Alloy Resources acquires new ground near Horse Well Gold Project

Published 08-MAR-2018 09:10 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

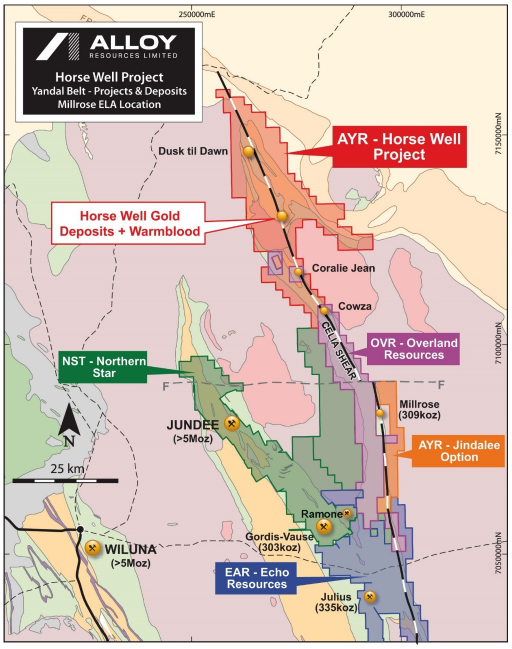

Alloy Resources (ASX:AYR) has reached an agreement with Jindalee Resources (ASX:JRL) to acquire an Option to purchase an exploration licence application within the highly prospective Millrose Greenstone Belt.

Exploration licence application 53/1962 (“ELA”) is adjacent to AYR’s Horse Well Gold Project, which is situated in the north eastern goldfields of Western Australia and adjacent to Northern Star’s Jundee Gold mine (below).

Both sites are on a major mineralised structure called the Celia Shear, which extends into the eastern margin of the Millrose Greenstone Belt.

According to the company, ELA surrounds Millrose’s eastern flank, which has an Inferred Mineral Resource of 309,000 ounces of gold.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

AYR Executive Chairman Andy Viner spoke on the new acquisition, “We think the new ELA area significantly enhances the potential for Alloy to make new gold discoveries as it expands our coverage of the mineralised Celia Shear from 60 to 80 strike kilometres.

“One of our most intriguing targets is the Celia Shear extensions to Overland Resources new high-grade surface quartz vein discovery at Coralie Jean which has only emerged in the last quarter.

“Another reason for excitement is the location of the ELA licence is only 8 kilometres east of Northern Star’s Ramone discovery, which is also showing the untapped potential of this area,” he said.

AYR expects the Millrose ELA to be granted shortly as it commences field work at the nearby Horse Well Gold Project.

Transaction terms

The binding Heads of Agreement for the Option to purchase the Millrose ELA are as below:

a) A non-refundable payment on execution comprising of

- $50,000 cash and

- $50,000 in non-escrowed, fully paid ordinary shares in Alloy priced at a 5 day VWAP, totally 8,333,333 shares

b) Alloy to expend a minimum of $34,000 on exploration at E53/1962 during its first year of grant, agreeing to keep the tenement in good standing prior to withdrawing from the agreement

c) Upon the first anniversary of grant of E53/1962 Alloy can

- Withdraw from the agreement reverting 100% to Jindalee, or

- Pay a further $50,000 cash and $50,000 in non-escrowed, fully paid ordinary shares in Alloy to acquire a 100% interest in E53/1962

- On election of the above Jindalee will provide transfer of lease documents to Alloy and Alloy will provide for a 2% NSR to be retained by Jindalee over E53/1962

d) The parties agree to complete a formal agreement no later than 31 March 2018

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.