Aussie Gold Drilling in the Coming Weeks as Tiny NML Joins Exploration Rush

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Navarre Minerals (ASX:NML) is a compact gold junior capped at only $5M that has a simple, no-frills strategy to improve shareholder value from its gold exploration over the coming weeks .

NML could, in fact, be on the cusp of breaking out into a market landscape which already sees small and mid-cap gold explorers growing in value, and spot gold prices continuing to hammer out higher highs.

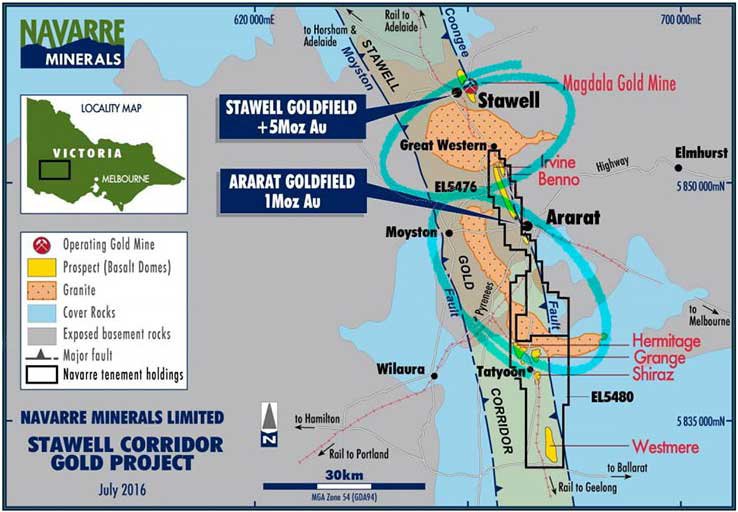

The company has two flagship projects in Victoria, Australia, within the world-famous “Golden Triangle” which has historically produced more than 70 million ounces of gold.

In fact given its position and the potential of its ground holdings, NML feels it may have evidence of two substantial gold discoveries on its hands, which you can see from the figure below.

At its Ararat Gold Project, the Company has recently identified a number of new drill targets which it aims to test with a fully funded drilling campaign planned to start in November – that’s in just a few weeks’ time and it could result in a strong and swift change in this company’s fortunes.

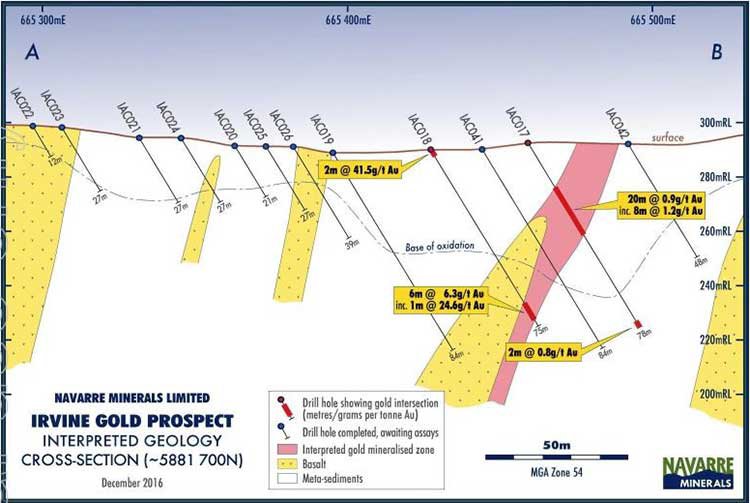

Twelve priority drill targets have been identified from mapping, sampling and geophysics at its Irvine gold prospect, located in similar rocks just 15kms south of Stawell’s 4 million ounce Magdala gold mine – the largest gold mine along the Stawell Corridor.

NML’s 12 drill targets underlie or are close to a geochemical gold anomaly known by the extent of old surface workings, which contained a million ounces of gold mined mainly by Chinese alluvial miners from the 1850s.

However NML is still an early stage play and there is no guarantee this company will make a significant discovery, so if considering this stock for your portfolio seek professional financial advice.

Could NML’s targets be the primary source for that million ounces and be another Stawell style gold deposit?

That’s certainly what NML is hoping for.

And there are encouraging signs with NML identifying geophysical targets that have never been drilled before, except for one hole which returned [email protected]/t gold from 86.5m. That target remains open in all directions...

It’s anticipated that peak gold results from the upcoming air core drill program will be followed up with a diamond drill program in early 2017.

That means there is a lot of news to come over the next few months for NML.

One of the prime reasons this little gold bug has strutted onto the gold catwalk is because it has recently bagged a $626,000 Victorian Government grant and has supplemented this with a recent $1.4M capital raising of its own. Every dollar spent on NML’s proposed $1.2M Ararat exploration program is matched by the Victorian Government up to a cap of $626,000.

That is great leverage next door to a producing multi-million ounce gold mine...

NML is now fully funded for its highly-anticipated exploration program which includes the aforementioned air-core and diamond drilling.

When it comes to profitable Resources investing, it’s often the case that less is more — especially in a market where project economics rule the roost.

Re-introducing one of the lowest-capped gold explorers, with the highest of market ambitions:

Navarre Minerals (ASX:NML) has a portfolio of early to advanced stage gold and copper projects in western Victoria, Australia.

Currently, the company is seeking to find multi-million ounce gold deposits in the shadows of Victoria’s long-life gold operations.

Importantly NML is attempting to lift the lid on 1 million ounces of previous alluvial gold production – that 1 million ounces must have come from somewhere ...

In July this year, NML was galvanised into action, spurred on by a funding grant which essentially sees the government funding half the exploration:

Victoria may not be your first thought when thinking of gold exploration frontiers due to its prolific gold mining history during the 1850s to early 1900s when a lot of easy gold was won. Very little has been done since, which is actually now providing a great opportunity, especially if we take a look at what NML has in its closet.

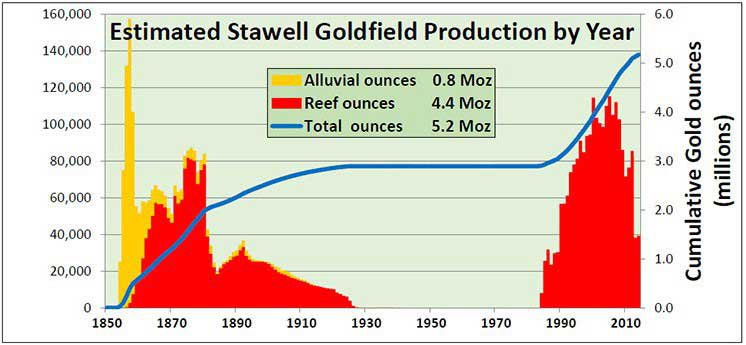

Take a quick look at the rate of historic production along the Stawell Gold Corridor where NML is exploring:

As you can see...the early alluvial mining at Stawell was quickly followed by the discovery of reef gold mining which carries on today. Contrast that to Ararat and you can see a similar “gold rush” alluvial history but the reef mining never eventuated. Why is it so? As the good professor once said.

Over 70 million ounces of gold have been scooped up from Victoria’s Golden Triangle, and of course contributed to the early success of towns like Ballarat, Bendigo and Stawell. We are pretty sure this gold also funded a lot of Melbourne’s iconic 19 th century buildings too.

NML are of the opinion that there is still plenty more gold where that came from and believes it may have a new Stawell-style gold target on its hands at Ararat...

Of course, this is speculation at this stage, so do your own research and apply caution to your investment decision if considering this stock for portfolio.

Let’s take a look at NML’s wares in Victoria

NML has two exciting gold projects — the early stage Ararat Gold Project and the more advanced Tandarra Gold Project — both of which are showing alluring qualities.

Notice that NML has found a sweet-spot right in the middle of two known ‘gold corridors’ (shaded yellow) in the shadow of many existing major deposits and operating gold mines (red dots). Additionally there is a base metals corridor to the west (shaded green). The entire region is busy with exploration activity searching for new gold deposits likely to be littering the area.

Ararat Gold Project – ‘Lifting the Lid’

Beneath the shallow Chinese alluvial workings dating back to the 1850s is possibly the primary source to Ararat’s gold.

You see, the early miners were working the easily won surface gold or ‘secondary gold’ shed from gold reefs exposed to millions of years of erosion. They simply scooped this gold up out of the shallow gutters and creeks that drain the area.

NML knows this secondary gold has not moved far from its source and has provided them with a large footprint upon which to apply their craft.

Look at the cover of NML’s recent presentation below. You can see what NML believes to be the alluvial gold gutters draining from the Irvine gold prospect with the Stawell Gold Mine in the distance...

At Ararat, NML believes the Irvine prospect, which apart from the one drill hole which recorded [email protected]/t gold from 86.5m has never been drill tested in the past, could be the key to Ararat’s missing primary gold. They believe that the geophysical anomalies could represent potential sources that contributed to the 1Moz ‘geochemical signature’ from historic alluvial gold mining...

...and NML has therefore collated a $1.2M kitty with which to drill test its theories at Ararat.

Up to 4,000m of air-core drilling will be commencing in the coming weeks on the 12 priority targets identified so far. A subsequent diamond drilling programme is on the cards to commence soon after in Q1 2017 to follow up any air core success.

If NML strikes anything similar to the Stawell-style mineralisation, we could see an immediate re-rating of NML from its current low base.

Drilling into the details

Twelve drill targets have been identified following a fieldwork program culminating in an Induced Polarisation (IP) geophysics survey at the Irvine gold prospect. Irvine is only 15 kilometres from Stawell’s 4 million ounce Magdala deposit — the largest single gold deposit in the local area.

As we said earlier, no one has ever drill-tested particular high potential areas of NML tenement holding which gives NML a super opportunity to locate substantial gold mineralisation and raise its valuation.

One historic 1994 drill result returned 0.5m @ 7.2 g/t gold from 86.5m and remains open in all directions (Target 5 below). This particular result at drill hole DD94AA254 is one of the areas where NML intends to conduct part of its 4,000m air-core drilling program to test shallow IP targets and follow-up with a diamond-drilling program in Q1 2017.

Another confidence-inspiring result is confirmed gold grades up to 22.8 g/t from rock chip sampling outcrops located on the eastern flank of Irvine (Target 3 below).

NML’s exploration programme is honing in on the prize, driven by extensive traditional geological work like mapping, sampling and geophysics producing strong anomalies at Irvine, much like a bloodhound looking for a fox.

The IP survey work completed by NML covered 4 kilometres or 50% of the 8 kilometre length of this large basalt dome prospect. By the way the basalt dome is thought to be longer than that which hosts the Stawell Gold Mine.

If you look to the top of the above image, towards the northern part of Irvine — you will see the Stawell Granite beyond which lies the Magdala mine with 4 million ounces of reef production already completed, and a further 2 million ounces have been produced from alluvial gold mining in the surrounding Ararat and Stawell areas.

Funding secured

One of the major advantages of operating in Western Victoria is access to state government grants – and in NML’s case this totals $626,000.

With access to grant money and the completion of a recent capital raising, NML is now well funded to progress exploration at its Ararat project.

A dark-horse factor that could make all the difference in the gold race

One key factor that may give NML just that little bit more chance of becoming a successful gold producer is that one if its major shareholders happens to also be the operator of the largest mine in the region: the Magdala Gold Mine.

Magdala is the largest gold mine in the Stawell Corridor, and produces gold mined to depths in excess of 1,600m. Modern gold mining at Stawell has been continuous since 1982 with Magdala contributing more than 4 million ounces of the total 5 million ounces of gold produced to date from the Stawell Goldfield.

Also a little known fact is that many of NML’s management and directors are familiar with the Stawell Gold Mine from their time with Leviathan Resources and MPI and have a strong understanding of the geology.

With similar gold-bearing host rocks extending south of the Stawell Granite, NML is hoping to find another multi-million ounce Stawell deposit – the upcoming drill campaign is a significant step in the journey.

Tapping a new market for gold

Let’s now take a moment to look at another significant local player on the Victorian gold scene...

Newmarket Gold (TSX: NMI) is a Canadian gold mining and exploration company with three 100%-owned operating mines across Australia, with two right in NML’s home patch of Victoria.

The company is focused on creating substantial shareholder value by maintaining a strong foundation of quality gold production of over 200 koz./year.

You can get an insight into Newmarket’s thoughts on the Australian gold market here .

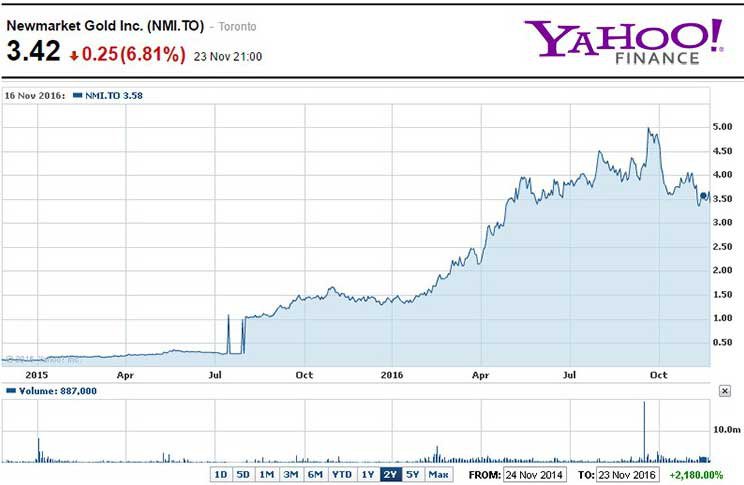

And this is how Newmarket has performed over the course of this year — no doubt buoyed by the rise in the Australian gold price:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

If we take a look at a handful of other gold miners, it’s clear that business has remained strong since the start of the year.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As further validation that mid-cap and mature gold market is a beehive of activity right now:

Newmarket has ripened for a combination with none other than Kirkland Lake Gold Inc., to make a new mid-tier gold company in a deal worth CAD$1BN (A$0.98BN).

Once the deal has been completed, the combined company, called Kirkland Lake Gold, will have a market cap of nearly $2.4BN and an annual production of over 500,000 ounces of gold, spread across seven mines in Ontario and Australia.

If mature and junior miners are tussling for position, and there happens to be a tiddler mixed up amongst them — that can often indicate a strong chance of all that speculative sentiment spilling over into smaller exploration juniors like NML too.

Oh, and by the way, Newmarket is NML’s largest single shareholder with 13% of the issued capital!

Perhaps they might be interested in seeing what NML can develop over the coming months...

Let’s take a look at NML’s other Gold project in Victoria

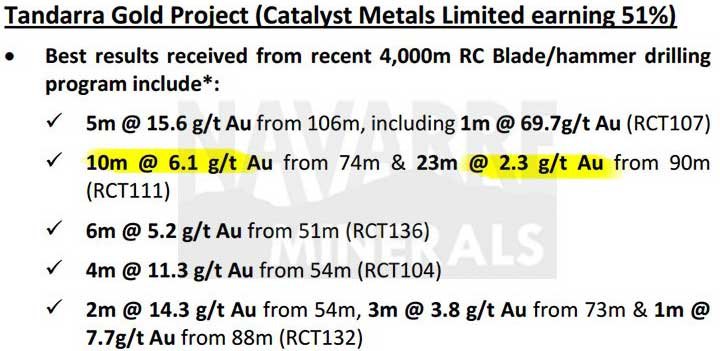

In addition to NML’s Ararat Gold project is the Tandarra Gold Project, just north of Bendigo.

Tandarra is an advanced high-grade prospect located in central Victoria, where NML is aiming for the discovery of gold deposits under shallow cover never found by the old timers.

The location has premium positioning given the 22 million ounce Bendigo Goldfield 40km to the south located on the same controlling structure.

NML’s modus operandi here was to bring in a partner in the form of Catalyst Metals, another junior gold explorer, and progress this project towards mineral resource status. Catalyst Metals will earn up to a 51% interest in Tandarra by spending $3M over 4 years.

Tandarra is only 60km away from Victoria’s largest operating gold mine at Fosterville, also owned by Newmarket Gold Inc. This again underlines Navarre’s strategy of searching for substantial mineral deposits close to existing mining infrastructure.

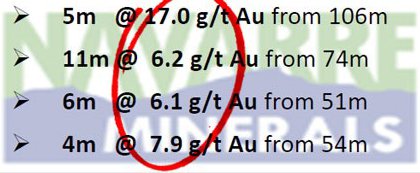

Recent high-grade drill results suggest Tandarra could potentially develop into a substantial high-grade mineral resource once Catalyst completes its exploration spend. With further drilling success, we think NML could be a good candidate for a near-term re-rating just on Tandarra alone. Check out the recent drill results from Tandarra below:

Tandarra is also close to Gina Rinehart’s company operating in the area (Hancock Prospecting) in JV with Catalyst. Hancock is spending $4.2M over the next 12 months on exploration and again reaffirms the intense interest in the area from explorers.

A golden opportunity?

NML has moved back into the forefront of the currently frenetic gold market. Gold prices have been volatile over the course of 2016, and have recently come off their historic highs, premium-priced in Australian dollars.

Now could be a time to take a cue from the gold market sluggers such as Newmarket and Kirkland who are actively scouring the developed world for economically viable gold projects to slap on their plates.

Take a look at this gold ETF (exchange traded fund) indicating the potential buying opportunity after gold miners have consolidated recent gains.

As they say in trading circles, ‘ the trend is your friend’ — so as gold prices and gold miners stage retracements from the most recent record highs — this could be a prudent buying opportunity as gold stabilises and resumes its uptrend.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Frenetic gold market activity that’s worth swinging at

NML has been quietly flying under the radar and has not missed a beat this year —firstly acquiring a state government grant providing co-funding of up to $626,000 for Irvine and secondly by completing a capital raising to fund the other half of the costs of the program at Irvine and quickly mobilising a dual-pronged exploration programme including air-core and diamond drilling.

So with its operations neatly scheduled, cash in the hand, catalysts in the pipeline and a relatively undervalued compared to its peers, NML is loitering with intent.

NML represents a small, simple, leveraged and straightforward entry into junior gold exploration...

...meanwhile, its small, simple and straightforward program schedule could be perfect for gold bugs and gold value investors.

We all know that small-cap Resources investing can be a difficult enterprise, with lots of risks and potential rewards.

However, when looking to conduct a risky enterprise it can be a good idea to embrace simplicity rather than complexity; drill for grade rather than largesse, and take a bite out of a small-cap gold junior still small enough to be in with a chance of delivering a huge multiple before Christmas.

Of course success here may not eventuate and no investment decision should be based on this type of speculation alone. If you are considering investing in this stock, seek professional financial advice.

Currently valued at just AU$4.72 million and priced at $0.032 per share, this punctual gold nugget may be worth a swing at.

Heads up!

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.