South Korean ATM Investment to Re-rate STL?

Published 08-FEB-2016 10:44 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Here’s something to consider:

According to the Reserve Bank of Australia , Australians made 6.2 billion credit and debit card transactions in the 2015 financial year, with a combined value of $503 billion.

That number is continuing to climb higher, and Stargroup Limited (ASX:STL) has been set up to take a substantial slice of the pie.

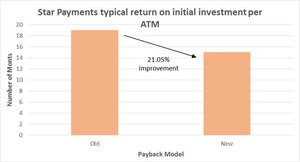

Since STL first came to our attention back in September 2015, the company has finalised several deals including renegotiating a number of key supply contracts in its ATM division , namely its Star Payment Systems, which has reduced major operating costs of its ATM network by 52.9%, accelerated the payback on initial investment per ATM to 15 months, and could deliver further cost savings through 2016.

It has completed its acquisition of Cash Plus taking its ATM network to over 230 machines and increasing revenues from A$2.4M to $5M.

Furthermore, NeoICP, a private South Korean company that manufactures ATM technology and in which Stargroup owns 19.25% of issued capital, recently released half yearly results which blitzed its full year EBITDA result from 2015.

Due to the synergies between the two companies, STL is now in an even stronger position to reach its goal of becoming the largest ASX listed company in this market.

NeoICP has just reported a valuation of its assets at $28.5M – significantly more than STL’s previous book value of its investment which was less than $1M.

Given STL’s large holding in NeoICP, if that isn’t cause for a re-rate, we don’t know what is.

Aside from that, STL is expecting dividends from this investment in the next 2 financial years.

STL has set up a business to capture Australians’ love of spending cold, hard, cash and is positioning itself across the payments chain to try and capture the growth.

At this stage, STL is only capped at about $14.5 million, and yet already has built a business which is more effective than the $187 million capped Directcash Payments out of Canada (we’ll get to that later).

Imagine the kind of efficiencies that could be gained as STL starts to scale up...

But the ongoing success of this company is no guarantee – as a junior company, there will be challenges ahead for it to continue its growth. This is a speculative stock.

STL has seen a 51% increase on ATM transactions and 50% increase in gross ATM revenue compared to the prior quarter, a 38% increase in the number of active ATMs compared to the prior quarter and a 24% increase in gross revenue.

STL is currently in that sweet spot where previous investment decisions are starting to show up on the balance sheet, and investors are starting to see a bit of a glimpse of the payments behemoth STL may turn into.

In this article we’ll run you through the STL game plan and give some insight into the payments game, and how STL’s previous bets are starting to pay off.

Re-introducing:

Star Group Ltd

Getting to grips with STL

So what exactly is Stargroup Limited (ASX:STL)?

You can find out more in our original article, $670BN Payments Industry to Bear Fruit for Aussie Rising Star? and the most recent follow up article STL on Course to Become Australia’s Prime ATM Distributor .

This article will focus on new developments in the STL camp, but for the uninitiated, here’s a quick catch up on all things STL.

At a very broad level, STL is an ATM company which has a fleet of ATMs, from which it takes a clip on each transaction.

Of course, there’s much more to this story ... first, to the ATMS .

STL currently has a fleet of about 230 active ATMs in the field, in fact, you may have seen one or two without knowing about it.

Here’s one example below:

Now, do us a favour: go outside.

Go on, we’ll wait.

...

Back? Good?

How many ATMs did you see when you took a walk around outside?

If your answer to that question is: ‘I saw them absolutely everywhere’, you’d be right.

And this is even with the growth of Paywave and EFTPOS technology.

There is still a place for ATMs at the banking table.

And there is a special place for those who have entered the industry with a smart plan to also profit from the newer payment technologies.

STL has its place.

Unlike other ATM providers, STL actually has an interest in the manufacturer making the machines it deploys.

Normally, a big ATM company like ANZ needs to buy the actual machines from a manufacturer.

That’s a huge cost on an individual machine basis, and it can take years for individual machine payback.

But STL has taken a page right out of Economics 101 with its play for sweet vertical integration.

The NeoICP deal

STL swung a deal with Korean manufacturer NeoICP which saw it take a 19.25% stake in the manufacturer.

This deal has two aspects to it:

Number one, it helps STL keep costs for the machines lower. After all, if one of your cornerstone investors came knocking for orders, you’d be pretty motivated to not gouge the customer...

STL has estimated that its stake in NeoICP helps reduce costs by around 30%, saving it about $1.1 million in capital expenditure per year.

Of course, the saving will increase as orders increase.

The second aspect of the deal, and why NeoICP was keen to get STL onto the register was a collaborative approach to R&D including the manufacture of its ATMs (giving it an advantage over the big banks).

Before we look at that approach it is worth noting that the NeoICP deal is working out very well.

One of the more intriguing parts of the STL investment in NeoICP is that as time goes on the strategic element of the investment is taking a back-seat to the fact that it’s just a really good investment.

Remember, STL’s 19.25% stake in NeoICP was originally pursuant to more of a joint venture arrangement on technology.

However, NeoICP keeps on kicking goals of its own.

It just reported earnings before interest of $1.9 million for the half year.

During the 2015 financial year, it had EBITDA of $1.66 million.

For the entire year.

Better yet, STL hasn’t really updated its set of books on NeoICP for a while.

This means it still values its 19.25% investment at just $938,368, while NeoICP has assets valued at over $28 million.

On that basis alone, a significant re-rating of that value is due to show up on the STL books, which should make it much easier to access capital.

To add icing to the cake, there’s a dividend policy in place whereby if NeoICP reports a NPAT (net profit after tax) of least $500,000 in the 2015, 2016, and 2017 financial years, then NeoICP will declare a dividend of 30% of that NPAT.

STL CEO Todd Zani has told investors that “it is reasonable to expect a future dividend payment from this investment”.

So now not only is STL in the farm to make money from ATMs, EFTPOS, back-end payments – but it could start making money from its investment.

Looking at the R&D

Two of the key technologies NeoICP is working on is casino settlement machines and cash redemption terminals.

The casino settlement machines are...machines, which are installed under casino tables (currently on trial in Macau) which allow players to settle accounts and submit cash payments right there at the table.

It means the player doesn’t need to leave the table to settle up accounts, and has the potential to keep tables open longer.

So, as you can imagine, casinos are pretty interested in the tech – and if there is one profitable kind of business that has the cash to throw at these kinds of initiatives, it’s definitely casinos.

Then, NeoICP and STL are working on a ‘recycler’ ATM.

This essentially means that customers are able to put cash into the machine and immediately see that money land in its accounts.

It’s a little old-hat, but if you’re in the practice of putting actual cash into your bank account then you know how much of a pain it can be to go into a bank – small merchants like cafes and shops tend to do this a lot after the till is closed at the end of a day.

You stand there, listen to a boring jingle for what seems an eternity, get to the cashier and then be told you haven’t filled out the deposit slip correctly.

Imagine you could do that at an ATM while out and about, cutting out the wait and corporate jingles...

The tech is currently being trialled in places such as China, Sri Lanka, Malaysia, Cambodia, Turkey, and South Africa.

The tech is still in its infancy of course so don’t base any investment decision on this alone. It’s always a good idea to seek professional advice if considering STL for your portfolio, including thinking about your own personal circumstances.

But ATMs aren’t the only game going for STL...

It’s more nimble than that

STL is building a larger game here and quickly moving through the gears to be seen not just as an ATM company, but a payments company.

Increasingly, STL is moving into the EFTPOS game.

As with ATMs, you’re generally more surprised if you go into a business and they don’t have an EFTPOS machine.

STL is increasingly supplying EFTPOS machines and has more recently started rolling out contactless payment machines as well...

And it’s in a growth market.

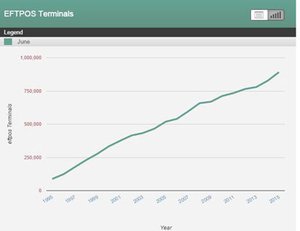

According to the Australian Payments Clearing Association, which knows a thing or two about how people are paying for stuff, there are almost a million EFTPOS machines out there – and that figure is growing.

STL has previously estimated that its EFTPOS offering, StarPOS, could generate net revenue in between 0.25% and 0.85% of the gross revenue processed each day by the unit.

That may seem low, but consider an EFTPOS machine may process anywhere between $10,000 and $100,000 per month – depending on location of course.

That’s between $250 and $2500 per month, or between $3000 and $30,000 per year.

We can tell you that it doesn’t cost that much to create an EFTPOS machine.

Now consider the average payback period for STL at the moment is 15 months for each machine it owns and that is a great result on its part.

EFTPOS machines may end up being a smaller scale but smarter revenue play for STL...

Getting into the back-end

STL has also devoted some time in getting into the infinitely geeky but potentially lucrative back-end payments space.

Consider the deal it struck with Anthem Software back in November .

The aim of the deal is to develop a software channel and get STL’s EFTPOS devices into Anthem’s business customer network.

Anthem is an ‘electronic data interchange’ (EDI) and supply chain software vendor with more than 50,000 users of its software across Australia and New Zealand.

At the moment, a business uses the Anthem system to order supplies from a supplier, using the Anthem gateway to process the payment, with the goods and services provided to the buyer once the payment has been processed.

Ultimately, the buyer needs to receive payment for the goods or services from a customer – and this transaction is handled by a separate EFTPOS payment.

Under the tech play STL is working on, the business will be able to order the goods or services from a third party via an EFTPOS system and then the customer will be able to use the same system to pay the business.

It means that there isn’t two separate transactions taking place for essentially what is the same service.

The early plan is to roll it out to Anthem’s 50,000 customers, but you can see the strategic thinking from STL here...

That’s a lot of payments!

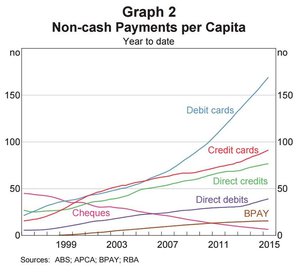

Each year, the Reserve Bank of Australia puts out a massive report on the number of payments made in Australia.

It does so to track how people are paying for things and why, just to get a handle on the times and see whether the RBA needs to move with the times as well.

For the last five or so years, the trend has been pretty stark:

Cash payments have been down, non-cash transactions have been up.

Again, it doesn’t mean that there is no place for ATMs, but you would think it’s a pretty good time to be in the non-cash payments business.

What STL is attempting to do here is capture the full suite of this growth. It wants in on the ATM business, knowing that fewer and fewer people carry cash around until they need it.

But it also wants in on the EFTPOS market, knowing that at the point of sale, cash is on the way out.

STL is in the early stages of getting in on the back-end of the payments chain.

The message here is pretty simple: wherever there’s a transaction taking place, STL wants to be there taking a cut.

STL could be anything, and on the evidence of what it’s done so far you’d back them to take a fair chunk of the ‘multi-trillion’ (rough estimates) payments being made out there.

Starting to see a (cash) plus on the balance sheet

In October last year, STL announced that it would acquire Cash+ and its network of 109 ATMs.

That deal went down, and in January we got our first glimpse of what sort of value the deal could offer STL.

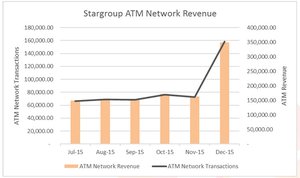

It said that it had recorded its eighth consecutive quarter of revenue growth , with its revenue for the quarter reaching about $750,000, a 24% jump on gross revenue quarter-on-quarter.

That result was driven by a 50% hike in ATM revenue for the quarter, which in turn was driven by a 51% increase in ATM transactions.

Revenue from the ATM segment reached almost $350,000.

Here’s the thing though: it only included one full month of revenue from the ATMs captured from the Cash+ deal.

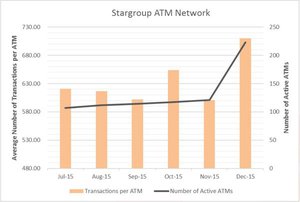

As you can see from the above, STL has over 230 ATMs at its disposal.

The Cash+ acquisition made up 109 of those, or 47% of the entire fleet.

Now, remember that that 47% of the fleet only made up one month of revenue for the quarter.

In a lot of ways, revenue is only one indicator of how well STL is doing in the ATM space at the moment, which is odd because one would have thought making money was the aim of the game here.

However, one metric STL prides itself on is the average transactions per machine indicator.

This goes to how smartly STL is thinking about its placement of machines.

After all, you can have all the machines in the world but if they’re all in the back room of the Iron Clad Hotel in Marble Bar, you’re probably not going to get much out of that.

But if you’re smart, you can put them where you get the most foot traffic, next to locations and businesses which require cash.

STL’s average transactions for the month reached 667 per month during the quarter, which was a 9% increase quarter on quarter.

Interestingly, TSX-listed DC Payments which is capped at US$186.4M and is thought to be a leader in the space only had 35.2 million transactions in the third quarter last year.

Now, divide that by three to get a monthly figure of 11.7 million. Now consider it has 21,824 active ATMs in the field.

That comes out to just over 536 transactions per month on average per machine for the third quarter.

Remember, STL had a monthly average of 667 .

DC may be the bigger fish, but STL may be the smarter .

Running in both directions

You know what’s good? Making money.

You know what’s better? Making money and reducing the cost of making said money.

STL has been hard at work on increasing its revenue pool, and now it’s hard at work in an attempt to convert more of that revenue into juicy, juicy profit.

One of the way it’s managed to do that is by re-negotiating key supply contracts in the ATM division.

The great thing about getting to the point STL is at, is that you can start to think about some pretty big plans.

You can start to think about ordering an amount of ATMs you couldn’t have done so otherwise.

So, little ol’ STL can start to bring scale to the table, and that makes for a very interesting discussion with key suppliers.

Earlier this month STL told the market that it had managed to reduce operating costs on a machine-by-machine basis by more than 50%.

The effect this has is to reduce the payback period on machines by over 20%, in this case, to 15 months.

ATMs are pretty big capital investments for a company of STL’s size, so any reduction in payback costs is appreciated.

It shows that STL isn’t just focused on relentless growth. That sounds like a good thing, but by focusing on the next opportunity you can ignore problems or possible improvements in your core business which have a nasty way of festering.

Instead, STL has one eye on its own business and one eye on the horizon – not a bad feat.

The final word

STL is in that sweet spot for a small-cap.

It doesn’t just have some sort of crazy idea that it’s hoping to milk shareholders with, but it’s actually starting to make some money.

It’s, however, still cheap enough to buy in right now.

Its previous bets are starting to show up on the balance sheet, while it’s starting to offer glimpses of the company that may be.

However its early days for this speculative stock, and there are simply no guarantees the company continue to grow – caution is advised if considering for your portfolio.

STL, however, has clearly laid out its scope for growth and is in a boom industry.

As people make more and more money, they are making more and more transactions.

What STL has actually tapped into is a love of spending money, and as people get more and more money they will make more and more transactions.

It’s a pretty good time to be in the payments game, then.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.