KSN delivers JORC resource at Misima Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Kingston Resources (ASX:KSN) has announced a maiden JORC Resource at its gold project in Papua New Guinea (PNG), after acquiring it through the acquisition of WCB Resources earlier this year. Kingston currently owns 49 per cent of Misima and earning in to 70 per cent.

KSN announced a JORC-compliant Mineral Resource estimate for the Misima Gold Project, containing a total 82.3Mt @ 1.1 g/t Au and 5.3 g/t Ag for a total of 2.8Moz Au and 13.9Moz Ag. This represents a 22% increase in contained gold relative to a recent NI43-101 resource conducted in Canada, which operates under its own Compliance framework rather than adopting JORC regulations.

Following the announcement of the news at market-open this morning, KSN shares have seen a modest gain of 10 per cent, currently trading at $0.022.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

KSN’s Resource tabulated in full:

If comparing with previous Resources in the area, KSN’s new resource total of 82.3Mt @ 1.1g/t Au compares favourably to the historical 1986 pre-mining mineral inventory published by Placer Dome (76.1Mt @ 1.19g/t Au for 2.9Moz at a 0.5g/t Au).

Back in the 1980s and 1990s, Placer subsequently produced 3.7Moz Au from KSN’s local area before mining ceased in 2001. Between then and now, several gold processing plants have been constructed in the vicinity while gold processing methods have improved markedly. From an economic-viability perspective, these two factors are expected to provide a positive influence on KSN’s ongoing work in PNG.

With a production history of approximately 4Moz and a current resource of 2.8Moz, Misima now has a total known gold endowment in excess of 6Moz — thereby positioning KSN’s Misima Gold Project as a world-class gold deposit in a region with confirmed precious metals mineralisation.

With excellent potential to add to the resource through ongoing exploration at a number of large-scale, advanced exploration targets, KSN believes it is well positioned to continue growing the resource base at Misima.

However, it is still early stage here, so investors should seek professional financial advjce if considering this stock for their portfolio.

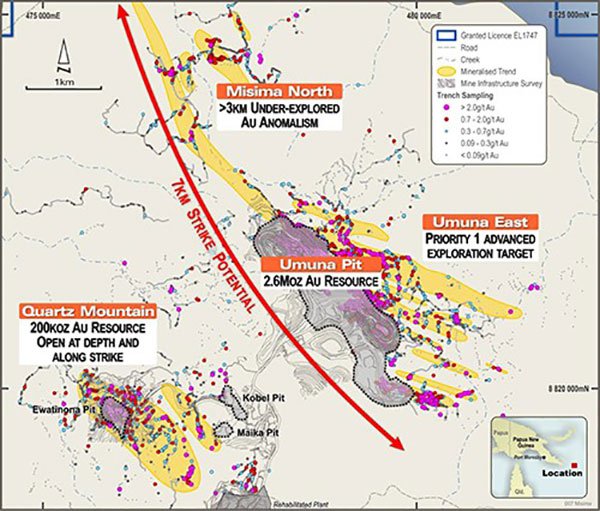

“The Misima Gold Project is a world-class deposit, and this initial JORC resource sets a benchmark for our exploration going forward”, said KSN’s Managing Director Andrew Corbett. “We believe there is enormous potential to significantly increase the contained ounces from drilling the near-mine extensions, initially focussing on outcropping mineralisation at Umuna East and Misima North. The resource is open at depth, so there is also excellent potential to extend it down dip,” he added.

From the geological results seen so far, KSN thinks there could be an additional 300-800koz Au (10-20Mt at 0.8-1.2g/t Au) of mineralisation within the block model which falls outside its current Resource, but which is inside the interpreted zones of mineralisation. In effect, it could be additional gold-bearing ore that sits within KSN’s exploration permit, but has not yet been captured in exploration drilling efforts.

This conceptual addition remains just a possibility at this stage, but it’s something the ASX junior hopes to explore further in future drilling programmes.

Priority target areas. Work to date has defined over 7km of prospective strike at Misima. Source: Kingston Resources

In addition to its precious metals assets, KSN also holds a portfolio of lithium exploration tenements covering four key project areas in the Northern Territory, and, the Livingstone Gold Project holding a 50,000-ounce gold resource.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.