Pedal to the Metal: ARD Cashed up and Drilling Right Now

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

We get the feeling that good times are ahead for today’s ASX explorer, which has set up camp at three base and precious metals projects in NSW.

The company is accumulating some of the state’s most prospective land, in a domain famous for the fact that it boasts Australia’s first discovery of gold.

The area is host to multi-billion dollar deposits like $15.7 billion-capped Newcrest’s (ASX: NCM) Cadia Valley Operations... which produced 2.4 million ounces of gold in 2016, and according to the company, still has some 40+ million ounces remaining.

Today we are covering Argent Minerals Ltd (ASX:ARD), whose tenement trifecta covers significant ground across highly prospective exploration regions in NSW.

ARD is attracting investor attention, and at the end of April announced the completion of a heavily oversubscribed private placement to add $2.28 million to its cash reserves.

Last month it also announced it had expanded its holding in West Wyalong from 51% to 70% — where it has identified a substantial porphyry copper-gold target.

Now flush with its latest injection of cash, ARD has completed diamond drilling at the highly prospective West Wyalong project – and assays are pending...

In the near term, ARD will also advance with drilling at its flagship Kempfield play, and at Loch Lilly — an early stage project that ARD is farming-in.

At last count, ARD’s three projects offer exposure to silver, gold, lead, zinc, copper and nickel — a broad sweep of metals, most of which have been enjoying renewed interest to varying degrees over the last 6-12 months.

With some potentially price-moving news looming on the horizon, the $12 million-capped ARD might be on track toward a higher valuation, if it can prove up the value on any one of its three projects.

Although, it must be noted though that ARD should still be considered a speculative investment and investors should seek professional financial advice if considering it for the portfolio.

ARD is one of several explorers vying for the best metals tenements across the country, at a time when the metals market looks to be building up steam for a broad scale revival.

Nobody knows for sure which metal will be next to break out, following the surprisingly robust lithium boom of recent years...

But in such an environment a smart company makes sure they at least have one thing: options.

ARD’s West Wyalong play is strategically located in the Cowal historic gold mining region just 37km to the South of the world-class Cowal gold mine purchased by Evolution Mining for US$550 million...

While it’s been a bit overlooked so far, ARD could be ready to make itself known. It’s been on a bit of a streak lately, though the wider market is yet to cotton on.

Which is why we thought it was a good time to refresh you on:

The way ARD is going, it’s likely to be feeding the market with continuous drilling results, Resource additions, and market moving news flow until at least the end of this year.

And let us remind you again that the company is only capped at $12 million – for now . This polymetallic play could be set to go ‘turbo’ on its growth curve, as the dust begins to settle on its opportunistic acquisitions and the value of what it is holding becomes clearer.

In ARD’s corner pushing the company along is Dr Tony Crawford, one of the country’s pre-eminent experts on NSW geology and an internationally recognised metals expert. ARD has a JORC 2012 Resource of 52 million oz silver equivalent of silver, lead, zinc and gold at its flagship Kempfield project. And as of last month, ARD has a significantly greater pile of cash in which to progress its projects with.

There’s a growing list of reasons to pay serious attention to ARD. In a region swarming with takeover activity, and packed with copper/gold/zinc producers, ARD may not stick to the small-time for much longer...

Another win at West Wyalong

ARD has upped its interest in the West Wyalong project from 51% to 70%, after satisfying the earn-in requirements of its JV agreement with Golden Cross Operations.

ARD’s agreement with Golden Cross at West Wyalong required ARD to invest a further $372,570, including $200,000 of direct in-ground expenditure, in order to earn the 70% interest — which it has now done.

The company has also completed its diamond drilling programme at the West Wyalong project.

ARD has budgeted to assay 70% of the diamond drilling samples, which covers six holes for 2,427 metres. This should provide significant clarity around the project’s potential as companies typically usually only assay less than one-third of the drill core.

If you read between the lines here, assaying 70% of the core indicates ARD clearly likes what it sees.

Perhaps the market has missed this, but ARD is certainly moving forward at rapid pace based on visual observations that give it confidence that its assets could match it with its neighbours.

To ensure adequate sampling, ARD extended the depth of the drill holes.

The six-hole programme — completed at a total of 2,427m for an extension on the originally planned 2,300m — is now in the sample processing stages, with cores sent to its headquarters in Kempfield.

From there the results can be released to market, and turned into a 3D model to aid analysis and further targeted drilling.

As for the JV, it will continue on a 70/30 basis — putting ARD in a great position to profit down the track, should the results be as positive as expected.

A large part of what has made this possible is the fact that 50% of the drilling is being co-funded by the NSW State Government — up to a total of $200,000.

The exceptional prospectivity of the area saw these funds awarded after a merit-based assessment of the project by a panel of experts. It’s in the interest of both ARD and the Government to explore whether drilling at the project will reveal a porphyry copper-gold deposit with possible gold offshoots from the main geological structure.

The company you keep

ARD is certainly in good company — as we touched on earlier, Evolution Mining and Newcrest have both landed some massive Resources in the highly prospective region... and appear to be doing quite well out of them.

The West Wyalong Project is surrounded by holdings belonging to big name gold producers such as Evolution Mining ($3.6BN market cap), Sandfire Resources ($877M market cap) and St Barbara ($1.3BN market cap), as can be seen here:

Sandfire is of real significance to those looking into ARD.

When Sandfire acquired Straits Resources, it was to acquire the tenements below ARD. Sandfire is a real rags to riches story and in the space of six years went from almost penniless to a Top 200 producer.

The good news for ARD is that there are large systems on the ground being covered by ARD and Sandfire that tend to be linked at depth.

Meanwhile, in the opposite direction, Evolution’s Cowal Mine sees the same volcanics belt to the north of West Wyalong. Cowal was acquired by Evolution Mining for US$550 million in 2015 and is considered to one of Evolution’s most attractive gold assets, estimated at 5.05 million ounces of contained gold, including an ore reserve estimate of 2.85 million ounces of gold.

Late last year, Evolution entered a Binding Agreement with Newcrest to purchase the latter’s Marsden copper-gold project for $10 million.

There’s clearly something attractive in the region and ARD is well placed to potentially make good on its assets.

Yet, whether ARD can reach the heights of its neighbours remains to be seen and investors should therefore take all publicly available information into account before making an investment decision.

Of course West Wyalong isn’t the only thing that ARD has on the go.... let’s see how the company’s Kempfield project is travelling.

Keeping score on Kempfield

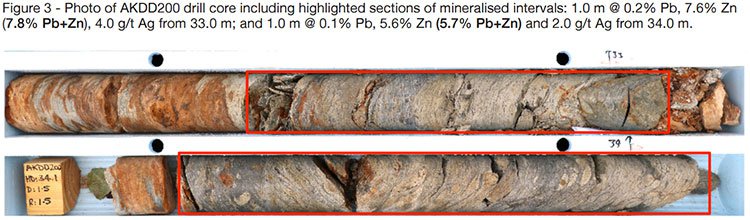

In mid-March, ARD announced some of the findings from its eight-hole diamond drilling campaign at Kempfield.

The key news was the fact that it had intersected significant Ag/Pb/Zn mineralisation at the project’s ‘Henry Zone’. The returned results identified five separate mineralised sections — some highlights were:

- 6.0 m @ 1.0% Pb, 0.1% Zn, 22 g/t Ag and 0.0% Au from 2.0 m.

-

10.0 m @ 0.1% Pb, 2.8% Zn and 2.0 g/t Ag from 32.0 m, including:

- 1.0 m @ 0.2% Pb, 7.6% Zn and 4.0 g/t Ag from 33.0 m , and

- 1.0 m @ 0.1% Pb, 5.6% Zn and 2.0 g/t Ag from 34.0 m

- 5.0 m @ 0.3% Pb, 0.8% Zn and 2.0 g/t Ag from 161.0 m

-

8.9 m @ 0.6% Pb, 1.8% Zn and 46 g/t Ag from 193.2 m including:

- 2.0 m @ 0.5% Pb, 2.2% Zn and 96 g/t Ag from 198.9 m

-

16 m @ 0.6% Pb, 1.8% Zn, 83 g/t Ag and 0.1 g/t Au from 205 m

, including:

- 7.6 m @ 1.2% Pb, 3.4% Zn, 126 g/t Ag and 0.2 g/t Au from 212.4 m

- 1.0 m @ 2.2% Pb, 8.3% Zn, 250 g/t Ag and 0.2 g/t Au from 213.4 m

And if after scrolling through that, you’ve decided perhaps you’re more of a visual person, then here’s a photo just for you:

It’s good to put all the talk into tangible results and see the core samples from the ground which contain actual zinc, silver and lead.

During drilling, the team also identified the potential for a 1,000m northeast strike extension from Kempfield North to the Henry Zone, as indicated below:

The team also found evidence to support the possibility of an extension of the deposit to the south and south-east, as well as high-grade mineralisation potential at Kempfield West.

These are the kinds of results that can drive up interest very quickly, and get new investors keen to snap up stock before there’s a price inflection...

In fact this drilling programme at Kempfield could very well lead to extensions to the mineralisation and a JORC Resource update, as two of the stated objectives of the company.

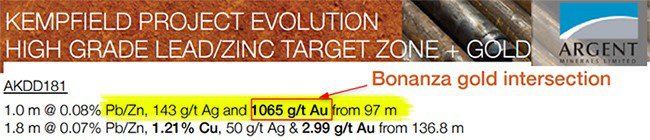

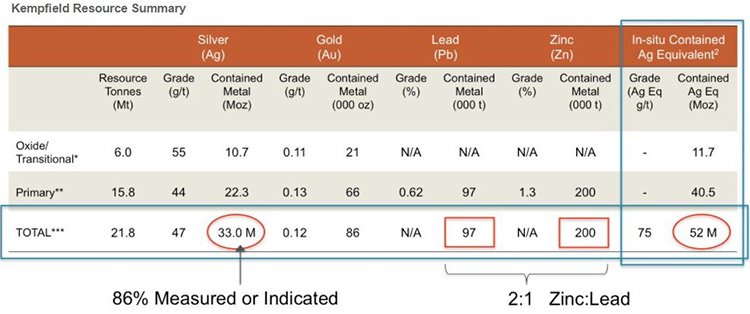

All of this begins to form a bright-looking future for ARD, when you consider the current JORC Estimate for Kempfield is already 52 million oz of silver equivalent of silver, lead, zinc and gold.

Here’s the current JORC Estimate summary:

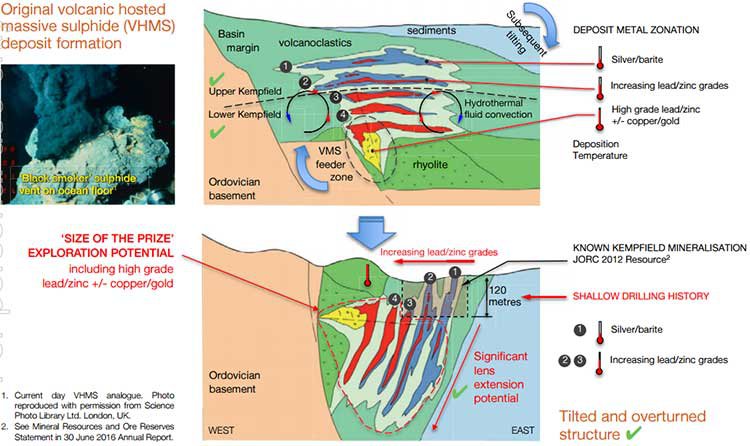

ARD has a clear objective now to gather proof of concept regarding its anticipation of a VMS at Kempfield (VMS means a Volcanogenic Massive Sulphide deposit, for those playing at home) beyond the known zinc, silver and lead deposit.

The below graphics give a picture of the ‘conceptual deposit model’ currently being tested by ARD’s drilling at Kempfield:

You can also see, bottom right, what’s covered in the existing JORC Estimate as compared to the mineralisation ARD are hoping to define with its current drilling efforts.

With the recent inflow of cash, ARD now has an excellent opportunity to follow up its previous drilling results with more targeted campaigns — like the one it’s currently undertaking — to fully explore the Resource its sitting on.

Making ends meet on three polymetal plays

It’s interesting to note that the NSW Government has awarded ARD upwards of $2.9M in R&D funding since September 2013. And that’s not including the $750,000 in merit-based co-funding awards from the NSW Government Cooperative Drilling.

Combined with the latest oversubscribed share placement, it seems the world is a funding-friendly place for ARD, with several options within its reach...

As at the end of the March quarter, ARD were holding $830,000 in cash — not too shabby considering the extensive drilling it has undertaken in recent months.

But since then, as we told you earlier, it has welcomed in $2.28M cash via a private placement. The funds were raised to go towards drilling costs and project advancement — including the anticipated update of the JORC 2012 Estimate for its key Kempfield project.

As a rule, a heavily oversubscribed placement means that the company has strong support among a sophisticated investor base – always a good sign.

The company issued 60,000,000 new fully paid ordinary shares, plus 30,000,000 attaching listed options (ASX:ARDO).

That should set ARD up nicely for what’s ahead...

Such as the planned JORC Estimate update at Kempfield and metallurgical testing of existing drill core to determine recovery rates; completion of the drilling programme at West Wyalong; and the inaugural drill test of analogous Western Tasmania Mt Read Volcanics potential at ARD’s third project, Loch Lilly (980km south of Broken Hill).

We haven’t mentioned Loch Lilly yet, but the project also holds potential being located in a region that is home to Australia’s highest grade base and precious metals deposits. The project is in the Loch Lilly-Kars Belt in western NSW, which hosts polymetallic volcanic-hosted massive sulphide, copper-gold porphyry and nickel sulphide.

ARD has the right to earn in to a maximum of 90% of the Loch Lilly project through exploration expenditure. And it is farming-in at a very low cost, with 75% of its costs (up to $150,000) to be co-funded by the NSW Government.

ARD’s metals expert, Dr Tony Crawford had identified the potential of this project and its drill targets and approached ARD to form a JV.

And now... ARD is set to begin diamond drilling at the project next month.

Chance of a price inflection?

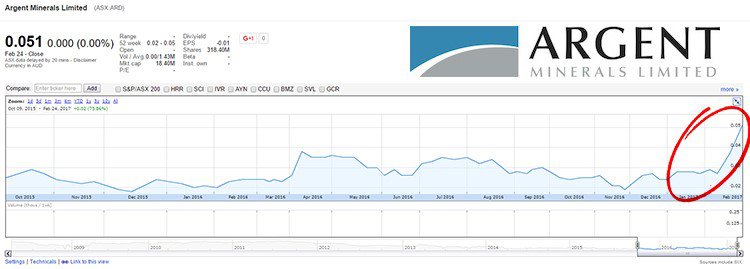

In the last few years, ARD’s share price has overall trended north — albeit with a couple of detours.

With recent major news triggering more interest in the company, there have been a couple of stand-out spikes of around 70% — one in late February and again in early April.

Of course it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

This is a good indication that investors watching, and beginning to gain interest from the market.

With a number of potential catalysts released over the next few months, ARD could see some significant forward momentum.

ARD’s attractive qualities include plenty of funding flexibility, as well as a unique spectrum of opportunities spread across several metals, projects and timeframes... yet all conveniently located in the safe mining jurisdiction of NSW amongst a bevy of large metals miners.

We can see plenty of chances in the near-term for ARD to hog the spotlight as it attempts to deliver on its promise.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.