$4M MOZ Continues to Take On Graphite Majors: This Time in Tanzania

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Mozambi Resources (ASX:MOZ), the micro-cap that acquired strategically significant ground in Mozambique adjacent to Syrah Resources & Triton Minerals, has just done it again...

This time with an option over highly prospective licenses in close proximity to Tanzania’s largest graphite companies.

While investors wait on official authorisation to commence fieldwork on its Mozambique graphite tenements, MOZ has not been resting on its laurels.

Over the past twelve months, MOZ has been busy behind the scenes, quietly negotiating for a war chest of no less than 18 high potential graphite tenements covering thousands of square kilometres in neighbouring Tanzania.

Just like Mozambique, Tanzania also hosts abundant graphite deposits, including Magnis Resources’ (MNS) Nachu Project – which holds 156 million tonnes at 5.2% Total Graphitic Carbon (TGC).

The majority of this graphite resource is classified as jumbo and large flake sizes – the most valuable type of graphite, priced as high as $1,500/tonne.

Magnis are capped at over $75M – and MOZ have snaffled up ground in close proximity to their Nachu Project

MOZ has just signed a binding term sheet to acquire these Tanzanian graphite tenements – and the best part is, work can start immediately.

MOZ will likely need to raise funds for this exploration, but there will be no waiting around for government approvals here.

MOZ has 90 days to appraise and choose which of the tenements are worth keeping.

MOZ has the right to take up as many of the 18 tenements as the company sees fit – giving the company the freedom to adjust its risk profile and only keep the best ground on offer.

With prospects in Tanzania looking bright, MOZ is now standing shoulder-to-shoulder with some of the biggest graphite explorers across of Africa – the likes of Syrah Resources & Triton Minerals in Mozambique and Magnis Resources in Tanzania.

But MOZ’s market cap remains at a paltry $4M...

We have already covered MOZ’s tenements in Mozambique in great detail in the following articles:

- Graphite Whales Joined by Minnow MOZ

- $3M ASX Nano-Cap Next Door to the Biggest Graphite Resource Known to Man

MOZ shares have more than doubled in price since the start of 2015 – largely due to expectations of strong future performance given the high likelihood of good graphite deposits and MOZ’s ability to take full control over its licenses. Since we first shed light on MOZ’s graphite potential in February, its stock price has appreciated by approximately 58%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

It’s all been driven by MOZ’s location in Mozambique – nestled in the vicinity of the some of the most high potential graphite deposits on earth, controlled by Syrah Resources, currently capped at over $700M, and Triton, capped at around $130M.

Tanzania in Focus

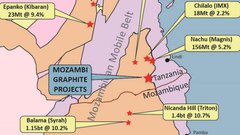

On the map below, the new Tanzanian licenses MOZ’s hold an option over are marked in red, with Magnis in green, the State Mining Co. in dark grey, and Syrah Resources in blue.

Key terms for MOZ’s option agreement with the vendor are as follows:

- MOZ to pay $75,000 USD and issue 3.3M ordinary MOZ shares immediately (with a 90 day voluntary escrow);

- On exercise of the option, MOZ to pay $125,000 USD and issue a further 20M ordinary MOZ shares.

Production milestones were also struck – If MOZ can develop up a JORC compliant inferred and indicated resource of:

- A minimum of 5 million tonnes containing over 5% total graphitic carbon, yielding at least 250,000 tonnes of contained carbon, MOZ will issue the vendor with 20M fully paid ordinary shares;

- A minimum of 20 million tonnes containing over 5% total graphitic carbon, yielding at least 1,000,000 tonnes of contained carbon, MOZ will issue the vendor with a further 40M fully paid ordinary shares in MOZ.

By accepting shares in MOZ in exchange for the Tanzanian licenses, it’s clear that the original vendors still want to be leveraged to the high potential upside of resource discovery.

MOZ now have another, bigger graphite neighbour

MOZ’s new neighbour Magnis intends to produce the highest quality ‘jumbo’ flake graphite by the end of 2016 with 9% of production in the 500+ micron ‘super jumbo’ category and a further 64% in the ‘jumbo and large’ categories.

Before mining or production has even started, Magnis is already valued at $75 million.

A significant reason for such a valuation is the completion of two off-take agreements with China National Nonmetallic Materials Industry Co. Ltd. (“SINOMA”) and Sinosteel Liaoning (“Sinosteel”) respectively. The expected output set out in the deal is 180,000 tonnes per annum of graphite.

Furthermore, Magnis has signed a binding debt finance term sheet with SINOMA for US$150M covering the engineering, procurement, construction and financing of a 200,000 tonnes per annum plant for the Nachu project in Tanzania.

Considering that the MOZ tenements are located near Magnis’ graphite project, the company is anticipating that some of that high quality graphite can also be identified on MOZ’s ground.

We will start to gain a better understanding of this once fieldwork commences...

The prospect of uncovering additional graphite is already a positive development but the kicker for MOZ is that Tanzanian deposits are generally known for predominantly ‘Jumbo’ and ‘Super Jumbo’ flake which is most preferable for the production of graphene.

If forthcoming fieldwork confirms the existence of commercial quantities of graphite, these new tenements could diversify MOZ with high tonnage of lower grade graphite in Mozambique in tandem with lower tonnage at higher grades in Tanzania.

In a nutshell, the move into Tanzania provides MOZ the ability to diversify its risks both in terms of flake size and country-specific geo-political risk

Strategically speaking, MOZ is keeping all its bases covered as the company waits for imminent approval of its existing exploration rights in Mozambique and ventures into a region known for high quality graphite in Tanzania.

Another thing to note on the map above it’s the dark grey mining tenements, owned by Tanzania’s State Mining Co.

Government-owned tenements tend to be highly valuable, potentially resource rich and excluded from private exploration – the government generally keeps this ground to themselves.

However, with MOZ tenements literally surrounding land owned by State Mining Co., there is a reasonably good chance of MOZ tenements having graphite mineralisation.

MOZ’s requested tenements are scattered in and around other tenements belonging to other explorers including those with proven deposits and larger market valuations like Magnis and Syrah.

The tenements’ close proximity to main roads and an international port at Mtwara also means the region already has sufficient infrastructure to ensure efficient extraction and timely delivery of graphite to market.

With Magnis valued at $75 million and on course to extract 180,000 tonnes of graphite per year through its Nachu project, the $4 million valuation of MOZ could be understated to say the least.

It’s early days however, and MOZ will soon know a whole lot more once drilling begins.

On your marks, get set, go

The big difference between MOZ’s prospective licenses in Mozambique and its tenements in Tanzania is the fact that geological work including testing of outcroppings and sampling can commence immediately without waiting for government approval.

We would expect the company to shortly determine which of the 18 Tanzanian tenements have the best potential, and cherry picking these most lucrative locations based on quantity, quality and proximity to existing infrastructure.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks.

To note just a few:

- Following the Next Mining Boom article on European Metals Holdings (ASX:EMH), Electric Cars Need This: ASX Junior’s Billion Tonne , EMH has risen as high as 250%;

- Since the Next Small Cap article on Carnavale Resources (ASX:CAV), Drill Results in Weeks: Tiny ASX Explorer with Multi Million Ounce Target , CAV has been as high as 130%;

- We released the Next Small Cap article on Rumble Resources (ASX:RTR), So You Think Sirius Is Big? $5M ASX Explorer Drilling in Weeks – since this release, RTR has risen as high as 160%.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

The Obsession with Flake Size

Potentially the most lucrative prospect for any graphite explorer is the possibility of entering the market for graphene.

Graphene is 200 times stronger than steel, conducts heat and electricity efficiently and is almost transparent. Due to these properties, graphene is threatening to put a serious dent in the $350 billion semiconductor industry dominated by silicon.

However, in order to produce graphene, the raw graphite required to create it must be of the highest calibre – termed ‘jumbo flake’ within the industry. It’s why MOZ have decided to pounce in Tanzania, in a region known for larger flake sizes.

At current market prices, amorphous graphite at lower flake size can expect to fetch approximately $500 per tonne whereas the best quality graphite at super jumbo flake size is worth triple as much, being priced at $1,500 per tonne.

With the graphene market in its infancy and largely in the Research and Development (R&D) stage, the potential for future growth is significant.

This is in addition to the existing market for graphite which is far more developed than graphene.

The electric car graphite connection

Around 80% of all graphite used in batteries is specifically for lithium-ion batteries.

Use of such batteries is growing rapidly with greater proliferation of devices that require battery power growing immensely around the globe; for example, laptops, mobile phones, tablets and even electric cars.

Tesla Motors, Inc., a U.S automotive company has announced plans to invest USD $5 billion in a new lithium battery factory dubbed the “Gigafactory”.

This is expected to increase demand for natural graphite by as much as 37% before 2020 with the factory likely to start production by 2017. The rapid increase in the use of lithium batteries across various industries is expected to drive demand for graphite in the years to come.

Hopefully one day MOZ can supply quantities of graphite into this emerging global market...

Currently, China is one of the largest consumers of graphite globally and is working hard to satisfy its insatiable demand for graphite by securing access to abundant sources around the globe.

Domestically, China is currently suffering production problems due to an exhaustion of jumbo flake mining, rising extraction costs and environmental problems. These issues are the key catalysts that have induced the sudden rise in off-take agreements between Chinese and Western firms, like those struck for MOZ’s neighbours Triton and Syrah.

Given that applications for both graphite and graphene are growing in scale and scope, future demand for this resource is likely to be strong.

This pent up demand for graphite is bringing increased focus on tiny explorers like MOZ – emerging explorers who are looking to locate some commercial quantities in some famous graphite post codes.

Mozambique Update

Just because of all the news on Tanzania, it doesn’t mean we have forgotten about MOZ’s Mozambique tenements... it’s a key reason of our investment in the company.

Remember, one of MOZ’s tenements is virtually within the tenement holding Triton’s Nicanda Hill deposit, while the other is to the south-east, down the road from Syrah’s Balama deposit.

These are the gargantuan resources which MOZ sits directly above and beside in Mozambique:

- Syrah’s Balama deposit is 1.15 billion tonnes @ 10.2% graphitic carbon and 0.23% V2O5. Syrah are currently capped at over $700M.

- Triton’s Nicanda Hill deposit is 1.457 billion tonnes @ 10.7% graphitic carbon and 0.27% V2O5. Triton are currently capped at $130M.

Here is that map again with MOZ tenements shown in red, Syrah in blue, and Triton in grey:

Recently, two different Chinese firms were proactive in securing agreements with Triton Resources for hundreds of thousands of tonnes over the next decade.

Once MOZ start conducting fieldwork, surely it will only be a matter of time before the Chinese start looking at MOZ’s ground in a bit more detail.

In our previous coverage of MOZ we highlighted the exclusive option agreement over the two highly prospective Mozambique licenses. This exclusivity period was recently extended to November 2015, giving MOZ plenty of time to explore the licenses in detail.

In Perspective

MOZ is the $4 million David going toe-to-toe with industry Goliaths such as Magnis ($75 million market cap), Syrah ($730 million market cap) and Triton ($130 million market cap).

Competing on the same playing field as its larger competitors, MOZ is looking to kick its exploration efforts into a higher gear over the coming months, which may see the tiny company undergo a growth spurt.

As MOZ investors ourselves, we are hoping for this to be the case.

Having got their foot through the door, all that remains is for MOZ to start drilling for graphite!

Are you a MOZ investor and want to spread the word?

Get the message out there – make sure everyone knows about MOZ and share this article by clicking the buttons below:

[sd_share_article title=”$4M MOZ Continues to Take On Graphite Majors: This Time in Tanzania”]

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.