Tightly Coiled ASX Gold Explorer Drilling Right Now

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Good things come to those who wait.

Gold and copper explorers had been waiting for metals prices to lift-off from their multi-year lows for years.

Partly aided and partly hindered by the Trump-fuelled market volatility currently hitting news wires daily, metals prices appear to be marching higher.

Both base and precious metals are quickly recovering their lustre as part of a global demand resurgence, which could mean that now is a good time to go out looking for undervalued stocks in the small-cap metals space.

After all, that’s what The Next Small Cap is all about — conveying some of the most opportunistic early-stage ASX stocks directly to our readers, and digging up regular commentary on how they are developing, including performance and future catalysts.

In the case of one particular ASX stock, we think the timing could scarcely be better, with gold exploration drilling at full tilt and assay results expected in the coming weeks.

This company has a handful of alluring gold, base metals, and copper assets in WA and the means to increase their value.

Any of its WA projects could potentially be sold-off or “JV’ed” down the track, ideally at a large premium to today’s valuation.

However, at the same time, this company is still an early stage gold play and therefore investors considering the company for their portfolio, should seek professional financial advice.

The local vicinity where this company operates has no less than 9 existing mining projects currently in production; all within 200km of this company’s operational space.

As with many other Resources investments, the ‘nearology’ factor can play a huge part in setting a company’s valuation, not to mention help its evolution over time.

So before the rest of the market wakes up to this freshly-funded gold-exploring buckaroo, with a spring in its step and a sparkle in the eye, maybe you should too.

Unveiling:

Kalamazoo Resources Limited (ASX:KZR) is doing pretty much what it says on its tin...

Kalamazoo is another term for a manual handcar, widely used in the 1880s. Today however, these contraptions have been relegated to museums.

Or the odd Guinness World Record attempt:

Kalamazoos may have gone out of style some time ago, but their principle lives on.

If you have a fixed route, combined with the sufficient determination, you can get to anywhere you need to go.

So too with KZR.

This particular explorer is now set on a path towards gold production within the coming 12-18 months.

And the best news is that another company is footing the bill.

One of KZR’s biggest attraction points is its partnership with Minjar Gold — One of China’s largest Gold developers and producers

Minjar is funding KZR’s entire drilling program at its A-Zone development and has also signed up to funding its Feasibility Study (in exchange for 40% of the resulting free cash flow) as and when sufficient exploration data has been collated.

This means that KZR’s total capital expenditure is largely de-risked — a superb feature for any small-cap Resource stock.

The other confidence-inspiring aspect of this deal, is that Minjar has also agreed to an Ore Purchase agreement for all of KZR’s gold production.

This remains conditional on various Feasibility milestones, however, we think KZR’s project location and its geology should help to mitigate the risk of poor drilling results.

Here they are coming into view now...

And here’s a look at the rig on site...

So with those tasty caveats in mind, let’s run through what early investors can expect to encounter when they board this Kalamazoo

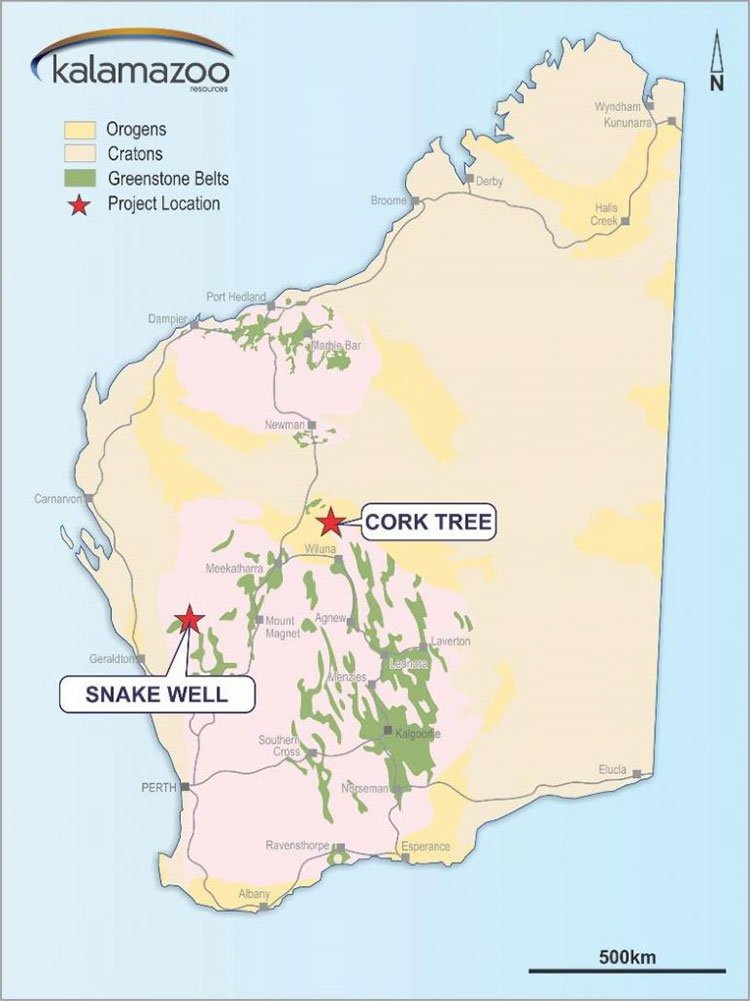

KZR has two Projects in its possession, both located in Western Australia (WA) — Cork Tree and Snake Well, mapped out below:

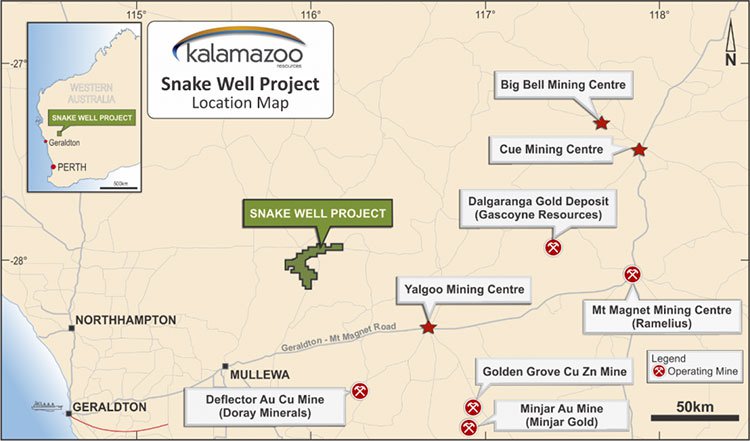

Snake Well is KZR’s flagship project, about 450km north of Perth.

The Project is north-west of the well-known Golden Grove operation and the Deflector gold and copper project recently commissioned by A$115MN-capped Doray Minerals (ASX:DRM).

Zooming in further on Snake Well, we can see exactly why KZR has been so keen to get into this area, and why other metals developers are keen to offtake some of KZR’s capital expenditure...

As you can see, Snake Well’s local vicinity is littered with existing projects, mills, mines and existing Resources which all help to boost confidence in KZR’s future growth aspirations.

KZR recently completed its initial gold production at Snake Well with a Stage 1 trial mining exercise producing approximately 4,459 ounces of gold at 6.83 g/t. For a first score, that’s pretty good going. This was also funded by its big buddy Minjar.

KZR is hopeful that by undertaking appropriate technical work, further Mineral Resources might be defined at its other prospects at Snake Well, and added to its overall Resource estimate which KZR hopes to have officially declared sooner rather than later in 2017.

Going deeper still, now we can see KZR’s detailed plans...

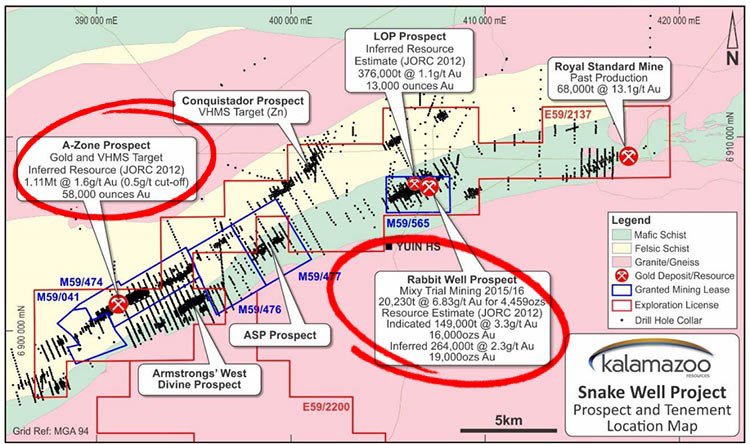

The two prime prospects currently grabbing all the attention at KZR are A-Zone and Mixy.

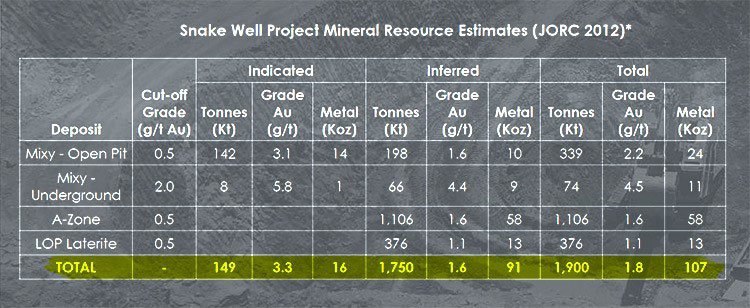

Both these prospects already have JORC Resources trickling onto their books. A-Zone sports an Inferred Resource if 1.11Mt @ 1.6g/t Au for 58,000oz contained Au.

Meanwhile, a stone throw’s away at Mixy, KZR has already produced 20,230t @6.83g/t Au for 4,459oz contained Au, recorded as part of the Mixy Trial Mining run in 2016. Broadly speaking, Mixy has a combined Indicated and Inferred Estimate of 413,000t @ 2.6g/t Au for 35,000oz contained Au.

The estimate at A-Zone was confined to the upper 100m from surface considered as being the approximate limit for open pit mining based on current information.

One noteworthy fact with respect to KZR’s progress so far is that no resource estimate has been completed for any metals other than gold.

This could potentially become a factor is KZR drilling results indicate something later this month.

Mark your calendars — KZR could be publishing crucial drilling data within weeks

As we mentioned earlier, KZR has an action-packed 2017 ahead of it which could mean price catalysts somewhere along the way.

Although any catalysts would be speculative at this stage, so seek professional financial advice for more information of considering this stock for your portfolio.

Currently capped at just AU$13 million, KZR represents a timely addition to the emerging strength of junior gold explorers in Australia.

If KZR manages to make significant strides in expanding its gold resource in WA (as well as conjuring up some other metals ore, that may well deliver silver, copper or zinc as a supplement), it could quickly join the rank-and-file of other Aussie gold developers.

As you can see, a bit of a renaissance in Australian gold is currently in effect. The Aussie gold miners that managed to weather the storm of rapid gold price declines have now emerged fitter, leaner and meaner compared to 5-10 years ago.

Existing gold producers such as Saracen, Northern Star, Evolution Mining and St. Barbara, all experienced double-digit percentage returns since the start of 2016 — this has largely attributable to resurgent gold prices — and it’s suchlike performance that KZR wants to emulate over the medium-long term.

A bit like what Glencore is doing:

Glencore‘s annual profit rose by 48% on higher metals prices and strong trading results. This performance could potentially be an early bellwether of what is awaiting smaller, less mature gold/copper developers over the coming months and years.

KZR’s total Resource figures are tabled below:

With the help of Minjar (and a bit of luck), KZR will be able to move onto a formal ‘decision to mine A-Zone’ and thereby possibly early gold production by the end of 2017.

The latest results from KZR’s mill testing also indicates a strong likelihood of KZR building a long-term development position in WA.

Here is a snap from KZR’s trial mining run at Mixy Lode; as you can see, it’s coming along quite nicely to become a simple open-pit mine at shallow depths, and most importantly, with few geological imperfections that reduce grade and raise processing requirements.

The final mill reconciliation for the mill feed was 20,320 tonnes of ore at a grade of 6.83 g/t Au for a total of 4,459 ounces. The mill recovery averaged 98.1% despite the Minjar plant not having a gravity gold recovery circuit.

Let’s dive deeper into this Chinese goliath, with KZR under its wing

Minjar Gold is a fully owned subsidiary of Shandong Tyan Home Co Ltd, a listed company on the Shanghai Stock Exchange. Tyan Home acquired Minjar Gold in 2014.

Minjar is a heavy-hitter in the global gold exploration stakes, having successfully completed the acquisition of the Pajingo gold mine and surrounding exploration tenements from Evolution Mining last year.

Gold Projects are being horse-traded with increasing frequency these days, yet another indicator that gold mining is coming back into style, boosted by returning aggregate demand for not just base metals, but precious metals too.

One of the biggest knock-on effects from re-emergent gold prices has been Chinese buying interest in several Aussie-based gold projects.

Minjar Gold has reportedly made a $US1.3 billion bid for 50% of Kalgoorlie Consolidated Gold Mines with its parent company already securing Foreign Investment Review Board approval for the transaction.

Since acquiring Southern Cross from St. Barbara for $22.5 million in 2013, previous developer Hanking spent $165 million doubling its Resource to 4.6Moz and hitting an annualised production rate of 130,000oz per year since restarting production in February 2015.

All this exploration and takeover activity suggests that the ‘commodity crash’ is most definitely over, and that a new cycle is now underway.

With the background macro picture coming into focus pretty nicely for KZR, let’s take a look at what procession of juicy catalysts is coming out from KZR.

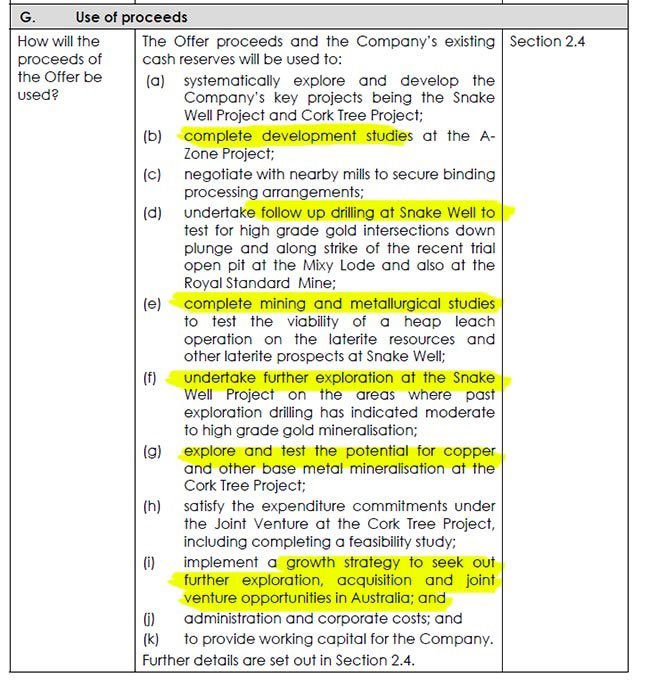

Check out this bumper-pack schedule picked out of its IPO prospectus:

Highlighted in yellow above, are all of KZR’s likely catalysts over the foreseeable few months.

As you can see, any one of these events has a good chance of affecting KZR’s valuation.

Although be mindful of the fact that KZR remains a small-cap resources company that may not achieve its prescribed targets. Invest with caution.

To summarise KZR’s development path:

- Systematically explore and develop Snake Well and Cork Tree Projects;

- Complete development studies at A-Zone;

- Undertake follow up drilling at the Snake Well Project to test for high grade gold intersections down plunge and along strike of the recent trial open pit at the Mixy Lode;

- Complete drilling, mining and metallurgical studies to test the viability of a heap leach operation at Snake Well;

- Undertake further exploration at the Snake Well Project, on the areas where past exploration drilling has indicated moderate to high grade gold mineralisation;

- Explore and test for the potential of copper mineralisation at the Cork Tree Project.

With all that and possibly more coming out of KZR over the coming months, let’s take a quick peek at the macro picture in the background.

Macro Gold

On a macro level, gold remains the go-to metal from safe-haven and store of value perspectives. Gold is very resistant to inflation, or even higher expectations of inflation in future.

The election of Donald Trump, combined with the Federal Reserve’s now typically directionless actions, has added volatility to gold prices.

However, despite more volatility and a stronger US dollar, gold prices remain well supported around US$1,200/oz. (A$1,600).

For Aussie investors, anything gold-related has its own little bonus in the form of Aussie dollar strength.

Take a look at this chart indicating a very timely diversion between gold prices in USD contrasted with prices in AUD:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Joining the Cyclical Uptrend

KZR is doing what many other aspirational gold explorers would be keen to get their hands on — developing a known high-grade base/precious metals project in the heart of a historically abundant region.

KZR appears to have plentiful funding available on tap, courtesy of Chinese behemoth Minjar Gold, a company that is spending big bucks around the globe in order to advance its own market position.

For KZR, walking towards a gold wonderland in Minjar’s shadow is likely to bring many tangible benefits including quicker development time, guaranteed sales and possibly an out-and-out sale of its WA Projects should the need arise.

An ore purchase agreement with Minjar has already been signed and Decision to Mine before the end of 2017 is a reachable milestone KZR intends to achieve.

KZR is eyeing off the commercially-lush promise-land of gold sales — without actually being there just yet.

Alongside the rise of metals prices, also comes the blooming of new mining projects, exploration activity and...

...games of whack-a-mole in earnest.

Miners are coming out of the woodwork and rolling out of their market-imposed hibernation, a bit like moles out of the ground...

And it’s our job as small-cap Mining investors to forehand the most succulent morsels into a diversified portfolio.

Smash it.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.