Infant ASX Explorer Drilling in Days: Targeting Giant Gold Systems in Elephant Country

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

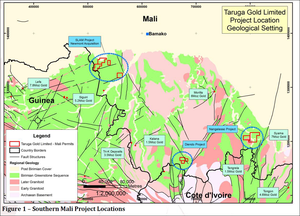

Our latest investment has numerous, high grade drilling targets over multiple projects in Mali, Niger and Cote d’Ivoire. The targets are truly large scale, with strike lengths of up to 10 kilometres, across 4,000km 2 of 100% controlled exploration ground. What makes this story especially compelling is that several of these targets cover large areas of shallow artisanal mining – and yet have never been drilled.

If locals are digging gold out with hand tools, who knows what a modern drill bit could find...

Adding further to the story is the fact that several giant gold mines surround this explorer’s targets, including Resolute Mining’s 7 million ounce Syama mine, within 15 kilometres. Big finds are relatively common in this region... this company is surrounded by no less than 8 separate multi-million ounce gold deposits holding over 32 million gold ounces. Despite all this, our embryonic explorer’s market cap is tiny – currently just $3 million, and it holds almost $1 million in cash. This means big leverage to any discovery hole while also having very limited downside from its current low enterprise value. Potential upside is increased again by the tight capital structure – the top 5 shareholders alone control over 50%. And the best part is that there is no waiting around for the action to commence – drilling is due to start in just days. Introducing our latest Next Small Cap investment:

Taruga Gold (ASX:TAR) is soon to be in the midst of a serious drilling campaign targeting multiple large, high grade gold systems which show some potential to develop into profitable gold mines in the future. But let’s not get too ahead of ourselves. There is a lot of exploring still to go. Drilling is scheduled to start any day now... which is when buyers may really start jostling for position. If you remember the mega run of Birimian Gold early last year, TAR may be of particular interest. Birimian Gold was capped at $3 million, and almost 10 bagged from $0.004 to $0.039 in the space of 3 months:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This all happened shortly after commencing a gold drilling campaign in Mali, West Africa.

It piqued unusual levels of market interest because of the large scale gold systems it was targeting, combined with a particularly low market cap of $3 million. Of course it doesn’t happen every time someone puts a drill bit down into West African ground, but ever since Birimian Gold’s drilling success in Africa we have had our eyes peeled for a similar situation... Eventually we stumbled upon TAR – in a similar position as Birimian Gold, before they started drilling. TAR is planning to drill at both the Nangalasso and SLAM Projects in Mali, which you can see on this map:

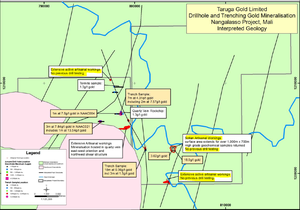

At Nangalasso, drilling will aim to further define the geology on the back of previous drill results that included 3m at 7.84 g/t and 1m at 7.8 g/t gold. The drill bit will also prod beneath those artisanal mines you can see in the photo above – where no previous drilling has occurred. At the SLAM project, the drill bit will focus on geochemical anomalies with peak values of 2 g/tonne that have recently been a site of major artisanal workings recovering abundant gold. All the green you see in the maps indicates Birimian Greenstone – it’s the geological sequence that hosts world class deposits in West Africa – it’s what gets exploration geologists hot and bothered in the region. And it’s where TAR find the bulk of their mining concessions. TAR is focussed on West Africa, and hold mining concessions in three pro-mining countries, all within proven mineralised districts:

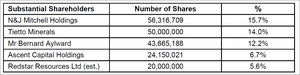

TAR’s market cap is miniscule at only $3 million – and they hold almost $1 million in cash, with zero debt. And the free float is even smaller... the top 5 shareholders control over 50% of the stock on issue:

These large shareholders won’t be selling into any speculative buying pressure – they are invested in TAR for a prize much bigger than a few pips... TAR also has a big shot mining deal maker on its management team... this could come in very handy for attracting JV partners with deep pockets down the track – for example if a mine needs to be built. That deal maker is Frank Terranova – former Managing Director and CEO of Allied Gold, where he presided over its $1 billion merger with St Barbara Mines in 2012... You can read the Wall St Journal’s take on the big transaction below:

Frank also had a major role in the strategic and operational development of Allied Gold... And now he is leading the charge at little old TAR.

Are you a TAR investor and want to spread the word?

Get the message out there – make sure everyone knows about TAR and share this article by clicking the buttons below: [sd_share_article title=”Infant ASX Explorer Drilling in Days: Targeting Giant Gold Systems in Elephant Country”]

Our Track Record:

Did you see the Next Tech Stock article on Ziptel (ASX:ZIP) ? ZIP has been up as high as 160% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Tiny TAR Targeting Big Gold with Imminent Drilling in Mali

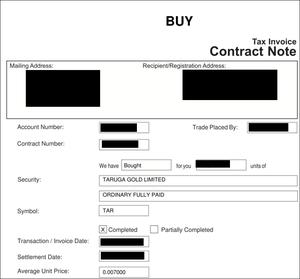

TAR boast multiple, large scale, gold prospects at its Nangalasso and SLAM projects in Mali ... And in just a few days, the drills will be turning, penetrating the rock beneath high grade artisanal workings. High grade artisanal workings that have never, ever been drilled. Here is our BUY note for TAR:

For our newer readers, it’s important to note that we invest in every stock we write about for the long term – for more information please see our Financial Services Guide and Disclosure Policy . RM Research have recently released a report on TAR, rating the company a ‘Speculative Buy’ – you can read the full report here :

Analyst reports are only one source of information we use when we analyse stocks – these reports don’t always get it right. As you will see in the map below, TAR’s Nangalasso tenements cover multiple, large, undrilled, high grade, near surface gold occurrences, over a strike length of 10 kilometres.

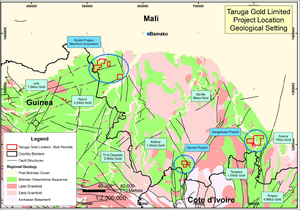

Here, local miners are literally pulling out gold with rudimentary hand tools – you can see in the photo at the top of the page... not surprising given soil samples of 18g/t gold , and trench assays including 7 metres at 4.3g/t gold. As well as these undrilled artisanal workings, there are other prospects that have been drilled, returning shallow intersects of 3 metres at 7.8g/t gold, and up to 13.5g/t gold, amongst others. These intercepts will also be followed up... but it’s the virgin, undrilled targets that we are really looking forward to. With a plethora of producing mines in the region, there is every reason to be optimistic about this upcoming drilling program. TAR’s Nangalasso Project concessions are located just 15km from the 7 million ounce Syama gold mine operated by Resolute Mining. This is in addition to being along strike from the 1.5 million ounce Tengrela deposit discovered by Perseus Mining. Perseus is valued at $130 million, and Resolute at $150 million. TAR is capped at a mere $3 million... Big finds are relatively common in this region... on top of Syama and Tengrela, TAR permits are surrounded by numerous other multi-million ounce gold discoveries. These include the 6 million ounce Morilla, the 3.5 million ounce Tri-K, the 7.8 million ounce Lefa, the 5.2 million ounce Siguiri, and the 4.6 million ounce Tongon deposits.

Including Syama and Trengala, tiny TAR is surrounded by no less than 8 separate multi-million ounce gold deposits holding over 32 million gold ounces.

You can see this all laid out in the image below: –

The artisanal workings that TAR will be drilling beneath include a massive 700 metre by 1km area, with grades within the shallow workings of 18g/t gold. Absolutely nil previous drill testing has targeted this area and the potential for primary mineralisation underlying the surface anomalism is high. In addition to the drilling at Nangalasso, TAR will also be drilling at its SLAM project in Mali. TAR acquired 100% of the SLAM Project in November 2013 from Newmont Mining Corp, which is capitalised at over $11 billion... quite a coup in itself to gain control of this asset. Initial geochemical sampling by Newmont defined a number of highly anomalous zones with up to 6.4g/t gold. With walk-up targets pre-selected by a multibillion dollar gold producer, drilling here may cause a bit of a feeding frenzy in its own right.

Our Track Record:

Did you see the Next Oil Rush article on Real Energy (ASX:RLE) ? RLE has been up as high as 115% since:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

A further 2,000 km 2 of Birimian Greenstone to explore

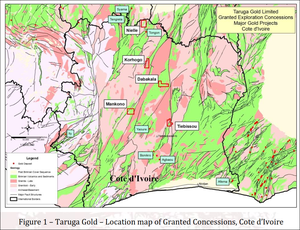

As well as the imminent drilling in Mali, TAR have just been granted an additional concession, bringing their total to five in Cote d’Ivoire, and now hold approximately 2,000 km 2 .

These concessions are right in the sweet spots – all within known mineralised belts, and situated close to structural zones and previous discoveries, the concessions are marked in red on this map, and you can see the Birimian volcanic rocks in green:

Field work is already underway now, with a view to rapidly identifying high priority drill targets in the near term. The Tiebissou concession (to the east on the map) is along strike from operating mines at Agbaou (Endeavour Mining) and Bonikro (Newcrest Mining), immediately south of a Resolute Mining concession. Similar to the Mali assets, it too has extensive artisanal workings, and strong geochemical anomalies. With 20km of prospective strike length, we will be watching progress here with interest. At Korhogo, there are more artisanal workings, plus this concession is next door to drill campaigns conducted by $130M capped Perseus Mining.

More Drilling: Gold-Copper-Moly Porphyry Targets in Niger

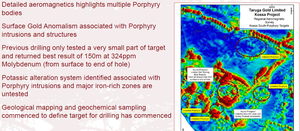

TAR is also planning reverse circulation drilling at its Kosser project in Niger shortly. This will investigate the potential for large scale copper-gold-molybdenum porphyry deposits. If the size of the targets shown in the image below is any indication, there is quite some potential... TAR will test four never before drilled porphyry targets, and one target with limited historic drilling. These prospects are circled in red:

The previously drilled prospect intercepted a whopping and continuous 150 metres of molybdenum grading 324ppm, from surface to end of hole. These porphyry targets are also likely to get the market talking once the drills start spinning... For an example of what a microcap drilling into global scale porphyry bodies can do for a share price, we remind you of Inca Minerals (ASX:ICG)... Many will recall this also – the wild ride from 1c to 17c in the space of around 6 months, instigated by the same catalyst that TAR will be engaging in shortly:

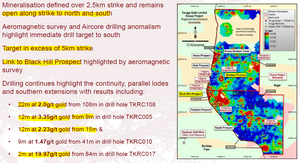

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. So TAR’s exploration program contains multiple ingredients for a potential rapid share price rise... the trick is to book a seat before drilling actually starts. Kossa also holds several standalone gold targets, with strike lengths up to 5 kilometres. Deep drilling will follow up previous intersections at the Borobon prospect of 22m at 2g/t gold, 12 metres at 3.35g/t gold, and 2 metres at 19.9g/t gold. The Black Hills and Borobon prospect appear on an aeromagnetic survey to be linked underground to form a single mega-system :

If drilling shows this mega-system to be strongly mineralised, TAR shareholders may have yet another major catalyst for a potentially steep ride.

TAR is about to embark on the most important drilling program of its ASX life to date

This landmark campaign will test extensive, high grade gold prospects and giant gold-copper-porphyry targets, in two of West Africa’s most prolific mining provinces. With a miniscule market cap of just $3 million, even a modest discovery could warrant a sustained appreciation in share price. But of course we are hoping for much more than just a modest discovery... Yes, it is early days for TAR – there is a chance they may not find much in this drilling campaign. One reason we have invested in TAR is the sheer number and size of multi-million ounce gold deposits in the immediate vicinity of their multiple high impact drill targets. When the drill bit hits the ground, the market could sit up and take notice, and with good reason. Plus, in the event of a major discovery, TAR’s Frank Terranova has the skill set and the contacts to turn the find into a profitable mining operation. TAR is a baby elephant if ever we’ve seen one.

Are you a TAR investor and want to spread the word?

Get the message out there – make sure everyone knows about TAR and share this article by clicking the buttons below: [sd_share_article title=”Infant ASX Explorer Drilling in Days: Targeting Giant Gold Systems in Elephant Country”]

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.