)

Hydrogen

Can hydrogen help the world reach net zero? (FT)

Lithium

Why lithium is the centre of the $765b battery arms race (AFR)

Battery Metals

Volkswagen Picks Insider to Lead Audi After Tesla Pulls Ahead (Bloomberg)

Ford Gets $9.2 Billion to Help US Catch Up With China’s EV Dominance (Bloomberg)

Critical Minerals

Critical minerals boom a ‘remarkable time in history’ (AFR)

⏲️ Upcoming potential share price catalysts

Updates this week:

- BOD: Phase III clinical trial for CBD insomnia treatment.

- No material news this week, but we did put out an update on what’s coming next for BOD. See our note here.

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- KNI went into a trading halt on Thursday, and yesterday after-market, we saw Stellantis announce an $8M direct Investment in KNI and an offtake from its Norweigan battery metals projects. See the Stellantis announcement here.

No material news this week:

- LNR: >10,000m drill program at rare earth’s project in WA.

- GAL: Drilling at its Callisto PGE discovery in WA.

- SLM: Maiden drill program at its Brazilian lithium project:

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- TG1: Drilling at its NSW gold project in May.

- MNB: Offtake agreement for its phosphate fertiliser project.

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q4 2023).

- GTR: Maiden resource estimates across two of its uranium projects in Wyoming, USA.

- LCL: Maiden drilling underway at primary PNG copper-gold target.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.