$2BN Deal Maker Bolsters ADV Team: Lithium Drilling to Start in Days

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Ardiden Ltd (ASX:ADV) has stepped up the pace in its lithium and graphite hunt in Canada.

It’s just bolstered its team with the recruit of high calibre deal maker Brad Boyle, who comes with a pedigree from none other than Triton Minerals (ASX:TON).

Brad Boyle was instrumental in the 20 year, $2BN graphite offtake deal that Triton sewed up, and oversaw that company go from a $5M market cap to a $100M market cap at its peak.

He has run the ruler over ADV and it appears he is out to repeat his Triton success again, this time in Canada.

And better yet – we are expecting ADV to start drilling for lithium any day now – just the kind of catalyst that could keep this stock moving.

Of course, this is minerals exploration – so there is no guarantee of success here – this is a small company with a number of hurdles to pass before it starts shifting product, so caution is advised if considering making an investment.

We first wrote about ADV back in October last year, when it was solely a graphite explorer, in the article Graphite Drilling in Weeks for Tiny ASX Explorer , and since then, ADV has gone from strength to strength. Its share price has been up as high as 250% since we first called it:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

After the graphite news, came the acquisition of a lithium project, and the last time we wrote about the company we told you about its first steps there.

It was a great move, with the potential to double its exposure to the lithium-ion boom, which is being driven by the likes of Tesla.

Since then, ADV has decided to pick up another advanced lithium asset, again in North America.

The company doubled-down on the strategy and as time goes by the reasons for doing so have become much clearer.

ADV hopes to position itself as one of the chief suppliers in the North American lithium-ion battery game – this is a bit further off though, and ADV have a lot of work to do.

You can’t build a home without good foundations. Well, you can, but it’s probably not going to be a great house.

And to that end, so far, so good for ADV’s foundations.

As we indicated earlier, ADV is firing up the drill rig on its first Canadian lithium project, at Seymour Lake.

Drilling approvals are under review now, and as soon as they are confirmed, drilling will commence shortly after – likely any day now.

All this from a company which is still capped at just under $17 million (at the time of writing).

In this article we’ll run you through the ADV game plan, take a look at its assets and tell you why exactly everything’s starting to come up ADV.

Re-introducing:

The ADVantage

From a tactical point of view, Ardiden Ltd (ASX:ADV) is starting to position its pieces on the chessboard.

While previously it’s been a promising graphite player, ADV is now aiming to become a chief supplier to the lithium-ion powered revolution which is taking place in North America.

ADV has its foot on graphite, and it has options in play to get into lithium.

While having the material is one thing, getting it to the market is quite another.

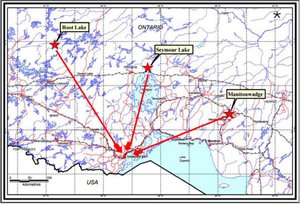

In this respect, all signs point to Thunder Bay , which is mightily close to the US border.

Traditionally a grain hub, it has pivoted in more recent times to become one of the more vital industrial export hubs in the country.

It hit an export tonnage record of 135,000 freight tonnes back in 2012. That gives you an idea of the kind of scale we’re talking about here.

The great thing about that port through is that it offers export opportunities.

Now, those of you with an atlas may question that given its position on Lake Superior, it doesn’t seem to offer any sort of access to the Atlantic.

However, through Lake Superior you can get to the “Seaway”, a series of canals which will get ships to the Atlantic in five days.

All of a sudden, ADV isn’t confined to just the North American market...

Longer term, if ADV is able to get offers from North America and elsewhere it may be able to drive a wedge between both parties and ADV will start to feel like the prettiest girl at the dance.

The strategic thinking from ADV is pretty impressive here, and it has been demonstrated again by its recent options...

More on that later, first let’s take a look at the big news of this week – the appointment of Mr. Brad Boyle – the Triton man.

Could ADV follow in Triton’s footsteps?

To strengthen its management, ADV have added a couple of big guns to its Board.

With the appointments of Executive Director Brad Boyle and Canadian-based General Manager Michael Stares, ADV hopes to have a seamless transition into the next phase of its growth.

There is no doubt Boyle has done it before at other small cap emerging explorers hoping to make it to the big time.

He has vast experience working within the resources and energy sectors and was paramount in negotiating off-take agreements with key end-users such as lithium-ion battery manufacturers while acting as CEO and Managing Director of Triton Minerals (ASX:TON).

He has serious graphite deals under his belt, which works perfectly into ADV’s business strategy.

While working with Triton, Boyle secured a 20-year, $2 billion graphite off-take deal.

He established partnerships with two market leading graphite producers, and was instrumental in the identification and acquisition of the Triton’s Mozambique Graphite Projects...

And now he has had a look at what ADV are putting together up in Canada and has decided to join the company for its next phase of growth.

The fact that Triton’s market cap rose from $5 million to over $100 million at its peak, under Boyle’s reign is also cause for shareholder enthusiasm.

Source: Yahoo Finance

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Helping Boyle achieve these goals will be Mick Stares, who has been involved with Canadian mineral exploration businesses for the past 30 years and is based in Thunder Bay, Ontario.

In 2007, Stares was a joint recipient of the prestigious Prospectors and Developers Association (PDAC) Bill Dennis Prospector of the Year Award.

Suffice to say, with Stares on board as GM ADV’s prospects are further improved.

Stares has already had influence at ADV, being instrumental in the discovery of the company’s Silver North Star graphite prospect at its Manitouwadge Graphite Project.

With new gun recruits Boyle and Stares on board, ADV’s new plays should hopefully start to bear real fruit.

Getting to grips with Root Lake

Okay, so here’s the new play for ADV.

The company has picked up an option to acquire 100% of the Root Lake lithium project in Ontario, which is within cooee of both Seymour Lake and Manting.

Now that doesn’t look particularly sexy, but what’s interesting about this project is that it has had over 10,000m of historical diamond drilling in the past.

It consists of two main deposits in the McCombe Pegmatite and Root Lake Pegmatite , which were both discovered back in the 1950s.

The McCombe is the one which has had over 10,000m of drilling in the past, and has been identified as having a strike length of up to 550m and width of 19m.

In fact, a previous driller proved up a deposit of 2.3Mt of lithium oxide grading at 1.3%, which is a good sign, however this is not a JORC compliant resource just yet.

What ADV will hopefully be able to do is prove it up to a point where it can indeed generate a JORC-compliant resource.

Meanwhile, the Root Lake Pegmatite hosts at least some lithium-bearing pegmatites with a width of up to 17m.

Back in 1956, a company called Consolidate Morrison Exploration came along and dug some trenches on the deposit. These trenches were several hundred metres long and up to 9.14m wide. Sampling returned grades of up to 3% over 9.14%.

Then, subsequent drilling traced the deposit about 1200m to the west, along strike and towards the McCombe...

Due diligence on the old trenches done back in 2009, using modern equipment, backed up the previous trenching results and even found one trench had 4.43% Li 2 O over 5m.

As a rough and ready rule, typical lithium rock deposits have grades of between 0.5% to 2% .

Below are some of the samples taken in 2009:

More drilling will be needed to really get the ball rolling and plans are in place to get that happening – first at Seymour Lake and then at Root Lake.

Now here’s the really interesting thing:

When ADV announced the potential deal, it let slip (probably strategically) what it was thinking about the two deposits.

You see, they’re only 2km apart.

Remember that part about the subsequent drilling at McCombe? Well, it turns out that the deposit remained open towards Root Lake when the drilling stopped...

“[Root Lake and McCombe]...are over 2km apart along strike and have the potential to be connected , subject to further drilling and due diligence,” AVD said in the statement.

That’s the play here, and if AVD subsequently exercises the option and is able to connect the two deposits, then it could be well and truly off to the races here...

However – this is no guarantee – minerals exploration is no sure thing – caution is advised if considering an investment, and its always a good idea to seek professional advice.

Seymour Lake

The first lithium option ADV picked up was the Seymour Lake project, and undoubtedly ADV will be hoping to see more lithium here (see what we did there?) and it’s looking to start drilling here as soon as approvals come back.

The project has 4000m of historical diamond drilling, which has previously firmed up some promising lithium grades:

One of the nifty things about this project is that the rocks contain Beryllium.

Not sure what Beryllium is? Well, we won’t bore you with the details but the important thing here is that it goes for about $500/kg, adding a nice little offset for the lithium.

The main lithium (or to more accurate, spodumene) deposit here is the North Aubry zone.

Based on the historical drilling, it’s thought that it exists within a 200m by 250m area and is about 26m in thickness.

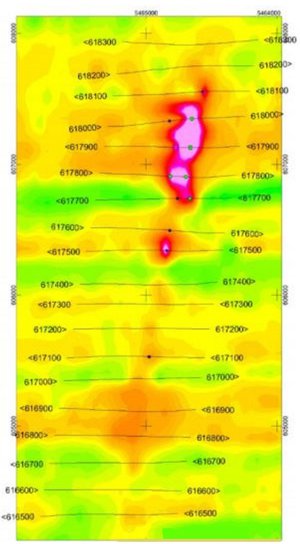

This is what it looks like on the ground:

The main zone remains open to the north and to the east, and it already has a lead on a nearby zone.

It’s early days yet, but there could be another zone in the works to the south, with the South Aubrey zone about 200m to the south worth following up on.

Better yet, soil sampling indicates that there could be an excellent chance of extensions to both North Aubrey and South Aubrey.

It is, however, soil sampling, so ADV will need to test with the drillbit before it can have any sort of confidence about extensions.

One of the other neat things about the project, which often goes overlooked when talking about mining projects, is that it’s just 8km from a planned hydro-electric project which is being scheduled to pump out 85MW.

It’s also just 10km from rail sidings, which go all the way down to export hub Thunder Bay.

Investors tend to get excited about rocks and markets, but don’t often stop to consider the practicalities of a mining project.

You can be sitting on a pile of wealth-creating rocks, but unless you have power to drive the project and a way to get it to market you essentially just have a pile of shiny rocks.

Manitouwadge

So far, this project is the main game for ADV and is its sole graphite play.

At the rate this company has been tying up options on more ground though, we can’t exactly rule out it being the only graphite play on the table for ADV...

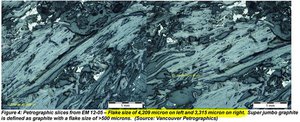

It picked up the project back in 2014, and it measures 3400 hectares, with historical metallurgical testing indicating that roughly 55% of the project’s graphite came in the form of either large or jumbo flake.

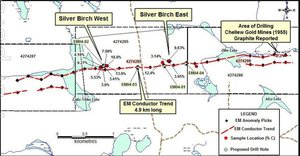

There are three main leads as part of the project, pictured below:

The tenements in red are the most recent acquisitions on the project, with the main players the Silver Birch, Thomas Lake West, and Silver Star tenements.

They were also at the centre of outcrop testing done, where a simple flotation test found that samples could be produced at 95.6%. Meanwhile, testing using a caustic bake process produced graphite with a purity of 99.95% graphite.

That’s already quite high, and of course as time goes on and ADV works out its flow sheet, that should get higher.

Overall, what ADV is chasing on the project is a previously identified electromagnetic anomaly measuring 19.3km of strike length.

Anomalies are generally a sign that there’s something going on under the earth, so it behoves an explorer to test those with the drillbit when it has the opportunity to do so.

That’s just what ADV did.

Back in November it started a drilling program, drilling for 2000m in areas where there had already been successful chip sampling – and the sampling which had been sued for the previous flotation device.

In January, it reported back with the results of the drilling program.

ADV came back with high grade assay results as high as 12.65% total graphitic content, and with potential for super jumbo flake measuring as high as 4200 microns .

To give you an idea of just how nuts that is, according to CSA Global the “Extra Large or Jumbo Flake” category starts at just 300 microns.

This is just one result, but it’s promising to say the least.

The drilling prompted ADV to call the result “a resounding success, with all objectives achieved, and results often exceeding initial expectations.”

We’re inclined to agree, and so was the market.

In the day before the announcement until the middle on January, shares in ADV shot up by over 36% on the drilling. More broadly, the market is starting to pick up on the story too... This chart bears repeating ADV has been up as high as 250% since we first brought readers the story back in October:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

One of the outcomes of ADV’s graphite drilling is that it basically narrowed down its first JORC target to Silver Star North.

This particular project, however, only contains 5% of the elecrtomagnetic strike previously identified...

This means that while ADV will focus in on Silver Star to generate a JORC resource with more drilling as quickly as it can, that there’s plenty more for ADV to chew on down the road.

In fact, the exploration showed strong electromagnetic anomalies along 10km of the potential 19.3km strike length previously identified. The remaining 9.3km “remains highly prospective for additional discoveries during 2016 field programs”, according to ADV.

ADV hasn’t outlined the upcoming drill program at Silver Start North, but we can’t wait to hear about it.

Doubling down on the lithium-ion game

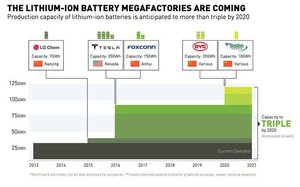

Of course the whole reason ADV has chosen to pick up lithium projects to complement its graphite game is that it offers double the chance of getting in on the lithium-ion battery game.

Both lithium and graphite are used in the batteries, so while you could be a supplier of one material, why not go for two?

Below is a chart from Roskill made in 2012.

While we admit it’s a little out of date given batteries are getting smaller and smaller all the time, it serves as a rough and ready guide as to how much grapite and how much lithium is in each battery.

Now, again these numbers are a touch out of date, imagine an electric car with a battery of 60kWh... such as Tesla’s Model S for instance.

That means for each electic car, you’ll need 36-48kg of lithium and 72-96kg of graphite.

That’s per vehicle.

Tesla’s Gigafactory in Nevada is planned to be churning out 500,000 vehicles per year.

That, of course, doesn’t include all the other car manufacturers rushing to get their own electric vehicle production up to scracth so they don’t lose the market.

Now you’re starting to get an idea why every man and his dog is starting to get into either the lithium or graphite market.

As a rough and ready guide, the world currently consumes about 38,000 tonnes of lithium metal per year, and Tesla alone wants another 38,000 tonnes.

That means Tesla will effectively double world supply, right?

Well, Goldman Sachs has estimated that the gigafactory will soak up 17% or world supply...

We’ll let you do the maths on that one.

It’s why the lithium price has been doing this over the past few years:

Now, this is a fluctuating market price – the lithum price may not hold, and there are a myriad of factors that surround this – so don’t assume the lithium price will continue to climb.

That’s not to mention the graphite market, of course.

So far we’ve taken a look at the automotive sector and that’s going to be a huge part of what drives graphite demand, but it’s not the only thing.

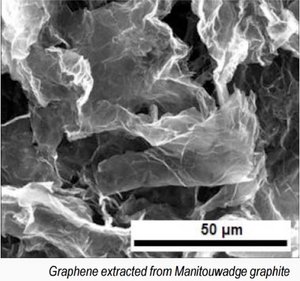

Graphene has been hailed as somewhat of a wonder material which is an excellent electrical conductor, is flexible, and holds up under high temperatures. This makes it fairly suitable for a whole range of applications.

To make graphene, you need graphite.

In fact, here’s a breakdown of just how many uses are being found every day for graphene:

This is basically a chart of worldwide patents for graphene usage, demonstrating that as the scientific community has cottened onto just how to use graphene, they’ve started experimenting.

Another key industry where graphene could make waves is the phone market.

Samsung, among others, have previously announced that they’re experimenting with lithium-ion batteries in order to improve the battery life of their mobile phone models .

![]()

Key to the improvement, they think at this early stage, is graphene technology.

If Samsung and others are able to crack the lithium-ion code, then it could very well spur another wave of growth for both graphite and lithium. That’s speculation on our part of course and should be treated as such.

The key here is that by developing both lithium and graphite plays, ADV could effectively double its chances of catching the lithium-ion wave.

ADV’s trump card though is that it’s develping its projects in North America...

Oh Canada!

This is a map we’ve used before, but it demonstrates why ADV is in such a sweet spot.

As you can see from the above production figures, provided by the U.S. Geological Survey, China is absolutely bossing the graphite production market.

With graphite in particular shaping as a strategic material which will be used heavily in energy production and manufacturing in the future, you can bet your bottom dollar US buyers will be looking to Ottawa rather than Beijing.

The second highest producer is India.

If I were one of the movers and shakers in the U.S. government, I may think twice about buying up big from India as well.

Not because India is particularly risky, but because there happens to be a neighbour to the north the government needs to have onside for a whole bunch of reasons.

This neighbour doesn’t particularly like India either, and may not like people enriching them with massive trade deals...

As regular readers of The Next Small Cap and The Next Mining Boom would know, there’s a lot of exploration going on in east Africa right now, with a fair bunch of Australian companies getting in on the mix.

It’s great for them – but not so great for the U.S.

As chronicled in various places, China has moved into Africa in a big way, getting its hooks into projects in the country.

Partly for geopolitical influence, but also because they want to buy raw materials from the continent.

This is best demonstrated by the $2 billion offtake deal ASX-listed Triton Mineral managed to do with a Chinese outfit last year .

In fact, the current producers of graphite just read as a who’s who of complicated relationships for the U.S.

China, India, Brazil, North Korea, Turkey, Russia...

Luckily for the U.S., little ol’ Canada is ramping up its exploration efforts.

In fact, one could speculate (and it’s just that), that Canadian producers such as ADV may be able to command a premium from US buyers.

With ADV also looking at the export capacity Thunder Bay offers (as outlined before), there’s scope for ADV to really hold the upper hand in negotiations...

The jigsaw pieces are falling into place, and it appears everything’s coming up ADV.

The Final Word

A few months ago, ADV was a promising junior with its foot on a pretty nice graphite asset.

Nothing particularly world-beating about that, or exciting to anybody not intimately involved in the space.

Ove the last couple of months however, ADV has shown a strategic acumen not normally associated with small cap ASX companies.

It’s effectively doubled its exposure to the lithium-ion boom to come and positioned itself as a long-term supplier to the North American market.

With promising drill results in at Manitouwadge, now we’re waiting for the same at Root Lake and Seymour Lake.

If those come in and ADV ends up exercising its options in both projects, then the market may just sit up and take notice of the sort of play ADV has been putting together.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.