STL to Acquire Cash+, Shoots for Cash Flow Positivity

Published 07-OCT-2015 10:11 A.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Stargroup Ltd (ASX:STL) is backing up its claims to gradually become the largest ASX-listed ATM and payment services provider in Australia.

STL has just announced a planned acquisition of Cash Plus – a 109 ATM network – which is set to boost its revenue by 76% and move the company to profitability.

The acquisition which is scheduled to complete in November will see the Stargroup ATM network have in excess of 230 machines, processing 1.8million transactions a year with annualised gross revenues of $4.5million.

The Cash+ ATMs which are to be purchased for $6.5 million, will be deployed throughout Australia.

The move comes shortly after NeoICP, a major shareholder of STL and key ATM supplier, purchased several off-market parcels of STL shares increasing their stake from 7.5% to 12.25%.

Meanwhile, STL is awaiting certification for its best-of-breed StarATM machines that will enable customers to deposit and withdraw money in real-time – likely to be a hit in rural communities with few banking facilities.

But STL’s potential doesn’t end there...

By installing its technology in casinos, STL could save casinos in Macau – where the ATMs are being tested – time and effort doing manual settlements by streamlining the banking process and automating the cash count. In effect no table will ever have to close, which eventually translates to more revenue.

All in all, STL is shooting to become the one and only star player in the Australian payments industry by introducing trailblazing technology and building up its customer base via cornerstone acquisitions that serve to validate its overarching strategy...

At the same time, it is still early days for this small ASX listed stock and there is no guarantee of success.

We continue to track:

Star Group Ltd

Stargroup Ltd (ASX:STL)’s journey began back in 2013 when the company started putting together the required components to become the only ASX-listed company deploying ATM machines in Australia and the only ASX-listed company with a direct ownership interest in the manufacturer of its hardware.

These two aspects are key in helping STL achieve a dominant market share that is commercially viable for its shareholders.

You can read more about that in our September article, $670BN Payments Industry to Bear Fruit for Aussie Rising Star? .

But since then some key news has transpired.

Recent acquisition underlines expansive strategy

On 1 October , STL substantiated its operational strategy by announcing the acquisition of Cash Plus Australia Pty Ltd (Cash+) for $6.5M paid in cash (50%) and shares (50%).

The share/cash consideration may be adjusted to ensure that Cash+ does not acquire more than 20% of Stargroup shares on issue.

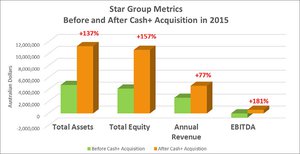

The deal vastly improves all of STL’s key metrics, shown in this chart:

The acquisition boosts STL’s EBITDA by 181%, taking it from a loss of $732k to a profit of $592k for the period 1 July 2015 to 30 June 2016.

If approved at the STL AGM, this acquisition will add 109 ATMs to STL’s existing network of 121 machines. This adds 1 million transactions to STL’s current number of 800,000, meaning STL will now be handling almost 2 million transactions each year.

Also to be acquired are all supporting ATM site agreements and modems supplied and maintained by VComms Connect Limited.

STL merged with iCash Payment Systems in July. Since then they have delivered another record quarter of revenue, the 7th in a row.

The revenues for this quarter were 12% up on the previous quarter and on a 2015 YTD versus 2014 YTD comparison, the result was a 168% improvement.

Average monthly transactions per ATM for the last quarter were 613 transactions, a 5.3% increase on the last quarter result.

An excellent result for this company currently capped at under $8M.

In order to proceed with the acquisition, STL will conduct a $3M capital raising. Looking at STL’s fundamentals and its scalable model that caters for the acquisition of earnings accretive businesses, this shouldn’t be too much of an issue. At the same time, there is no guarantee that strong revenue growth will continue and investors should seek professional advice before investing in this stock.

STL offers two distinct products which it distributes in Australia:

StarATM

Currently STL’s prime offering, StarATM machines provide users with the ability to withdraw money at their convenience. StarATM sales revenue rose from approximately $20,000 in 2014 to almost $120,000 in 2015 – a 500% increase.

Now, the lucrative differentiator for STL is about to come online, in the form of brand new ‘Recycler’ ATM machines, to be certified and rolled out across Australia later this year. The only thing standing in the way of Recycler StarATM’s hitting the high street is official certification from Australian authorities – this permitting hurdle is expected to be cleared soon and could even act as a price catalyst for STL.

The new Recycler machines are expected to raise the bar for ATM deployers because they are able to fully automate the deposit-withdrawal process for customers.

The big banks are currently losing millions in operating sprawling ATM networks that bring little back aside from some semblance of brand recognition on the high street.

STL’s Recycler ATMs could solve this problem by facilitating a much cheaper maintenance and servicing schedule for banks.

If you are able to deposit and withdraw your money from a secure ATM machine, would you ever need to visit a bank branch again?

For a lot of people, the answer is no.

Recycler ATMs are likely to be a hit especially in rural communities where access to traditional banking services is limited or not existent.

STL could corner the market in rural communities in addition to its staple line-up of bars, restaurants, public events and shopping centres.

StarPOS

ATM machines provide a good bread and butter business model for STL. But as we move towards a cashless society, new functionalities are required to maintain their attraction to customers.

This is where STL’s StarPOS unit comes in – as a diversifier as well as a fresh revenue driver.

STL’s EFTPOS machine

Essentially StarPOS machines are provided to merchants and allow cashless payments for customers through the EFTPOS system.

STL entered this market by signing a leveraged wholesale agreement with Visa and MasterCard enabling it to roll out its very own EFTPOS machines to its customers – at excellent rates negotiated by industry veteran Todd Zani. He’s a seasoned operator in this space with an excellent track record that saw him float ASX-listed Ezeatm (ASX:EZA) in 2011.

When you consider that there’s almost 1 million EFTPOS terminals in Australia, growing at 8% per year, STL is entering a sustainable and growing market.

What’s even more interesting is that payments providers tend to be well insulated from the business cycle therefore even during the darkest days of the GFC, EFTPOS payments and ATM withdrawals remained steady.

People spend money in tough as well as good times. When it comes to small, one-off transactions, they do it even more and cut back on spending on large, high-value items.

STL estimates that StarPOS will generate net revenue of between 0.25% and 0.85% of the gross revenue processed by each terminal. Any one terminal can process anywhere between $10,000 – $100,000 per month depending on location and venue.

Terminals used in crowded areas or at premium venues can generate over $2M per year. That could translate to $50,000 to $170,000 per terminal in annual revenue for STL. However these kinds of revenue numbers are no guarantee – and STL remains a speculative stock.

STL is positioned for dominance in Australian payments

Operating as a vertically integrated payments provider allows STL to obtain the best market rates when sourcing ATM hardware to be installed across Australia. The ongoing maintenance of its network of 200+ ATM machines including software updates can also be done competitively therefore improving profit margins.

Sales revenues from ATMs and ATM related software increased 2,187% on a YTD comparison from 2014 to 2015 for STL. Meanwhile StarATM sales revenue rose from approximately $20,000 in 2014 to almost $120,000 in 2015 – a 500% increase.

This is further evidence that the local Aussie market has embraced the NeoICP CashPod brand of ATM machine.

Lower hardware costs also opens the door for STL to revisit previously unprofitable installation sites and means unviable locations are now back up for grabs. The new distribution agreement will result in a 30% cost saving compared to STL’s previous purchase costs for new ATMs.

Bear in mind that STL maintains a 19.25% stake in its hardware manufacturing partner NeoICP.

When we take a look at how NeoICP is getting along, it’s clear things are looking good for this integrated duo.

NeoICP recorded an EBITDA of $1.67M for FY 2015 with a book value of $27M. Its Net Profit After Tax (NPAT) was $1M which means STL qualifies for a pre-agreed 30% dividend of total profit earned by NeoICP ($300,000).

Yet another commercial string in this emerging payments player’s bow.

Looking Ahead

STL has a number of potentially transformative months ahead, with first revenues from StarPOS expected this month and the Recycler ATM rollout earmarked for late 2015 or early 2016.

The potentially lucrative casino connection currently being explored by NeoICP as part of field trials in Macau will also come under consideration, but it is the Cash+ deal, should it go ahead, that has the ability to change STL’s direction in the near term.

The next checkpoint for STL is an AGM (currently scheduled for October 19 th 2015) where the Cash+ acquisition will be proposed to shareholders. From there, we expect to see STL starring a lead role in Australian payments as it rolls out its Recycler ATMs and launches an EFTPOS service where it has beefy commercial margins courtesy of a tidy deal with MasterCard and Visa.

STL’s scalable proposition could achieve recurring revenue in an industry poised for ongoing trend growth.

We’ll most definitely be watching this particular star with much anticipation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.