Has LCL found the source rock of its nickel boulders at surface?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 9,755,814 LCL shares and staff own 14,285 LCL shares at the time of publishing this article. The Company has been engaged by LCL to share our commentary on the progress of our Investment in LCL over time.

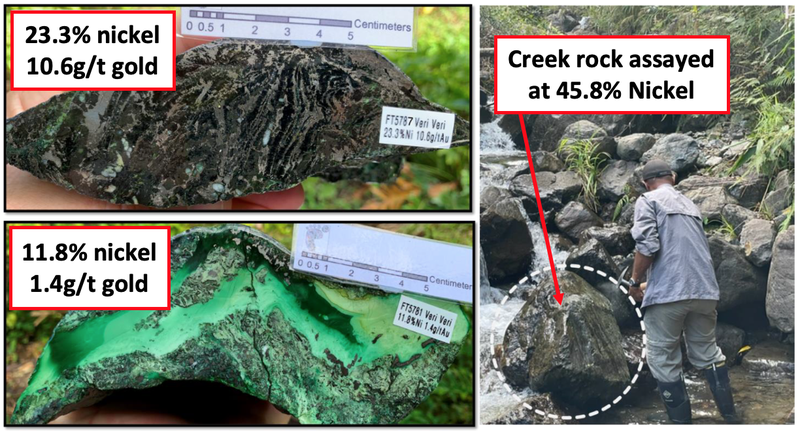

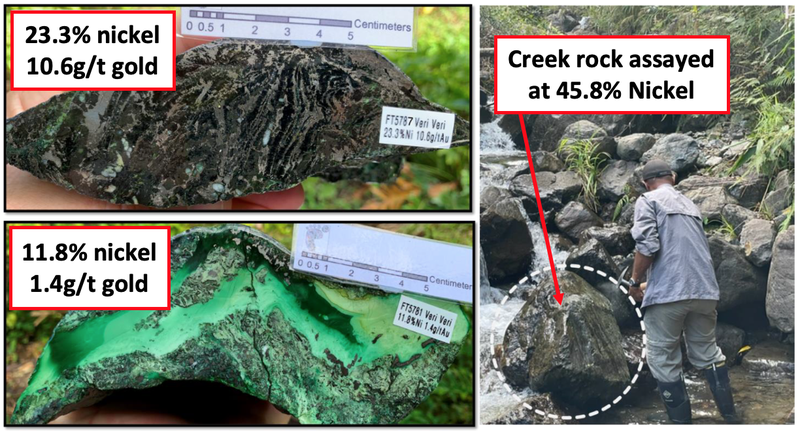

45.8% nickel.

In a giant boulder sitting in a river.

That is pretty much unheard of.

Our junior exploration Investment LCL Resources (ASX:LCL) looks to be getting closer to what could be the source rock of a series of high grade nickel boulders and outcrops at surface at its PNG project.

LCL has just released assays from a reconnaissance program that included surface sampling and digging new trenches.

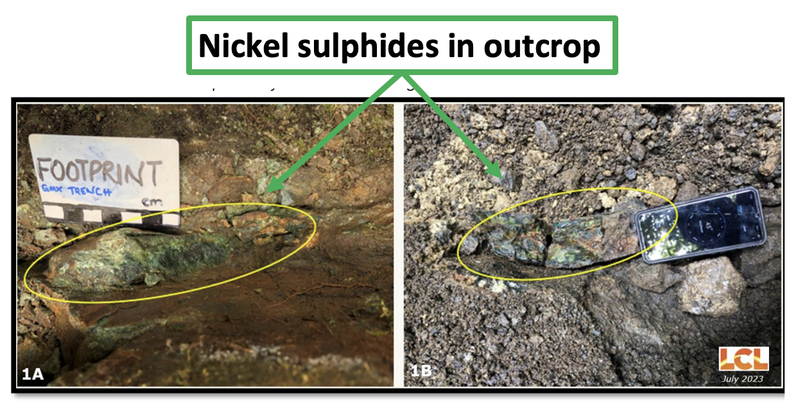

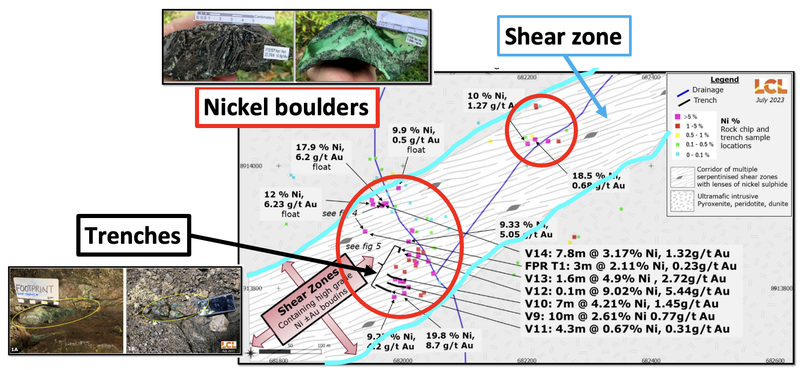

This program revealed a 200m wide mineralised corridor in ultramafic rocks that included outcropping sulphides with grades of up to 13.4% nickel.

Multiple samples returned over 10% nickel from nickel sulphides.

It is early days, but this could be a large nickel sulphide-gold system with scale.

Previously LCL had found nickel boulders at surface with nickel grades of up to 45.8%.

That is literally a huge rock that is almost half nickel:

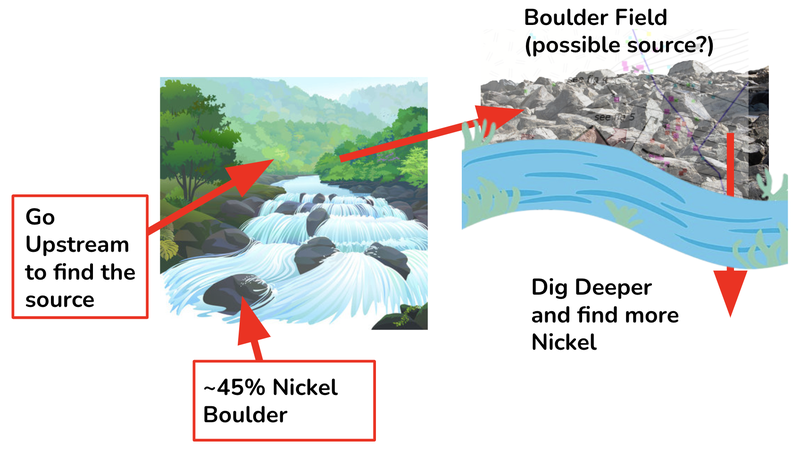

Up until today, LCL was finding these nickel boulders in creeks running through its projects - however the source for the boulders was unclear...

Today LCL found what it believes could be the likely source of the mineralisation, showing:

- Outcropping nickel sulphides grading ~13.4% - LCL found nickel sulphides after digging random trenches and more importantly, confirmed that the boulders were IN SITU - meaning they are found in the rocks in that area, not washed down from other places.

- Multiple samples returned nickel grades over 10% - for context a nickel grade above 1% is considered strong.

- A 200m “shear zone” that could be the source - So far, LCL has mapped a ~200m long area which it thinks could be the source, but the area continues along a major fault, so it could be bigger.

- Still to figure out - how big is it? LCL just doesn't know the extent and number of nickel-bearing shear zones within the structural corridor. Only a small area has been mapped so far, so that suggests to LCL that the high grade boulders and samples found so far are part of a large nickel mineralised system.

When LCL acquired the Veri Veri project it had nickel boulders in the creek grading up to 45.8% nickel.

This boulder is what is called a “float” meaning that it is not attached to an outcropping or a “source” - it’s essentially a loose rock.

For LCL, the goal of the Veri Veri project is to find the source of the nickel boulder, and identify where there could be more high grade nickel “in situ” meaning “in its place”.

Today, LCL found what could be the source to the boulder fields at surface - a 200m corridor containing numerous ‘boudins’ of nickel sulphides.

Boudins are sausage-shaped lumps or nodules of rock that form in shear zones - where two slabs of rock have moved past each other.

From our understanding, the boudins are attached to other rocks as opposed to loose, like the boulder was.

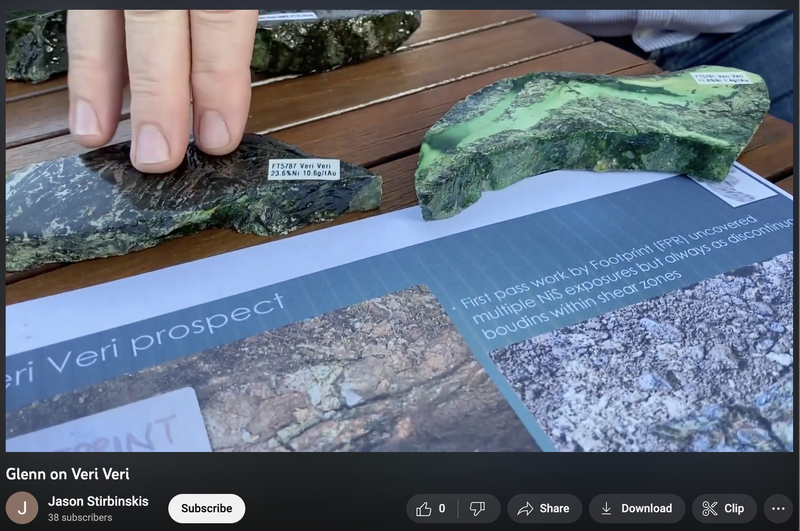

LCL Managing Director Jason Stribinkis said that the “frequency of boudins and the very high nickel grades bode well” for the project.

And our take is that this could be the start of a new high grade nickel sulphide discovery, which is few and far between.

Here is a video of LCL’s country manager Glen Twomey discussing today’s announcement:

(Source)

Here is our crude take on LCL’s mapping program to find the source of the nickel boulder:

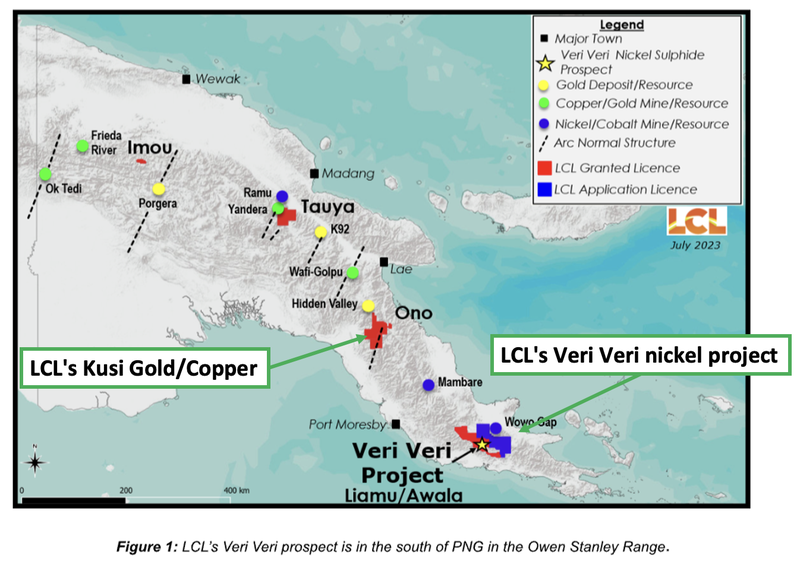

To date, LCL’s focus in the PNG has been its gold project, where LCL has hit high grade, big meterage gold in five of its first five drillholes.

LCL is planning a total of 18 holes, and drilling is ongoing, with additional assays expected over the coming weeks and months.

After today’s announcement on its Veri Veri nickel project, we think LCL has a potential company making a nickel sulphide project on its hands.

Here’s a quick summary of LCL’s two key PNG projects:

- Kusi (gold/copper) - A known discovery with multi-million ounce gold and copper/gold porphyry potential. Definition drilling stage.

- Veri Veri (nickel) - LCL is looking to make a giant high grade nickel sulphide discovery. Blue sky exploration potential here.

Up until today’s news, LCL had nickel boulders grading 45.8% but wasn't sure where the boulders were coming from.

Now LCL has managed to define an area where it has the same nickel sulphide boulders in outcroppings and with a clear target area to focus its future exploration work.

We see LCL’s Kusi project as a lower-risk exploration project where LCL largely knows what it is dealing with and can spend cash to define a large gold resource.

The Veri Veri project, on the other hand, is LCL’s blue sky nickel sulphide exploration project where we think one drill campaign could re-rate LCL’s share price in a big way.

High-grade nickel sulphide discoveries are rare, but when they get made, they often lead to a giant buyout by a major producer.

Think Sirius Resources’ Nova Nickel discovery which led to the buyout by IGO for $1.8BN.

LCL is capped at just $30M, had $8.7M at 31 March, meaning the company trades at an enterprise value of just ~$21M - bearing in mind a quarterly cash update is due soon, and LCL would have spent some of that cash this quarter.

Ultimately we are hoping today’s news is a precursor to a significant nickel discovery for LCL.

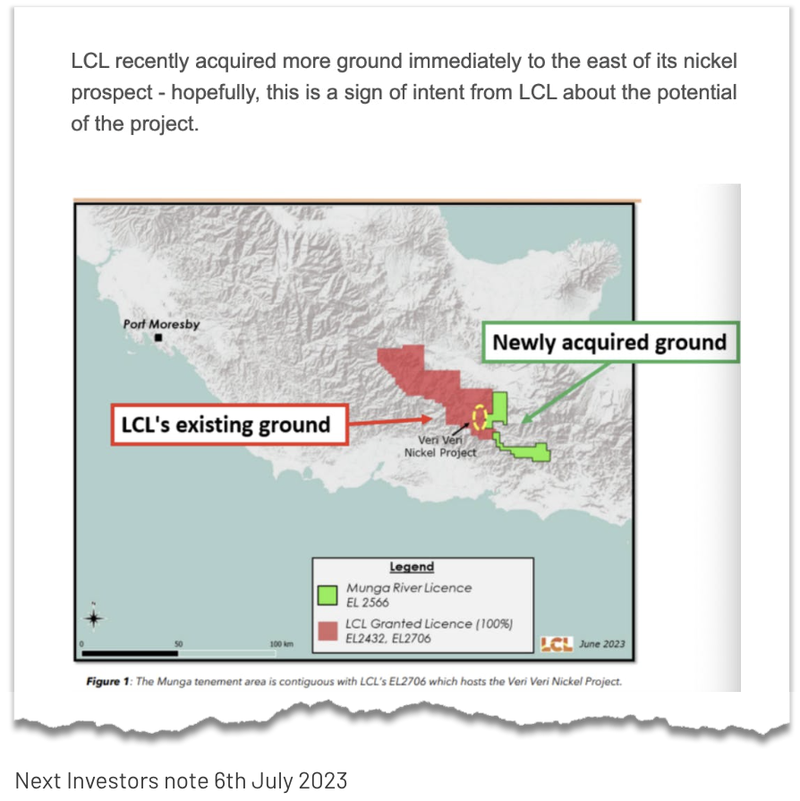

We also noted in our last LCL note that the company had acquired more ground immediately to the east of its Veri Veri nickel project.

(Source)

Typically a move by a company to take control of the ground around a project is a sign the company likes what it sees.

After today’s news it's pretty clear why LCL was busy consolidating the ground around Veri Veri.

Next, LCL plans to run an airborne EM survey before likely firming up drill targets at Veri Veri - so the company still has a bit of work to do before we get to see a drillhole put into this project.

Ultimately we are hoping LCL is able to deliver a discovery and realise our LCL Big Bet which is as follows:

Our LCL Big Bet:

“LCL to deliver a 1,000% return off exploration success on its PNG gold, copper, nickel projects OR from developing its advanced gold project in Colombia”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LCL Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress LCL has made since it acquired its PNG assets and how the company is doing relative to our “Big Bet”, we maintain the following LCL “Progress Tracker”:

Some context on today’s nickel news:

Back in November 2022, LCL acquired a portfolio of gold/copper and nickel projects in the PNG.

The projects were vended in to LCL by two ex $44BN Barrick Gold geologists:

- John Dobe - was previously the principal geologist and was in charge of project generation for Barrick.

- Glenn Twomey - was previously Barrick’s exploration manager in the PNG.

The pair took payment mostly in LCL shares for the projects - and now own ~10% of LCL.

At the time of the acquisition, the story was mostly focused on the gold and copper assets, BUT LCL did make specific mention of the nickel boulders at one of the many projects it was acquiring.

LCL flagged the giant nickel boulders being found downstream in the nearby creek.

The nickel boulders had grades of up to 45.8%.

The big question mark at the time was how the boulders got into the creek and where the source for the boulders was.

LCL then started drilling its gold/copper targets BUT was busy in the background doing fieldwork at the nickel project.

First LCL kicked off a field program.

The goal for the program was to walk the ground in and around the nickel boulders found in the creek.

Anywhere the geologists found interesting, LCL collected samples and dug some trenches.

The breakthrough came from one of the trenches LCL dug - LCL hit outcropping nickel sulphides grading 13.38% nickel.

For context on the grades - when a shallow, from surface nickel discovery is made, grades of 0.5-1.0% are considered decent.

From some simple trenching work, LCL hit 13.38%.

More importantly though, LCL confirmed the outcrop was in-situ (another word for in place) meaning it could be the source for the nickel boulders in the area.

What do we know now?

The working theory now is that the nickel boulders sit inside a shear zone filled with nickel sulphide boulders.

LCL will need to drill test this to identify whether or not the nickel boulder field continues at depth and along strike.

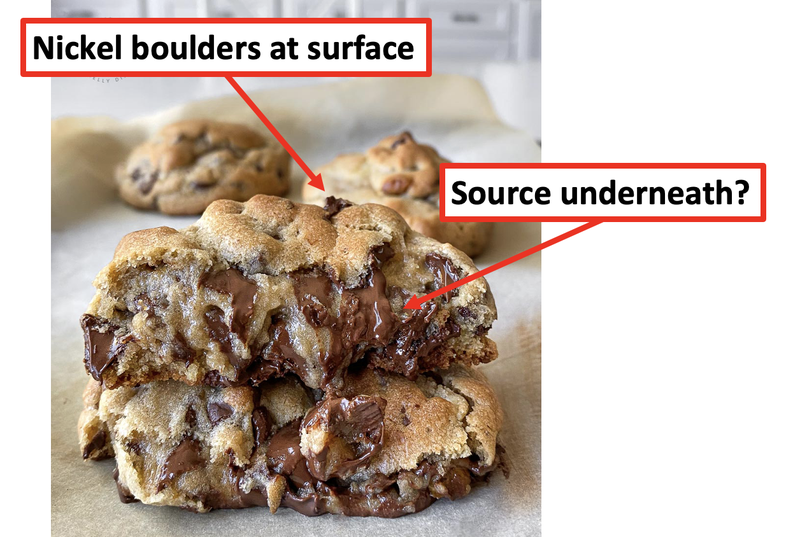

A good analogy for the type of theory LCL is testing is a thick chocolate chip cookie.

We think LCL just found the choc chips on the top of the cookie.

The next bit of work will be to see if there are more choc chips inside.

Now it's about LCL confirming its findings with more sampling and some airborne EM surveys.

Hopefully, the EM surveys give LCL some more information about where to drill.

Nickel sulphides - why discoveries are rare and valuable

The IEA expects nickel demand to increase by 7 to 19 times between 2020 and 2040.

The problem is that high grade nickel discoveries are extremely rare.

Even harder to find are new nickel sulphide discoveries.

Without getting too technical - nickel is found either in sulphides or laterites.

Sulphides are the ones most sought after because they are cheaper and typically profitable to mine.

Once discovered at scale, almost immediately, a major producer often comes in and buys it out...

But before the buyout, the companies that make these discoveries can re-rate exponentially.

A good example is Western Mines Group, off the back of its nickel discovery the company went from 11.5c to 99c.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

One of the biggest discoveries of the last decade was the Nova Nickel discovery by Sirius Resources in 2012.

Pre-discovery, Sirius had a market cap of ~$8M and a few years later was taken out for $1.8BN.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

A more recent acquisition is Andrew Forrest’s (Wyloo Metals) acquisition of Mincor Resources for $760M.

(Source)

The major players in the industry know how hard it is to make a new nickel sulphide discovery, so as soon as a project with size and scale potential shows up, they take notice.

The following quote from Wyloo Metals CEO Luca Giacovazzi sums up the major's rationale:

“It feels like at some point nickel will have its lithium moment when there is just not enough of it. We get to see it first-hand because we talk to car companies a lot. Every company is coming to us asking if they can do an offtake deal”

We hold a similar view - read our 2023 nickel outlook here.

What’s next for LCL?

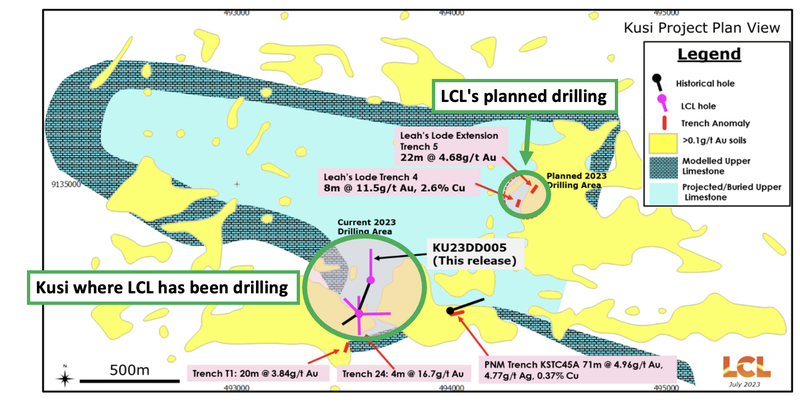

Drilling at the Kusi gold/copper target 🔄

LCL is five holes into a ~18 hole drill program at Kusi.

LCL has flagged that the focus for the next phase of drilling would be on the company’s “Leah’s Lode” prospect, which sits <1km north-east of Kusi and all of the existing hits LCL has been getting.

If we see strong results from Leah’s Lode, then it could start to hint at a much larger combined structure that includes both Kusi and Leah’s Lode.

Below is the area LCL specifically mentioned it would drill next:

Veri Veri Nickel Project 🔄

After today’s news, LCL has managed to define a target area where it can focus its future exploration work.

LCL’s next steps here will be to run new generation airborne electromagnetic (EM) geophysical surveys - these will help workout the best places LCL should focus its future drill programs.

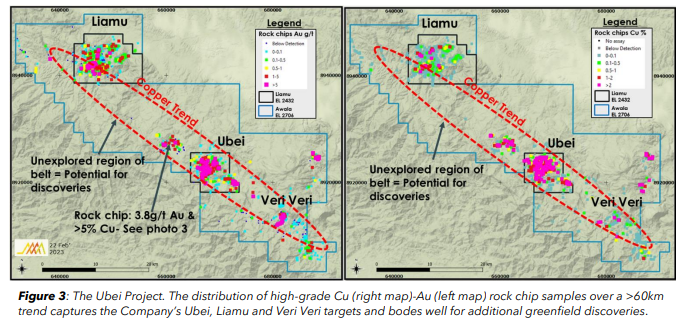

Other copper/gold targets in the PNG 🔄

LCL is planning fieldwork and desktop studies across its Imou, Liamou and Ubei targets.

The area we are particularly interested in for now is the ~60km channel between its Liamou and Ubei targets.

Here LCL is working with a similar theory (like at Kusi) where the undrilled EM & IP geophysical anomalies could be indicative of a copper-gold porphyry system.

We are looking forward to LCL drilling these at some stage in the future.

(Source)

Joint Venture discussions 🔄

With the company's focus now on its gold/copper targets in Papua New Guinea, the company is also working on looking at Joint Venture (JV) partnerships over its other projects both in PNG and Colombia.

Key risks to Veri Veri project

Like all small cap exploration stocks, there are risks.

The main risk is exploration risk.

Although LCL has found nickel outcropping, there is no guarantee that the nickel extends below the surface.

The second risk is access risk - being in the mountains of PNG, access can be a challenge.

Given LCL is a pre-revenue exploration company, LCL is also dependent on raising capital or bringing in a farm in partner to continue to explore its projects. This can dilute share ownership of existing holders.

See the key risks we listed in our LCL Investment Memo here:

Our LCL Investment Memo:

Click here for our latest LCL Investment Memo, where you can find a short, high level summary of our reasons for Investing, including the following:

- Key objectives for LCL

- Why we are Invested in LCL

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.