Australia announces Critical Mineral Strategy as stocks defy tax loss selling

Published 24-JUN-2023 12:00 P.M.

|

11 minute read

There’s only 5 trading days left in the financial year.

That means the final 5 days of tax loss selling.

We expect to see some wild swings in share prices this week, either:

- Companies where share prices are trading near 12-month lows get smashed as tax loss sellers finally capitulate and sell.

OR, - Most of the selling in those companies is done, and the companies start to rebound from the lows as bargain hunters swoop in.

So far, the May/June months have played out much as we expected, BUT there have been a select few companies out-performing in the gloom:

In our Portfolio, Latin Resources (ASX:LRS) and Solis Minerals (ASX:SLM) continue to trade around all time highs since we first made our Investments in both companies.

LRS ended the week at 28 cents - up ~1,550% from our initial entry price of 1.8 cents per share back in 2020.

SLM ended the week at $1.01 - up ~500% from where it traded a few weeks ago.

Both hit the highs off the back of material news:

- On Tuesday, LRS delivered its first resource upgrade to 45.2Mt at 1.34% Li2O - an increase in its hard rock lithium resource of 241%.

- On Friday, SLM kicked off its 11-hole drill program in what we hope is the drill program that delivers the company's first lithium discovery in Brazil (and the first step to becoming LRS 2.0).

Both companies sit on very different parts of the Lassonde curve, which is commonly used to describe the junior mining lifecycle:

We predicted back in March a phenomenon that might occur in a bad market where the few stocks that manage to go up a bit (while everything else is going down) will draw outsized attention from investors:

This certainly seems to be coming true with a few big runners out there in an otherwise sea of red.

Thankfully a few of these stocks are in our Portfolio (SLM, LRS, ONE).

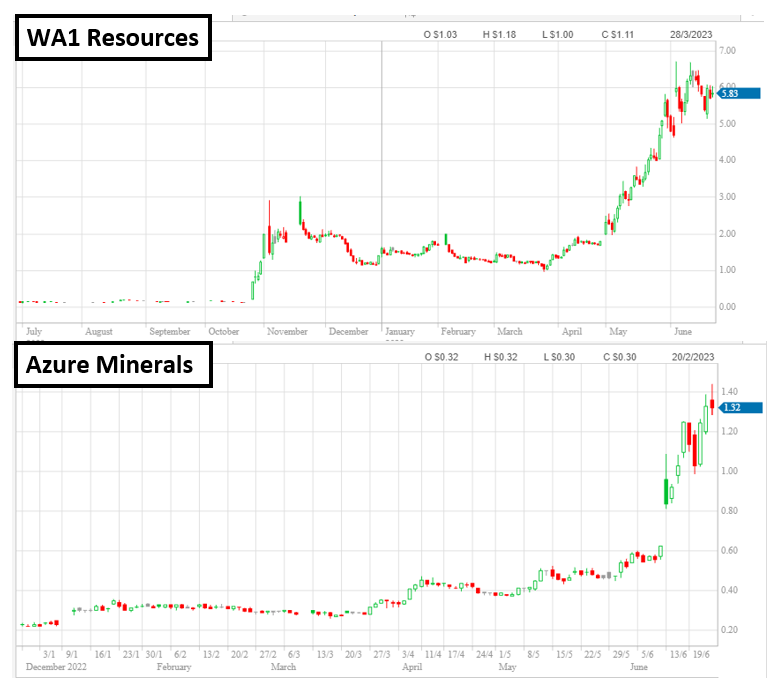

Outside of our Portfolio, the talk of the town is Azure Minerals' lithium discovery at its Andover project (60% owned by Azure and 40% by mining billionaire Mark Creasy).

Azure is up over 600% over the last six months.

The other company is WA1 Resources which is drilling out its rare earths project in WA.

WA1 is up over 4,300% over the last 9 months.

For some investors, watching the stock market during tax loss season can feel like watching a long bad movie.

Just when you think it’s over and can’t get any worse... it does.

But it’s not all doom and gloom.

There are SOME companies that have shown that they can still perform during this period and investors/traders have flocked into those names.

Perhaps it's “any port in a storm” for traders and Investors.

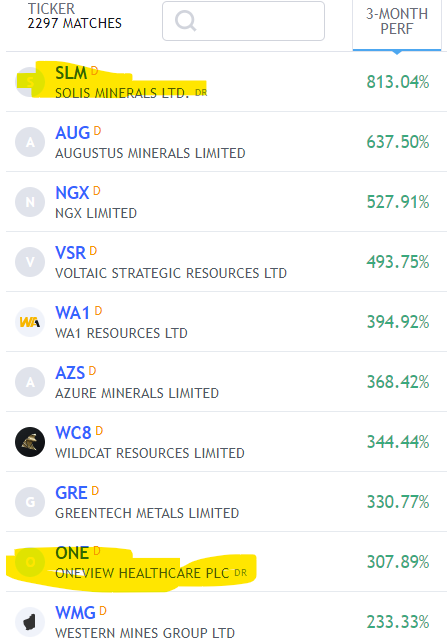

In particular, the sector holding up the strongest has been the critical minerals space, an area we are very familiar with.

For context - we did a quick scan of the top 10 best performing stocks on the ASX over the last 3 months, and 9 of the top 10 are in critical minerals:

Pleasingly, two of the stocks in this list are also our Investments - with a rare tech stock rise spotted amongst the pack - Oneview Healthcare (ASX:ONE), our 2021 Tech Pick of the Year.

And of course, our 2023 Small Cap Pick of the Year, Solis Minerals (ASX:SLM).

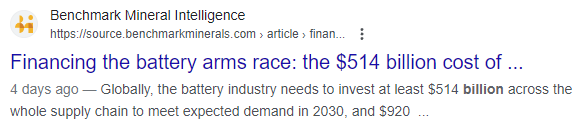

Overall our Portfolio is highly leveraged to the “commodities supercycle” - driven primarily by the energy transition and growing demand for critical minerals.

And we think that this period of tax loss sellings shows that the sector still has much more room for growth, for the right stocks.

Why are some critical mineral investments still going up?

We have been banging on about the importance of critical minerals for over three years now.

And, over that time, global interest has been increasing - with leaders from key nations looking to shore up their critical mineral supply chains as the world transitions towards a clean energy future.

According to an IEA report in 2021, the world’s total demand for minerals necessary for the development of clean energy technologies is forecast to double or even quadruple by 2040.

In recent times, the importance of critical minerals has moved beyond the push towards electric vehicles and battery storage, as supply chains are now seen as vital to national security.

Control over natural resources is now driving geopolitics - almost like oil did back in the 1970’s - and critical minerals are in the spotlight.

Nations are putting forward critical mineral strategies to strengthen their supply chains and encourage critical mineral development and discovery.

This week Australia released its critical minerals strategy with the highlights including:

- Further $500M in funding for NAIF (North Australia Infrastructure Fund)

- Support for downstream mineral processing

- Establish the National Reconstruction Fund, which includes $1 billion for value-add in resources and $3 billion for renewables and low emissions technologies.

- Track and monitor foreign investment in Australian critical minerals projects

- Grants available for exploration programs

Read the full Australian Critical Minerals Strategy.

Our take on Australia’s critical minerals strategy:

Everything in life is relative, and we think that Australia has NOT gone as hard on its critical minerals strategy when compared to the US or Europe.

Fortunately, Australia has a history of mining entrepreneurship and so private capital has led Australia into a position of market leadership for minerals like lithium.

Indeed, Australia is the world's biggest lithium producer at ~56% of global supply.

Aussies just get mining.

We have written in depth about how the ASX is a unique market to invest in early-stage mining exploration companies - likening it to the US and the tech sector over there.

See that weekend email here: Is the ASX a Venture Capital (VC) style market for junior explorers?

It seems like every year a new Australian junior mining company makes a company-making discovery like Challice in 2021, Galileo Mining in 2022 or Azure Minerals in 2023.

So, while the incentives for new mine supply were underwhelming in the Australian Critical Mineral Strategy the key “winners” are those that are looking to undertake downstream processing of critical minerals in Australia.

We currently have one Investment that fits the bill and that is FYI Resources (ASX:FYI).

FYI is looking to develop two different critical minerals processing facilities - both of which are listed in Australia’s Critical Minerals list:

- For High Purity Alumina - Definitive Feasibility Study (DFS) stage project with a Net Present Value (NPV) of US$1.1Bn based on US$202M capex.

- Rare Earths oxides - FYI, recently announced the acquisition of a project where it plans to partner with $660M Arafura Resources in the NT.

One thing Australia’s strategy was missing (that its global peers put more dollars into) was tax concessions to make project economics stronger.

The US (with its Inflation Reduction Act) and the EU (with its Critical Raw Materials Act) both dished out plenty of tax incentives to encourage new mines.

We do note however that last month Australia did sign a deal with the US government, which COULD see Australian critical minerals projects benefit from the US tax concessions.

With the spotlight on critical minerals both from an energy transition perspective, and a national security perspective - governments around the world are putting in place their own Critical Minerals Strategies.

This week, Norway also released its Critical Minerals Strategy Norway designed to speed up the development of critical minerals projects.

The three key pillars of the Norwegian plan were:

- Unlocking big swathes of capital - Norway is considering a Norwegian state mineral fund, which could mobilise private capital too.

- Slashing red tape - Norway wants to fast track the processing of licence applications - to accelerate the extraction and production of Norwegian minerals.

- More geophysical mapping - the government plans to conduct geophysical mapping across the country to incentivise more exploration.

We currently have one Investment in Norway, Kuniko (ASX:KNI), who stands to benefit from the policy changes across the EU.

You can read our full update: Norway fast tracks critical minerals push - KNI in the box seat.

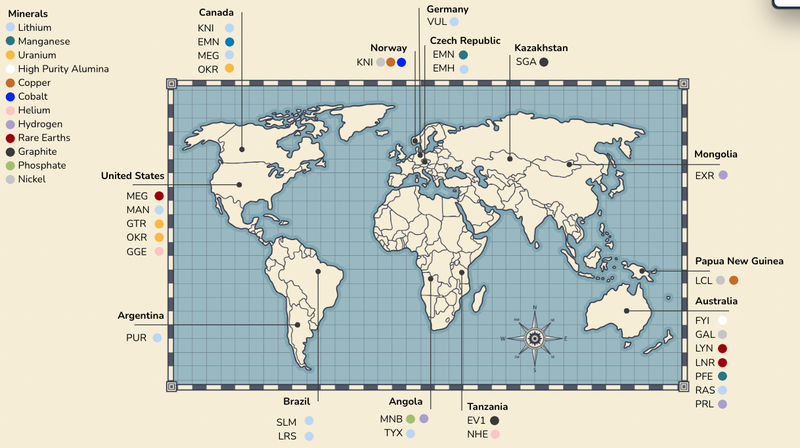

There are many jurisdictions that we think pose a significant advantage for mineral investments and we have constructed our portfolio accordingly.

Branching out from Australia we have looked at jurisdictions that have at least one of these factors:

- Large geological potential

- Historical mining culture

- Strategically located

- Regions that could be considered “friendly” to the US & the EU to take advantage of the Inflation Reduction Act and the Critical Raw Materials act.

Here is a map showing where our Investments in the Critical Minerals space sit:

Ultimately countries like China, the United States and Europe are encouraging critical minerals processing to shore up their supply chains from friendly nations.

Whereas regions like Africa, Australia, Canada and South America are looking to move quickly to discover and extract these critical resources and commercialise the geological potential for their region.

We have noted an increasing amount of Chinese investment into ASX small caps with African critical minerals projects, we are speculating the US capital will soon enter that region with adding some competitive tension.

With lots of government money flowing into this critical minerals race, we have positioned our Portfolio to take advantage - with investments from across the globe.

You can see all of our current critical metals Investments here, click on any of the companies to see our current Investment Memo for that company.

What we wrote about this week 🧬 🦉 🏹

SLM drilling “pegmatite grand canyon” - can it evolve to $610M LRS?

Our 2023 Small Cap Pick of the Year SLM is now drilling what we are calling pegmatite “Grand Canyon”, in Brazil. We are Invested in SLM to see it become LRS 2.0.

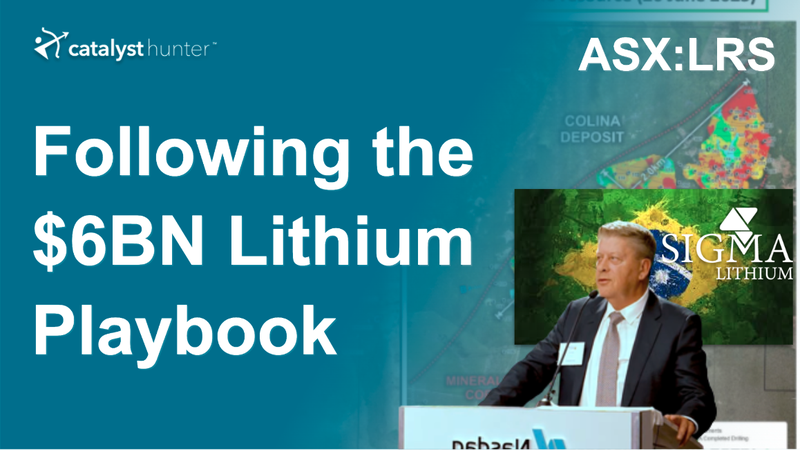

LRS takes another step towards lithium production and becoming Sigma 2.0

This week, LRS released its long awaited JORC resource upgrade on its Brazilian lithium deposit. With $50.1M in the bank, 8 drill rigs on site LRS is in the midst of a 65,000m drilling campaign to make its resource even bigger.

Norway fast tracks critical minerals push - KNI in the box seat

This week Norway unveiled its new critical minerals strategy designed to speed up the development of projects inside the country. We think our Europe based exploration Investment KNI is in the box seat to take advantage.

ONE signs agreement with the largest hospital bed supplier in the US

Oneview Healthcare (ASX:ONE) signed an agreement with the largest hospital bed supplier in the US, Baxter International. ONE has moved up the charts nicely and is now sitting at ~31 cents and market cap of ~$160M.

Quick Takes 🗣️

GAL: GAL keeps hitting more mineralisation to the north

BOD: BOD to expand into Malaysia?

OKR: OKR pursuing development of large US uranium resource

88E: Permitting and planning underway for flow test

Macro News - What we are reading 📰

DFS-Stage Companies

Discovery to production averages 15.7 years for 127 mines (S&P Global)

Gold

Northern Star set to build country’s biggest gold mine by 2029 (AFR)

Graphite

Analysis: Auto firms race to secure non-Chinese graphite for EVs as shortages loom (Reuters)

Hydrogen

Billionaire Forrest ‘Can’t Wait Forever’ for $80 Billion Congo Hydro Deal (AFR)

Lithium

CATL commits $1.4BN to develop lithium production in Bolivia (MERCOM)

General

Short Bets on US Stocks Hit $1 Trillion, Most Since April 2022 (Bloomberg)

⏲️ Upcoming potential share price catalysts

Updates this week:

- SLM: Maiden drill program at its Brazilian lithium project:

- This week SLM kicked off its maiden 11 hole drill program. See our note on the news here.

- GAL: Drilling at its Callisto PGE discovery in WA.

- GAL hit over ~184m in mineralisation ~600m to the north of its Callisto discovery. See our Quick Take on the news here.

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- No exploration newsflow but the Norweigan government did put out its critical minerals strategy which we think bodes well for KNI. See our note on the news here.

- LNR: >10,000m drill program at rare earth’s project in WA.

- LNR finished its drill program this week (see the announcement here). Now we wait for the assay results.

- BOD: Phase III clinical trial for CBD insomnia treatment.

- No update on its insomnia trials but the company did sign a letter of intent (LOI) marking a potential entry into the Malaysian CBD market. See our Quick Take on the news here.

No material news this week:

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- TG1: Drilling at its NSW gold project in May.

- MNB: Offtake agreement for its phosphate fertiliser project.

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q4 2023).

- GTR: Maiden resource estimates across two of its uranium projects in Wyoming, USA.

- LCL: Maiden drilling underway at primary PNG copper-gold target.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.