PMY Reports Highly Positive Copper Testwork Results

Published 09-NOV-2017 09:58 A.M.

|

15 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacifico Minerals’ (ASX:PMY) highly experienced management team, along with its $1 billion-capped joint venture partner, Sandfire Resources (ASX:SFR), is making excellent progress in the Northern Territory’s world class base metals district, the McArthur Basin.

When we last updated you on PMY in August with the article, ASX Junior with a Mining Powerhouse Partnership Gears up to Drill in the McArthur Basin , the company was about to begin drilling at its Borroloola West Project JV.

Since then, PMY has seen plenty of progress at its NT operations.

PMY most recently reported highly encouraging leach test work results from the Borroloola West’s Lorella prospect and has also progressed exploration having completed and analysed diamond drilling at Borroloola West’s Coppermine Creek, Mariner, and Berjaya prospects.

Acid leach testwork on oxide copper mineralisation from Lorella returned highly positive results and indicates >90% recoveries with low acid consumption.

Given these positive results, PMY is considering the development of a solvent extraction, electrowinning (SXEW) operation.

The value in this would be that PMY could recover copper from an entirely different set of ores and mining byproducts than is possible by smelting; namely, oxidized materials.

PMY has found that leaching of the oxide copper material could be economically viable with relatively low acid consumption and high copper recoveries,

Should this be the case, it is anticipated that a copper cathode producing plant could be established within a short lead time and at relatively low capital and operating costs.

Suffice to say, PMY’s copper operations in the NT are moving along well, with work underway on estimating a JORC inferred resource and exploration target based on potential strike extent. An inferred oxide copper resource with lots of upside with the exploration target could have a significant impact on the share price of PMY.

Of course, as with all minerals exploration, success is no guarantee – consider your own personal circumstances before investing, and seek professional financial advice.

An aircore program to 2000 metres at Lorella is planned to start during November to test strike extensions to increase potential tonnage of oxide copper.

But PMY’s portfolio of highly prospective projects extends further than Australian borders.

The company has two highly promising early stage gold plays in Colombia.

The South American country offers huge opportunities for foreign miners. With limited exploration conducted over the past 40 years, less than 5% of the country has been explored with modern exploration techniques and technology.

Another benefit is that the Colombian government has opened its doors to miners offering favourable mining royalties and a low corporate tax rate.

PMY’s Colombian assets add considerable depth and longevity to the company’s portfolio of assets. It recently uncovered several gold anomalies during exploration activities at its Berrio Gold Project which is situated in the Segovia gold belt — Colombia’s most prolific gold belt.

Catching up with:

Western Australia based Pacifico Minerals (ASX:PMY) continues to progress its exploration projects in the Northern Territory and Colombia.

In the Northern Territory, PMY is focused on advancing the Borroloola West JV project, where it is exploring for base metal deposits. While in Colombia, it is progressing exploration activities at its 100%-owned Berrio Gold Project, which is within the southern part of the Segovia Gold Belt.

Let’s start right at home with the ...

Borroloola West Project – Northern Territory

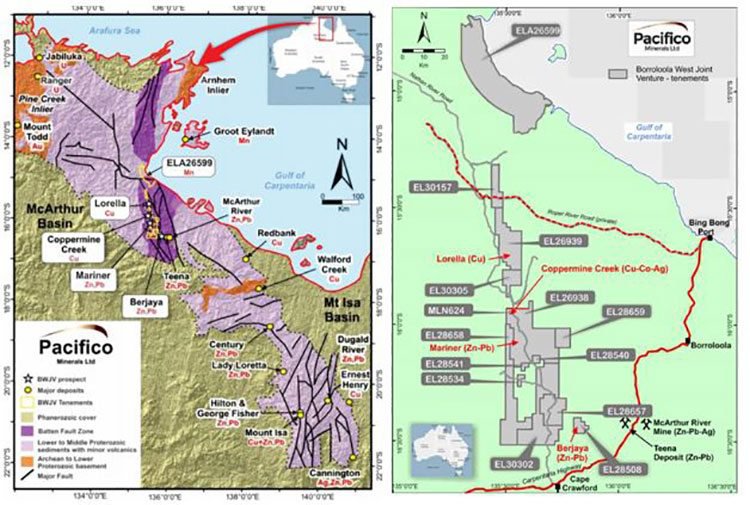

The Borroloola West Joint Venture (JV) consists of 12 exploration licences and 1 mining licence over a large and unexplored ground package of 1817 square kilometres in East Arnhem Land, NT.

PMY has a 51% holding in the JV and is the project operator, while JV partner, $1 billion-capped Sandfire Resources NL (ASX:SFR), holds 49%.

The Borroloola West Project covers an outstanding tenement package that has high potential for the discovery of world class base metal deposits. The project area is underlain by the McArthur Basin, as well as the northern extension of the Mt Isa Basin.

This area is home to several world-class sediment hosted massive sulphide deposits. These include the major zinc/lead/silver and copper deposit at Mt Isa and the McArthur River zinc/lead/silver deposit, which is the world’s largest producing zinc-lead mine and is just 25 kilometres east of the Borroloola West tenements. The project is also near Teck Resources world class Teena zinc-lead deposit.

Here you can see the McArthur and Mt Isa Basins and the Borroloola West Project Area along with the Borroloola West tenements and nearby world class mines.

On November 6, PMY announced highly positive testwork results from the Lorella copper prospect at Borroloola West.

The Lorella Prospect is located in an area of historical drilling by Sandfire Resources, 100 kilometres northeast of the McArthur River Mine, seven kilometres west of the Nathan River Road and 9 kilometres east of the Lorella Springs Road. The prospect has the potential for both primary and oxide copper resources.

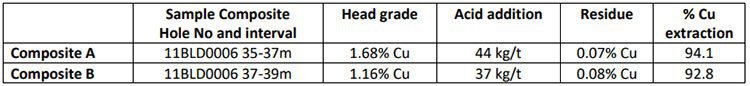

Preliminary acid leach test work that was carried out at SGS Metallurgy in Perth returned highly positive results. It found that acid consumption is relatively low and copper recoveries better than 90% were obtained.

The results indicate that leaching the oxide copper material could be economically viable.

Two composite samples from Sandfire’s drill core underwent acid leach testwork. The preliminary test results show encouraging copper leach extractions at relatively low acid additions (37kg/t and 44kg/t) for both samples. The key copper leach testwork results are as follows:

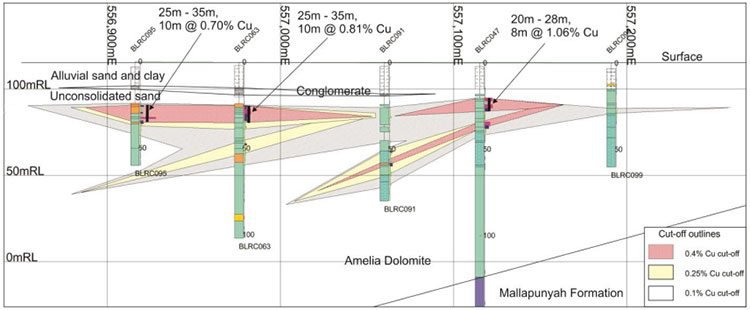

The oxide copper mineralisation consists of disseminations, blebs, veins and fracture fill of malachite and azurite within highly leached siltstone and fine grained sandstone. The intersection thickness averages 8m using 0.4% copper cut-off, and results in an average grade of about 1.0% copper.

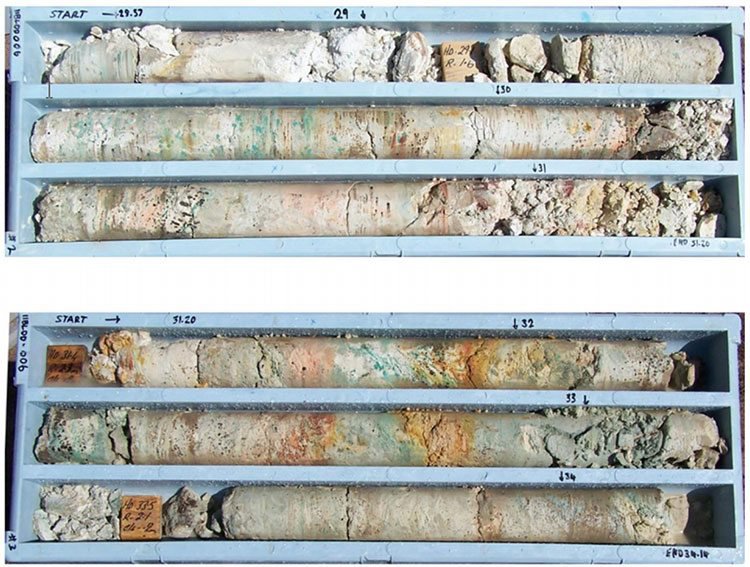

Blebs and disseminated malachite in Sandfire diamond hole 11BLDD006:

Given the results indicate leaching of the oxide copper material could be economically viable with relatively low acid consumption and high copper recoveries, PMY is considering developing a solvent extraction, electrowinning (SXEW) operation.

Should this be the case, a copper cathode producing plant could be established within a short lead time and at relatively low capital and operating costs.

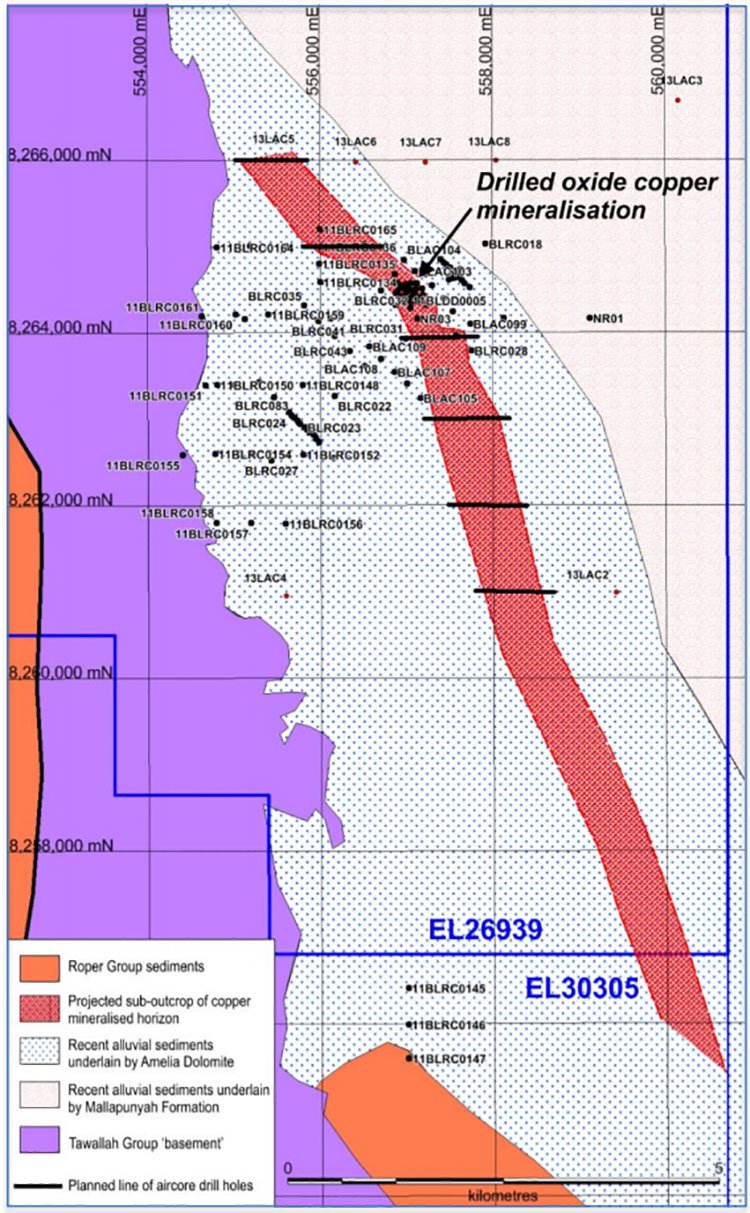

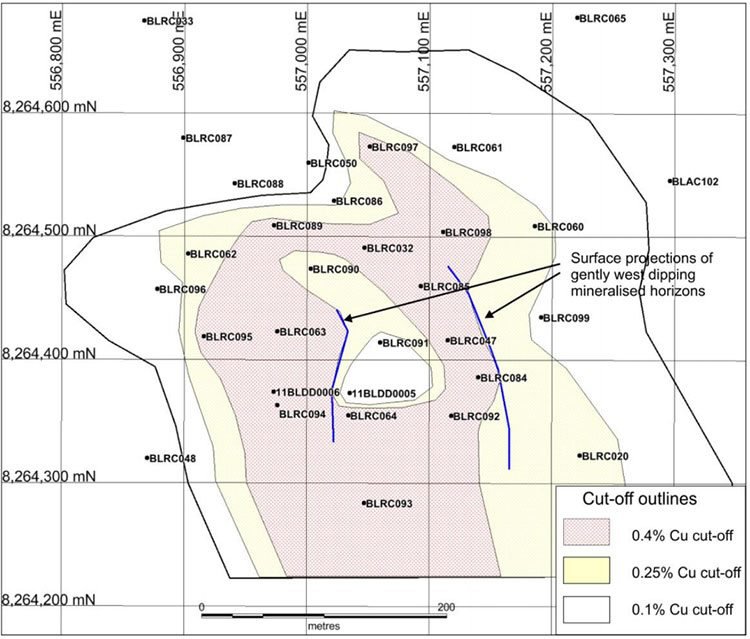

Here is the Lorella Prospect (EL26939) in more detail. You can see the historical drill hole collars and projected extent of sub-surface copper mineralisation:

With regard to the geological characteristics, copper mineralisation at Lorella is flat lying, beneath about 25 metres of unconsolidated sands.

In 2010 and 2011, an extensive drilling program by Sandfire targeted primary sulphide copper mineralisation, of which 17 RC holes and 1 diamond hole intersected significant flat-lying oxide copper mineralisation over an area of about 160,000 square metres.

The primary control of the copper mineralisation is considered to be stratigraphic, dipping gently to the west. At Lorella, the distribution of copper mineralisation indicates that it has been oxidised, transported and enriched by supergene processes.

Only 400 metres of the sub-outcropping strike of mineralisation had previously been tested. That leaves about 12 kilometres of strike under shallow alluvial cover within the project’s tenements that is virtually untested.

The oxide copper mineralisation is open to the south-southeast and there is the likelihood of further lenses to the northwest.

Here are the cut-off outlines based on a preliminary assessment of historical drill data:

Section through oxide copper mineralisation, Lorella prospect:

Work has commenced on estimating an inferred JORC resource in the area of detailed diamond and RC drilling by Sandfire and to set an Exploration Target estimate based on the potential strike extent.

A 2000 metre aircore (AC) drill programme is planned to begin this month, just days from now. It will test the strike extensions to the northwest and south-southeast of previously intersected oxide copper mineralisation, and also for indications of significant down-dip primary sulphide mineralisation.

The holes will be drilled on lines 1 kilometre apart, with hole spacing along the lines of 100m, to an average depth of 50m.

If it’s successful, the entire strike length will be explored with AC drilling. PMY would then work towards defining inferred and indicated resources via RC drilling programs, some PQ diamond drill holes, and more comprehensive testwork on the drill chips and core.

Potential investors should note that PMY is still in early stage exploration mode and therefore any decision with regards to adding this stock to your portfolio should be taken with caution and professional financial advice sought.

These results were reported as ‘Breaking News’ by news.com.au on the morning of the announcement. Note the positive reaction from the market, with shareholders seeing a 25% share price rise on heavy volume immediately after the results were published.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Prior to this on October 17, PMY announced that diamond drilling at Borroloola West’s Coppermine Creek, Mariner, and Berjaya prospects had been completed and analysed. This drilling had been designed to test for major primary copper and zinc-lead mineralisation.

Coppermine Creek

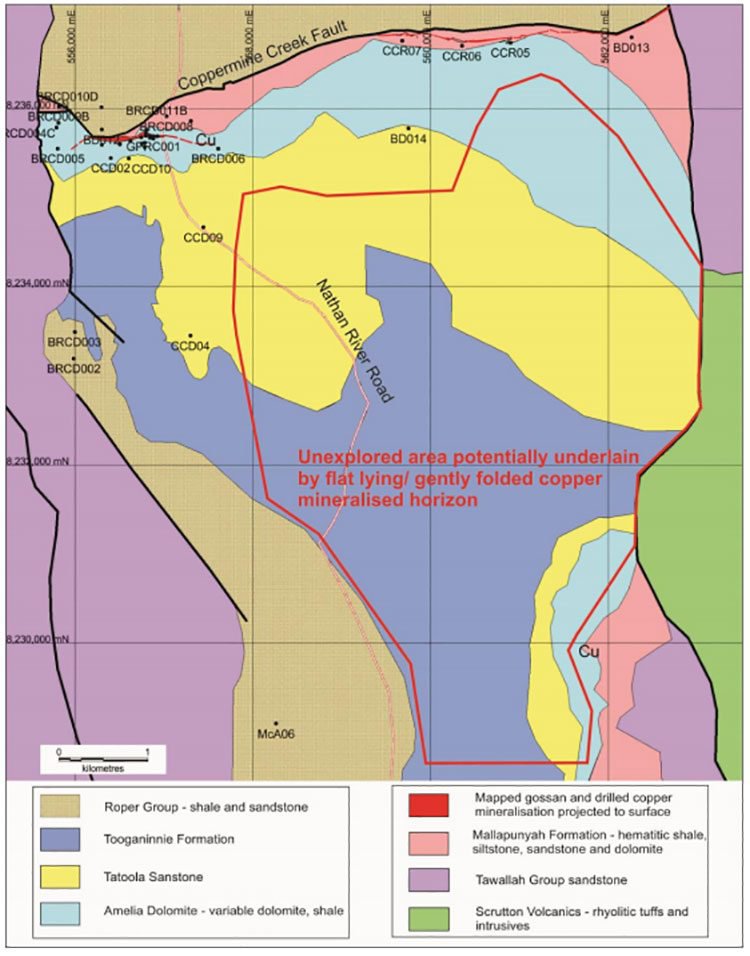

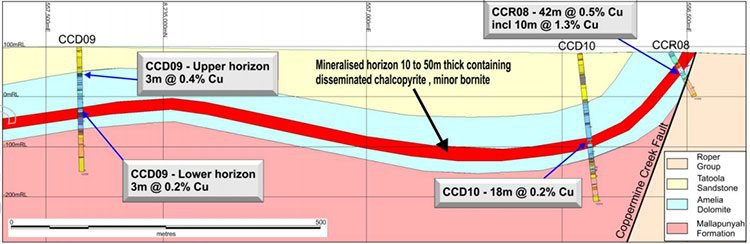

At the Coppermine Creek Prospect, a model of a potentially extensive stratiform, shallow, flat to gently dipping, zone of copper mineralisation was confirmed.

Two holes were drilled at the prospect, both intersecting visible copper mineralisation over significant widths. There are large areas where the depths of the layer are relatively shallow, lying between 50 metres and 250 metres.

Below you can see the geology and drilling, including the recently drilled diamond holes (CCD09 and CCD10), at Coppermine Creek. Note the significant area potentially underlain by a gently dipping mineralised horizon.

And here is the section through diamond holes CCD09 and CCD10 at Coppermine Creek:

There remains major potential in the undrilled extension towards the south and east of the copper mineralisation. The next stage of exploration will include detailed mapping and rock chip geochemistry over the prospective area to define targets for large economic concentrations of copper mineralisation.

Mariner prospect

At the Mariner zinc-lead prospect, PMY has completed two diamond drill holes, MND05 and MND06.

The first, MND05, passed from Roper Group sediments, through a fault breccia zone, and into moderately fractured dolomite interpreted as being part of the Mara Formation. The fractures were often oxidised and contained limonite and cerussite (lead carbonate).

The second hole, MND06, drilled through a sequence of black carbonaceous, very pyritic shale and dolomite to 204 metres depth where the hole passed into coarse sandstone and grits. The carbonaceous black shales fit stratigraphically to be part of the Barney Creek Formation, lying beneath the Roper Group sediments, and above a dolomite that could be regarded as the Mara or Teena Dolomite.

It’s important to note that the Barney Creek Formation is host to the world class McArthur River zinc-lead deposit and holds potential for the discovery of further zinc-lead deposits. The formation has never before been recognised or mapped in the Mariner prospect area.

A growth fault is indicated by the coarse sandstone unit which is only developed on the western side of the fault intersected in MND05. The observed lead mineralisation in this hole, supported by geochemistry from the diamond drill holes, supports the prospectivity of this Barney Creek Formation sub-basin. PMY say that it could extend to the north of the Mariner Prospect beneath the younger Roper Formation.

The company will undertake geological mapping and systematic rock chip sampling geochemistry to define the possible boundaries and extent of the Barney Creek Formation sub-basin.

Colombian Projects

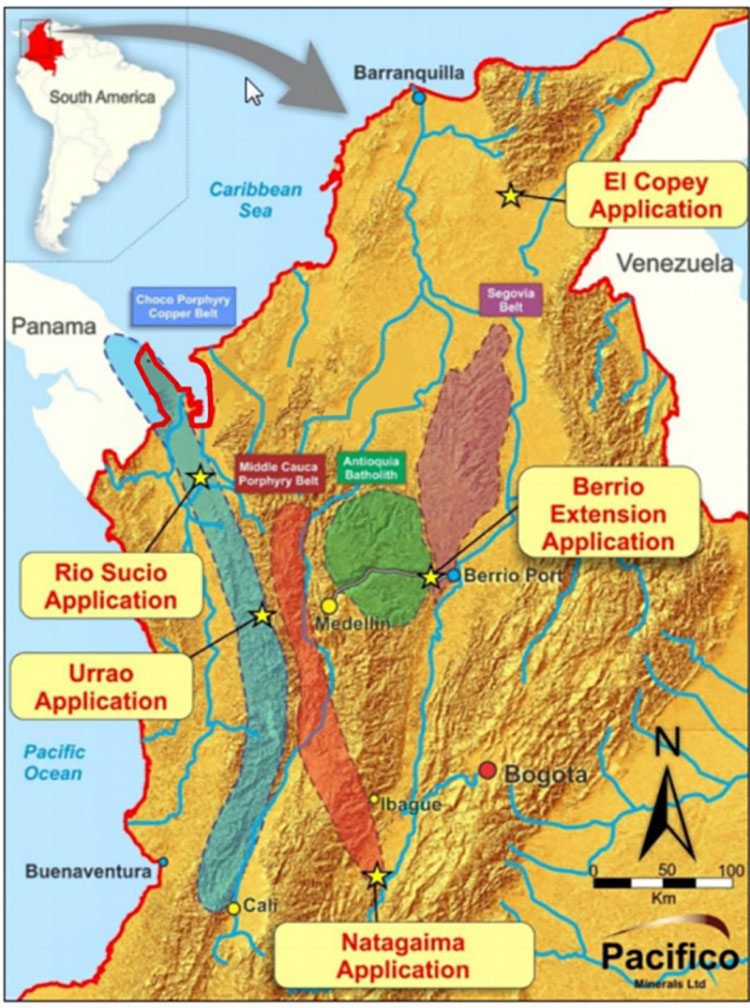

PMY currently has two projects in Colombia — The Berrio Gold Project and the Natagaima prospect, which is highly prospective for precious and base metals.

The country has a rich mineral endowment and while it has only seen limited modern exploration over the past 40 years, Colombia is an established produced of gold, nickel, coal, oil and emeralds.

The Andean Mountain chain which runs down the west of the South American continent has been thoroughly explored in almost all regions, except for Colombia:

The Colombian government is now actively encouraging mineral exploration. It has favourable mining royalties of just 3.2% and a low corporate tax rate of just 25%. These factors combined have seen major operators including Anglogold Ashanti, Anglo American, BHP, and Glencore set up operations in Colombia.

As for PMY, it has been in Colombia since 2011, which has presented the opportunity to identify and evaluate a range of attractive precious and base metal prospects throughout the country.

PMY was able to lodge tenement applications when the ground became available ahead of its peers. It now has tenement applications for five high quality projects totalling more than 46,000 hectares.

Berrio Gold Project

PMY’s primary focus in Colombia in the near future is advancing its Berrio Gold Project. Berrio is situated in the southern part of the prolific Segovia Gold Belt and is characterised by a number of operational, artisanal-scale adits.

Segovia is Colombia’s most prolific gold belt, from which gold has been exploited for more than 150 years.

The project, located 35 kilometres from the Magdalena River which joins the Caribbean Sea, has excellent infrastructure in place including hydro power, sealed roads, a water supply and telecommunications coverage.

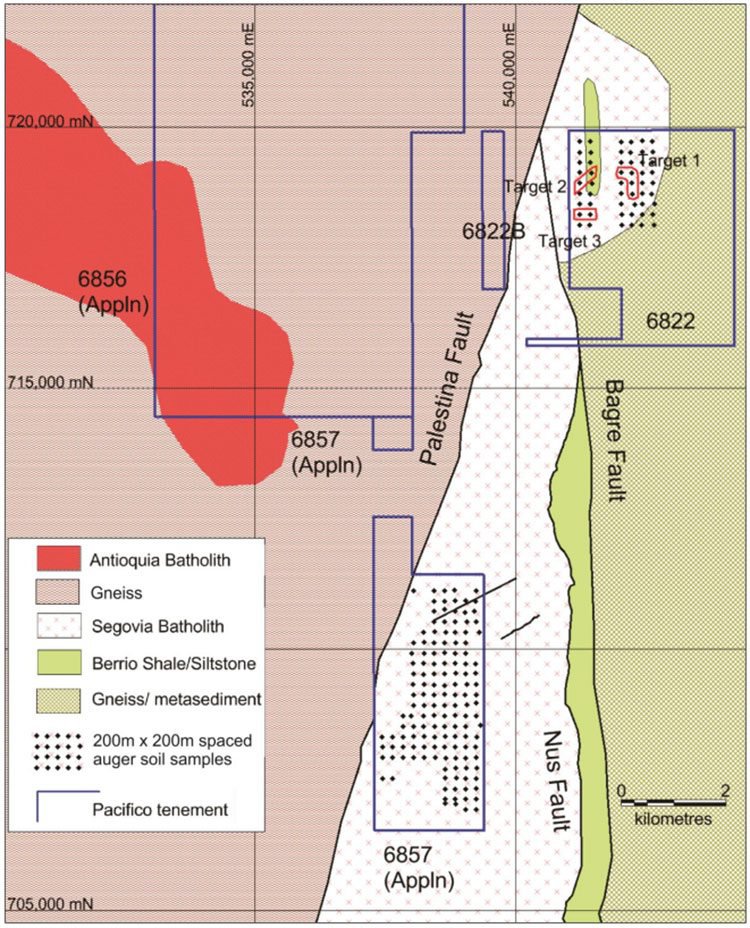

The area covered by the project tenements lies close to the intersection of three major regional faults, the Palestina Fault, Nus Fault and Bagre Fault, and in a district with significant known gold mineralisation.

Over the past decade, Colombia has opened up as a highly appealing mining destination. This follows a significant improvement in the country’s security, along with the government actively encouraging foreign (mining) investment with favourable mining royalties and a low corporate tax rate.

On October 24, PMY reported that early stage gold analysis at its Berrio Gold Project had identified several gold anomalies .

Three gold and multi-element anomalies are identified within an overall area of 1.2 by 1.0 kilometre. These can be seen as targets 1, 2 and 3 on the map below. The map also shows the geology and PMY’s 100%-owned tenements (6822, 6822B) and tenement applications (6856 and 6857):

PMY’s tenements and applications have all been covered previously with reconnaissance traverses, including mapping of the geology and taking rock chip samples.

Anomalous gold values and widespread hydrothermal alteration of the rocks in structures were noted in the areas selected for the 200 metre by 200 metre soil grids, as can be seen on the map above. These areas are largely underlain by diorite of the Segovia Batholith.

The northern area (within tenement 6822) is also underlain by diorite of the Segovia Batholith, as well as some Berrio sediments consisting of black carbonaceous shale, siltstone and sandstone.

Structures containing pyrite mineralisation were identified during reconnaissance work, while values of up to 71ppb gold, 43ppm arsenic, 264ppm copper and 360ppm lead were obtained.

PMY’s findings were summarised in an article from finfeed.com (Finfeed is a related entity of S3 Consortium Pty Ltd as defined in Section 9 of the Corporations Act 2001) on October 24:

The gold anomalous areas on tenement 6822 will now be followed up with 100 metres by 100 metres soils, and then power auger drilling, pitting and trenching to define diamond drill targets.

It should be noted that success isn’t guaranteed here and investors should take a cautious approach to any investment decision and seek professional financial advice with regard to this stock.

As for the Natagaima prospect, PMY is expecting to be granted an exploration licence for the copper/gold/silver prospect by early 2018 — another potential catalyst for PMY coming out of its Colombian operations.

PMY: a Micro-cap with a High Quality Portfolio

PMY has a solid pipeline of quality projects, including the Borroloola West JV backed by Sandfire Resources and its 100% owned Berrio Gold Project in Colombia. This combined with a board and management team that has a proven track record of identifying, funding, and developing projects, PMY could be worth a closer look.

With a market cap of just $4.45 million, PMY is still in early days. While it trades under the radar today, if positive newsflow continues as we’ve seen in recent months we could soon see increasing attention from small cap enthusiasts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.