CAZ Reports High Grade Cobalt + Base Metal Potential

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A diverse portfolio of quality assets brings a high degree of flexibility to junior resource explorers and aspiring producers.

With a portfolio of projects containing gold, copper, zinc, cobalt, zinc, nickel, iron ore, graphite and lithium, Cazaly Resources (ASX:CAZ) has room to move.

Recently, CAZ announced results from first pass reconnaissance mapping and rock chip sampling at its 100%-owned Bungonia Cobalt project in NSW.

The results included rock chip grades of up to 1.4% cobalt and confirmed the presence of shallow high grade cobalt mineralisation associated with manganese enriched quartz sandstone units.

Add to this historic mining from several locations at the project and there seems to be significant potential to extend known deposits as well as make new discoveries within the project area.

Also of particular interest right now is the fact that CAZ has 50 kilometres of strike at its Mount Venn project in one of the most under-explored greenstone belts in Western Australia. CAZ has recognised that the potential stretches much further with more on offer at Mt Venn than its previous focus of just gold. The project is also prospective for nickel/copper/cobalt and platinum group elements (PGE).

CAZ is currently reviewing the potential of the several untested geochemical nickel-copper anomalies located within Mount Venn project. These highly prospective base metal targets have been significantly underexplored and offer huge base metal potential upside.

The decision follows the November discovery of copper-nickel-cobalt mineralisation by Great Boulder Resources Limited (ASX:GBR) at its Yamarna project. GBR’s project lies at the extreme southern end of the Mount Venn greenstone belt the majority of which is controlled by CAZ.

The region also has the potential to host an extensive gold project, which we have reason to believe could be a compelling geological lookalike to $635 million-capped Gold Road Resources’ (ASX:GOR) Gruyere gold deposit at its Yamarna Gold Project.

Of course, CAZ remains a speculative stock and investors should consider professional financial advice if considering this stock for their portfolio.

Just like the Gruyere deposit, which holds six million ounces, CAZ’s Mount Venn Gold Project contains large internal granites and favourable host lithologies that don’t require drilling into fresh rock, with both of the projects within the region’s Yamarna Shear Zone.

While the Mount Venn project remains the immediate priority (and opportunity), CAZ has proven track record of acquiring, developing and adding value to a range of resources projects.

But CAZ’s extensive metals portfolio doesn’t end there. It is also looking to capitlise on new energy metals, those vital to the renewable energy revolution: graphite, lithium, copper and cobalt.

Catching up with...

Diversified mineral exploration and resource development company Cazaly Resources (ASX:CAZ) continues to explore it’s diverse project portfolio.

We last updated you on $9.03 million-capped CAZ earlier this year, with the article, On the Gold Road: $10M ASX Explorer Chasing $580M WA Gold Project Lookalike .

The company was focused on the gold potential of its Mount Venn project at the time, and had earlier completed a capital raising with the view to develop Mount Venn, along with some of its other projects from its diverse portfolio.

Today’s update focuses on its recent announcement of high grade cobalt mineralisation at Bungonia, as well as all the latest on Mount Venn.

Looking at the location of its cobalt project, CAZ may be onto something here.

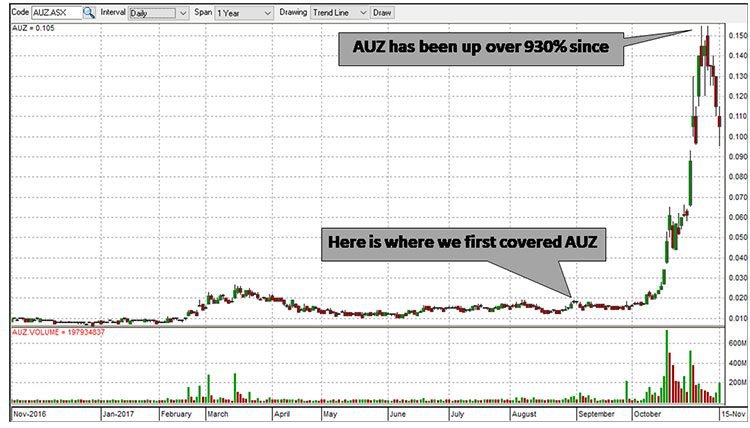

Exploring in similar territory in NSW is Australian Mines (ASX:AUZ).

We have been tracking AUZ since August and in that time, the company has been as high as 930%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Also in the region is the near billion dollar capped Clean Teq (ASX:CLQ).

CAZ is hoping to tap into the current sentiment surrounding cobalt exploration in NSW as it looks to build on its current sub $10 million market with a project that is already producing comparable results.

High grade cobalt returned from Bungonia Project

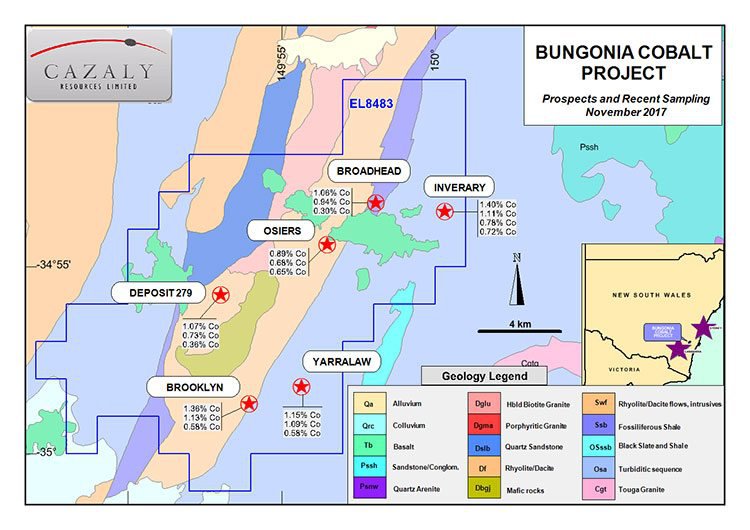

CAZ’s 100%-owned Bungonia Cobalt project is located 130 kilometres north-east of Canberra and 25 kilometres south-east of Goulburn in NSW on the eastern edge of the Lachlan Fold Belt.

Previous exploration at the project, which covers approximately 242 square kilometres, has defined several areas of significant cobalt and nickel mineralisation. Some of these areas have been historically mined, dating back as early as the 1890s.

Cobalt mineralisation occurs as flat lying residual on hills extending for several hundred metres associated with manganiferous deposits. These deposits typically contain relatively rich cobalt values, with minor nickel and copper credits, and have been worked historically with high cobalt recoveries.

The new results included rock chip grades of up to 1.4% cobalt, with an overall average grade of 0.62% cobalt.

Add to this historic mining from several locations at the project and there seems to be is significant potential to extend known deposits as well as make new discoveries within the project area.

In total, CAZ collected 36 rock chip samples from six targets within the project area. Of this 36, eight had cobalt grades of above 1.00%.

The areas sampled during this first phase are only a small percentage of known mineralisation throughout the entire project area. CAZ expect to gain access to other areas when follow-up programs are prepared.

The targets and the project area can be seen on the map below:

The samples collected thus far are summarised below:

Inverary

13 samples were collected with an average of 0.48% cobalt and a peak value of 1.40% cobalt. Cobalt/manganese bearing sandstone grits were sampled over timbered flat hill tops across approximately 700m of exposure. Other evidence of mineralisation is documented in historic work in the area with similar grades for the Inverary Group of prospects.

Broadhead

Three samples were collected with an average of 0.77% cobalt and a peak value 1.06% cobalt. This prospect was not documented in previous work and occurs in a road cutting three kilometres west of the Inverary Group of prospects. An outcrop of manganiferous grits was sampled and results highlight the potential for discovery of new cobalt mineralisation within the project.

Osiers

Seven samples were collected with an average of 0.4% cobalt and a peak value of 0.89% cobalt. This group comprises historic deposits one kilometre south of Angel Myst. The principal deposit was not able to be accessed during the program which is said to be open to the north having potential to contain extensions and additional cobalt bearing grits.

Brooklyn

Four samples collected with an average of 0.89% cobalt, peak value 1.36% cobalt

A cluster of cobalt/manganese deposits in the central southern area of the project. The deposits are poorly exposed apart from road cuttings which were accessible for sampling. A large flat elevated area of about 1000 square metres east of the road is documented as hosting the bulk of mineralisation. Future access to these areas is being negotiated with landowners.

Yarralaw

Six samples collected with an average of 0.66% cobalt, peak value 1.15% cobalt.

Several exposures of cobalt/manganese bearing sandstone occur along Yarralaw Road over a distance of 1.5 kilometres. These documented prospects lie within the south east of the project area and occur within fine to medium grained quartz sandstone exposed in road cuttings and verges. Potential exists in this area to extend the area of outcrop with mapping and further sampling once access is negotiated with landowners.

There is much work to do here, so investors should seek professional financial advice for further information if considering this stock for their portfolio.

Deposit 279

Three samples collected with an average of 0.72% cobalt, peak value 1.07% cobalt Deposit 279 is a historically documented cobalt prospect within the central western part of the project. It occurs on a large rise with significant potential to host extensions and other potentially ‘blind’ cobalt deposits.

This recent rock chip sampling at the Bungonia Cobalt Project has confirmed numerous historic occurrences of cobalt bearing sedimentary units of Tertiary age.

No systematic modern exploration for cobalt has been completed at the project. That’s despite historic work indicating there’s potential for further extensions to these bodies as well as the discovery of new cobalt deposits, including blind ore bodies beneath Tertiary cover and the potential for basement primary cobalt mineralisation.

Most of the historic work only focused on three deposits out of more than 15 known occurrences. Therefore, very little historic drilling has been completed, and some proved to be ineffective due to encountering hard manganiferous grits that prevented proper assessment.

CAZ plans to continue expanding and assessing historic data sets while finalising access with key landowners in the area. It will continue to explore known prospects to prioritise for drilling in 2018.

CAZ’s Mount Venn Project

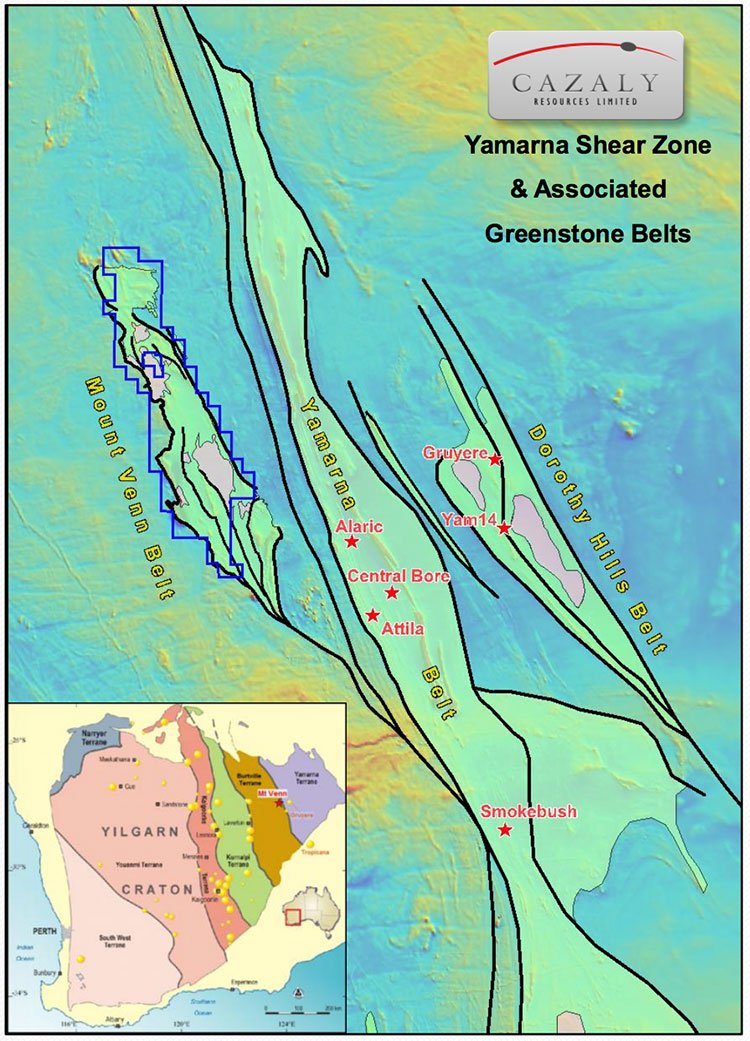

Across the continent is CAZ’s Mount Venn project, located in the Eastern Goldfields region of WA, around 125 kilometres northeast of Laverton.

CAZ gained access to the 400 square kilometre project in January 2017 when it as granted the key licence Exploration Licence 38/3111.

The project is within the Mt Venn greenstone belt and located 40 kilometres west of Gold Road Resources Ltd’s (ASX:GOR) Gruyere gold deposit (148Mt at 1.30g/t gold for 6.16M oz.) and three kilometres north of Great Boulder Resources Ltd’s (ASX:GBR) Mount Venn copper-nickel-cobalt discovery.

The belt is associated with the regionally significant Yamarna Shear Zone complex and has many similarities with the Dorothy Hills greenstone belt which hosts the Gruyere gold deposit.

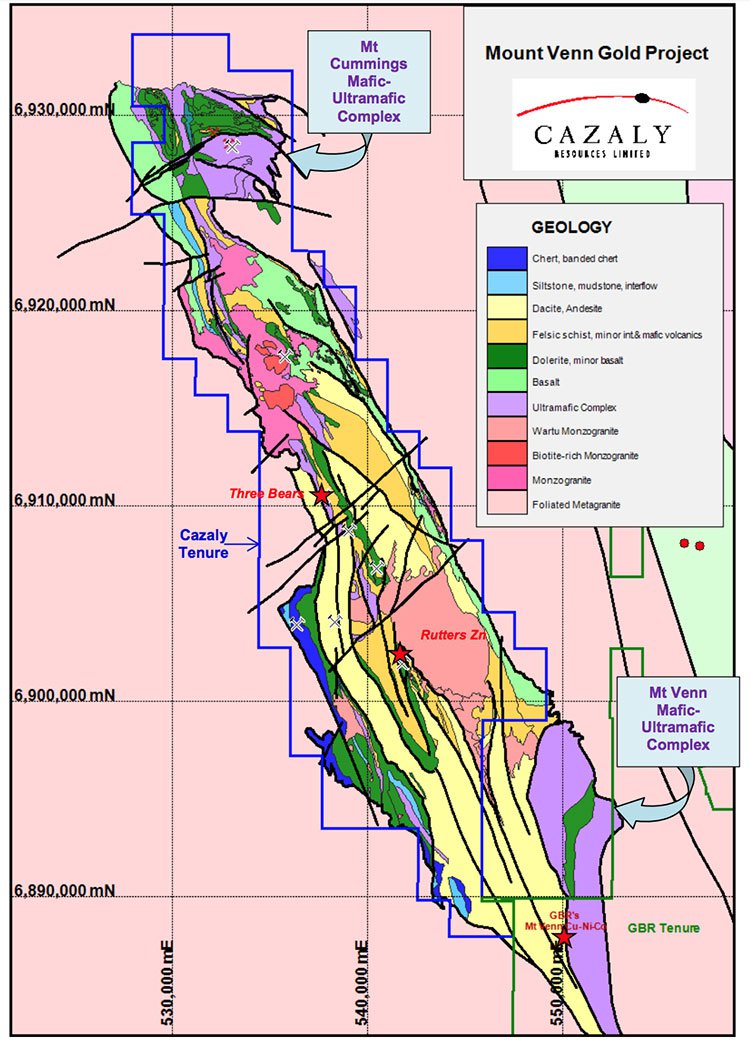

The Yamarna belt also hosts the Mount Venn Mafic-Ultramafic Complex in the south and the Mount Cummings Mafic-Ultramafic Complex in the north, as seen below.

CAZ controls the great majority of the belt with over ~50 kilometres of strike and ~400 square kilometres of tenure, and controls almost the entire Mount Cummings Mafic-Ultramafic Complex.

Mount Venn Base Metals Potential

Since gaining access to the Mount Venn project in early 2017, CAZ has mostly focused on the gold potential of the Mount Venn greenstone belt. But several other areas of interest have now been identified via desktop review of historic work at Mount Cummings.

These areas include:

- Mount Warren PGE (Platinum Group Elements) anomaly: an ~2-kilometre long, 3-11m wide gently dipping stratigraphic horizon with anomalous PGE’s located near a gabbro/pyroxenite contact as defined by soils and rock chips.

- Mount Cornell PGE anomaly: a ~2-kilometre long, very gently dipping PGE anomaly defined by soil geochemistry also associated with a gabbro proximal to the gabbro/pyroxenite contact.

- Several untested geochemical nickel-copper anomalies located within the basal portion of komatiitic basalts.

Supporting this research are recent major discoveries by neighbour, Great Boulder Resources (ASX:GBR)...

GBR discovers high grade mineralisation at Mount Venn

Great Boulder Resources have reported initial results from maiden drilling at its Mount Venn Yamarna copper-nickel-cobalt project. The project is emerging as a significant discovery where numerous targets are yet to be drill-tested along the prospective nine kilometres of strike length.

Drilling by GBR revealed the presence of copper, nickel, and cobalt over very wide intervals and extensive strike length.

What’s important to note here is that GBR’s project lies at the extreme southern end of the Mount Venn greenstone belt — the majority of which is controlled by CAZ. For that reason, CAZ has received much interest in its holdings in relation to GBR’s project since the announcement on November 13 .

GBR’s announcement, sent its shares soaring, rising more than 200% on the day the results were announced.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

That announcement was followed up by another announcement from GBR on November 27 detailing further copper-nickel-cobalt intersections at Mount Venn.

This article discusses Great Boulder Resources’ findings, and includes significant assay results:

Despite the limited number of holes drilled to date, GBR has outlined a substantial discovery of copper, cobalt and nickel over very wide intervals and extensive strike length. The mineralisation remains open in all directions and several highly promising targets are still to be drilled.

This certainly bodes well for CAZ since GBR’s project lies at the extreme southern end of the Mount Venn greenstone belt, which hosts CAZ’s Mount Venn project.

It is early stages for CAZ and investors should take a cautious approach to any investment decision made with regard to this stock.

In fact, CAZ is believed to have received approaches from other parties since GBR unveiled its discovery of copper-nickel-cobalt mineralisation.

Mount Venn Gold

Mount Venn’s gold potential has drawn comparisons to GOR’s extensive Gruyere Gold Project in the Yamarna Shear Zone. This article provides some background on GOR’s Gruyere Project and the region’s potential:

CAZ has recognised this potential, helped along by encouraging results from its maiden drill program at Mount Venn earlier this year.

In June, CAZ updated the market on its progress at the project saying it will soon commence drilling and ground geophysical programmes.

Since CAZ gained access to its Mount Venn project in early 2017 the focus has been on exploring the gold potential in the central part of the belt. This work has successfully defined a gold mineralised corridor of 3.6 kilometres long at Three Bears occurring within a wide shear structure.

Second phase RC drilling completed at Three Bears extending broad mineralisation down dip and down plunge; 44m at 0.21 g/t, 15m at 0.40 g/t, and 20m at 0.28 g/t gold.

(Previous results include; 12m at 1.19 g/t gold, 40m at 0.36 g/t gold, 36m at 0.47 g/t gold and 4m at 2.14 g/t gold.)

CAZ has also defined significant disseminated and veined sulphides within a package of felsic volcanics which appear to represent an exhalative style VMS system. Results include; 104m at 0.26% zinc, 39m at 0.23% zinc, 8m at 1.0% zinc, and 20m at 0.14 g/t gold.

Yet the Mount Cummings Mafic-Ultramafic Complex has had minimal exploration for nickel/copper/cobalt to date.

There has been no exploration of the cobalt potential of the intrusions and a complete re-appraisal of the historic datasets is required. CAZ expect follow up work to entail geological mapping of the three areas of interest, RAB/AC drilling over the targets, ground moving loop EM surveying and RC Drilling and downhole EM.

Plenty of upside on offer from multiple angles

The high cobalt grades returned from CAZ’s Bungonia Project, along with the available historical data are highly encouraging. Yet there remains opportunities for further exploration as historical drilling was limited and focussed on just three of 15 known cobalt occurrences. Significant potential remains and CAZ continues to further assess and rate the known prospects in order to prioritise for drilling in 2018.

At its Mount Venn Project, CAZ is the in the fortunate position of controlling almost the entire Mount Cummings Mafic – Ultramafic Complex which has had minimal exploration for nickel/copper/cobalt to date.

The belt, which is highly prospective for both gold and base metals, and is rapidly becoming one of the premier new exploration frontiers in Western Australia.

The company is committed to continually exposing shareholders to quality, in-demand high value mineral assets and is positioning itself well to reach commercial success with eyes on finding ways to increase the company’s value.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.