DEG to Acquire Gold Project Next Door: 160km of Gold Rich Strike Length

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There’s nothing we like more than seeing small explorers raising their game in opportunistic times.

De Grey Mining (ASX:DEG), an $8.6 million-capped ASX gold explorer, has expanded its gold portfolio with an option to acquire the Indee Gold Project near Port Headland in WA.

This acquisition, which neighbours DEG’s existing Turner River Project, will bring scale and development momentum to the company’s operations, and enables DEG to expand its gold and lithium footprint further still with new mining leases.

These leases are significant as they will allow DEG to move quickly towards production on its existing mining leases, which should then shorten its overall production timeframe.

The acquisition of Indee Gold means that DEG can commence evaluations and almost immediately go to Definitive Feasibility Study (DFS) stage.

This is a big step in DEG’s growth plans to propel it from explorer towards gold developer.

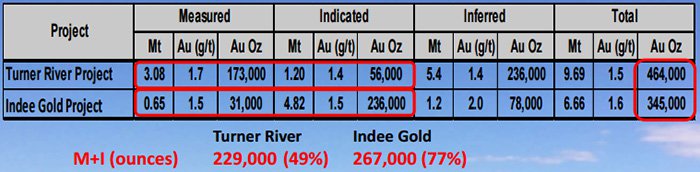

The Indee Gold Project would fast track growth and provide a huge bump up to DEG’s resources — adding 345,000 oz. to Turner River’s 464,000 oz.

The target resource growth is >1 million oz. within six months, however there is sufficient exploration potential to push the company over 2 million ounces if it can get all its ducks in a row.

DEG has reported extensive drilling results beneath existing pits at Indee that have not been included in the existing resource models and will be included in the resource upgrades. A selection of more significant results that have never been reported until now include:

- 16m @ 4.50g/t from 72m Withnell

- 12m @ 10.82g/t from 64m Withnell

- 22m @ 3.46g/t from 110m Withnell

- 12m @ 28.48g/t from 75m Camel 1

- 5m @ 10.8g/t from 84m Camel 1

- 11m @ 6.87g/t from 149m Camel 1

- 0m @ 4.49g/t from 79m Roe

It has also reported over 100 drilling results undertaken by the Indee vendor that have not previously been reported and which carry substantive mineralisation.

Investors and interested parties should expect a significant resource increase once the resource upgrades are finished.

Although this is no guarantee to occur and investors looking for further information should seek professional financial advice if considering this stock for their portfolio.

DEG has 12 months to evaluate the property, with the option to acquire it for $15 million by July 2018. This means there is no payment down for 18 months and therefore no significant dilution expected.

DEG will update Resources and complete a scoping study over the coming two months to help prove economics and scale before going into DFS.

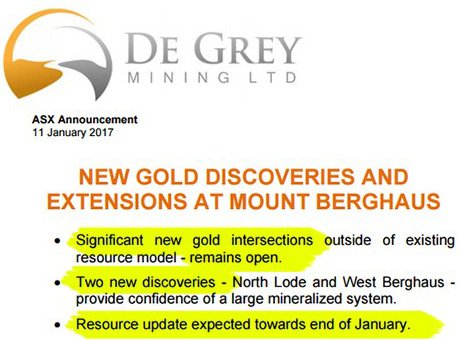

The announcement on Indee Gold follows other good news for DEG, with highly-awaited drilling results in from one of its juiciest tenements — Mt. Berghaus — at Turner Project.

DEG managed to expand its Mt Berghaus Resource by 227% to 3.5Mt at 1.2g/tAu for 141,000oz., which led to Turner River climbing to 9.7Mt at 1.5g/tAU for 464,000oz constituting a circa 25% improvement in several key metrics for its intended production ambitions.

It is also worth noting that 200-250 km down the road sits Millennium Minerals , a successful Pilbara gold miner. DEG is looking to better the all in sustaining costs enjoyed by Millennial who is producing at the rate of about 90,000 ounces a year at its flagship Nullagine project in WA’s Pilbara region. All-in sustaining costs are forecast to be AU$1190-1240/oz. for this calendar year.

When you consider DEG could be looking to produce up to 100,000 ounces at low cost, with enough ore and exploration potential to go higher, it compares well to its much larger $257 million capped peer.

Further to expanding its existing Resource, DEG has stumbled upon not one, but two new zones within the three kilometre prospective strike length between West Berghaus and Mt Berghaus that remain open at strike. This leaves plenty of room for further Resource expansion and momentum-building later this year.

As DEG up-shifts through the gears in its exploration and project development, we think now may be a good time to shotgun a seat on DEG’s mission to grow up from junior explorer, to mid-cap producer over the coming years.

Keeping you abreast of:

Gold is one commodity that has seen supreme investor interest in recent years, remaining for the most part, the staple go-to safe-haven in times of apprehension and insecurity.

As global macroeconomics morph and adjust to ongoing events, one could do worse than to back the precious metal and its historic performance record.

Which brings us to De Grey Mining (ASX:DEG) and its latest news, which has the potential to lead this company to a significant re-rate.

Indee Gold significantly expands Resource

The Indee Gold acquisition will effectively double DEG’s gold Resource and give it enough of a landholding including 414km 2 exploration tenure and walk up targets to potentially hit over 2 million oz. in just a few years.

DEG is certainly on a fast track to this number with its 823km 2 flagship Turner River Gold Project and Indee Gold combining for just under a million ounces already.

The potential acquisition of Indee Gold provides immediate resource scale and development potential, with a Scoping Study to commence in mere days, focusing on the JORC 2012 Resource update, preferred processing plant, scale of operation and cost structure.

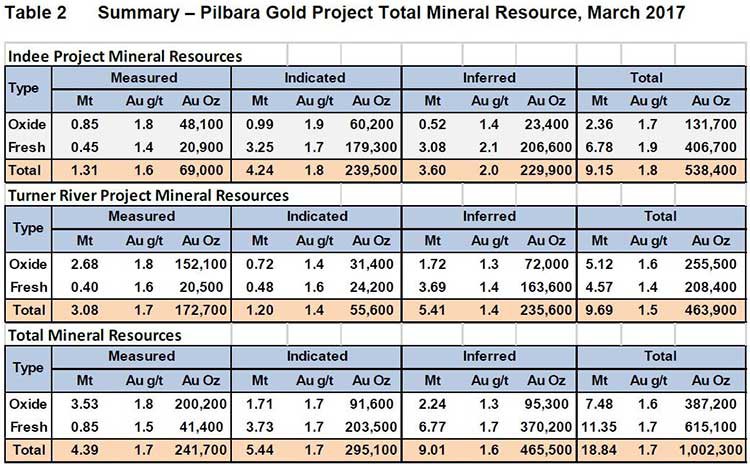

Here’s a look at the combined resources:

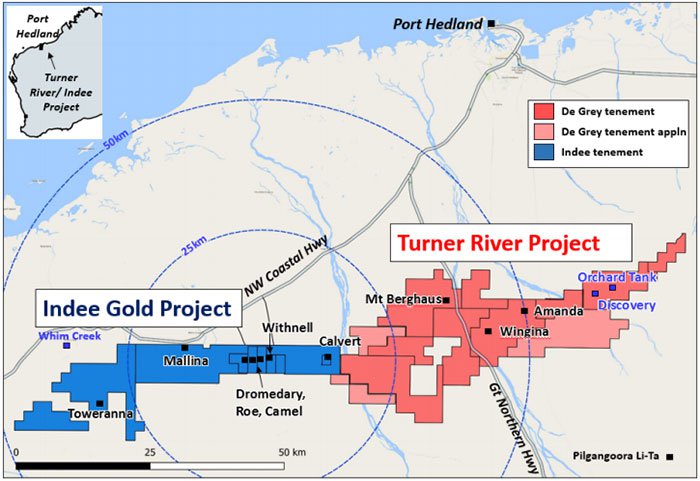

As you can see it is a pretty powerful combination, which really propels DEG’s growth ambitions – and both projects sit right next to each other – meaning DEG controls 160km of strike along the Mallina Shear Zone and Tabba Tabba Thrust.

Indee already has granted mining leases and infrastructure, as well as excellent exploration potential including walk up drill targets.

Here’s a summary of the Indee Project’s key assets:

- Resources (JORC 2004) with 77% Indicated category or better.

- Additional positive drilling results beneath current resources.

- Advanced walk-up drill targets provide resource upside.

- Additional 60km strike of Mallina Shear Zone.

- Mining leases to reduce development timeframe granted.

- Exposed gold mineralisation in five shallow open pits.

- 850,000t of crushed mineralised material in surface stockpile.

- Mine infrastructure including camp, ROM pad and haul roads.

Here’s a look at just how much ground DEG could soon cover, assuming the acquisition is completed:

All up DEG has three distinct resource centres: Indee, Wingina and Mt Berghaus. Turner River incorporates Wingina and Mt Berghaus and Indee Gold includes Indee and Exploration Target, Mallina.

The initial target resource growth is >1 million ounces within the next six months, but this could grow substantially with potential for over 2 million ounces down the line.

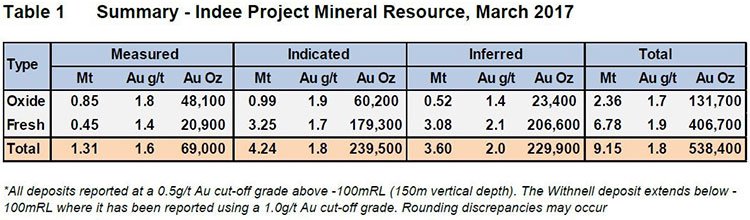

Indee’s resources are well defined, mainly in measured (9%) and indicated (68%) – so do not need a substantive drill out for Feasibility Studies.

As we stated above, there is a significant amount of drilling that hasn’t made its way into resource models, so when the update of the Indee Resources to JORC 2012 occurs this drilling will be brought into the models meaning it is highly likely that there will be a resource upgrade above the current 345,000 oz.

Furthermore, to get to JORC 2012 compliance, Mallina will require further drilling as is planned in the second quarter. However initial results reported at Mallina are promising:

- 23m @ 2.52g/t from 76m

- 7m @ 5.45g/t from 9m

- 29m @ 1.70g/t from 0m

- 27m @ 1.34g/t from 5m

- 25m @ 1.00g//t from 77m

- 4m @ 9.11g/t from 4m

Turner River

DEG already has a JORC Resource to the tune of 464,000 oz. gold, spread across several prospects at Turner River...

...and in early January solidified its position by snaffling up more ore and raising its official Resource:

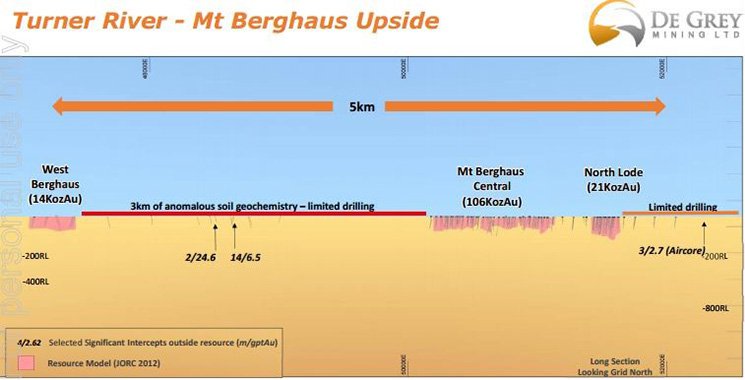

DEG’s latest drilling program at its most highly prized prospect — Mt. Berghaus — has delivered an ample slew of positive exploration results, so much so, that DEG was able to discover two entirely new prospects and expand its gold Resource by around 25%. The added bonus is that the resources appear to be open at strike in both directions at both discoveries — West Berghaus and North Lode.

That’s great going for an explorer capped under $10 million.

DEG plan to drill at Mt Berghaus (along with Mallina) in the second quarter seeking to further expand these resources.

Here’s a map illustrating the Turner River Project’s location and recent Resource additions:

Seeing DEG is racking up its list of Resource expansions at Turner River, we have covered DEG on a couple of occasions now. We first alluded to DEG’s workaholic exploration attitude in July and then published the article Scoping Its Way to a Larger Gold Resource in WA — DEG Nearing Revaluation? in October 2016, where we alluded to DEG’s expansive capabilities courtesy of the features unique to Turner River.

Over recent weeks, we are seeing DEG make acquisitions to expand its existing Resource and deliver a constant stream of heart-warming drill results. If the writing wasn’t on the wall before, it truly is now.

Of course, as with all minerals exploration, success is no guarantee – consider your own personal circumstances before investing, and invest with caution.

Just recently, DEG further substantiated its intentions to take Turner River into commercial production, led by DEG’s leading portfolio asset, Mt. Berghaus.

Drilling program at Mt Berghaus completed and 227% Resource increase accomplished

Over the course of 2016, DEG completed a 5,500m RC drilling program at Mt. Berghaus to enhance and extend resources at this particular prospect.

The results were reported in December 2016 and January 2017, and showed both extensions to the existing Resource and two significant new gold discoveries at North Lode and West Berghaus.

A Resource upgrade for the Mt. Berghaus deposit was only recently published ...

...and it’s showing exactly what we were hoping to see — additional gold mineralisation within new geological formations, previously undetected in DEG’s drilling efforts.

The following long sections show the exploration potential across this deposit and the potential for long term in fill and extensional drilling.

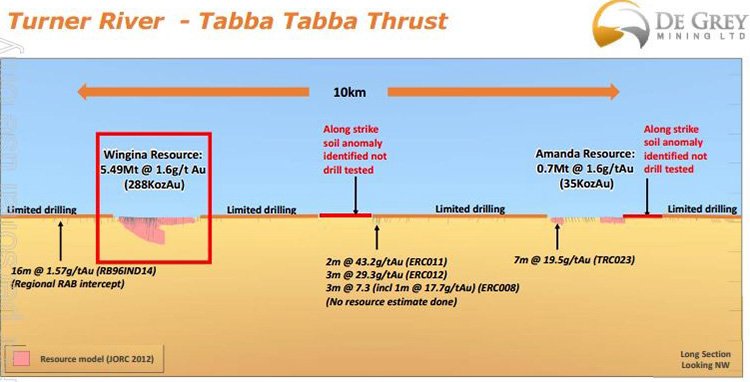

And as you can see below, there is further upside at Mallina as well, which as you would have noted by now is next on the list to drill.

These long sections at Turner River and Mallina, show the potential for significant increases in Resource.

As any junior commodities explorer would testify, the ultimate goal is to expand the size of one’s Resource to improve Project economics and extend commercial viability.

That’s exactly what DEG has been busy doing...

Mt. Berghaus gold Resource increased by 227% following recent drilling and further Project development...

...and with a breath of fresh air in the form of 50,000 oz. gold obtainable from surface.

Elsewhere, DEG has upgraded the Wingina Well resource estimate, which was increased by 7% to 5.49Mt @ 1.6g/t Au for 288,000 ounces. Over 60% of the mineralisation is in the measured category.

The upgrade also defined an internal high grade lode of 1.1Mt at 4.1g/t Au for 144,000 oz. from surface.

The ultimate plan is to raise the overall Resource at Turner River from its current 406,000 oz. and construct and commission a processing plant at Wingina.

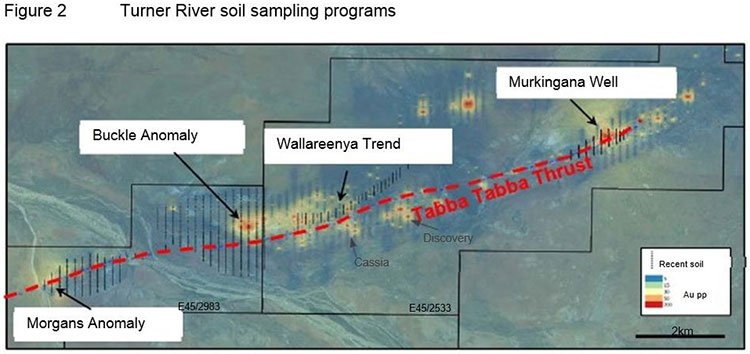

Wingina Well deposit remains open at depth and is hosted by the Tabba Tabba Shear Zone which extends for over 60km within De Grey tenure and remains poorly tested along strike providing opportunities for further for new discoveries.

Here is DEG’s current Resource tally (seemingly growing right before our very eyes):

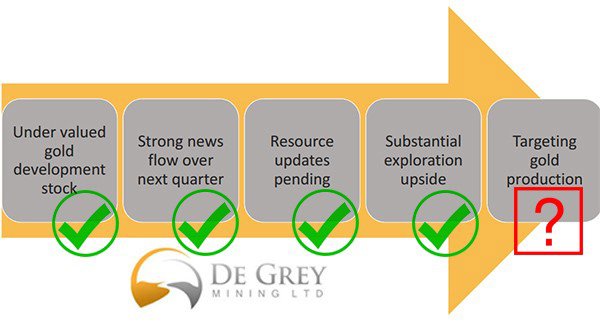

Here is DEG’s broad, simple plan:

It is a plan that could really put it on the radar in terms of its Pilbara peers. Just looking at the table below, you can see DEG is some way off, however the value potential is substantial given the news to come in the coming months including resource upgrades, infill drilling, a Scoping Study, DFS and successful gold production.

Add all that together and you have the makings for a significant re-rate.

Yet gold isn’t DEG’s only play. DEG is expanding its footprint in several highly prospective directions....

DEG is aspiring to prove Resources in both Lithium and Gold — all from Turner River.

Let’s take a quick look at what else DEG has up its sleeve.

Aside from having a 100% owned gold resource at Turner River, DEG has also drawn a strong base metals and lithium card with high grade lithium up to 4.22%.

Lithium has been the hottest metal of 2016, beating out even precious metals such as gold, silver and platinum. It is undergoing an exponential ramp-up in demand, which is being tipped to go parabolic by most market analysts over the coming years.

Bringing this back to DEG for just a moment, its proximity to the $638 million capped Pilbara Minerals and the $269 million Altura Mining, just 30km to the south east, puts it in good company. With potentially similar numbers, DEG will be hoping for a re-rate and to capitalise on this metal market uptrend.

Although the price trajectory of the metal has been subdued in recent months, the fundamentals behind the long-term trajectory suggest strong potential for long-term growth. Lithium prices more than doubled since 2014, largely in-line with the huge rise in lithium-ion battery use across digital devices, machinery, as well as energy storage.

Daimler is investing US$550 million into tripling its battery production capacity in Germany, Nissan’s planned investments in the UK for its third generation Leaf, and GM’s joint venture with LG Chem to produce batteries in Holland, Michigan, for its Volt and Bolt.

It is clear that auto manufactures are beginning to shift to electric—and in a very big way.

Given this new investment, plug-in electric vehicle (PEV) sales are expected to experience 62% annual growth in 2016 , 60% in 2017, and likely 100% in 2018. This translates into over 600,000 in PEV sales expected in 2018, creating a potentially gigantic market rivalling what we would term as ‘automotive industry’ today.

Future catalysts

DEG has secured significant Resources as it ploughs forward towards production. By the third quarter of 2018, DEG expects to be making a decision to be begin mining.

Yet, overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

This quarter, DEG will upgrade the Indee Gold Resources to JORC 2012. It will also complete Stage 1 of its Open Pit Mining Study.

In the June 2017 quarter, DEG will undertake Resource drilling at Mallina and Mt. Berghaus prospects. It will also commence detailed feasibility studies.

Soil sampling to be undertaken across the King Col pegmatite trend and the new Wallareenya Gold Target to identify further drill targets is on the menu for 2017.

Portfolio growth spurt underway

DEG is doing exactly what it set out to do when it first got its teeth in to completing the Turner River Project — a way of producing both gold and lithium from the same project location, just at a time when both commodities are undergoing a renaissance for very different reasons.

So far so good for DEG, and here at The Next Small Cap , we hope to be in the position of covering DEG’s mission-accomplished-status at some point over the coming months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.