CXO Drill Bit Now Probing for Silver… Results in Weeks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

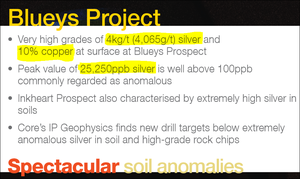

One of our most eagerly anticipated drilling programs so far this year has begun. CXO has just initiated the first ever drilling to test below 4.5 KG per tonne silver in rock chips and 25,000 parts per billion silver in soil at the Inkheart and Blueys targets. Around 100 parts per billion is considered a solid indicator of silver mineralisation at depth. CXO has measured 250 times that at Blueys! CXO will be drilling 2,500m in 20 holes, and expects to be complete in 3 to 4 weeks. Drilling assays will be hitting investors’ screens progressively as mineralisation is intersected – this means multiple results over the next 8 weeks.

The Next Small Cap first covered CXO in the article: BHP Circling... Micro Cap Neighbour to Drill Mammoth Targets . We also updated investors in the follow up: CXO Drilling Directly Below 4 KG/t Silver at Surface... In Just a Few Weeks . CXO is still trading at 50% above levels from our initial coverage:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance. If CXO can bag some big drill results in the next weeks we may see even higher levels. Somehow, CXO is still capped at less than $6 million, and that’s with a healthy $1.2 million bank balance . CXO is fresh from a handy cash boost, some of which was used to move to 100% ownership of the sprawling Albarta project in the Northern Territory. Albarta includes the big Inkheart and Blueys targets, so CXO holders have 100% exposure to any high grade silver, copper and lead that the drill bit bumps into .

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in reporting on high potential stocks. To note just a few:

- Since the Next Small Cap article on ASX:SEG, its share price has risen 100% following the report Sirius went from 5c to $5... New Upstart Explorer Has More Land, More Drilling Targets .

- After the Next Oil Rush article on ASX:SWE The last junior oil explorer operating in this exciting region with this same JV partner went up 800% in a matter of months – the share price has been up to 150% since we called it.

- Following the Next Mining Boom ’s coverage on ASX:TRF – This junior stock will rebound hard in a broad commodity rally – TRF has risen as high as 110%.

- And who could forget the Next Oil Rush tip of the decade, TSX:AOI, which has since a rise as high as 600% (!) since we called it in the report East African Oil – Hot Tip of the Decade!

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Ongoing, Near term, High Impact Drilling Results

This is a big milestone for CXO in its brief history... a comprehensive drilling campaign at two white-hot silver, copper and lead targets:

![]()

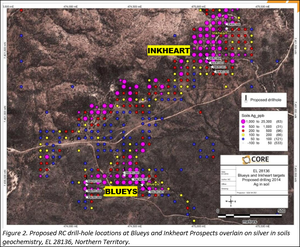

These surface hints are made even more compelling when combined with the big structural and sulphide targets identified at depth... CXO will be testing all this with over 20 holes and 2,500 of reverse circulation drilling, with results released to market progressively over the next 8 weeks. You can see in the drill hole plan below that they have both prospects very well covered. The big pink dots show the areas with very high silver in soils – the white stars are the planned drill holes:

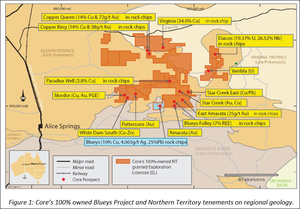

If there is a big metal deposit down there, CXO should find it. Initial drill cores could give indications of success in as little as 3 weeks... we wouldn’t like to be sitting on the sidelines. CXO’s biggest chargeable sulphide targets appear to be at 75m to 150m below surface... and directly below the silver in soil anomalism and uber-high grade rock chips. It’s also important to note that historic drilling has never tested these depths at Blueys before – previous campaigns were very shallow , with a maximum depth of 52m. Whilst drilling at Blueys is obviously the main game right now, CXO have a veritable army of ultra-high grade copper and gold targets in the surrounding Albarta ground. These will be drill tested a little further down the track... CXO is currently refining drill targets at the Copper Royals and Virginia Prospects to find out what is underneath the 34% copper and 72 g/t gold at surface. But Blueys is the main game for the time being... you can see it below, aptly coloured:

Remember that all these prospects are 100% owned by CXO, and this drilling at Blueys and Inkheart is fully funded from existing cash reserves . Over the next few weeks, the market’s eyes and ears will be focused squarely on CXO. For all the latest news on CXO, like them on Facebook or follow them on Twitter .

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.