MOZ Motoring as Graphite Story Gains Traction

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

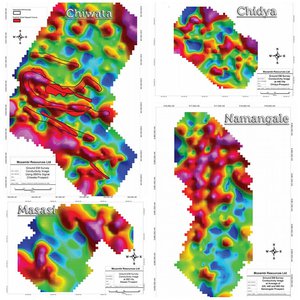

Mozambi Resources’ (ASX:MOZ) share price has begun its ascent as its valuation pulls closer to parity with larger neighbours Syrah, Triton and Magnis.

Have a look at its recent run following preliminary high grade results, announced to the market on 13th August. In fact, looking back a little further, MOZ has been as high as 280% since The Next Small Cap first brought you the story back in February of this year:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Impressive results so far for MOZ, however at the same time, operating in Tanzania does carry added political and social risk which can hinder mining projects from advancing. MOZ is therefore a high risk stock and caution should be applied when investing.

In many respects MOZ mirrors Magnis with both companies share price trending higher over the past few months – only MOZ is at an earlier stage.

Magnis’ market cap, fully diluted, stands around the $200M mark. This is likely attributed to its high quality jumbo flake deposits, and the offtake deals Magnis cut with China’s Sinosteel and Sinoma. The assurance of offtake partners allowed Magnis to secured 90% debt funding for their project.

MOZ are hoping to follow in Magnis’ footsteps over the coming months.

In fact, Magnis has outperformed the ASX 200 index by over 60% since the start of 2015. Over the same time, little ol’ MOZ has grown 400% on the back of promising early field results:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Could this be an indicator of the ‘graphite story’ gaining traction amongst investors?

Now could be a good time to look for long-term value plays amidst the market turbulence. Magnis, Syrah and Triton all provide exposure to the still developing high grade graphite/graphene market expected to become one of the fastest spreading technology leaps of our times .

In many respects MOZ is cut of the same cloth as Magnis, Syrah and Triton – same region, same commodity, ASX-listed, at exploration stage, high grade jumbo flake – only MOZ is much smaller and at an earlier stage of exploration in Tanzania.

When the Tanzanian prospects are added to its Mozambique play, MOZ has several potential routes to a large resource to rival its cohabitants.

We continue our coverage of:

You can trace the Mozambi Resources (ASX:MOZ) story via several articles we have published over the past six months starting with $3M ASX Nano-Cap Next Door to the Biggest Graphite Resource Known to Man in February. Our most recent article was MOZ Confirms High Grade Jumbo Flake Graphite published in August.

MOZ is on a similar track to its larger rivals; located only 60km from Magnis in Tanzania and is now in possession of a $2M war chest to fund its exploration through to defining a maiden JORC resource.

Meanwhile in Mozambique, MOZ is a 5km stone’s throw from Syrah’s Balama graphite resource – one of the world’s largest.

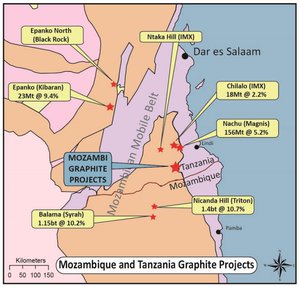

In addition to MOZ, Magnis and Triton, there are 2 other players in the broader East Africa region (Kibaran Resources and IMX Resources), but all are at various stages of development.

MOZ now has 11 tenements acquired and secured in Tanzania with exploration work indicating high grade graphite mineralisation, visual graphite outcropping and strong EM survey results.

The most recent exploration news has seen MOZ intersect mineralisation in 20 of 21 drill holes at shallow depth from its 4 most prime prospects alongside consistent discoveries of Large and Jumbo flake.

It seems like the more exploration work MOZ does, the more resemblance it has with Magnis at an earlier stage of exploration.

All of these budding, graphite exploring, graphene-potential-envisioning companies may even be tapping the same mineralisation schist below the ground considering the Cabo Delgado region is the richest source of graphite on earth, with wide tracts stretching hundreds of kilometres.

Some of those tracts potentially stretch into Tanzania and beyond.

We’ve been keenly following MOZ’s progress over the past 6 months, and so it wasn’t much to our surprise to see their share price rise so suddenly on the back of high grade results and a strike extension. It’s been a long time coming, and with heightened graphite demand looming on the back of tectonic shifts in manufacturing, we think there could be potential for more of the same.

At the same time, continued success is not a guarantee, and MOZ remains a speculative stock.

MOZ’s Quad-Core Prospects in Tanzania

MOZ is advancing its strategy of defining a large graphite resource in East Africa.

For now, its prospects in Mozambique are at the permitting stage and waiting on approvals. However, its Tanzania prospects are showing excellent potential – and results.

A couple of months ago, MOZ received high grade preliminary results from rock chip samples taken from a basket of its Tanzania tenements.

25-36% of tested material was classified as ‘Jumbo’ flake, 80-90% as ‘Medium/Large’ of ‘Jumbo’.

The all-important Total Graphitic Carbon (TGC) grade ranged from 7.2-9.1%.

And when it comes to graphite, flake size and TGC content are what explorers, metallurgists and manufacturers all look for. Jumbo flake graphite commands the highest market prices because it is rarer and can be used in a far greater amount of different applications compared to small flake graphite.

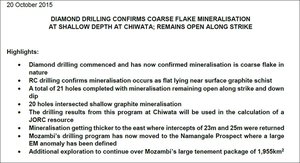

Here’s a snapshot of what flake really means for graphite explorers – and investors...

Jumbo flake graphite currently sells for around US$2,300/t and forecast to rise up to US$6,175/t within the next 5 years.

A reminder of where MOZ has come from

Rock chip samples sent for analysis two months ago came back with exceptional results , ranging between 7%-9%. These results are supportive of MOZ’s ambitions to define a large, high grade resource in the near future.

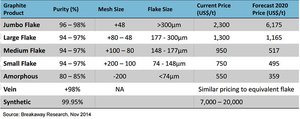

So much so, that MOZ then decided to pull the trigger to acquire 4 more tenements (Stage 2) on top of the 7 tenements (Stage 1) it had already sewn up earlier in the year .

In total, MOZ now has 11 tenements available for exploration in Tanzania covering a total area of 1,955km 2 .

Here they are mapped out below with Stage 1 tenements shown in red and Stage 2 tenements in blue:

With its Tanzanian operations now clearly laid out, MOZ has been rapidly progressing exploration with a view of defining a JORC resource.

The other added benefit for this small-cap explorer is that MOZ is the only company in the region to have access to a fully paved road able to transport material to port. Even the big hitters such as Magnis don’t have this infrastructure aspect resolved which means a heavier spend later down the line once production commences.

For MOZ, that piece of the puzzle is already solved and can expect to see all its material sent to Mtwara without the need for further infrastructure upgrades.

Following the first batch of rock chip samples, MOZ has gone on to complete pitting, trenching and electromagnetic (EM) surveys

MOZ has now zeroed in on 4 prospects where more detailed exploration is warranted. These 4 are likely to contribute to MOZ’s formal resource estimate when applying for JORC approval sometime next year –with the ‘Chiwata’ prospect raising most pulses.

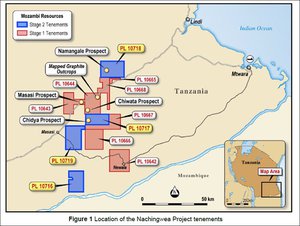

Shown below is MOZ’s most recent EM results stretching 67.3km and covering an area of 18.1km 2 , indicating high potential for high grade graphite on all 4 prospects:

The areas shown in pink indicate high ground conductivity (associated with high grade mineralisation) while blue areas indicate low ground conductivity (low grade mineralisation).

From the maps above, you can see that the Namangale and Chiwata prospects produced the strong magnitude targets and adds to existing visual evidence of graphite outcropping and large/jumbo flake found throughout the 4 core prospects.

Latest assay results indicate Chiwata and Masasi prospects as key

In a recent results salvo released a few weeks back, MOZ backed up its initial preliminary results with trenching results that showed average grade of 6.1% TGC including 4m @ 7.9%, 16m @ 5.9% and 7m @ 5.4% TGC. At Chiwata, MOZ is seeing samples average around 7.2% TGC.

These latest sample results from Chiwata and Masasi closely match previous results that averaged 7.2%-9.1% TGC from neighbouring tenements.

Also, as we mentioned earlier, as part of MOZ’s exploration work on Chiwata, the company just announced that 20 out of 21 drill holes intersected graphite schist mineralisation at shallow depths with mineralisation open along strike and down dip.

So MOZ has produced a series of high grade results that corroborate the highly prospective nature of its tenement package as a whole.

Strike length extended

After completing its geological mapping of the Chiwata Prospect, MOZ has established that “graphite mineralisation continues for at least 4 kilometres and is open along strike”. The average dip of the mineralisation is in the range of 5-15 degrees and an estimated true width of 10-20m.

This sets up the possibility of MOZ’s future exploration capturing even more mineralisation and further adding to its maiden JORC resource.

MOZ’s Development Path

The next stage is to conduct a broader aerial VTEM survey to further study the northern Namangale Prospect and existing Masasi, Chiwata and Chidya Prospects to identify possible extensions to mineralisation already seen.

Given the complex nature of resource exploration, MOZ is using various exploration methods including aerial VTEM which is the next stage.

With drilling in progress at all 4 prospects, MOZ is gradually honing in on the best locations that hold high grade mineralisation which fits in nicely with the company’s plans to define a resource as soon as possible.

Given current estimates, MOZ hopes to obtain its Maiden resource in Tanzania within the next 3 months before going on to a Scoping Study sometime next year.

As with all exploration, there is a chance of revealing mineralisation previously concealed, but by the same token, could also reveal nothing new. It’s part and parcel of any mining stock so investors should be aware.

Graphite and Graphene Explained

Graphite, and its space-age derivative Graphene, stand on the verge of changing the world.

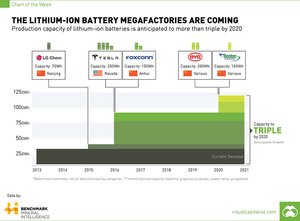

Already used in pencils, graphite’s applications have taken a much more futuristic turn over the past few years on the back of lithium-ion batteries.

It turns out lithium-ion batteries are being used in fuel cells, laptops, mobile phones among many other gadgets – and all those batteries need graphite as a key component.

Therefore, graphite has been earmarked as a one of the hottest new commodities that could literally propel the globe into cleaner energy, better energy security and more energy autonomy for the consumer.

If Tesla Motors (NASDAQ:TSLA) has its way, households will be driving electric cars and using PowerWall technology to store power directly at home – therefore alleviating pressure on already overburdened electricity grids.

There are numerous other lithium-ion battery manufacturers out there, hoping to scoop up market share before the battery market has had a chance to mature.

Given the expected surge in demand for lithium-ion batteries, the vis-à-vis surge in graphite demand is likely to forge lucrative opportunities for graphite miners able to source and deliver graphite that suits manufacturers best.

For a more visual insight into graphite, graphene, Tesla... and MOZ, take a look here:

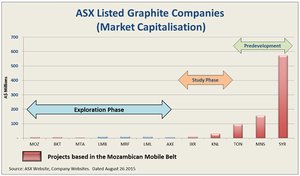

Valuation Convergence?

When comparing all the graphite explorers operating in East Africa, MOZ’s potential is clear.

Despite not defining a resource just yet, MOZ’s tenements are located in close proximity to proven resources belonging to explorers valued at several multiples compared to MOZ.

Could MOZ’s valuation move to par its larger rivals as and when a resource is defined?

Already, MOZ’s market cap has gradually grown from under $10M to $17M over the past couple of months, possibly as a result of investor awareness that it’s not just the big boys that are playing with graphite in East Africa.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Take a look at this comparison chart:

Image produced internally

MOZ’s tenements are located close by to proven resources that have produced high grade graphite for other explorers. But its share price and market cap is still languishing far behind the likes of Syrah, Triton, Magnis and others.

Here’s the East African graphite wonderland in full view (including all the important players):

A great diversifier for MOZ is that it operates in both Mozambique and Tanzania whilst its larger neighbours have assumed positions primarily in one country or another. This has great potential to add commercial value further down the track and prevent any significant devaluation if either Mozambique or Tanzania were to suffer some form of political turmoil.

MOZ’s other clear competitive advantage is its access to the only sealed road in Tanzania – therefore facilitating quick dispatch of mined material to Mtwara.

Looking forward to potential

MOZ is a small-cap stock that continues to hit important milestones on its way to defining a JORC resource.

Its market cap has been climbing steadily since August and now stands at $17M. Despite the recent growth, it still pales in comparison to its much larger neighbours that are at a later stage of exploration.

If MOZ’s drilling programme establishes mineralisation and MOZ goes on to define its maiden JORC resource, its valuation is likely to converge with those of its larger neighbours who are already in the Study or Predevelopment stages.

We’ll be keeping a close eye on MOZ as it competes with other explorers in the most graphite rich region on Earth.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.