This ASX Star Just Posted 299% Annual Group Revenue Growth

Published 04-NOV-2016 11:05 A.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Not all small-cap tech companies are made from the same cloth.

Whereas some tech ideas are about innovative apps and progressive use of digital tools for the masses, others are all about leveraging traditional bread-and-butter economics and commercialising the simple things that people do most often — like withdrawing or depositing cash.

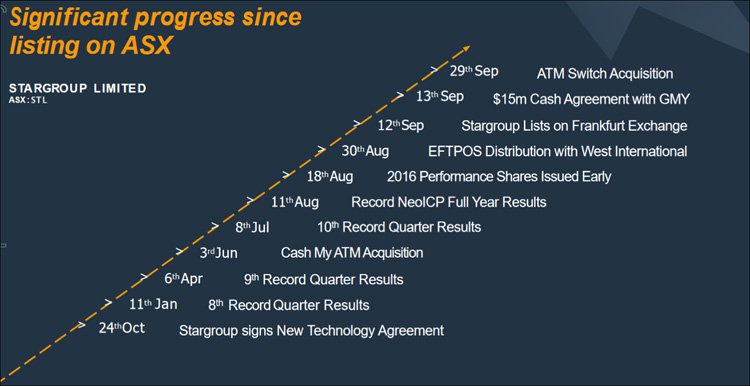

To that end Stargroup Limited (ASX:STL) is forging an impressive path in the ATM and cashless payments spaces with an eye to acquisitions (the most recent is the potential acquisition of telecommunications and ATM reseller Indue ), cost saving deals with the likes of Goldfields Money and distribution deals with Swedish listed West International .

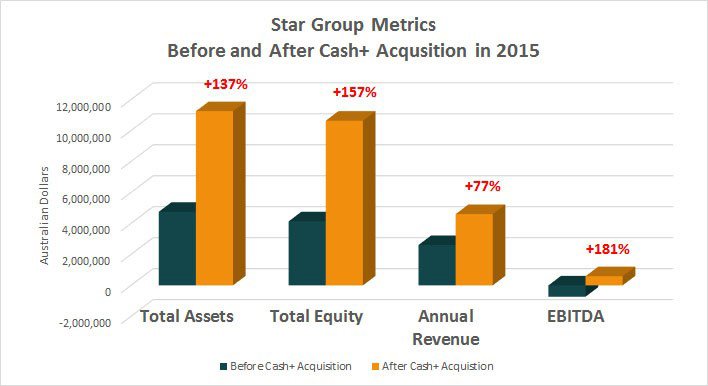

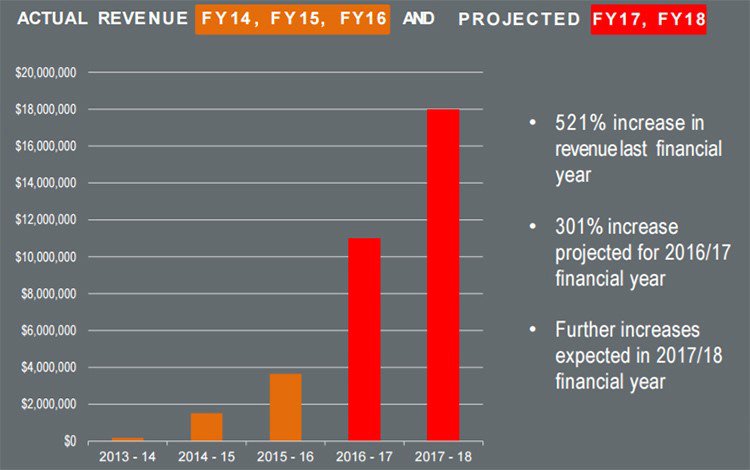

Given the success of its approach, STL boasted an impressive overall 521% increase in actual annual revenues, including a 299% increase in actual revenues in FY2017 compared to FY2016 and a 205% improvement in 2016 YTD revenues compared to the corresponding period in 2015. There is also a 30% increase in projected quarterly revenue on the back of organic growth.

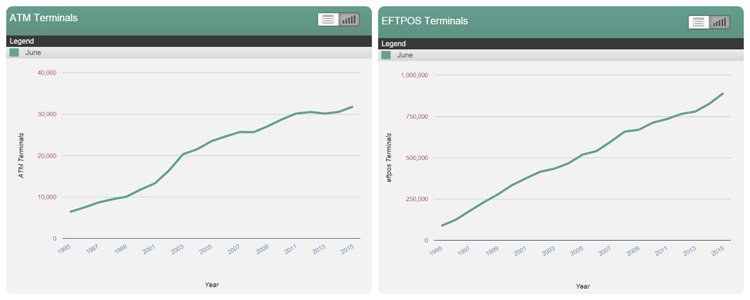

Certainly based on those numbers, STL is one such small-cap company that has now cast its long-term line directly into the circa $670BN payments industry, catering for people’s desire to withdraw cash and make small payments via their debit cards.

Given its aforementioned growth, STL is projecting a 300% growth rate in the 2017 financial year, and that is about the time when it is forecasting a maiden dividend payment to shareholders.

Note that the forward projections are speculative and should not be taken as exact figures. Seek professional advice when looking at the numbers and apply caution to your investment decision.

STL’s performance to date is mainly down to its business model.

STL charges users a small fee to withdraw cash from its network of 400 non-bank ATMs.

The business model is straightforward in that STL wants to get its mitts on as many ATMs as possible, to blanket the entire Australian continent with its machines, and pick up steady revenues over time.

It also has Germany in in its sights having recently listed on the Frankfurt Stock Exchange (FSE) under the ticker code S33.

So far, STL has outperformed all market expectations having posted its 12 th consecutive month of record revenue growth just recently...

...and possibly most commercially-alluring of all — STL has continued its mean acquisition streak by pencilling the $6.5M acquisition of Indue to bloat this accretive value generator’s commercial presence still further.

What could also set STL apart from its competitors is its soon to be launched world-first, one-of-its-kind ATM that will allow secure deposits as well as withdrawals in real-time.

This functionality could blow the door wide open on how people conduct their banking activities.

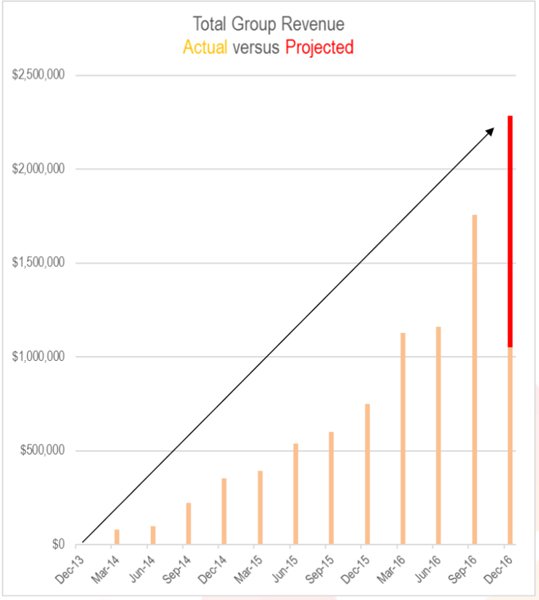

In the meantime, STL’s results speak for themselves. The following graph shows STL’s revenues for October and the projections for the next two months, which is considerably higher than anticipated:

Having recorded a record monthly revenue figure of $1.8M in September and revenues greater than $1M in October (a record month for the business and significantly greater than budgeted ) , STL is now aiming to extend its monthly haul in December and finish the calendar year with around $5.5M in revenue generated.

For a small-cap company currently valued at just $20M, we think STL could be a great under-the-radar contender for a stalwart payments company in the years to come.

Getting the scoop on:

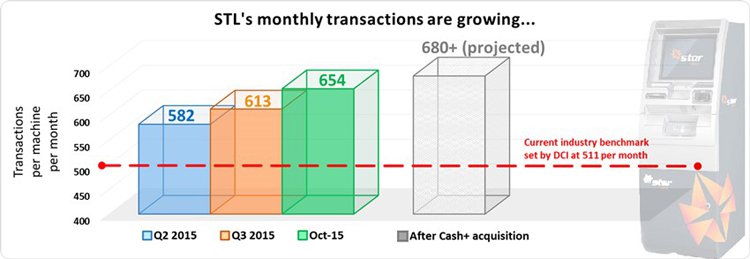

Stargroup Ltd (ASX:STL; FSE:S33) is an ATM operator seriously eyeing up the leading position in the ATM space by attempting to usurp current dominator Directcash Payments (DC Payments), a Canadian outfit capped at $333M CAD, with international expansion intentions.

However, considering STL’s relative technology, current market strategy and existing corporate ties to their technology supplier (NeoICP), STL now has a superb opportunity to claim its position as the leading ISO (Independent Sales Organisation) in the payments space.

STL is making progress on its claim.

Let’s go through STL’s market stance, to see if this payments aggregator has a chance of pouncing on some more market share

This is how STL looks from the inside: three subsidiaries working towards a unified payments company that captures a large catchment of daily payments being made across Australia...

STL has two distinct products which it offers to businesses and venues. Firstly, there are its ATM machines which can be installed anywhere:

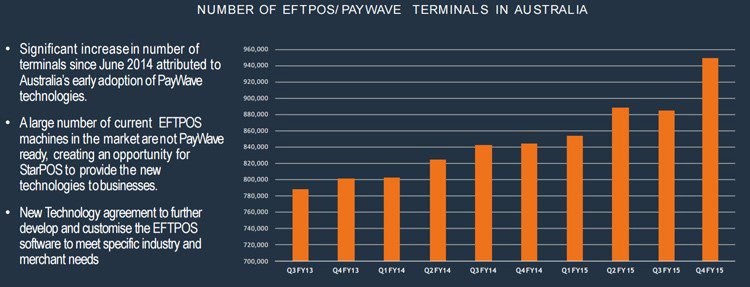

Next is STL’s EFTPOS and Paywave offering which is intended to capture the huge growth in cashless payments done via debit/credit card.

ATM machines provide an excellent staple income while cash is still around, but as we move towards a cashless society, cashless payments functionality is a must for any ATM operator.

For STL, its StarPOS system is already operational and being gradually rolled out across Australia.

Here is a summary of what kind of things give STL an edge over other ATM operators:

As STL continues to acquire and deal with other businesses, its edge grows larger still.

Indue acquirer

STL’s most recent acquisition came in the form of Indue, an existing ATM operator.

Currently at the MoU stage, there is due diligence and more negotiations still to come.

Assuming everything goes without any hitches, STL has agreed to acquire an ATM Switch, ATM Telco and ATM Sales business processing 12 million transactions a year.

Upon completion, STL will provide ATM switching services for 70 ATM operators, 1,700 ATMs and 1,350 modems processing approximately 12 million transactions per annum.

The ATM Switch, ATM Telco and ATM Sales business will increase the current annualised revenue from the ATM division from $7.5M to $11.6M with that figure increasing via further organic growth to at least $15M next financial year.

The expected increase in annualised revenue is around $4M while STL’s annualised EBITDA is forecast to increase by $1.7M.

At the same time, this deal is still in its early stages and caution should be applied to any investment decision relating to this stock.

To indicate just how serious STL is about becoming a market darling, take a look at this:

Despite being listed on the ASX for less than a year, STL is already earmarking dividend payments around June 2017 as a result of its strong start and cash flow positive status.

Going West

One of the key developments on the EFTPOS front has come from out West for STL.

STL’s newly-formed subsidiary, StarApps, has signed a distribution agreement with Swedish listed company West International for the distribution of EFTPOS payment terminals across Australia and New Zealand.

This agreement could raise the rate at which STL is able to add ATMs to its growing network which could mean a huge boost for this star’s luminescence as additional sales channels are added.

The carrot that STL is most chuffed with is the fully customisable source-code access West International provides.

By having complete control over the source-code being used, STL could possibly win greater market share in several merchant sectors given the added functionality and customisation West International will inject into proceedings.

STL’s mission is to become a dominant force in both ATM and EFTPOS distribution which means introducing state-of-the-art technology and securing appropriate funding for its acquisition spree – which will only likely continue when you consider that every acquisition STL makes adds directly to its bottom line.

New technology

STL is the exclusive distributor of the cashPod ATM range including the Recycler ATM until 2020.

ATM’s were always about people withdrawing cash, and required the following to keep it running efficiently:

That’s right — handymen are required to re-supply cash back into hundreds of ATMs each day which is very inefficient and time consuming.

What if an ATM could take the money people deposited and regurgitate it back to the next customer as a withdrawal?

STL became the exclusive distributor of the cashPod ATM range including the recycler ATM, back office and payment technologies in Australia for the next five years on 7 th August 2015.

And now in 2016, the first recycler ATMs otherwise known as ‘a bank in a box’ are being installed as part of STL’s deal with Goldfields Money Ltd (ASX:GMY), an up-and-coming Approved Deposit-taking Institution (ADI) offering banking facilities.

As part of a $15 million deal, STL and Goldfields will collaborate to provide banking services in remote locations by debuting the brand-new Recycler ATMs. The first installation is scheduled for late 2016 in Norseman, Western Australia. The deal will also see STL drastically cut its cost base over the coming months.

STL has around 15,000 EFTPOS terminals distributed across Australia while the total amount of terminals has reached 900,000 and installation of new terminals is growing at around 60,000 per year.

This effectively means that the payments industry is grossly fragmented and highly competitive, which means any market edge whatsoever could make all the difference.

Owning the source code that underpins its EFPTOS offering will allow STL to rapidly escalate its own range of products and services and hopefully improving its market share in the process.

Take a look again at STL’s steady revenue climb on a month-by-month basis since 2013:

In each financial year since 2013, STL has evidenced an exponential rate of revenue growth which has more than a reasonable chance of being repeated in future years — as long as STL’s machines continue plodding along and raking in micro-transactions from a growing network of ATM and EFTPOS machines.

When everything is tallied and calculated, STL’s transformation is on course to achieve $11.4M in annualised revenue in FY2017, compared to $9.3M in FY2016.

With such strong performance figures, STL is proving that start-ups needn’t necessarily spend years in the financial doldrums before going cashflow positive.

STL did it within 12 months and hasn’t looked back.

M&A

One little caveat about STL was its recent listing on the Frankfurt Stock Exchange (FSE) to access further pools of capital to bolster its merger and acquisition activity.

Considering the strategy STL is pursuing is all about buying existing networks of ATMs, we think a move into German capital markets could be a shrewd move that further helps to expand STL’s ATM arsenal.

NeoICP

STL is the only ASX-listed ATM operator with a stake in its hardware supplier — that’s a big deal because this ensures STL can quickly update or tweak existing hardware and negotiate from a position of strength when it comes to cutting deals and making additional purchase orders.

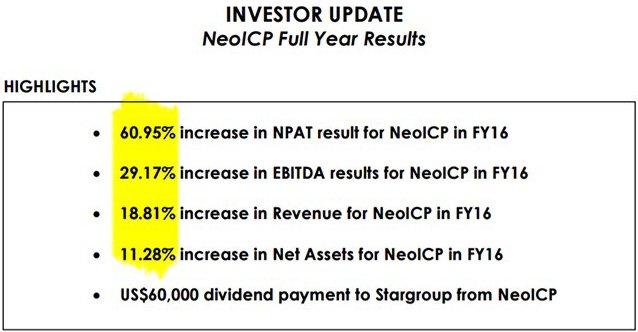

STL has partnered with South Korean firm NeoICP as its technology solution, and if we look at how NeoICP (11.3% owned by STL) is getting on...

...it’s clear that when it comes to Payments, business is good.

Conclusion

STL is one of our more tech-savvy Next Small Cap stocks.

STL has outperformed the incumbent industry leader and went cash flow positive, all within 12 months of us covering the story, so there is a chance the wider market has significantly undervalued this value-accretive ATM operator, that’s quickly rising through the Payments ranks.

However of course like all speculative early stage stocks, anything can happen here, and success is no guarantee. Seek professional financial advice of considering this stock for your portfolio.

The rabbit in STL’s top hat is all about employing an accretive mergers and acquisitions (M&A) strategy, designed to move STL up the ladder to become the top of the ATM pops in Australia.

After 10 consecutive months of record performance, STL is rapidly becoming a bit of a habitual shooting star when it comes to operating a network of ATM machines in Australia.

With metrics improving in all departments and exemplary performance to date, STL is determined to move out of the small-cap league, and move up a division to par with current industry trend-setter, the $332.9M CAD capped DCI.

Tap and go.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.