ACP’s Maiden JORC Graphite Resource is Due in the Coming Weeks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Small Cap presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

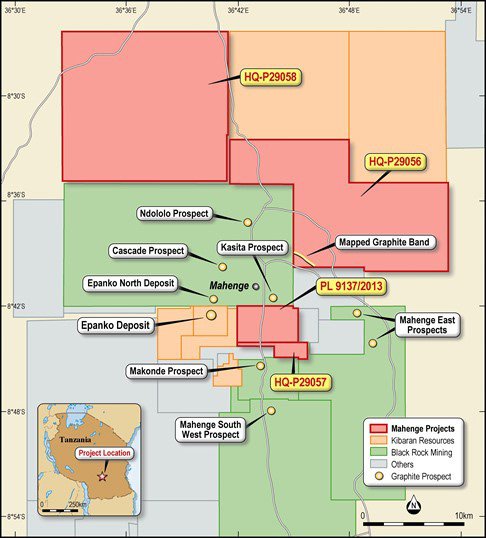

The majority of opportunistic graphite explorers that made early moves to secure favourable graphite exploration tenure have all been ASX or TSX-listed — but there is one UK-based company that wants to be part of the pecking order – Armadale Capital (LSE:ACP).

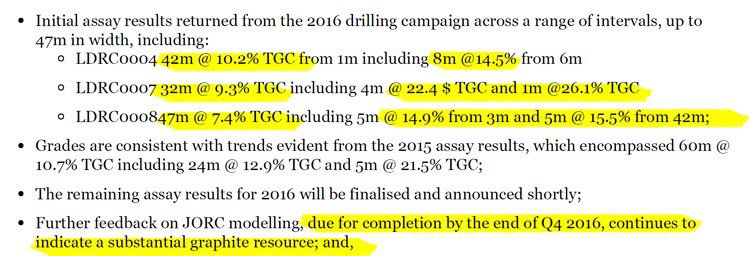

Since we last wrote about ACP just over a month ago, the company has released positive drill results that has confirmed a thick graphite schist deposit, while preliminary modelling has indicated a potentially substantial sized graphite resource.

Initial assay results have also been released showing high-grade graphite mineralisation up to 26% Total Graphitic Carbon (‘TGC’), commencing from or near the surface at the Mahenge Liandu Graphite Project in Tanzania.

ACP’s completed drill program confirmed that 18 from 21 drill holes at Mahenge were visually logged as intersecting high grade coarse graphite mineralisation.

That certainly points this Tanzanian play in the right direction.

Before we go too far, it should be noted that for political and social reasons, this is a very high-risk stock. Getting mining projects up and running in countries such as Tanzania is no simple feat, and there may be challenges ahead.

As well as good drill results, the macro outlook is also working in ACP’s favour. Graphite is captivating the imaginations of a host of end-users including consumers, producers and investors as electric car manufacturers in particular bring new paradigms to traditional ways of doing things, like driving.

There are similar companies to ACP already capitalising on this sentiment, which indicate the pathway for share price appreciation for this stock.

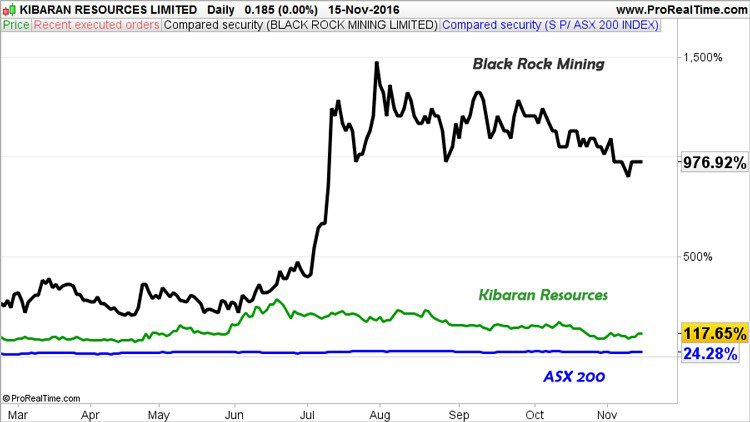

The likes of the £27.1M (AU$44.8M) Kibaran Resources (ASX: KNL) and £27.3M (AU$45.2M) Black Rock Mining (ASX: BKT) in Australia, were both teeny graphite explorers barely 12 months ago, but have made quick progress in their exploration and have therefore raised their valuations significantly.

Take a look at this brief comparison of these two explorers who are closest to the £7.8M ACP’s ground in Tanzania, as they have each progressed with their exploration and resource definition:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As you can see, these two pro-active early-birds have outperformed their domestic equity benchmark (the ASX 200) by 977% and 118% respectively...

...and ACP hopes to repeat the feat on UK’s AIM because of its unique status of being the only AIM-listed company currently digging for high-grade natural graphite.

With a maiden JORC Resource looming before year-end and preliminary drilling results suggesting grades well in excess of 26% TGC, we think we may have found a high potential small-cap stock that can grow itself into a commodities cash-cow for its foresighted Management team and early investors.

Updating you on:

Armadale Capital PLC

Armadale Capital (LSE:ACP) is nearing a price-sensitive critical moment in the early development of its flagship graphite project in Tanzania.

So far, preliminary assay and JORC modelling results indicate that ACP is on course to post a substantial, high quality coarse flake graphite Resource at Mahenge Liandu in Tanzania.

We wrote about ACP’s graphite lustre as recently as last month , where we delved into the specifics behind why this graphite junior had the minerals to mature into a graphite powerhouse over the coming years.

The hot news off the press is that ACP’s drill-bit is hitting high-grade mineralisation consistent with early expectations and possibly more importantly, 85% of drill-holes are striking graphite mineralisation.

The latest round of drilling results sets up a strong chance of a bulky JORC Resource before the end of 2016 – which isn’t far away at all

If we look at the latest drilling results from ACP’s exploration, hopes for a re-rating later this year are high.

The below chart shows the price action since June 2016.

We last wrote about ACP in October , since then the stock has been up as high as 4.73p – that’s a gain of over 50% in just a few weeks.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The reason for this is down to the drilling results that confirm strong grades at relatively shallow depths.

18 out of 21 drill holes at ACP’s Mahenge Liandu project intersected high-grade coarse flake graphite mineralisation — marking a very successful maiden reverse circulation drilling campaign.

With the first bout of exploration now coming to an end, ACP is clearly positioned as the only AIM-listed resource company with direct exposure to natural graphite.

However, this is an early stage play with a long road in front of it and investors should take a cautious approach if considering this stock for their portfolio.

Maiden JORC Resource expected before the end of 2016

ACP hopes it will define something similar to Kibaran and Black Rock, and all indications are that it may well do so. The next 1-2 months are therefore critical for ACP.

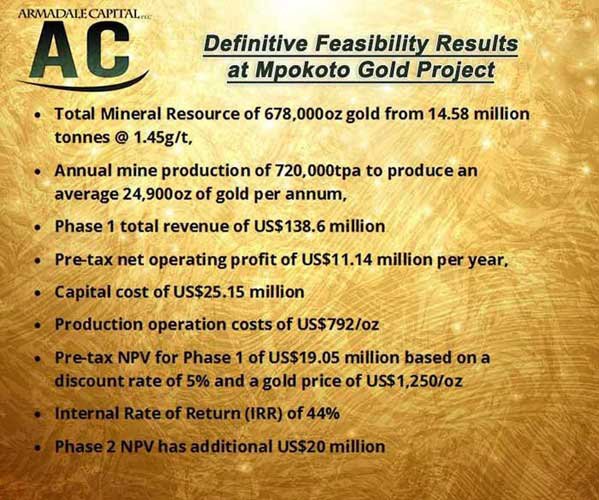

As a rough guide of what ACP is aiming for in Tanzania, take a look at the key points of Kibaran’s completed bankable feasibility study, finalised in mid-2015:

- Proven and probable ore reserves of 10.9Mt at 8.6% TGC;

- Annual EBITDA of US$33.6m for 15 years;

- Sale price US$1,466/t

- Operational expenditure at around $570/t

- Metallurgical results: 85.7% of distribution greater than 106 microns,

- Carbon concentrate of 96.3% TGC.

One of the standout factors that ACP can take great confidence from is Kibaran’s off-take agreements with Japanese trading-house Sojitz and German multi-national conglomerate ThyssenKrupp.

The signing of these contracts validates the mining potential in Tanzania and proves that graphite sales are not just a pipe dream, but rather an increasingly common sight as more manufacturers adopt graphite and graphene into the production lines.

Let’s briefly recap ACP’s location and near-term plans

The Mahenge Liandu project is located in the Ulanga District in south east Tanzania, approximately 300km south west of Morogoro and 10km from the town Mahenge.

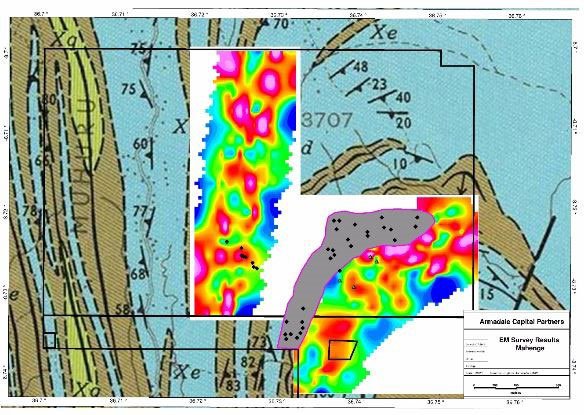

ACP is sandwiched right in the middle of all the commercially-alluring drilling currently going on in Tanzania — four tenements covering 485km 2 to be exact.

The factors that are likely to turn the screw for ACP and alleviate expensive delays in getting this project off the ground are:

- Mains power supply is within 5km;

- Abundant groundwater;

- Within 80km to rail hub at Ifakara and 320km to international port of Dar es Salaam, and;

- Labour and materials available within 10km at Mahenge township.

The rise of lithium

High grade graphite mineralisation of up to 33.8% TGC has been demonstrated through analysis of rock chip samples taken from Mahenge Liandu in June 2016.

Previous drilling has confirmed high-grade mineralisation from the surface, with results including 60m @ 10.7% TGC including 24m @ 12.9% TGC and 5m @ 21.5% TGC .

And what is all the drilling and exploration being done for?

...to hopefully supply one of the most incredible transformations from fossil-fuels to clean, battery-assisted energy made possible by lithium, graphite and cobalt.

It is now a well-known fact that Tesla has built a huge ‘Gigafactory’ in Nevada, USA, in order to flood the US market with more efficient/faster/cheaper/sexier electric cars that are a step ahead of the current gasoline-guzzling vehicles every Government on earth loves taxing the bejesus out of.

All in all, there is a very distinct possibility that electric cars (led initially by Tesla but joined by other manufacturers) will ram their gasoline cousins off the road altogether within the next generation.

That’s not the end of the graphite demand story however.

A further source of demand has arisen via expandable graphite for flammable retardant building materials that are gradually replacing toxic brominated products currently permeating millions of buildings worldwide. Regulatory changes in several populous regions such as China, the US and the EU have led additional graphite demand – as if lithium-ion batteries were not enough.

Regulatory changes in China and Europe have also put further upside pressure on natural flake graphite because of its preferred environmentally-friendly status compared to synthesised graphite.

The graphite industry has multiple avenues of demand, and that’s not including graphene — a space-age derivative of graphite that could ruffle world markets in its own right; if and when it is harnessed to the full extent.

However at the same time, investors should be aware that commodity prices do fluctuate. Caution should be applied and professional financial advice sought for any investment decision.

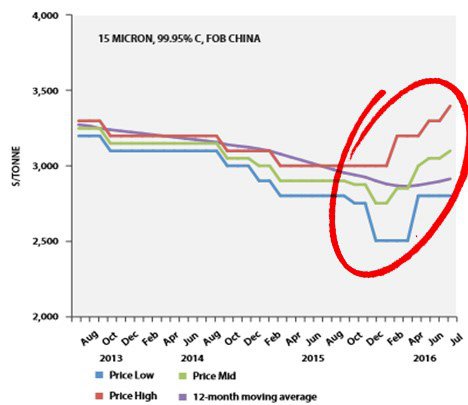

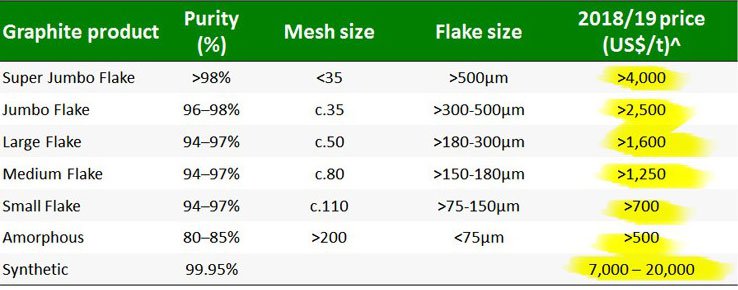

From a pricing perspective, spherical graphite prices are prepping for an upswing according to industry benchmark data:

Here are the estimated sale prices for ACP’s graphite:

Judging by the recent news, Tesla isn’t content with cornering the US and Americas market — it also has eyes on Europe:

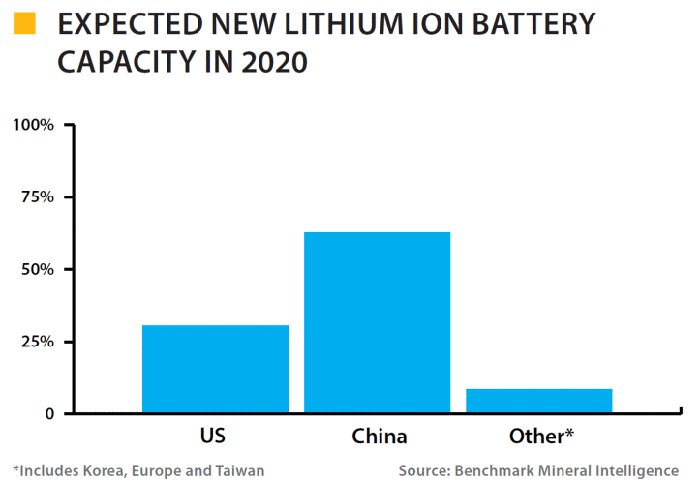

The global battery wars have most certainly begun with Tesla already facing stiff competition from Chinese manufacturers that have an advantage due to domestic Chinese dominance in synthetic graphite supply.

For ACP, taking an early position with a bulky resource could be a huge value driver and focusing on Europe as a final end-user market is also smart because of the high car ownership rates.

Charging towards a lithium-ion future, made of greenbacks

The Mahenge Liandu Project has the potential to be a world-class graphite deposit — but ACP needs to collate more data and work up a competitive JORC Resource.

For the time being, ACP has struck graphite mineralization 85% of the time during its most recent drilling round.

There is more exploration work to be done, but a key checkpoint in the form of a maiden JORC Resource is within sight.

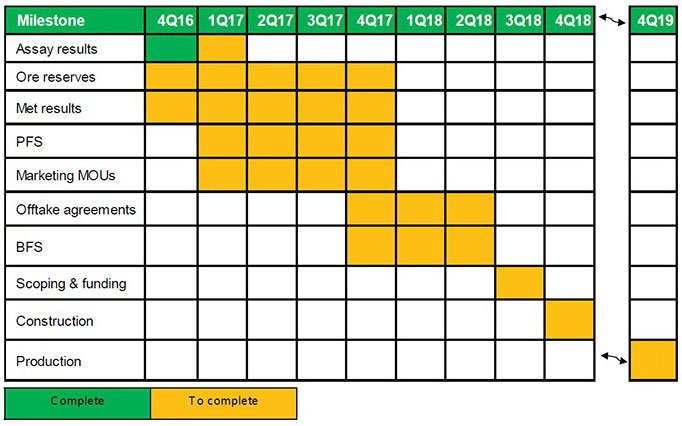

ACP’s planned schedule to progress at Mahenge Liandu is tabled below:

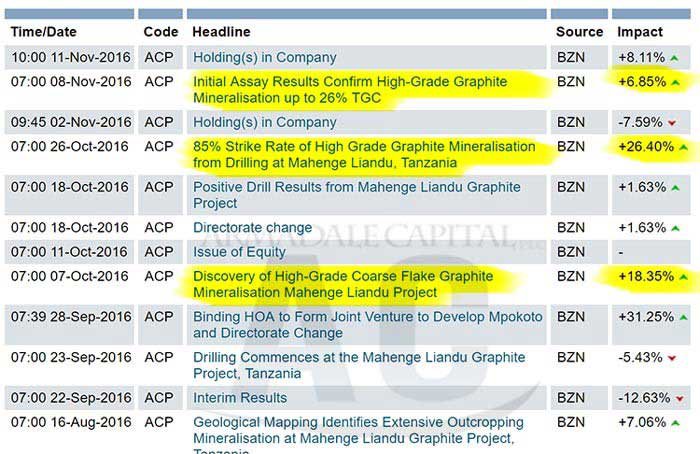

A JORC Resource is imminent for ACP and it could be of the bumper-variety that will hopefully add to this prolific list of share price jolting news announcements recently:

According to ACP, its initial resource modelling is pointing towards a substantial near surface graphite resource...

...and that’s exactly what would put this small-cap explorer on the graphite exploration map, and offer a worthy seat at the Cabo Delgado explorers table which already includes several flourishing ASX listed graphite explorers.

ACP’s initial assay results demonstrate Mahenge Liandu as a high quality (and sizeable) graphite resource that will satisfy the highest world standards demanded by battery manufacturers or builders.

Not only can ACP satisfy the technical requirements, it should also be noted that Tanzanian graphite is unique in having typically high flake size and can be easily processed using simple crushing and flotation — as opposed to synthetic or small-size flake graphite which typically requires more processing time and expense.

The good news is that downstream graphite end-users such as Tesla are increasingly showing a preference for graphite feedstock which is more environmentally friendly and doesn’t require complicated processing methods — as long as the price is right.

Currently priced at around 4p per share and capped at £8.5 million — yet packing an almost certain JORC Resource before the end of the year – ACP could represent a valuable commodities investment.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.