Re-rating on the Cards for NML? Stavely IPO Today on the ASX with $ 16M Market Cap

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It’s the day NML investors have been waiting for... Today, May 7 th , Stavely Minerals will list on the ASX after 80 million shares have been issued at 20 cents – Stavely will have a market cap of $16 million . Stavely’s $16 million market cap is all well and good – but we know of another company with a bigger list of targets, a longer strike length of prospective volcanic rocks, more confirmed mineral bodies and more land:

Navarre Minerals (ASX:NML) is still capped at just $4 million and hunting similar giant porphyries in the Victorian countryside next door to Stavely – who are valued at $16 million. If you don’t believe it, check out the ticker SVY. Today on listing, Stavely is valued 4 times more than NML! Once the market wakes up to this, there is a good chance NML could re-rate upwards. NML is still up 60% since we first featured the article Tiny ASX Company in Race to Discover the ‘Australian Andes’ :

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. However, this may just be the beginning. Following listing, Stavely will be cashed up and moving quickly with their drilling program. In the coming weeks, we understand Stavely are planning 3,800m of diamond drilling near NML’s targets. Any good news Stavely generates will impact positively on NML’s nearby project where four prospects are being explored with one close to confirmation. Stavely claims one modest inferred shallow copper resource in the Miga Arc but is yet to discover a deeper porphyry source to this mineralisation. NML has found a similar shallow copper blanket and is also searching for the deeper porphyry source. Stavely has a medium sized footprint compared to NML’s four prospects and monster sized land holdings. That’s a $16M market cap for Stavely with one inferred resource on the Miga Arc plus one modest inferred resource at its Ararat VMS project. NML is currently valued at a paltry $4M even though it’s got a superior position in the Miga Arc compared to Stavely. Could a re-rate for NML be on the cards? Stavely’s IPO could spark an upward market correction for NML as punters wake up to NML’s undervalued bigger and better potential. But no matter what the markets think the dash to strike copper riches in the Miga Arc is shifting up to Usain Bolt speeds! In addition to our plucky explorers, the Federal and Victorian governments have just started drilling even more holes into the Miga Arc to unlock its copper and gold secrets to turn the whole area into one big prize for mining companies to fight over. It’s all in the interests of boosting economic activity and jobs for western Victoria – NML investors aren’t complaining. The exact drill locations have not yet been disclosed, but since NML has so much prospective land in the region, there is a very good chance the government’s drilling might be on a couple of NML’s properties. But wait – there’s more! The government has just announced in its new budget – to be handed down today (May 7 th , 2014) – the so-called TARGET Strategy – grants will be made available for co-funded drilling and geoscience surveys to rejuvenate the state’s gold and copper industries. NML and Stavely will be in the box seat under this new initiative expected to focus on the Miga Arc. NML’s own drilling programme has stepped up a gear on the back of a stream of positive gold and copper finds at its Eclipse project. Part and parcel of being such a tiny company, The Next Small Cap expects NML will need to raise some cash in order to fund their next drilling campaign. Strap yourselves in; Stavely may be getting all the attention with its $16M market cap but we’re still cheering for NML to win this race.

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in reporting on high potential stocks. To note just a few:

- Since the Next Small Cap article on ASX:SEG, its share price has risen 100% following the report Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets .

- After the Next Oil Rush article on ASX:SWE The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months – the share price has been up to 150% since we called it.

- Following the Next Mining Boom ’s coverage on ASX:TRF – This junior stock will rebound hard in a broad commodity rally

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

NML’s red metal race in ‘The Australian Andes’

NML is based in the little town of Stawell in central Victoria where Australia’s oldest and richest running race is held, ‘The Stawell Gift.’ The 2014 running of this historic 120m race was just run on Easter Monday and the winner took the tape in a photo finish, collected $40,000 in prize money and retired on the spot! That’s the winner in black on the left falling over the line:

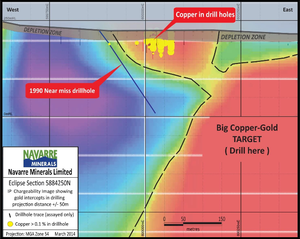

NML is running its own version of The Stawell Gift in the nearby Miga Arc mining region; but the prize is a lot bigger than $40,000 and they’re not planning on retiring any time soon! The prize NML is hunting is called a porphyry – a huge lump of predicted copper or gold mineralisation (or even both!) that geological surveys show dot the landscape of the Miga Arc like nuts in a chocolate bar. NML have a bulging red IP electrical chargeability target staring them in the face:

You can see in the 1990s someone came close to piercing this target – but just fell short. What exactly is emitting such strong chargeability? The shallow holes indicate it is caused by copper minerals and gold metal! NML investors are most definitely hoping for a big pile or copper and gold! NML are targeting this deeper target below the shallow copper and gold drill intercepts – the massive red bulge in the section above. However, to do so they will need to raise some cash and then get stuck into some deeper drilling. Porphyries are common in the Andes – that’s why South America is home to the largest deposits of copper on the planet. The Miga Arc is said to be geologically similar to the Andes – just millions of years older and a little deeper – but no less prospective. This prospectivity has earned it the nickname of the ‘Australian Andes.’ NML saw the Miga Arc’s potential early and snapped up 100% ownership of 1,278 km 2 of this highly prospective region – and have four copper porphyry prospects in the bag so far. Stavely, the IPO mob, are yet to find a porphyry deposit and have just ONE modest inferred copper resource for a shallow chalcocite blanket on the Miga Arc – earning it a $16M market cap. Both companies are looking to drill in the upcoming months before the winter rains – any discoveries for either company should float each other’s boat. The region will become even more prospective – but NML has a lot of catching up to do from such a low market cap – thus the re-rate potential!

Why Stavely’s $16M IPO is good news for NML

At The Next Small Cap we look for undervalued companies overlooked by the herd that have the potential to grow from near zero to total hero. That’s why we invested with NML instead of the more highly publicised Stavely. Both companies are heavily involved in the untapped Miga Arc region but from what we can see, NML has a superior position with four porphyry prospects compared to Stavely’s modest mineral resource. NML has more land, more drilling prospects and larger strike lengths. The market seems to be temporarily unaware of this. Stavely’s fully subscribed IPO and $16M market cap is proof of that. Although the Stavely IPO looks good, we think NML is better. We’re biding our time as the market slowly wakes up and become aware of NML’s gross undervaluation. The last few months have been an exciting time for Stavely. The buzz around its IPO has been impressive and has drawn a lot of attention to the prospectivity of the Miga Arc. Stavely were recently featured in the Australian Financial Review :

![]()

... and the Australian :

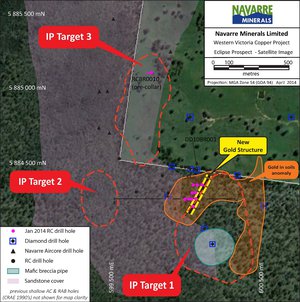

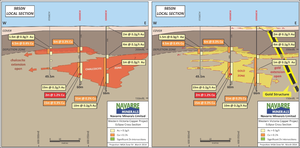

Stavely’s 30 million offered shares were taken up at 20 cents each leading to a $16 M market cap on listing. We expect Stavely will use its new capital position to accelerate its drilling programme at its Stavely prospect where it claims an inferred resource of 28Mt at 0.4% copper for 110kt of contained Cu. If Stavely can find a deeper porphyry source to that shallow resource and demonstrate to the market it’s got a big copper porphyry in the bag then a lot of investors will be rubbing their hands in glee. But so will NML! Remember, NML has got four prospects to drill in the Miga Arc with one, Eclipse, showing very encouraging signs of a porphyry. Porphyries occur in clusters and there are three porphyry targets alone at Eclipse and only one of them has been superficially drill tested to date:

Source: Navarre Minerals

Proving that the Miga Arc actually contains porphyries is half the battle. Being the more cashed up of the two, Stavely have already announced drilling to commence in a few weeks. NML will need to raise some cash to start drilling to the same extent that Stavely will.... or cash-in on the state governments co-drilling grants (more on this below). But if Stavely can prove up something big in their drilling campaign, then NML’s four prospects are going to look a whole lot better to the markets. Keep drilling Stavely and good luck – your success will fuel NML’s too!

NML closing in on a big copper porphyry deposit

Right now, at the Western Victoria Copper Project , NML is concentrating on proving up its most advanced porphyry prospect at a site called Eclipse. A drilling programme is planned for June to follow-up lots of encouraging gold and copper drill intercepts from its recent shallow drilling:

![]()

The results from the reverse circulation drill holes show significant gold and copper in a mineralised blanket above a deeper porphyry target. NML will look to raise some cash soon to start drilling even deeper at Eclipse and hopefully hit a red metal behemoth! This should happen sooner rather than later – it’s pretty unforgiving ground in western Victoria come winter, so NML wants to get the job done before the winter rains hit with full force.

NML to receive free drilling?

You read correctly.

Right now government geologists have commenced a program of 16-18 diamond drill holes into the Miga Arc to generate new geological information and boost mineral investment into this region. The exact locations of the drill holes are yet to be disclosed. So why is the government spending all this cash on the Australian Andes? To stimulate growth in the region. If they manage to drill on NML’s land and find something big, they will be stimulating NML investors wallets also! Back in January an announcement was made confirming that the Federal and Victorian governments would fund a multi-million dollar exploration program in the Miga Arc to generate new data on its copper and gold prospectivity:

![]()

The Deep Exploration Technologies Cooperative Research Centre (DET CRC) is managing the project on behalf of GeoScience Australia and the Geological Survey of Victoria. Drilling is now underway!

It’s safe to say the government work is hugely important for the region and NML. Through the programme, the government geological agencies will be able to throw the full gamut of tests on the drill samples with the goal of providing mining and exploration companies (like NML) with a detailed picture of the underground geology. This is fantastic news for NML, which holds an enormous land position within the Miga Arc of 1,278 km2. So NML’s attempts to hit a big copper-porphyry could be bolstered by free government drilling! Sounds like a much cheaper way to go about things! Using state of the art technology, DET CRC will deploy conventional diamond drilling as well as new real-time sensing technologies both down-hole and top-of-hole. Samples will then be sent to laboratories for analysis with data uploaded to the internet for real-time, remote access – a boon for NML’s field work!

Check out this video of what the process will be like:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.